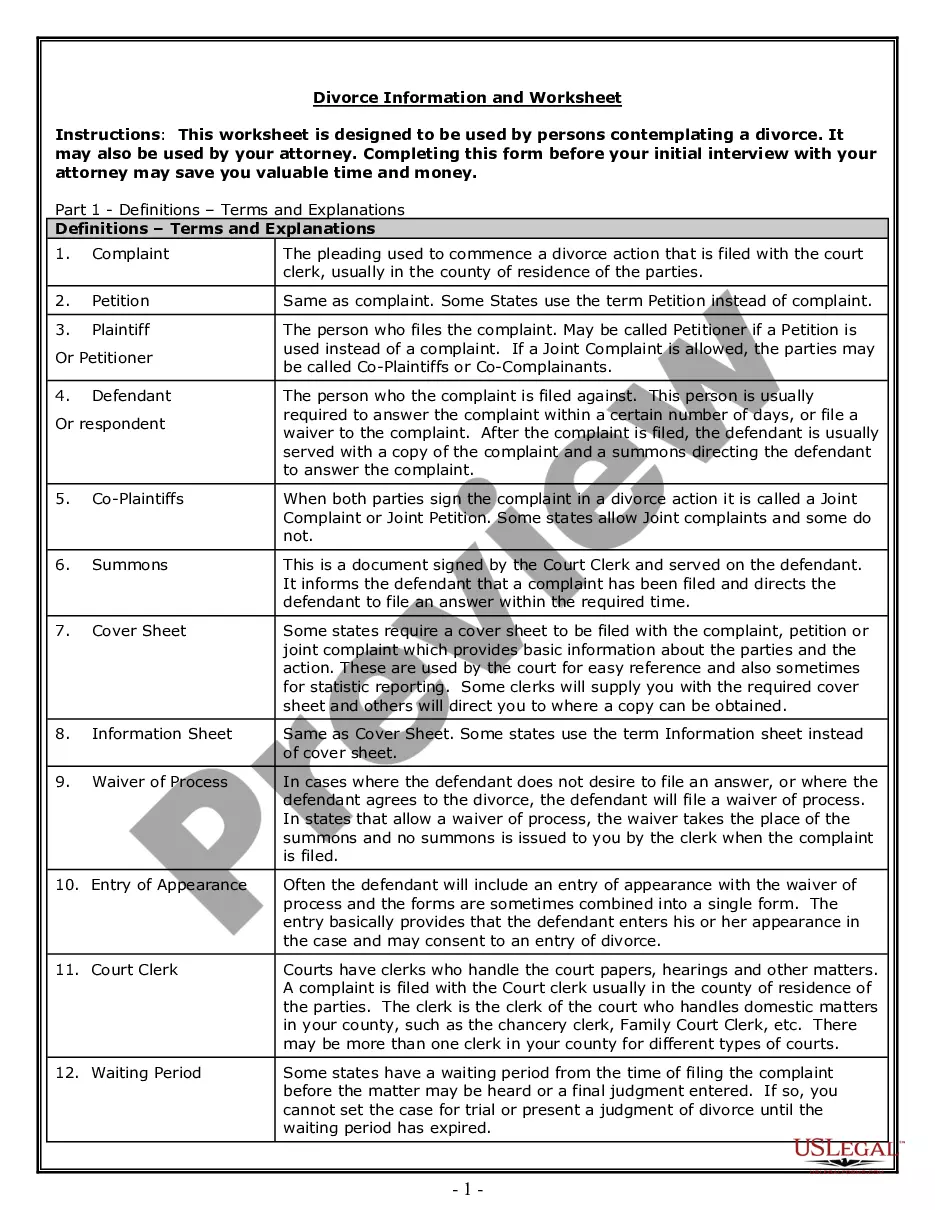

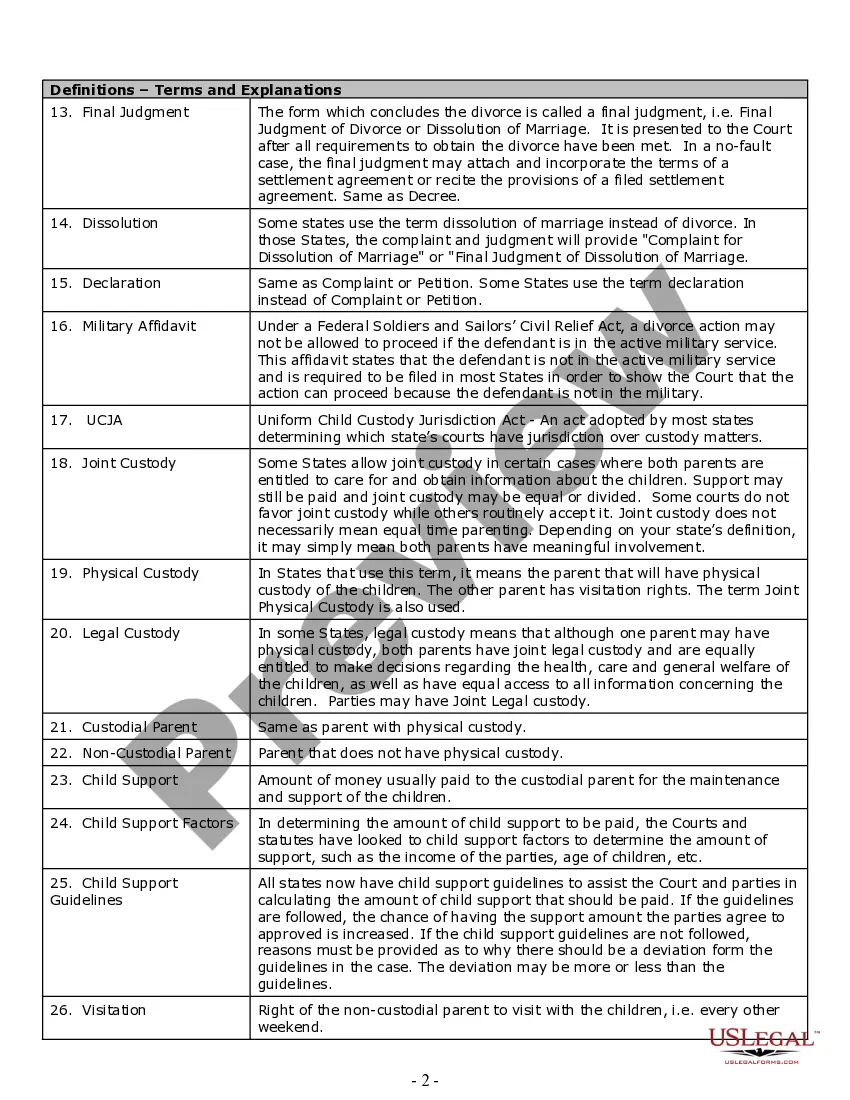

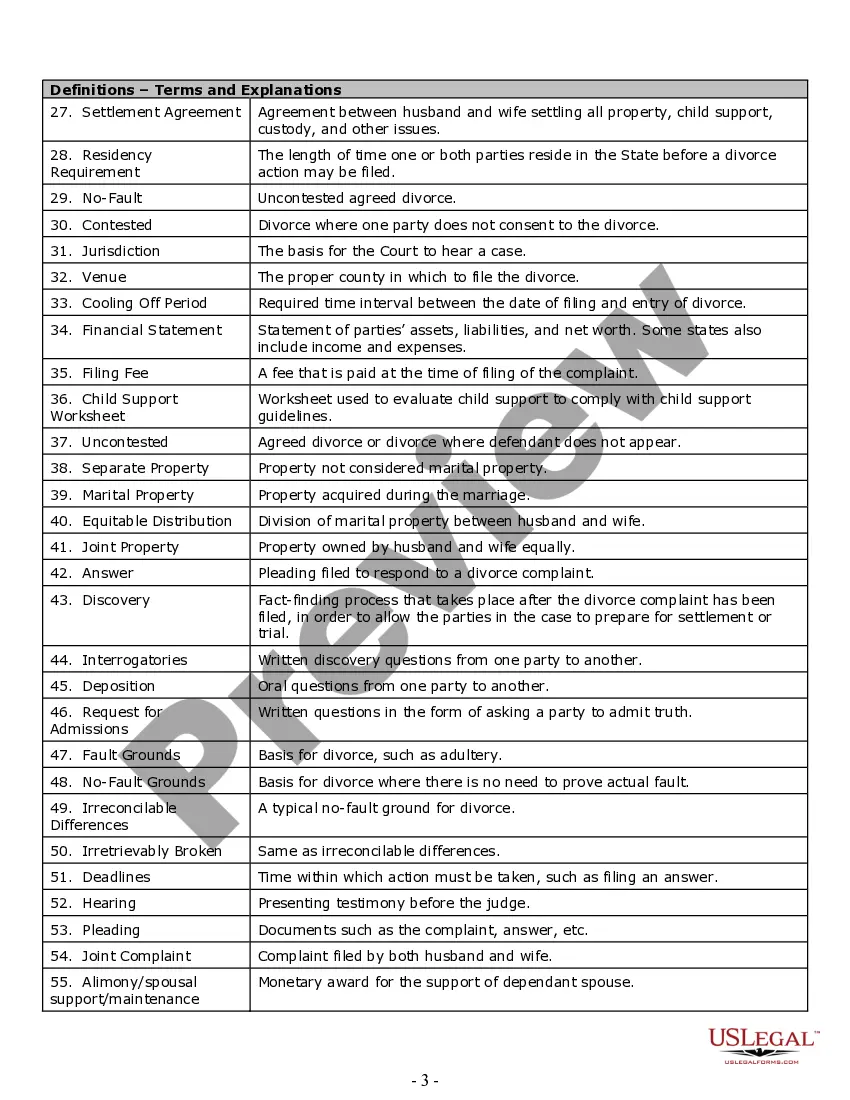

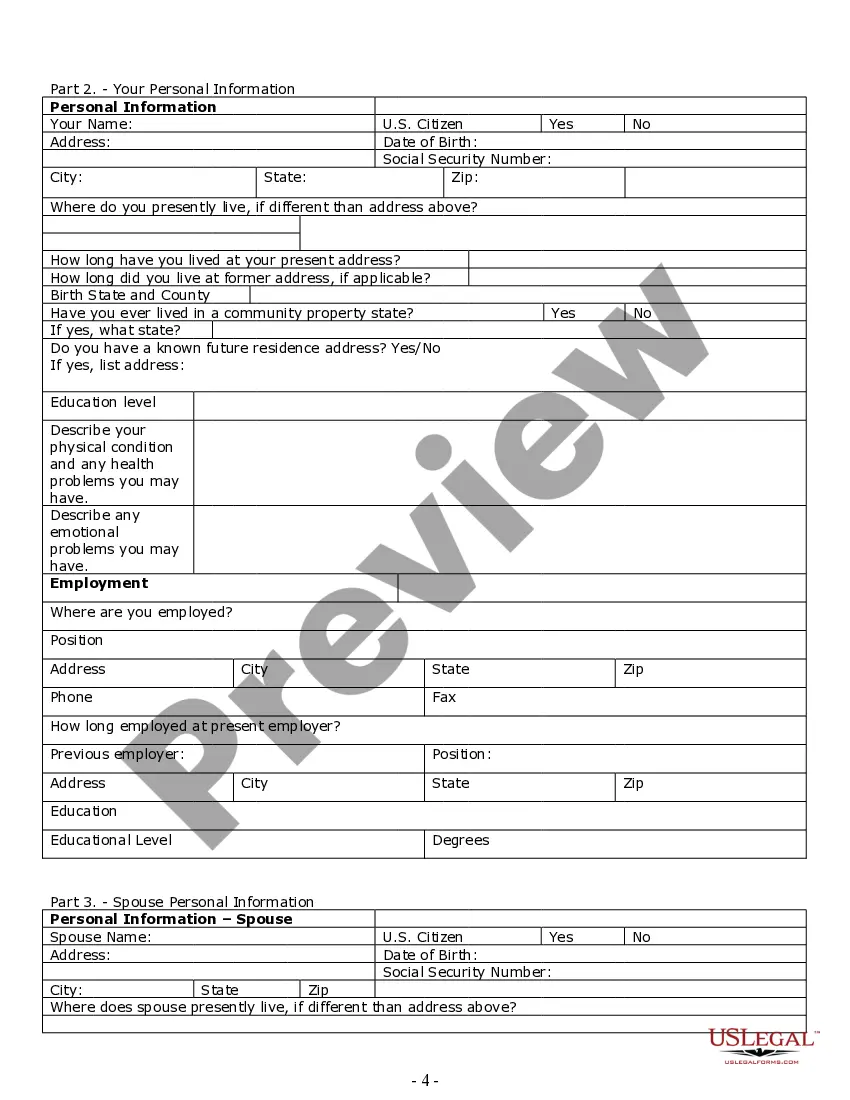

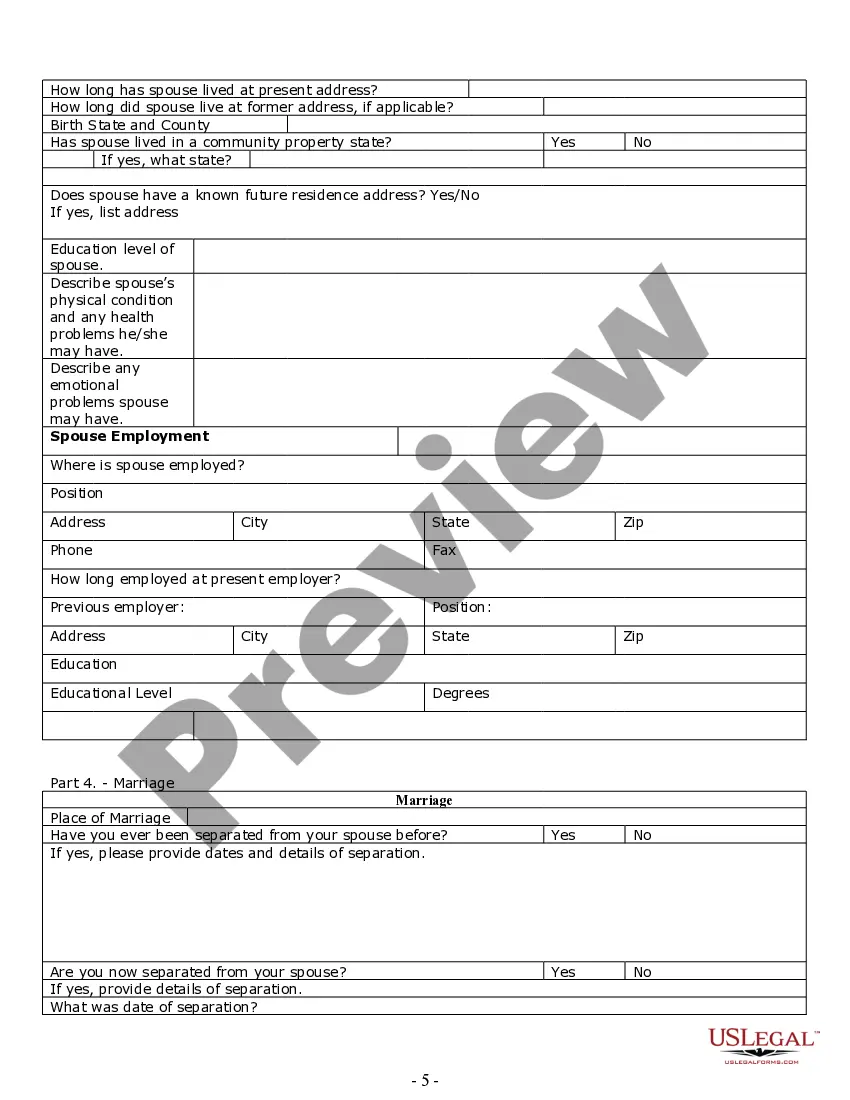

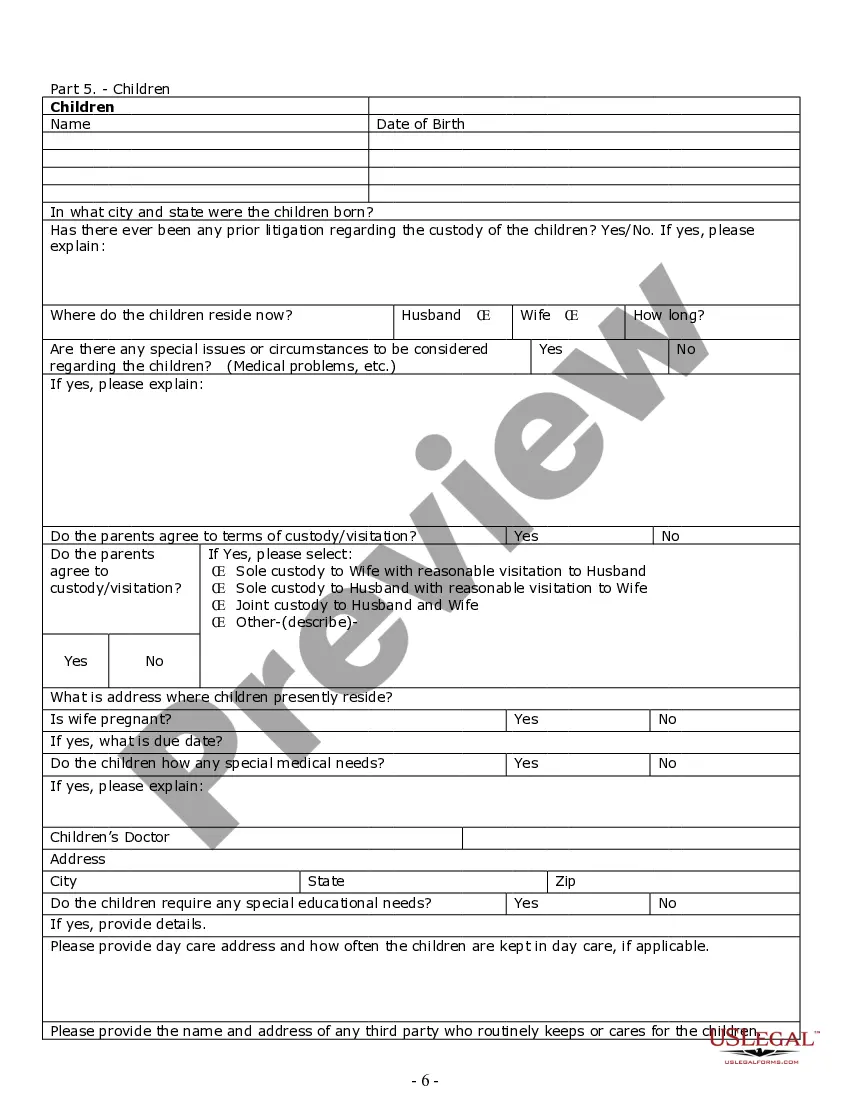

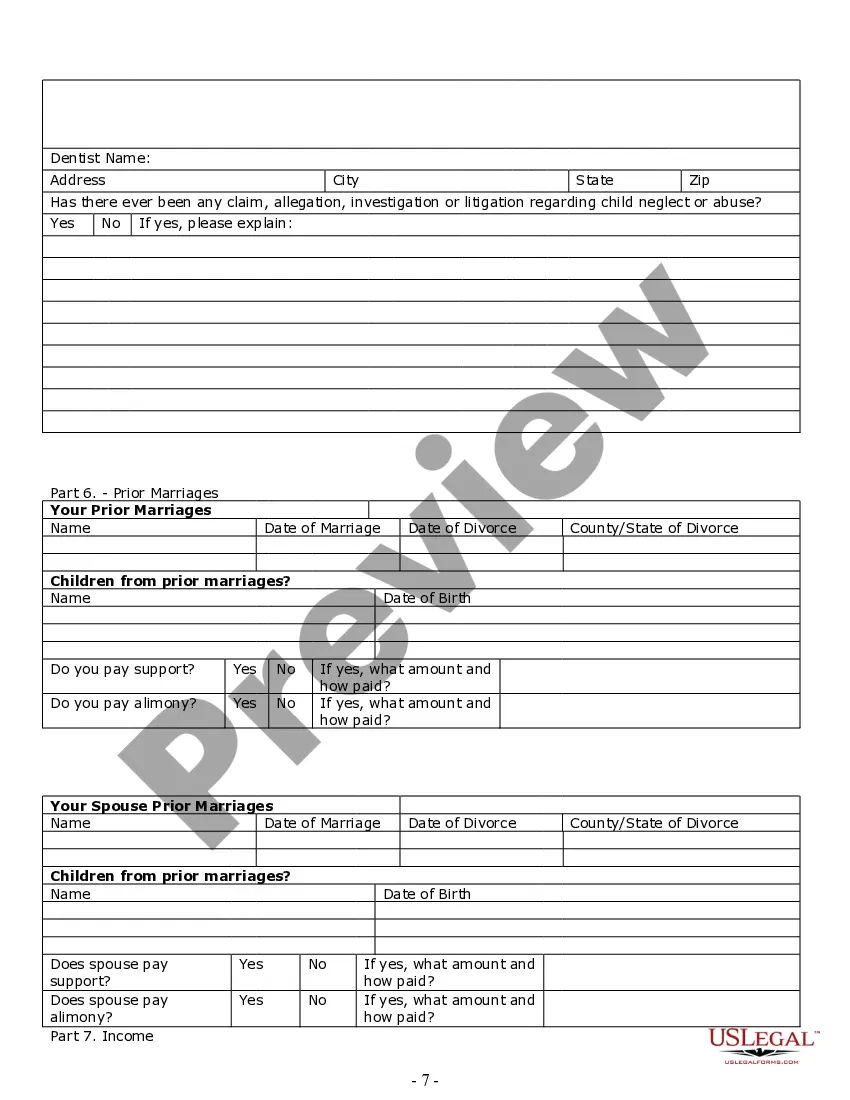

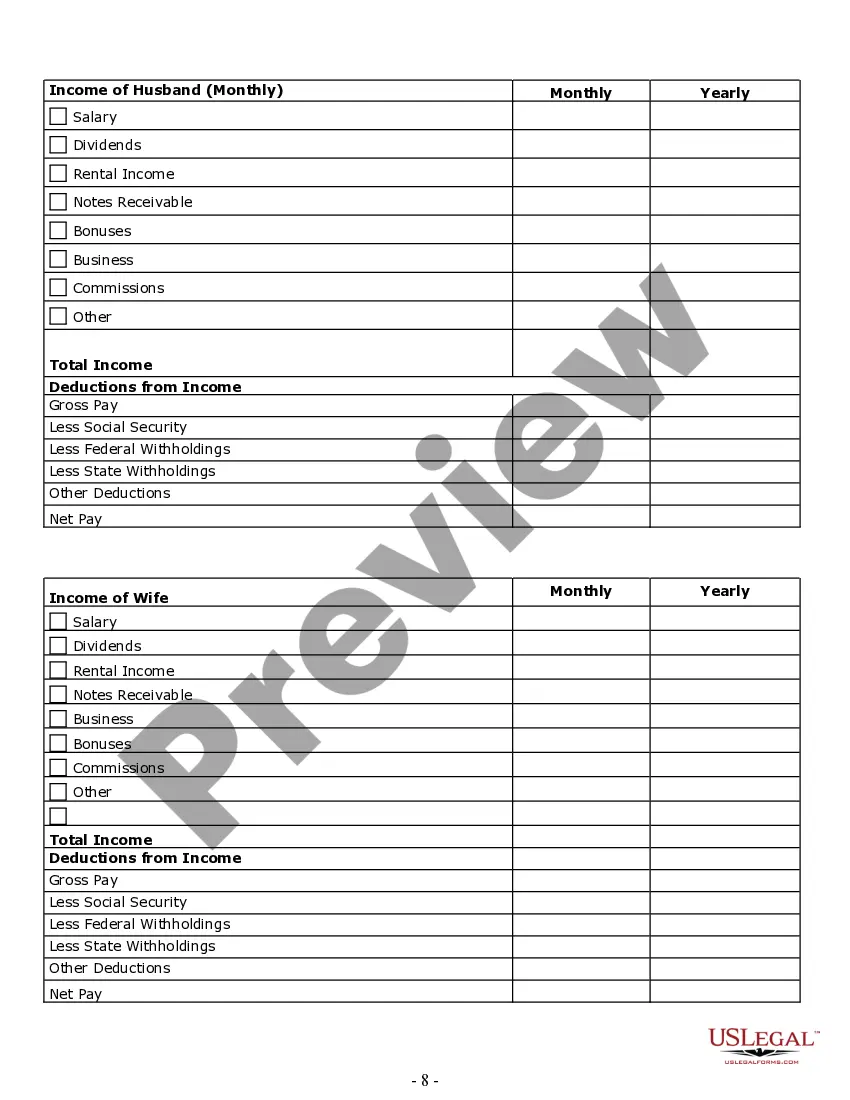

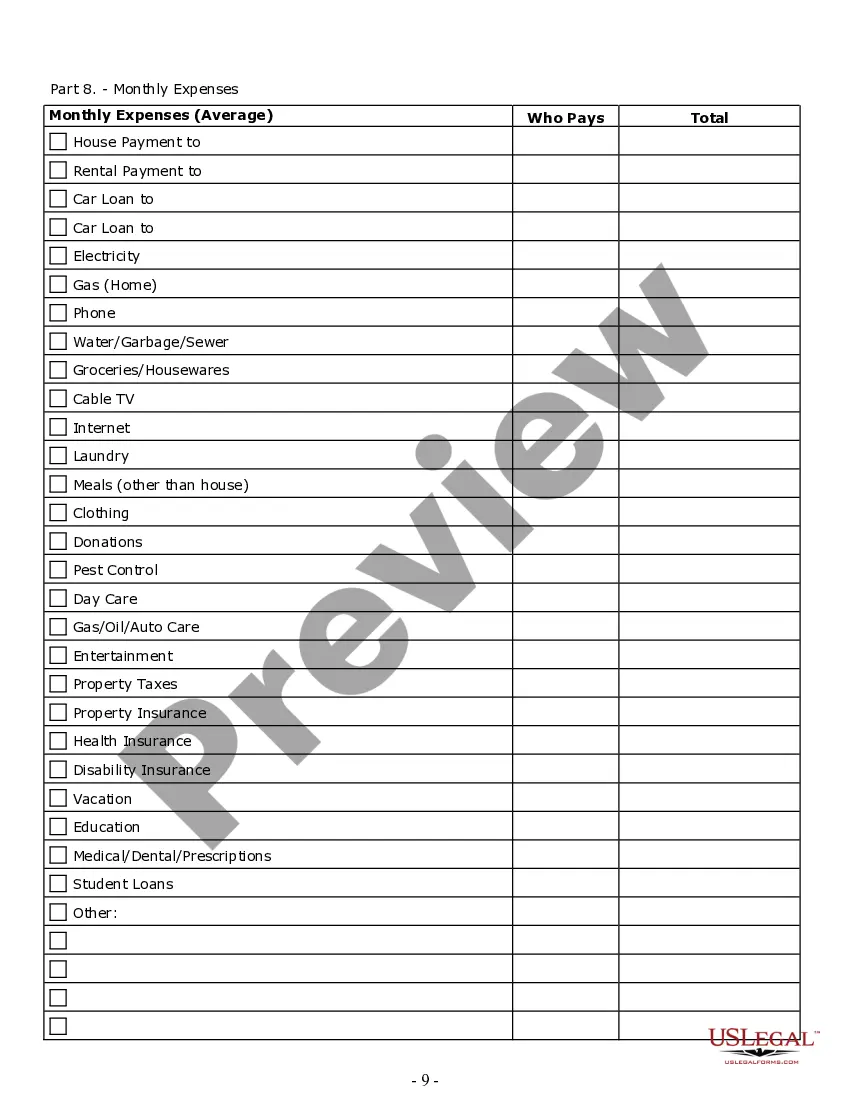

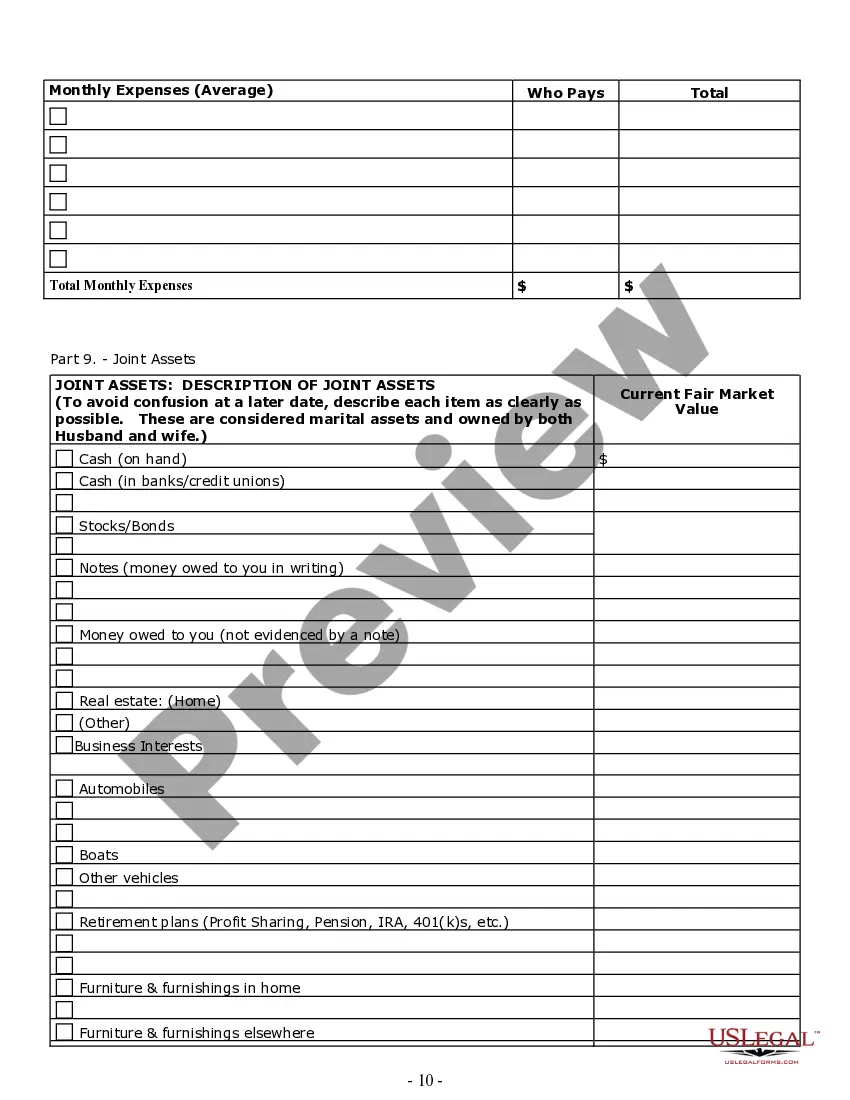

This Divorce Worksheet and Law Summary for Contested or Uncontested Cases is a package that contains the following: information about divorce in general, definitions, visitation, child support, child custody as well as other matters. Worksheets are also included that include detail information and financial forms. Ideal for a client interview/information