Hawaii Chapter 7 Means Test Calculation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Chapter 7 Means Test Calculation?

Drafting legal documents can be a significant hassle without accessible fillable templates. With the US Legal Forms online repository of official documents, you can trust the forms you find, as they all adhere to federal and state regulations and have been verified by our professionals.

So if you need to create the Hawaii Chapter 7 Means Test Calculation, our platform is the ideal source for downloading it.

Here’s a brief guideline for you: Document compliance verification. You should carefully examine the details of the form you are interested in to ensure it meets your requirements and complies with state law stipulations. Reviewing your document and evaluating its general overview will assist you in this matter. Alternative search (if needed). If you notice any discrepancies, search the library using the Search tab at the top of the page until you identify a suitable template, and click Buy Now when you find the one you desire. Account setup and form purchase. Register for an account with US Legal Forms. After confirming your account, Log In and select the subscription plan that works best for you. Proceed with payment to continue (PayPal and credit card options are available). Template download and additional use. Select the file format for your Hawaii Chapter 7 Means Test Calculation and click Download to save it on your device. Print it to complete your paperwork by hand, or utilize a multi-functional online editor to create an electronic version more quickly and efficiently. Have you not yet experienced US Legal Forms? Register for our service now to obtain any official document promptly and conveniently whenever needed, and keep your paperwork organized!

- Acquiring your Hawaii Chapter 7 Means Test Calculation from our repository is straightforward.

- Returning users with a valid subscription just need to Log In and click the Download button after finding the appropriate template.

- Subsequently, if desired, users can access the same document from the My documents section of their profile.

- However, even if you are unfamiliar with our service, registering for a valid subscription takes only a few minutes.

