Hawaii Resolutions - General

Description

How to fill out Resolutions - General?

Are you presently within a location where you often need documents for either business or personal reasons.

There are numerous legal document templates available online, yet finding reliable versions is challenging.

US Legal Forms provides thousands of form templates, including the Hawaii Resolutions - General, designed to comply with federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can acquire an additional copy of Hawaii Resolutions - General at any time, if needed. Just access the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Resolutions - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it is for the correct city/state.

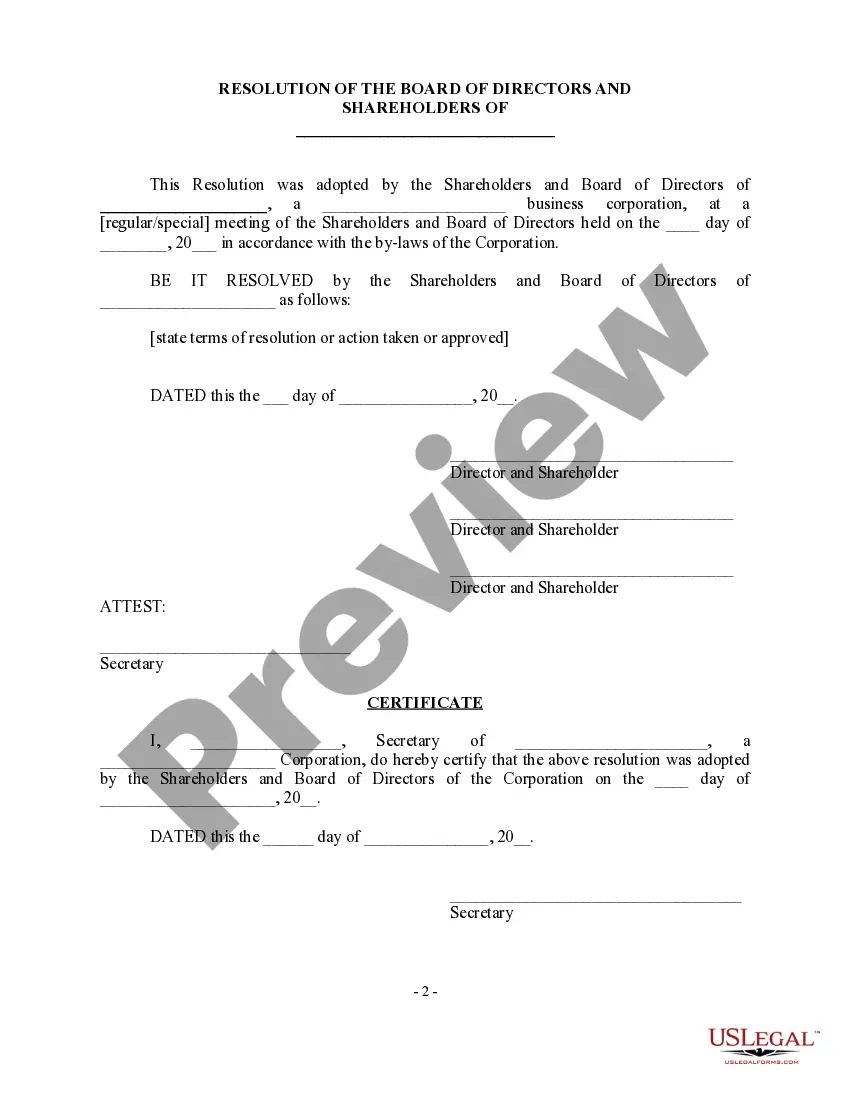

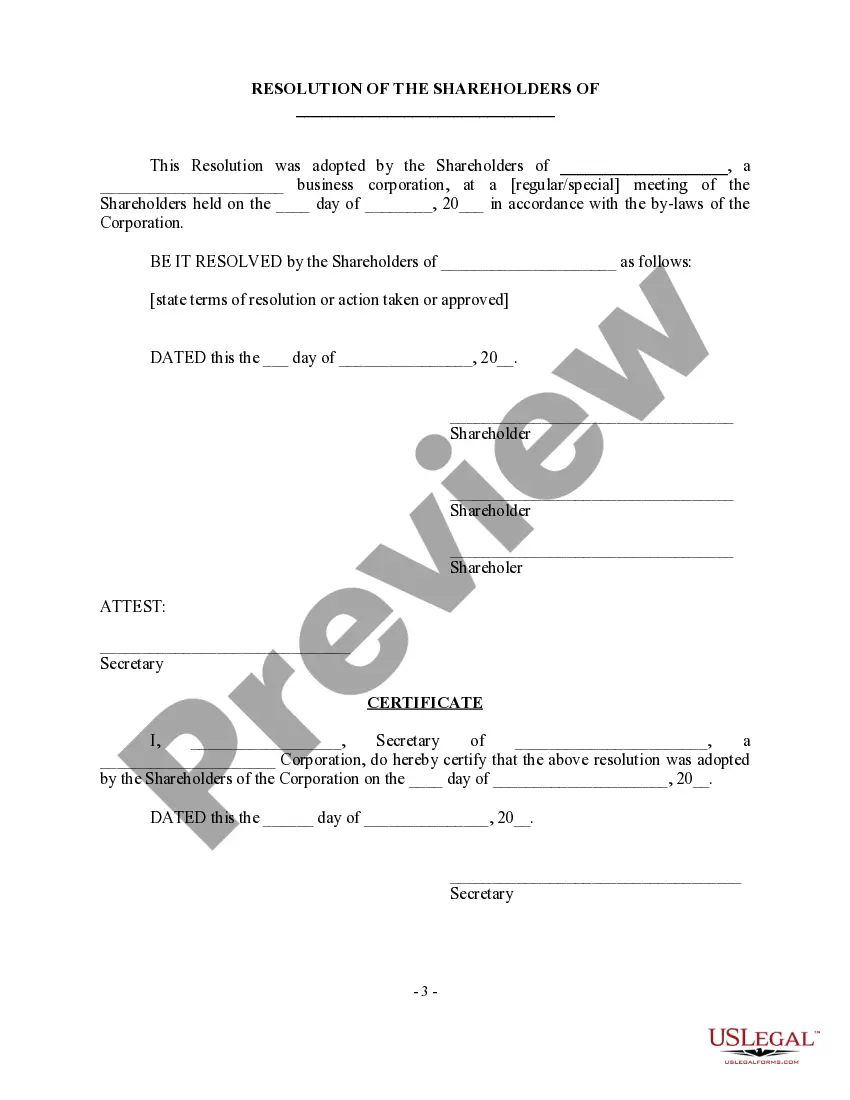

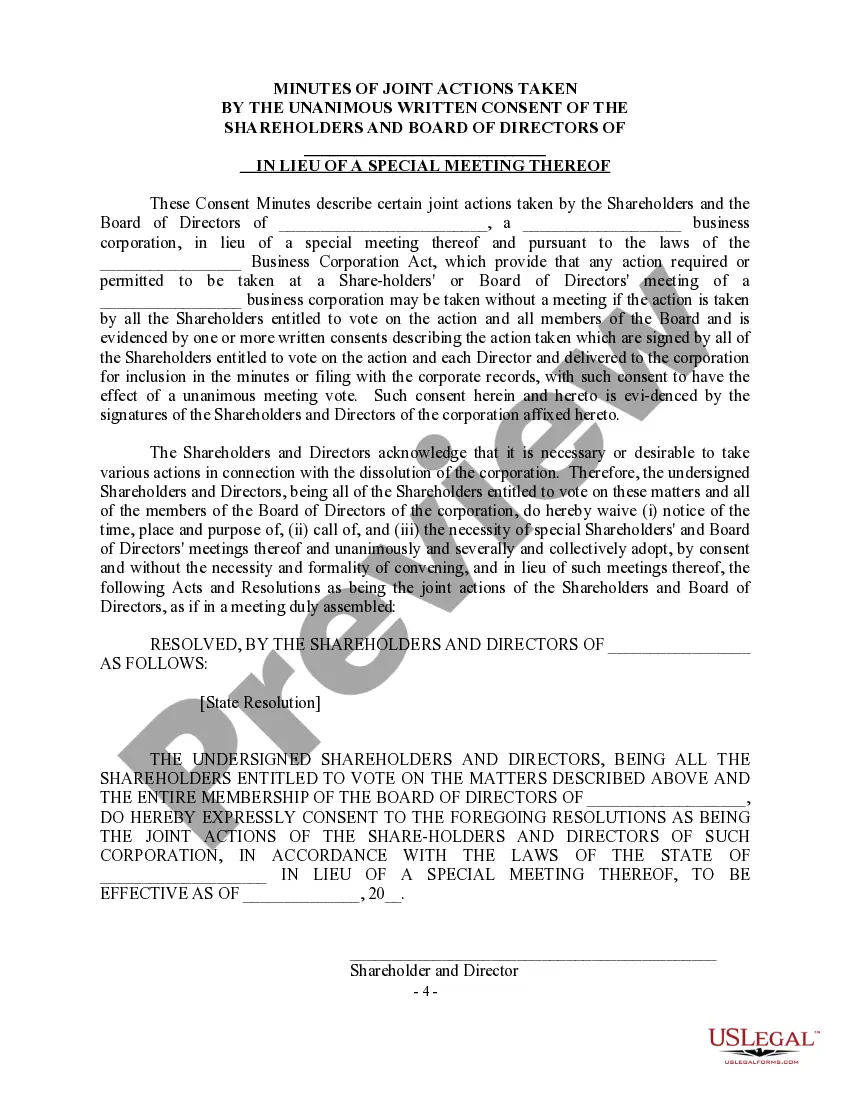

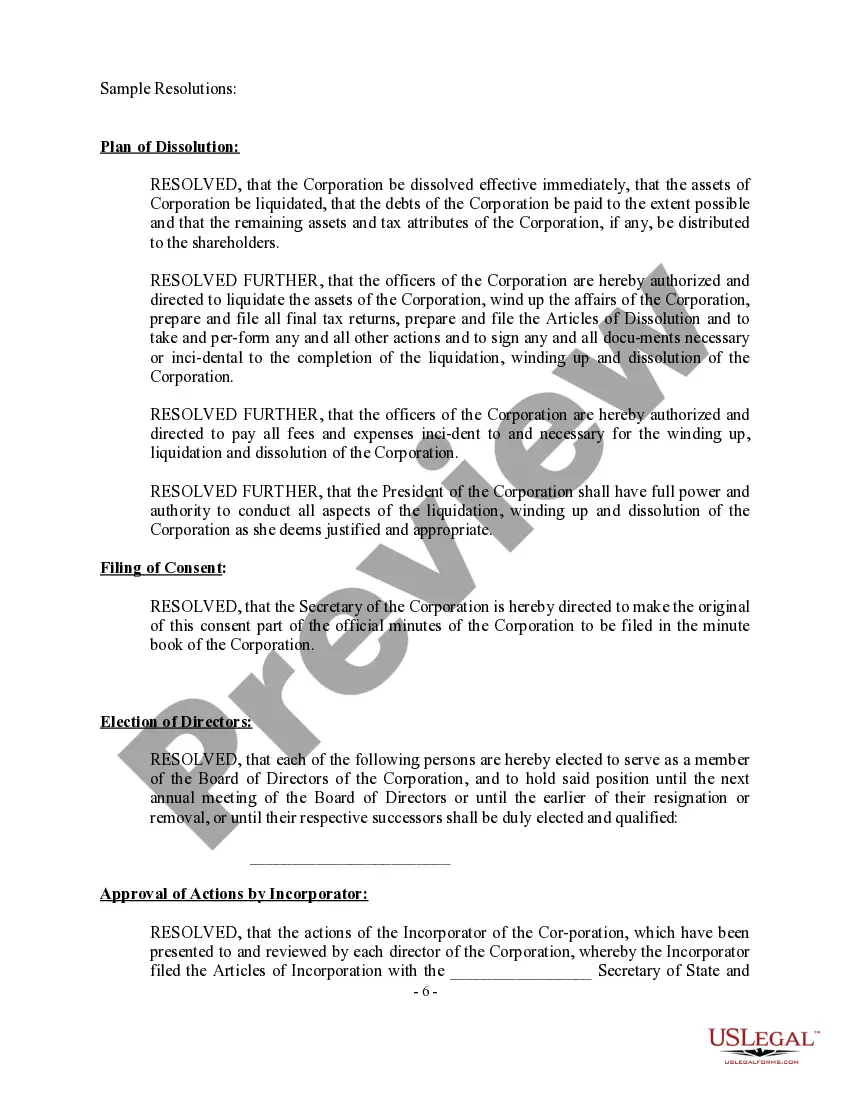

- Utilize the Preview button to review the form.

- Examine the details to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that fits your needs and specifications.

- Once you find the suitable form, click on Purchase now.

- Select the pricing option you prefer, enter the required information to create your account, and pay for your order using PayPal or a Visa or Mastercard.

Form popularity

FAQ