form, or for you to complete prior to an interview with an attorney. This package is also ideal for you to read and complete before attempting your own divorce.

Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Obtain access to one of the most comprehensive collections of approved forms. US Legal Forms is essentially a platform to locate any state-specific document in just a few clicks, including the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Cases spanning over 25 pages - Ideal Client Interview Form examples.

No need to invest several hours of your time searching for a court-acceptable template. Our certified professionals ensure that you receive current documents consistently.

To utilize the forms library, select a subscription and create your account. If you have already registered it, simply Log In and click Download. The Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Cases exceeding 25 pages - Ideal Client Interview Form file will be automatically stored in the My documents section (a section for each form you save on US Legal Forms).

That's it! You need to submit the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Cases of over 25 pages - Ideal Client Interview Form and verify it. To ensure everything is precise, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful forms.

- If you plan to use a state-specific template, ensure you select the correct state.

- If possible, check the description to understand all the details of the document.

- Utilize the Preview feature if available to review the document's content.

- If everything is correct, click Buy Now.

- After selecting a pricing plan, set up an account.

- Make payment via credit card or PayPal.

- Download the document to your device by clicking Download.

Form popularity

FAQ

While there is no legal advantage to who files first in Iowa, it can influence the emotional dynamics of the divorce process. The initiating party may feel more in control, while the other might respond defensively. An Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can guide you in understanding these dynamics and navigating your situation effectively.

Statistics show that women are more likely to initiate divorce proceedings than men in many cases. Factors such as age, education, and