Florida Resolutions - General

Description

How to fill out Resolutions - General?

Are you in a situation where you need documents for both professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Florida Resolutions - General, which are designed to comply with state and federal regulations.

When you locate the correct form, click on Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Florida Resolutions - General template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/county.

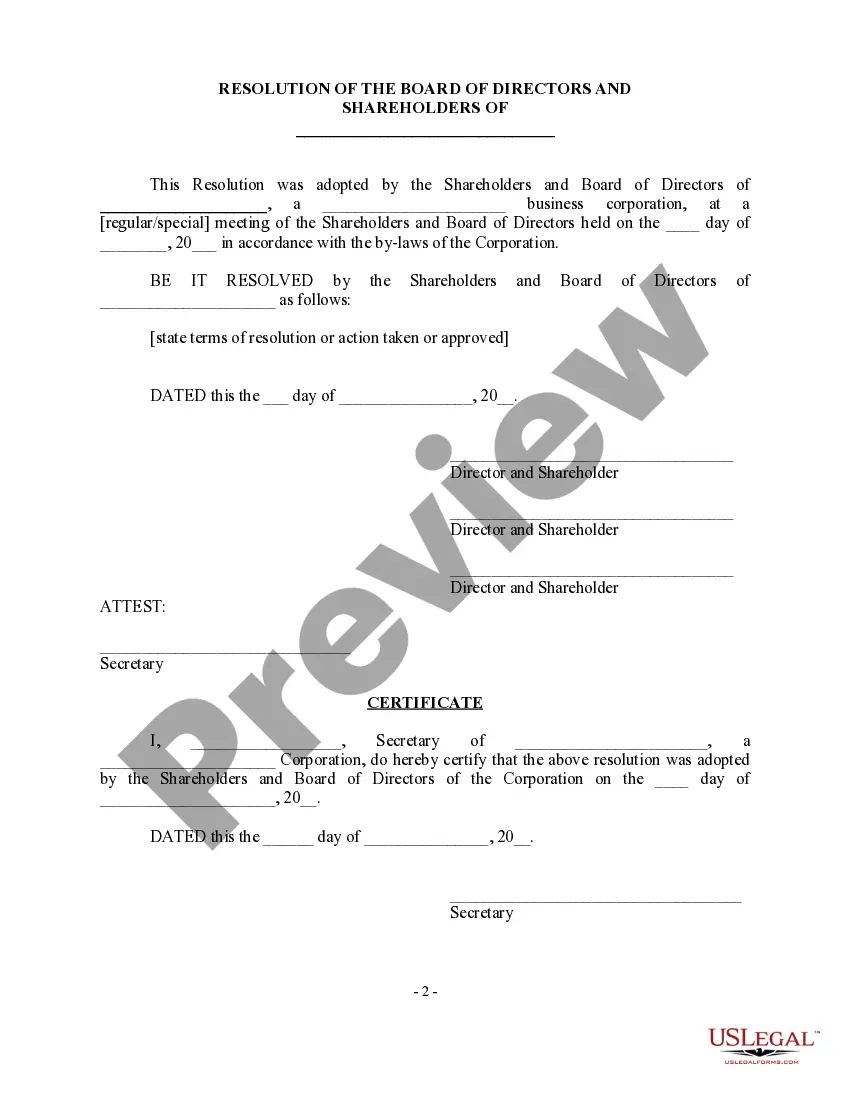

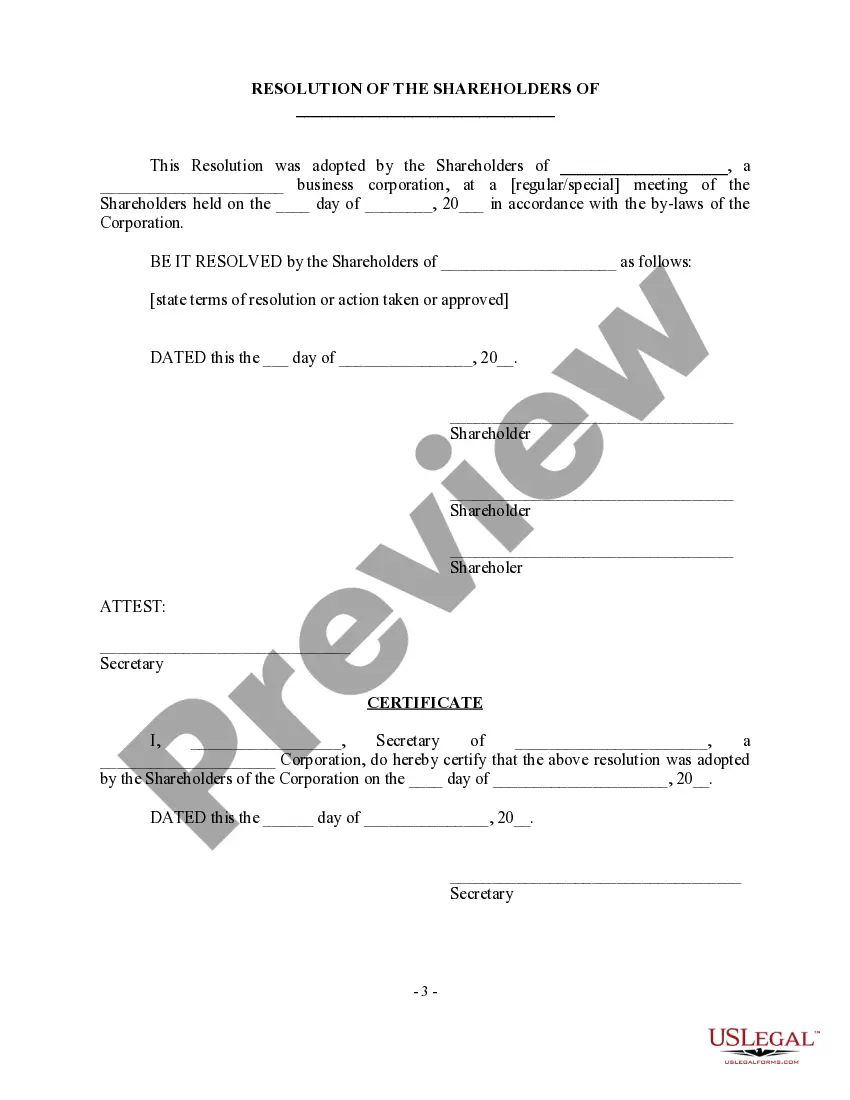

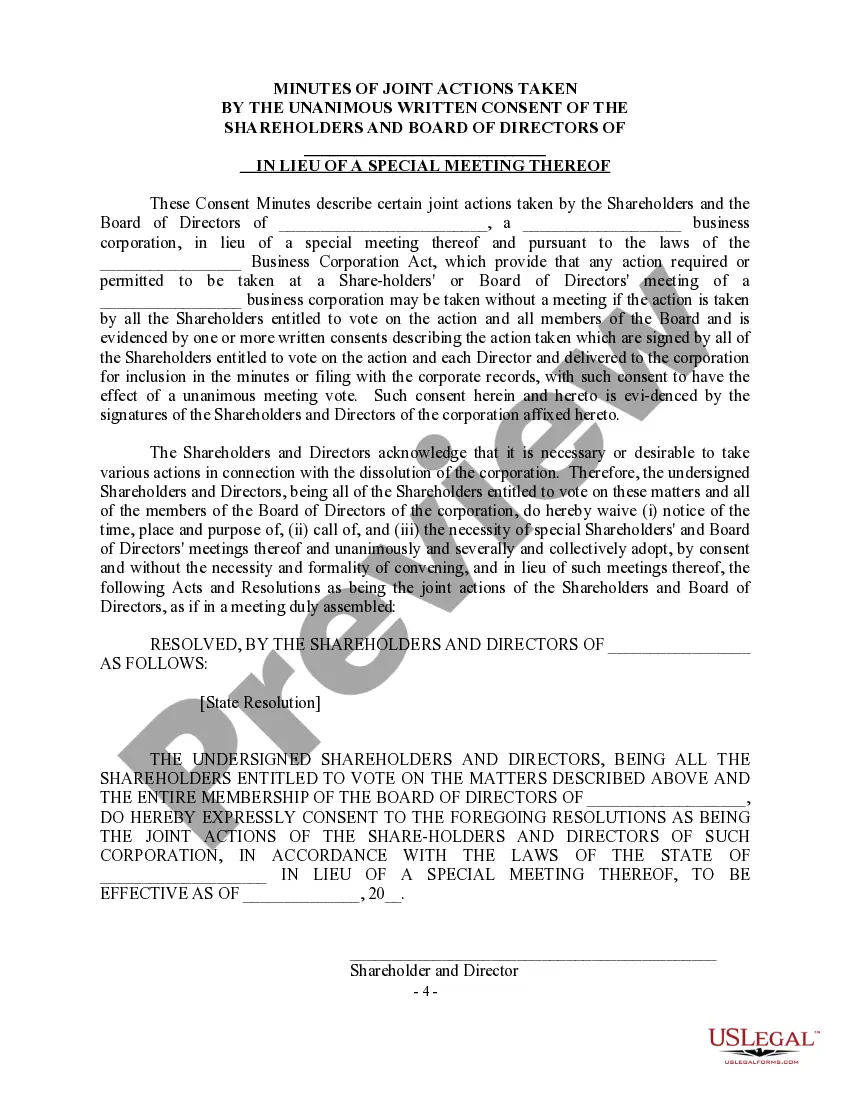

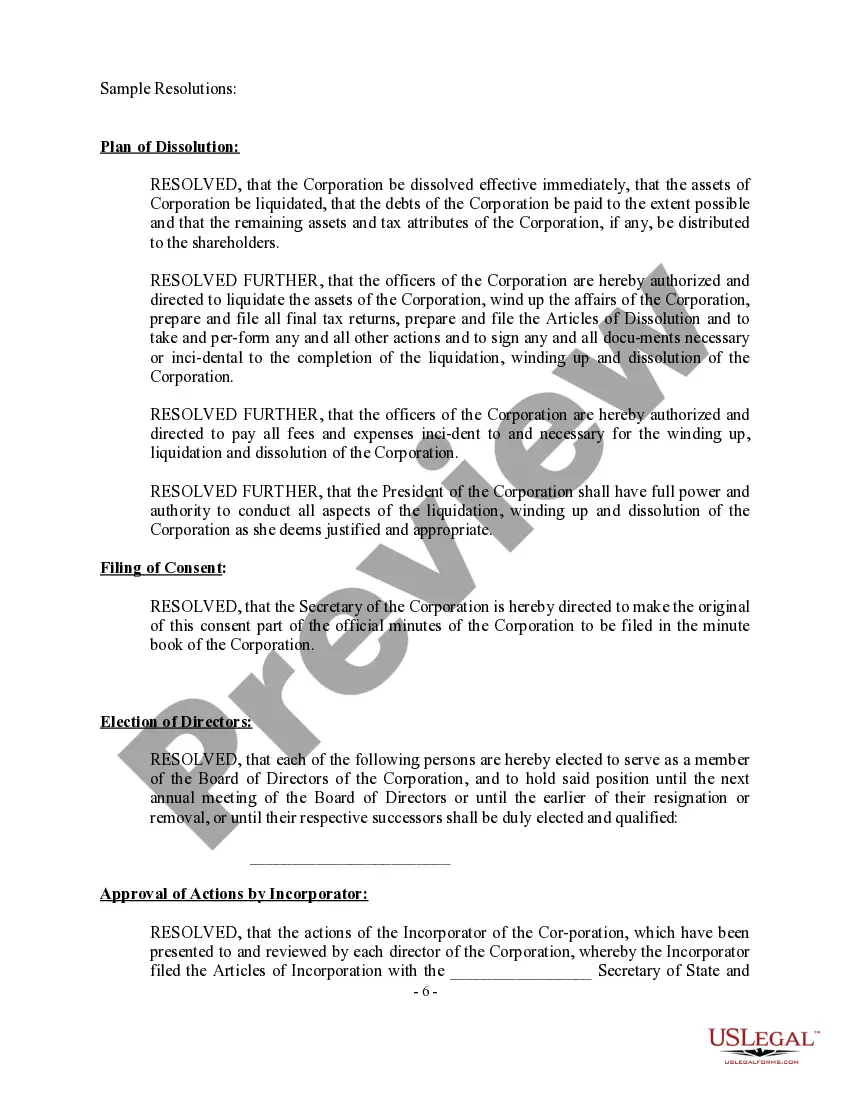

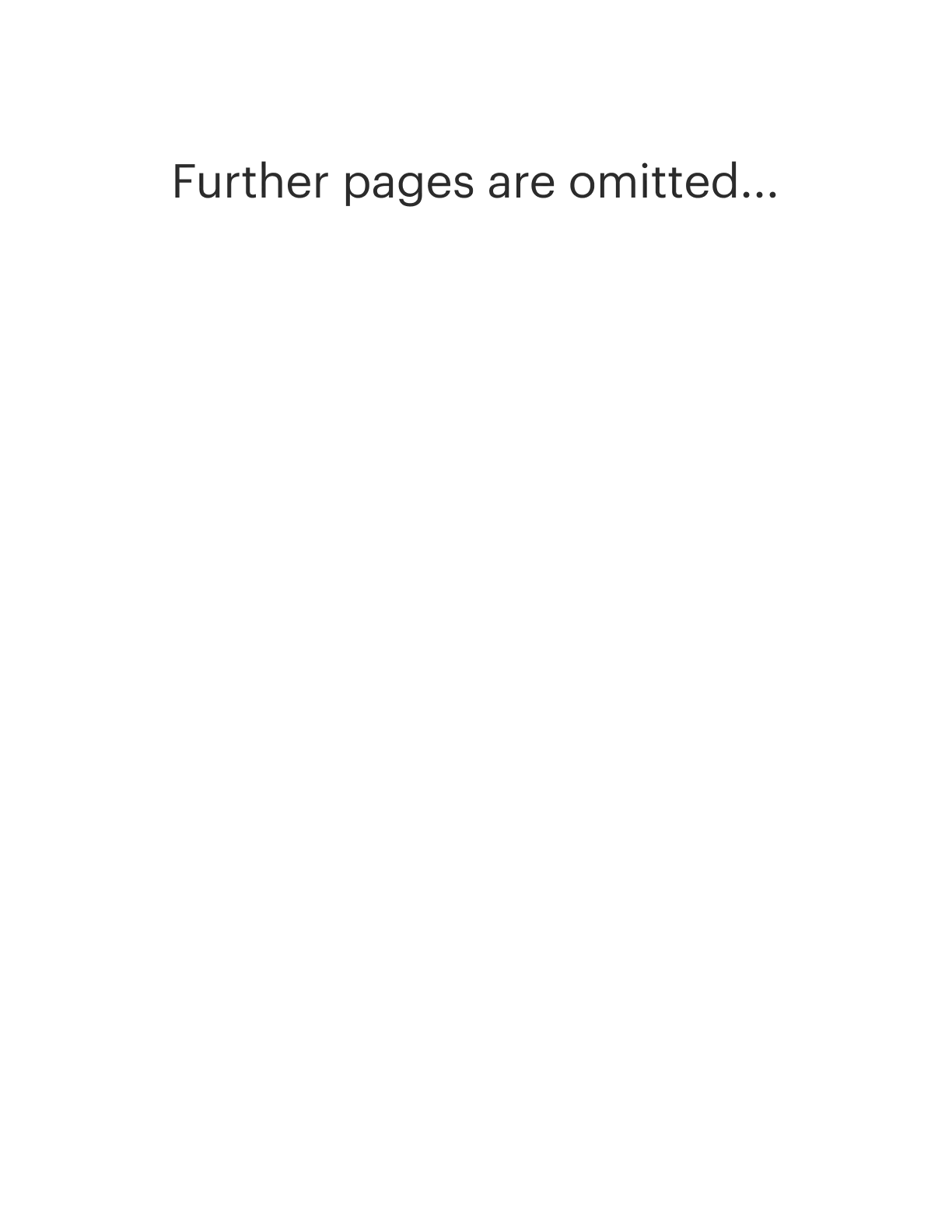

- Use the Review button to look over the form.

- Read the description to ensure you've selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

You can find a copy of Florida statutes online through the Florida Legislature's website or at local public libraries. Additionally, services like uslegalforms can provide access to legal documents, ensuring you have the most up-to-date laws at your fingertips. This helps you navigate legal aspects related to Florida Resolutions - General more effectively.