To file a 1099 in Hawaii, complete the appropriate 1099 form and submit it to both the IRS and the Hawaii Department of Taxation. You must report various types of income, such as freelance earnings or payments you made to contractors. Ensure you adhere to the instructions under Hawaii Resolutions - General for accuracy. Utilize platforms like uslegalforms to simplify the filing process and ensure compliance.

Yes, there can be penalties for filing an amended return, especially if it causes a delay in tax payments. Under Hawaii Resolutions - General, timely submissions are vital to avoid unnecessary charges. If you realize you made an error, it is better to file an amendment as soon as possible. Always consult the guidelines to understand potential penalties related to your specific situation.

The G49 form is used to report Hawaii state income tax withheld and must be submitted by employers. This form ensures that employees' withholding is reported correctly and aligns with Hawaii Resolutions - General tax responsibilities. It’s essential for employers to complete this accurately to avoid complications for their employees. Make sure to keep accurate records to streamline this process.

Submitting testimony to the Hawaii Legislature can be done online or via mail. You will need to prepare a brief document that is clear and concise, reflecting your opinion on specific bills or issues. Use the official legislative website to access submission guidelines and deadlines under Hawaii Resolutions - General. Engaging in this process allows your voice to be heard in the legislative arena.

To file an amended Hawaii state tax return, you will use Form N-2. This form allows taxpayers to correct errors or provide additional information on a previously filed return. Take note of specific guidelines under Hawaii Resolutions - General to ensure you follow the correct procedures. Once completed, send it to the appropriate tax office.

You need to file a Hawaii state tax return if you meet certain income thresholds, even if you are not a resident. It’s essential to understand your obligations to stay compliant with Hawaii Resolutions - General. Filing on time can help you avoid potential penalties. Always check with a tax professional or use reliable platforms for guidance.

In the Philippines, a resolution is a formal statement of a legislative body, while an ordinance is a local law enacted by a municipal council. Resolutions express opinions or positions but do not create binding rules, whereas ordinances govern local jurisdictions and have the force of law. Understanding these differences is essential for comprehending local governance, including perspectives like those seen in Hawaii Resolutions - General.

The legislative biennium in Hawaii refers to a two-year period during which the state legislature operates. Each biennium begins on the first day of January of odd-numbered years and ends on the last day of December of the following even-numbered year. This structure facilitates comprehensive legislative planning and encourages sustained policy discussions. Active participation is key in shaping Hawaii Resolutions - General during this period.

A resolution is an expression of opinion by a legislative body, whereas a decree is an authoritative order issued by a governing authority. Resolutions typically guide or suggest actions without imposing legal obligations, while decrees often carry the force of law. This distinction is crucial for understanding governance structures under Hawaii Resolutions - General and beyond.

The purpose of a resolution is to articulate the official position of a legislative body on a particular issue. Resolutions can address various topics, from expressing sentiments to directing government actions. They serve as a vital instrument for representation and policy-making. When exploring Hawaii Resolutions - General, recognizing these purposes enriches the legal dialogue within the state.