Hawaii Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

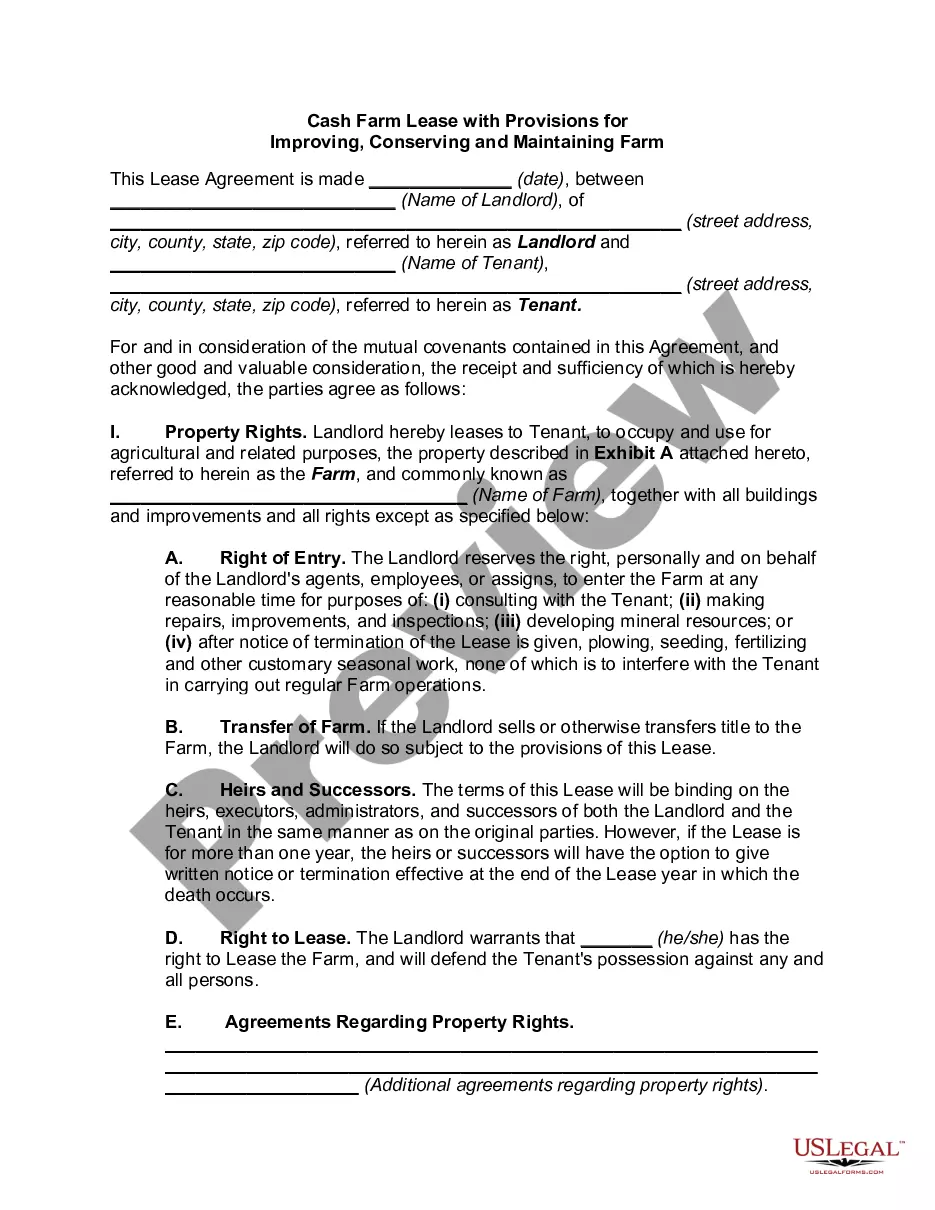

Finding the appropriate legal document format can be a challenge. Clearly, there are numerous templates available online, but how do you identify the legal type you require? Utilize the US Legal Forms platform. The service offers thousands of templates, including the Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets, which you can employ for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log In to your account and click on the Obtain button to access the Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets. Use your account to browse the legal documents you may have acquired previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, make sure you have selected the correct form for your location/region. You can preview the document using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain that the document is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document to your device. Complete, edit, print, and sign the obtained Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

US Legal Forms is the largest repository of legal documents where you can find a variety of file templates. Utilize the service to download professionally crafted paperwork that conforms to state requirements.