In Florida, corporate resolutions do not generally require notarization, but it's recommended to keep a signed record for clarity and validation. This documentation is crucial for decision-making and can be useful during audits. Understanding Florida Resolutions - General can enhance your familiarity with statutory requirements surrounding corporate resolutions.

Applying for an S Corp in Florida starts with submitting your Articles of Incorporation to the Division of Corporations. Afterwards, file Form 2553 with the IRS to elect S Corp status. Keeping in mind the Florida Resolutions - General will ensure that you incorporate all necessary steps and documentation in your application.

To get a law passed in Florida, you must introduce a bill in either chamber of the Florida Legislature. The bill then undergoes committee reviews and must pass several votes before reaching the governor's desk for approval. Knowledge of Florida Resolutions - General can assist you in understanding the legislative process more thoroughly.

To start an S Corp in Florida, you need to file Articles of Incorporation with the Florida Division of Corporations. After that, you must apply for S Corp status with the IRS using Form 2553. Familiarizing yourself with Florida Resolutions - General can simplify this process and ensure you meet all legal requirements.

Choosing between an LLC and an S Corp in Florida depends on your business needs and goals. An LLC offers flexibility in ownership and management, while an S Corp provides potential tax benefits. Assessing these Florida Resolutions - General can help you navigate which option aligns best with your business strategy.

One disadvantage of an S Corp is that it cannot have more than 100 shareholders, which may limit growth potential. Additionally, all shareholders must be U.S. residents, restricting investment opportunities. Understanding Florida Resolutions - General in this context can help address limitations and find alternative structures if necessary.

To fill out a board of directors resolution, begin by clearly stating the meeting details followed by the specific resolution being proposed. Include names and signatures of the directors for validation. Using Florida Resolutions - General as a reference will ensure your process is compliant and meets all legal requirements.

Filling out Florida Form 82040 requires you to provide detailed information about the resolution you are submitting. Ensure you have the necessary identification details, specific declarations, and any supporting documentation ready. The guidelines found in Florida Resolutions - General can help streamline this process, making it more straightforward.

To write up a resolution, format it with a clear title followed by a compelling preamble that outlines the reasons behind the resolution. Then, list the specific resolutions in numbered or bullet points for clarity. Utilizing Florida Resolutions - General can significantly enhance the structure and effectiveness of your document.