Hawaii Affidavit of Domicile for Deceased

Description

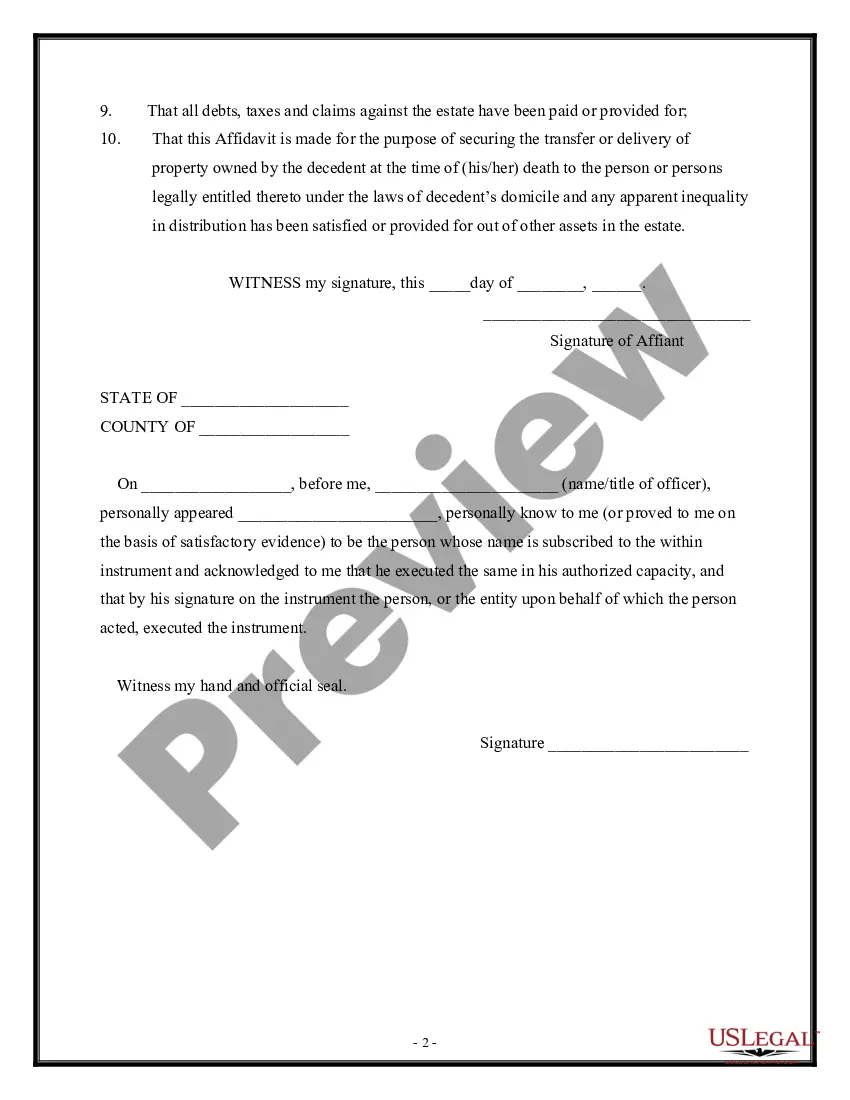

How to fill out Affidavit Of Domicile For Deceased?

Are you inside a position the place you will need paperwork for sometimes business or individual uses virtually every working day? There are a variety of authorized record templates accessible on the Internet, but discovering kinds you can trust isn`t simple. US Legal Forms offers thousands of type templates, like the Hawaii Affidavit of Domicile for Deceased, that happen to be written to satisfy state and federal requirements.

In case you are presently acquainted with US Legal Forms internet site and have your account, simply log in. After that, you are able to down load the Hawaii Affidavit of Domicile for Deceased web template.

Should you not offer an profile and want to start using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for that correct city/state.

- Utilize the Preview switch to check the form.

- See the outline to ensure that you have chosen the correct type.

- In case the type isn`t what you are trying to find, use the Research field to discover the type that fits your needs and requirements.

- When you get the correct type, simply click Purchase now.

- Opt for the rates program you need, fill out the specified details to generate your account, and purchase the order making use of your PayPal or bank card.

- Decide on a hassle-free file structure and down load your duplicate.

Locate each of the record templates you possess bought in the My Forms menus. You can aquire a further duplicate of Hawaii Affidavit of Domicile for Deceased anytime, if needed. Just click on the needed type to down load or print out the record web template.

Use US Legal Forms, by far the most considerable assortment of authorized varieties, to save efforts and steer clear of blunders. The service offers professionally made authorized record templates which can be used for a variety of uses. Generate your account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

In Hawaii, if a person dies owning real estate in their own name or if the total value of personal property is worth more than $100,000, their estate must be probated. In other states that threshold may be lower.

Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

There are no federal probate laws. Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

Even if there's no Will, a simplified probate procedure known as ?a summary probate? is possible if any estate is valued at $100,000 or less. You may also be able to use an Affidavit, which would allow you to transfer assets directly to beneficiaries and inheritors if an estate is worth less than $100,000 in value.