financial independence often influence this trend. Using an Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can provide insights into such trends and help you make informed decisions.

Iowa's waiting period after filing for divorce is typically 90 days to allow for cooling-off and resolution discussions. However, under certain circumstances, the court may grant a waiver if both parties agree and if the situation warrants it. An Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can help you assess your specific situation regarding waiting periods.

In Iowa, it generally does not impact the outcome of the divorce when one spouse initiates it. However, the initiator may feel more empowered and prepared throughout the process. By reviewing an Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form, you can better prepare for your filing and understand potential implications.

Iowa follows the principle of equitable distribution, not strict 50/50 division of assets. This means that the court divides property based on fairness rather than an equal split. An Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can assist in understanding asset division nuances that might apply to your situation.

In Iowa, either spouse can file for divorce, and there is no specific rule about who should go first. However, the spouse who files may have some control over the process, including when and how documents are submitted. Utilizing an Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can help clarify your options and outline the next steps.

If your spouse refuses to be served divorce papers, you may need to explore alternative service methods. Options include service by mail or through a process server, and if those fail, publishing a notice in a newspaper might be necessary. It's essential to stay informed about the legal options available, and the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can assist in outlining the process.

If one spouse does not want a divorce, the process can become more complex. However, the other spouse can still file for divorce, and the court will eventually make a decision based on the law. It's important to know your legal rights in such situations, and resources like the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form can provide clarity on how to proceed.

While an uncontested divorce indicates both parties agree on the terms, one spouse can still contest it. This might occur if there's disagreement on critical matters such as asset division or custody. Understanding your rights and options can be enhanced by using the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form, which offers valuable insights.

Yes, a financial affidavit is generally required for divorce in Iowa. This document outlines your income, expenses, assets, and debts, providing a clear picture for the court. Completing it accurately is crucial, and you can find handy tools like the Iowa Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form to assist in compiling the necessary information.