- Ensure proper selection for your area.

- Preview the form before confirming.

- Use the search function if needed.

- Confirm suitability before purchasing.

- Select a pricing plan for your needs.

- Download the document after payment.

Form popularity

FAQ

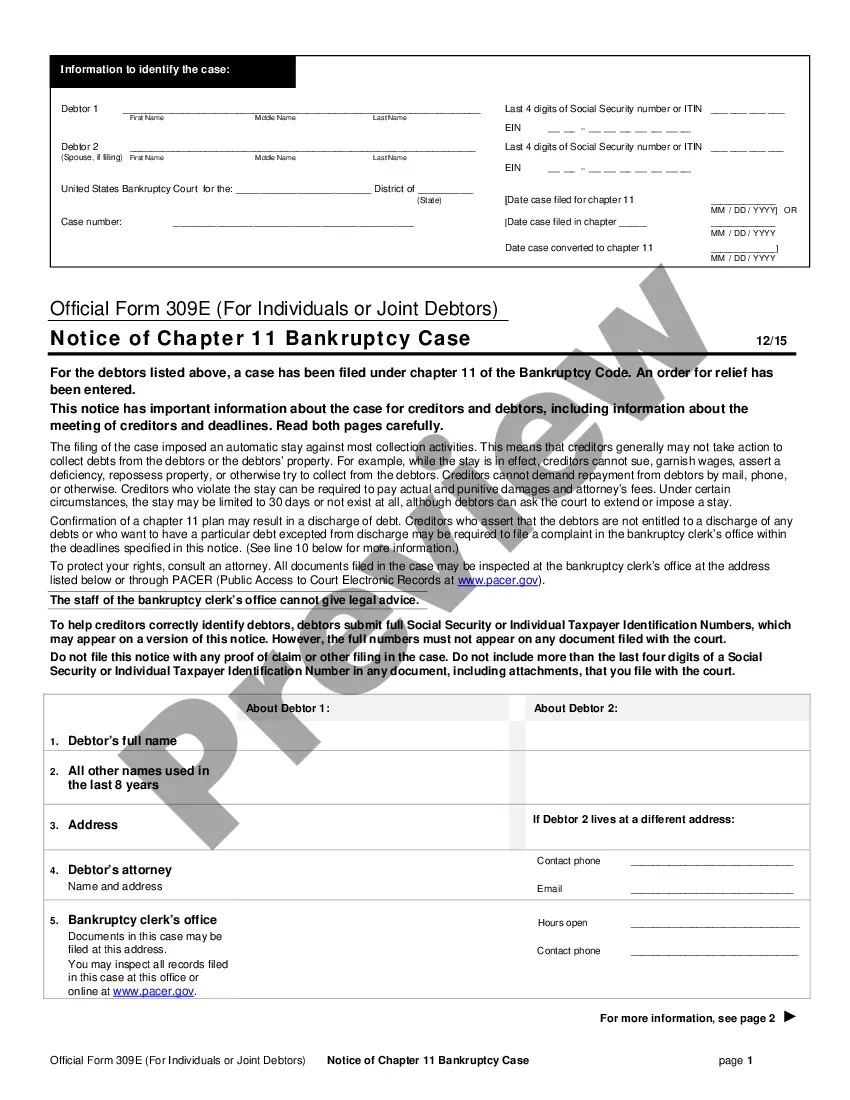

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

File a Dissolution Form. You'll have to file a dissolution of partnership form in the state your company is based in to end the partnership and make it public formally. Doing this makes it evident that you are no longer in the partnership or held liable for its debts. Overall, this is a solid protective measure.

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).14-Sept-2018

In California, a general partnership is an association of two or more persons, acting as co-owners of a business for profit. Any partner in a partnership is free to dissociate, or leave the partnership, at any time.