Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Assets Of A Building And Construction Business?

Are you presently in a situation where you require documents for both business and personal reasons almost every day.

There are numerous legal document templates accessible online, but locating reliable versions isn't easy.

US Legal Forms provides thousands of form templates, including the Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which are drafted to meet federal and state requirements.

When you find the correct form, simply click Acquire now.

Select the pricing plan you need, provide the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you desire and ensure it is for your appropriate area/state.

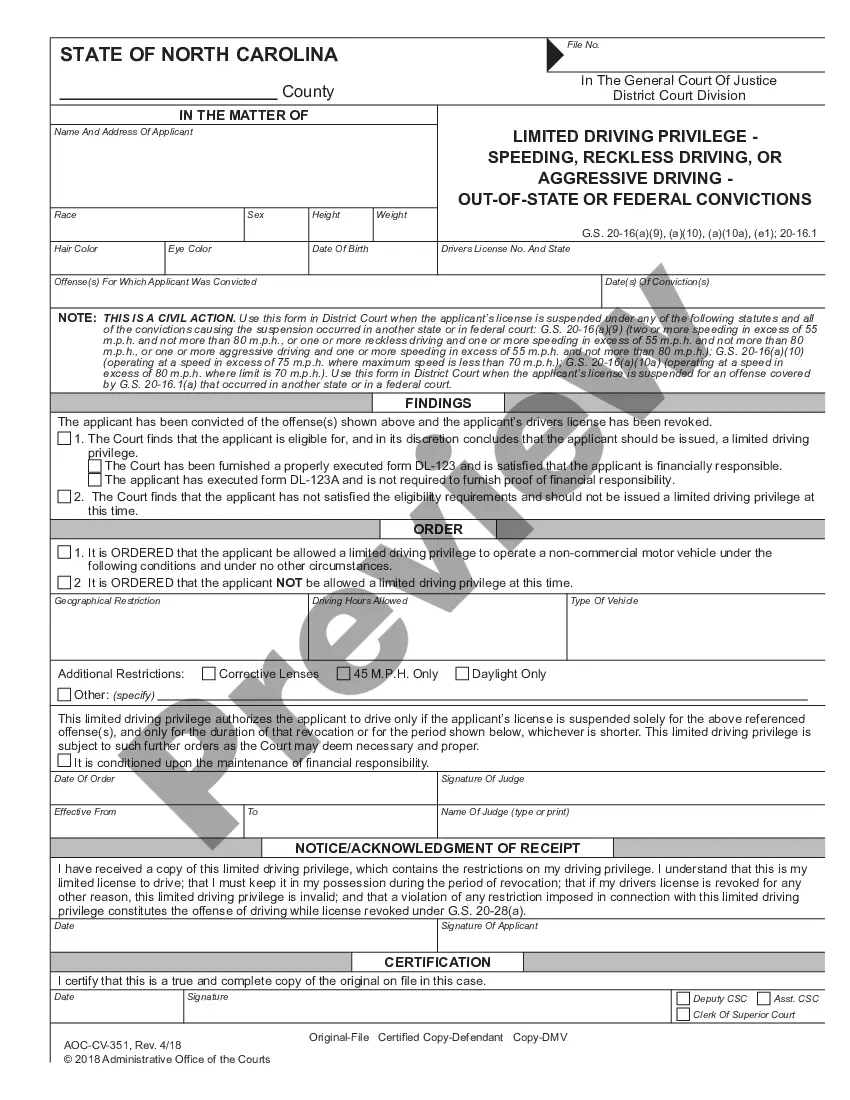

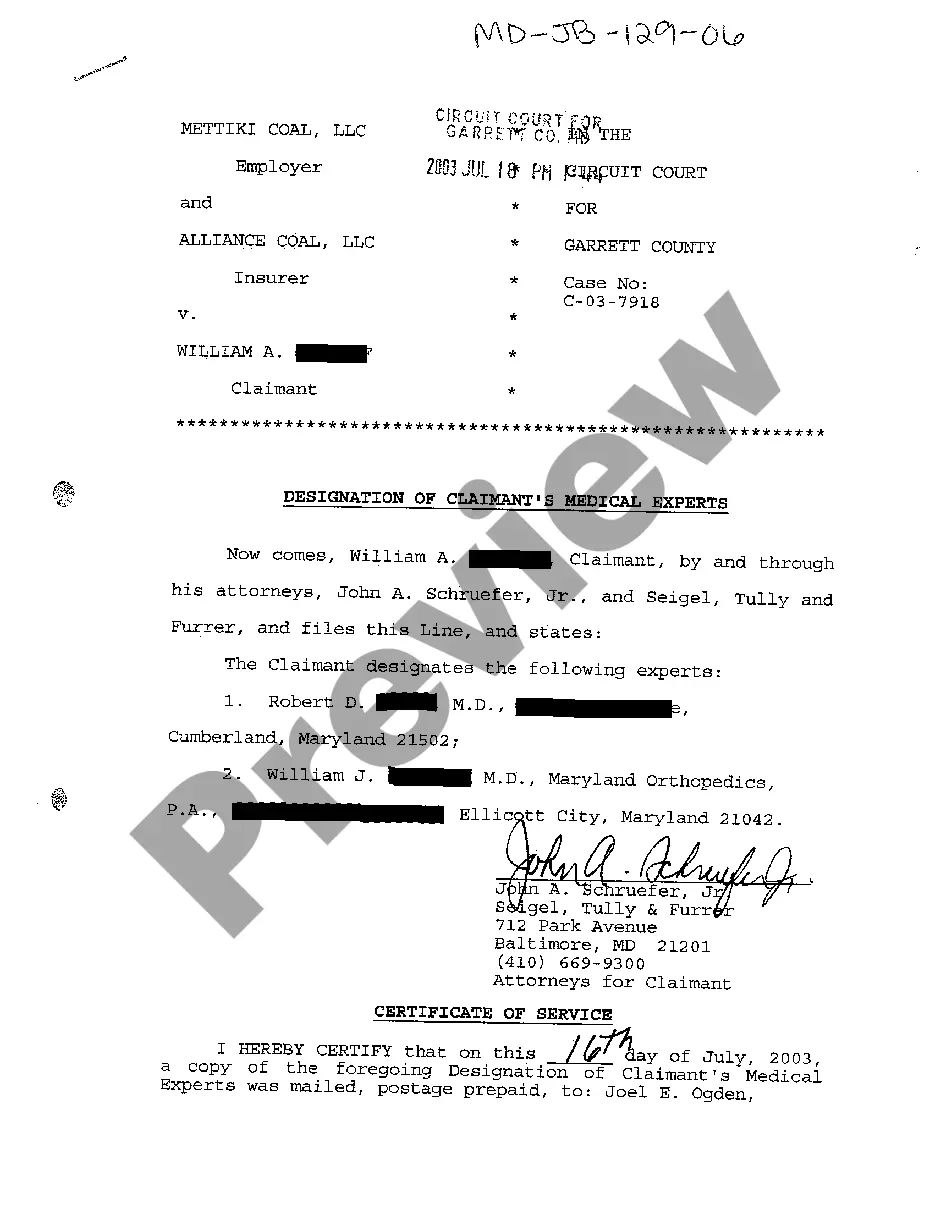

- Use the Preview button to examine the form.

- Check the overview to ensure that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Dissolving a partnership agreement requires you to follow the terms outlined in that agreement. Start with discussions among partners to ensure everyone agrees on the decision. Next, create a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, detailing the terms of dissolution, and make sure to file appropriate documents with the state for legal compliance.

Yes, winding up a partnership involves settling all business affairs before dissolution. This includes liquidating assets, paying off debts, and distributing remaining assets among partners. A well-crafted Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can streamline this process and ensure all parties agree on how to settle outstanding obligations.

To remove yourself from a partnership, start by consulting your partnership agreement for specific exit procedures. You should communicate your intentions to your partners and reach an agreement on how assets will be managed, often through a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. Documentation is critical throughout this process to protect your interests.

The procedure for dissolving a partnership typically starts with the partners agreeing to dissolve the business. Then, you draft a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which details the distribution of assets and liabilities. Finally, file any necessary paperwork with the state and notify relevant stakeholders to ensure a smooth transition.

