Hawaii LLC Agreement - Open Source

Description

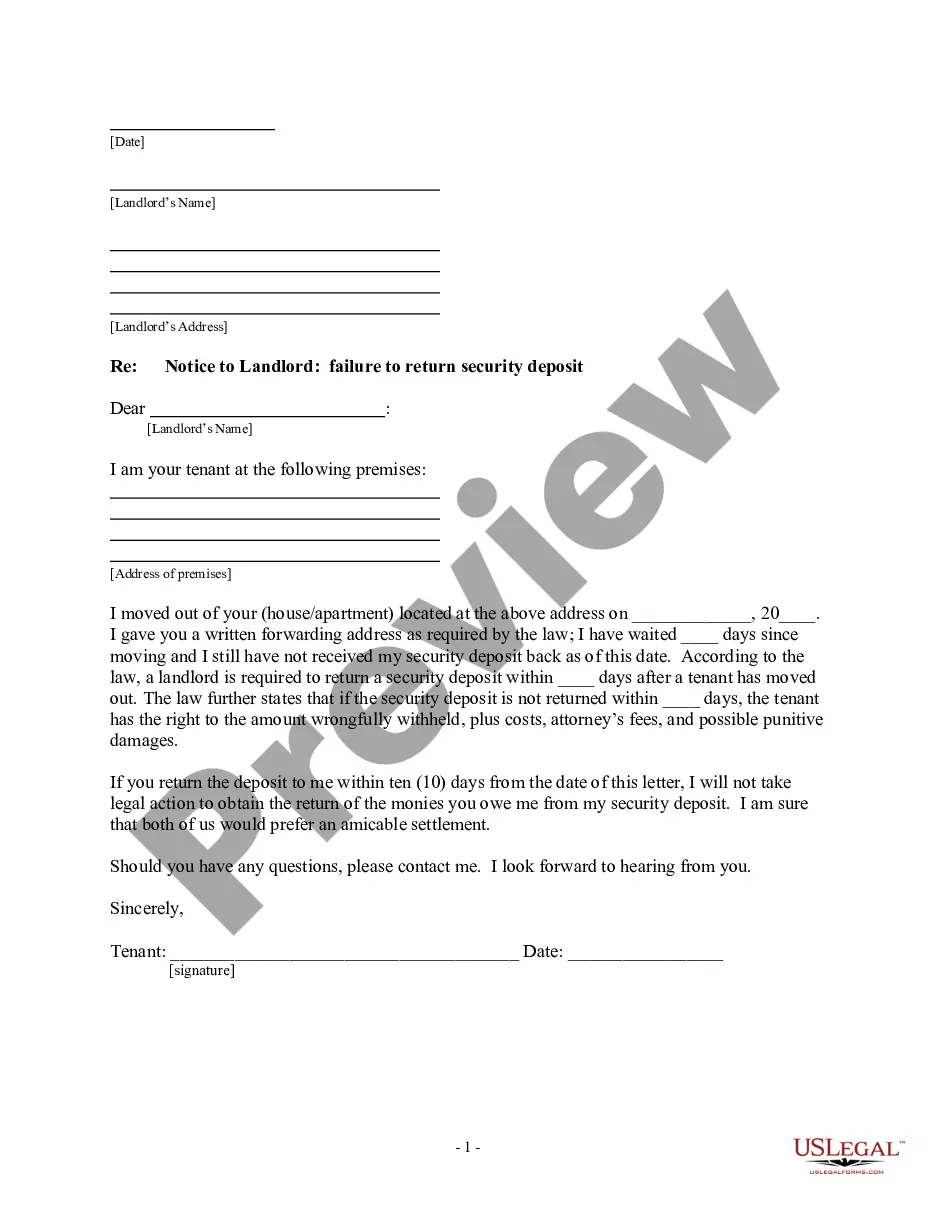

How to fill out LLC Agreement - Open Source?

If you have to complete, obtain, or print out authorized document templates, use US Legal Forms, the most important selection of authorized forms, which can be found on the Internet. Take advantage of the site`s easy and convenient search to discover the files you require. A variety of templates for business and personal functions are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Hawaii LLC Agreement - Open Source with a few clicks.

When you are presently a US Legal Forms buyer, log in to the account and then click the Download option to get the Hawaii LLC Agreement - Open Source. You can also entry forms you previously delivered electronically from the My Forms tab of your respective account.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for the proper city/region.

- Step 2. Utilize the Review method to check out the form`s content material. Don`t forget to read the explanation.

- Step 3. When you are unhappy with all the kind, utilize the Research industry towards the top of the display screen to discover other types of your authorized kind design.

- Step 4. Once you have located the form you require, click on the Get now option. Opt for the costs prepare you prefer and add your credentials to register on an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to finish the financial transaction.

- Step 6. Select the format of your authorized kind and obtain it on your product.

- Step 7. Complete, change and print out or indication the Hawaii LLC Agreement - Open Source.

Each authorized document design you acquire is yours eternally. You possess acces to each kind you delivered electronically in your acccount. Select the My Forms section and pick a kind to print out or obtain once again.

Compete and obtain, and print out the Hawaii LLC Agreement - Open Source with US Legal Forms. There are many skilled and express-specific forms you can utilize for your business or personal requires.

Form popularity

FAQ

It will cost you $50 to register your LLC in Hawaii with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division, plus an additional $1 State Archives fee. Filing online is the fastest way to complete the paperwork.

Starting an LLC in Hawaii will include the following steps: #1: Choose a Name for Your Hawaii LLC. #2: Designate a Registered Agent. #3: File Your Articles of Organization. #4: Create an Operating Agreement. #5: Request Tax ID Numbers. #6: File Your Hawaii LLC Annual Report.

Forming an LLC in Hawaii is easy and relatively inexpensive. Keep in mind that the state has requirements that are unique to itself. Begin by deciding on a name for the company, then performing a name search on the Department of Commerce & Consumer Affairs (DCCA) website.

Benefits of starting a Hawaii LLC: Protect your personal assets from your business liability and debts. Simple to create, manage, regulate, administer and stay in compliance. Easily file your taxes and discover potential advantages for tax treatment.

While there are no specific laws that make it more suitable for LLCs than other states, Delaware is the state of choice to incorporate because of their business-friendly corporate tax laws. There's a reason why 66.8% of all Fortune 500 companies choose Delaware as their incorporation state.

Federal tax identification number (EIN). An EIN is required for LLCs that will have employees. Additionally, most banks require an EIN in order to open a business bank account.

Hawaii LLCs are classified as pass-through tax entities by default, which means they don't pay corporate income tax. Instead, LLC revenue passes through the business to the members/owners, who report their share of the profits as personal income on their taxes.

Hawaii does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.