Form popularity

FAQ

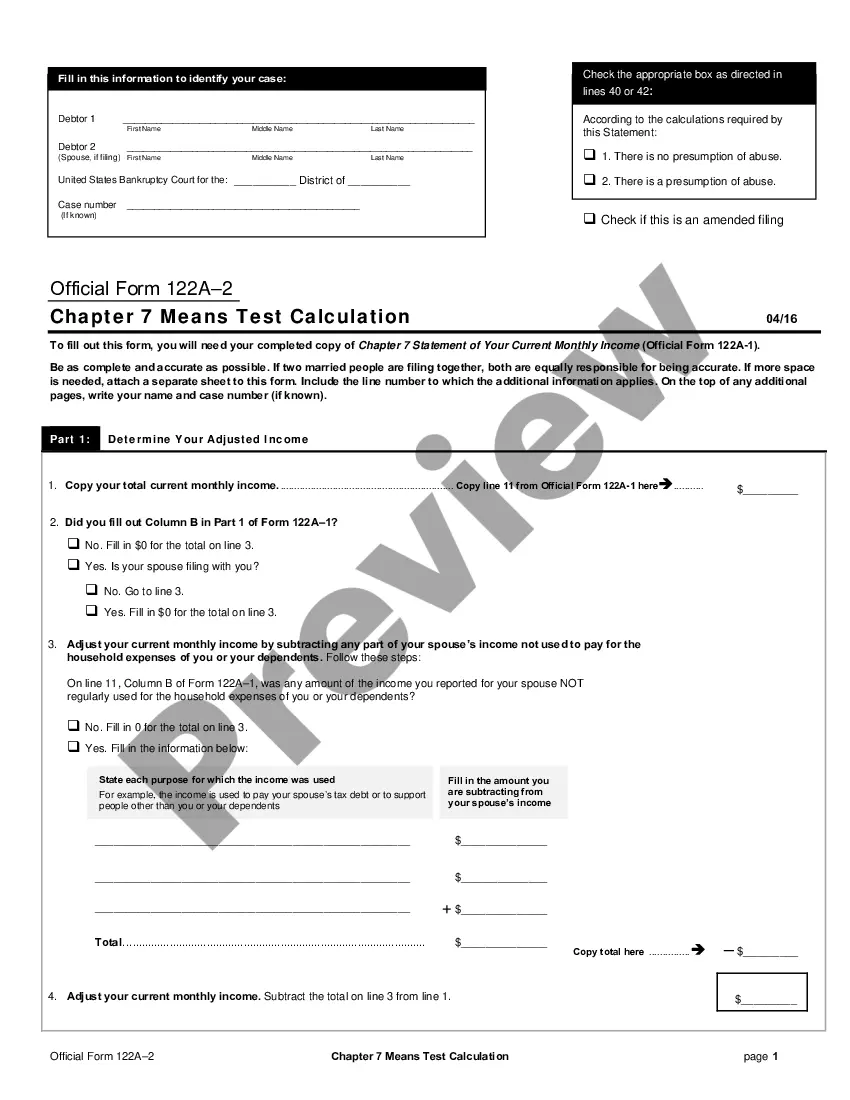

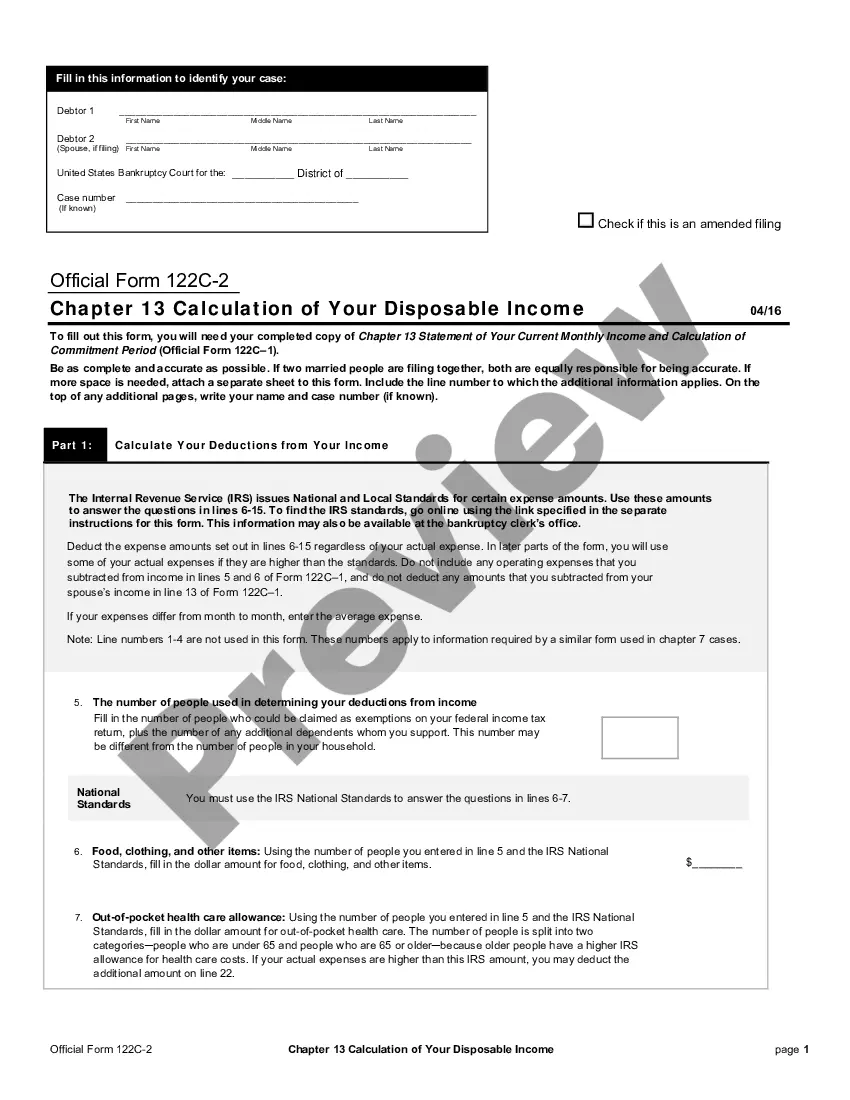

The means test method is a way to evaluate your financial eligibility for Chapter 7 bankruptcy. It involves calculating your income, framing it within the context of Hawaii's median income, and assessing deductions for necessary expenses. This process ensures that only those who truly need bankruptcy protection qualify. Using platforms like USLegalForms can guide you through this method effectively, simplifying your Hawaii Chapter 7 Means Test Calculation.

An example of a means-tested benefit is the Supplemental Nutrition Assistance Program (SNAP). This program provides food assistance to low-income individuals and families based on their incomes and other factors. Individuals must pass a means test that evaluates their financial situation. Understanding these benefits can be essential in the context of the Hawaii Chapter 7 Means Test Calculation.

To perform the Hawaii Chapter 7 Means Test Calculation, first gather your income information for the past six months. Use this data to find your average monthly income and compare it against Hawaii's median income for similar households. Next, subtract allowable expenses from your monthly income, and analyze the results. If the outcome shows your disposable income is low, you may have a viable path to file for Chapter 7 bankruptcy.

The Hawaii Chapter 7 Means Test Calculation starts with your monthly income over the last six months. You then subtract allowed deductions, such as taxes, mandatory retirement contributions, and certain living expenses. This helps to determine if your income exceeds the median income level for your household size in Hawaii. If your income is below this level, you may qualify for Chapter 7 bankruptcy.

Not qualifying for Chapter 7 often results from exceeding income limits established by the Hawaii Chapter 7 Means Test Calculation. Furthermore, if you fail to complete required credit counseling or have been involved in bankruptcy fraud, your application may be at risk. Understanding these disqualifications can save you time and effort. Checking out US Legal Forms can provide the necessary support throughout your filing journey.

You may be disqualified from Chapter 7 due to high-income levels, as indicated by the Hawaii Chapter 7 Means Test Calculation. Additionally, if you have received a Chapter 7 discharge within the past eight years, you cannot file again. Certain types of debts, like child support or recent tax debts, may also affect your eligibility. US Legal Forms provides helpful templates to assist you with your bankruptcy process.

A Chapter 7 bankruptcy can be denied for various reasons, including failure to pass the Hawaii Chapter 7 Means Test Calculation. If you have an unreported asset or omitted income, your application could face denial. Bankruptcy court also looks for good faith disclosures; any inconsistencies may raise red flags. Utilizing US Legal Forms can guide you to ensure your application is accurate.

Several factors may disqualify you from filing for Chapter 7 bankruptcy. The Hawaii Chapter 7 Means Test Calculation focuses on your income; if your income exceeds a certain threshold, you may not qualify. Additionally, prior bankruptcy filings or recent fraudulent activity may also disqualify you. Consulting resources on US Legal Forms can help clarify your specific situation.

Obtaining Chapter 7 bankruptcy can be a straightforward process if you meet the right criteria. The Hawaii Chapter 7 Means Test Calculation determines your eligibility based on your income and expenses. If your income falls below the state median, you may qualify easily. Working with a platform like US Legal Forms can simplify the process and help you understand your options.

The means test works by evaluating your financial situation to determine your eligibility for Chapter 7 bankruptcy. It assesses your income against state median income levels and evaluates household expenses. If your disposable income is below a certain threshold, you may qualify for Chapter 7. To facilitate accurate calculations, consider resources from USLegalForms for your Hawaii Chapter 7 Means Test Calculation.