Ending a partnership gracefully involves clear communication and mutual agreement between partners. Begin by discussing the reasons for dissolution, ensuring all parties understand the decision. Follow this with a formal Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which outlines the terms and conditions for ending the partnership.

A partnership can be dissolved in circumstances such as reaching the end of a specified term, completion of its purpose, or when a partner decides to quit. Each of these situations should be addressed in the partnership agreement to ensure all partners are aware of their rights and obligations. Engaging with a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can facilitate this dissolution process smoothly.

Dissolution of a partnership can result from various reasons, including lack of mutual consent among partners, financial difficulties, or changes in business goals. It is essential to note that reasons for dissolution should be explicitly stated in the partnership agreement. Utilizing a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can help clarify these situations and provide structure to the process.

Generally, a partner can dissolve a partnership, but this depends on the terms stated in the partnership agreement. If the agreement allows for unilateral dissolution, a partner may proceed. For a binding and fair process, it is advisable to outline the procedure in a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, to ensure clarity and minimize conflicts.

A partnership may be dissolved under various circumstances, including a breach of the partnership agreement, a partner’s death, withdrawal, or bankruptcy. Additionally, external factors such as legal regulations or significant changes in business operations can also trigger dissolution. The specific processes for dissolution can often be outlined in a comprehensive Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business.

A partnership firm can be dissolved under two primary circumstances: by mutual agreement among partners or by the occurrence of an event specified in the partnership agreement. In the context of a Hawaii Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, partners may choose to end the partnership due to mutual consent or after fulfilling specific conditions laid out in their agreement.