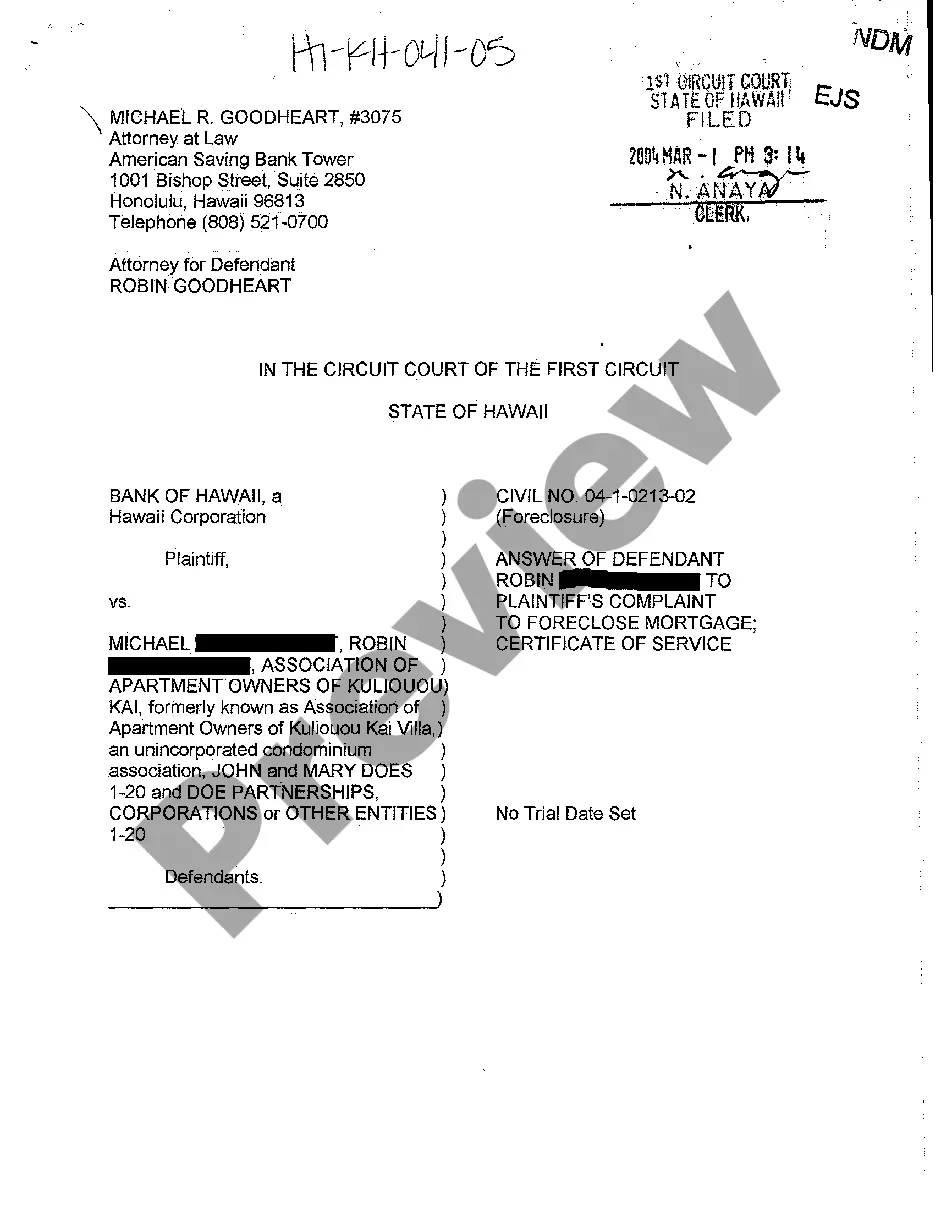

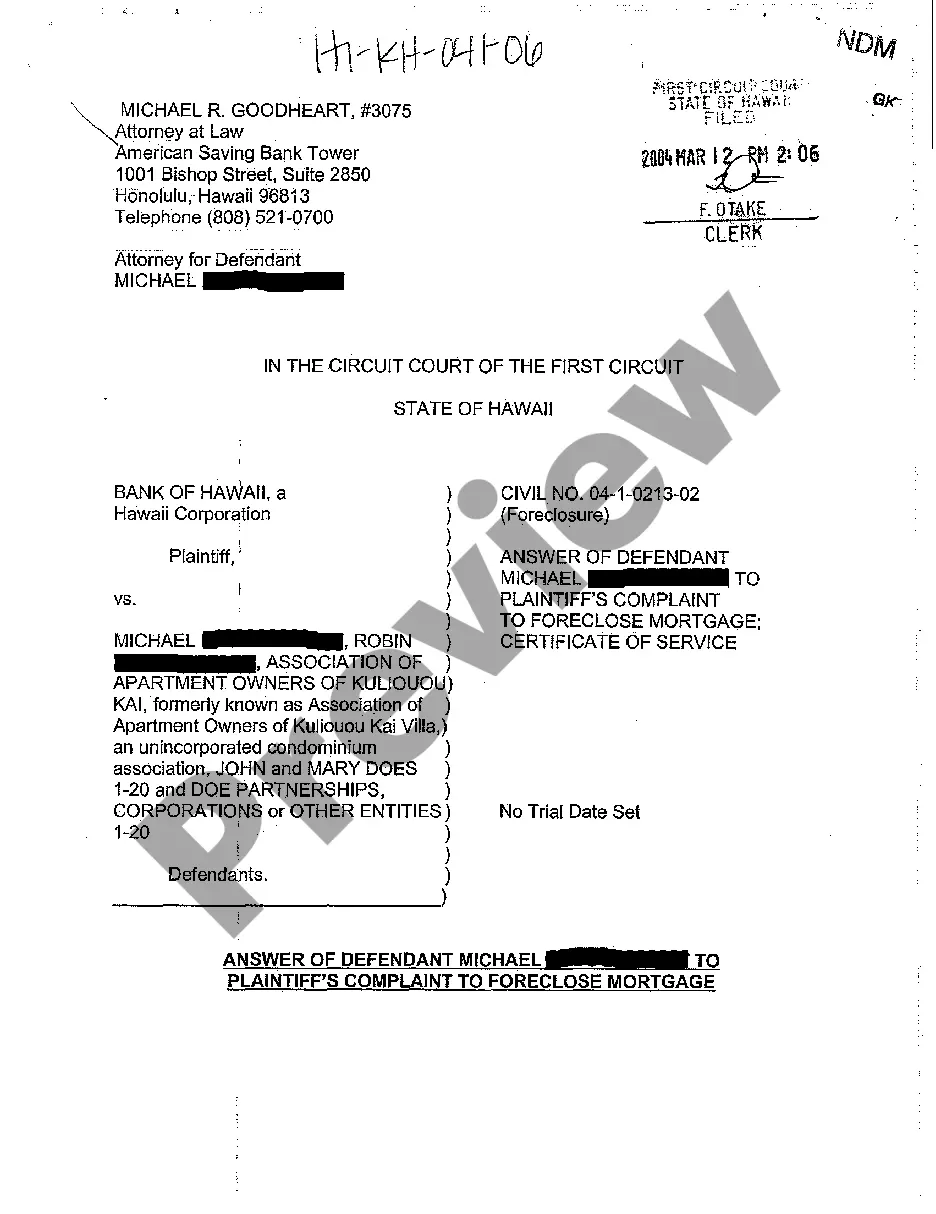

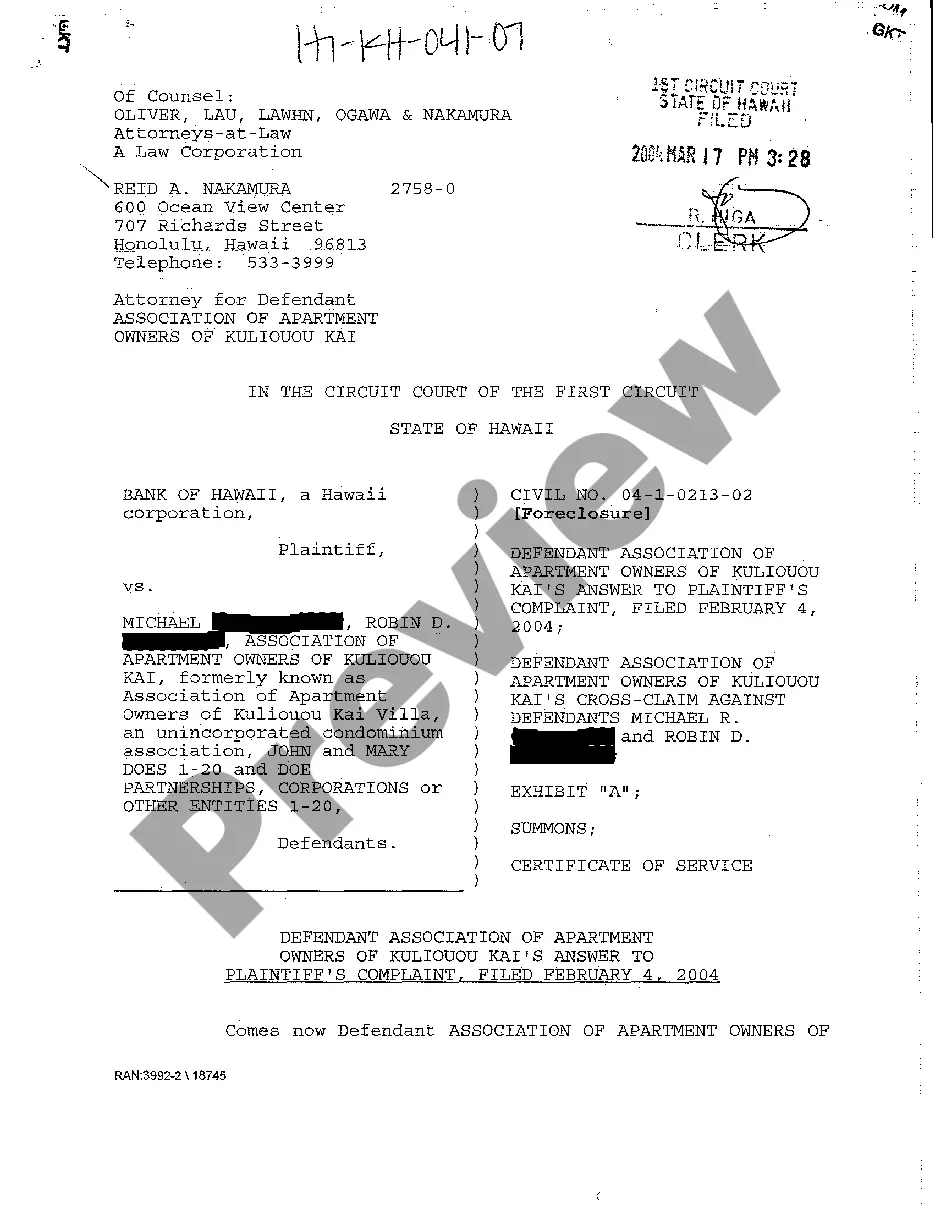

Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage

Description

How to fill out Hawaii Answer Of Defendant To Plaintiff's Complaint To Foreclose Mortgage?

Among numerous paid and free examples available online, you cannot be sure about their precision.

For instance, who created them or if they possess sufficient expertise to assist with what you require them for.

Always stay calm and use US Legal Forms!

Ensure that the document you locate applies to your area.

- Obtain Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage templates crafted by proficient attorneys.

- Steer clear of the expensive and lengthy process of searching for a lawyer.

- You won't need to pay them to draft a document that you can easily procure yourself.

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you seek.

- You will also have access to your previously saved files in the My documents section.

- If you are utilizing our service for the first time, adhere to the instructions below to acquire your Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage swiftly.

Form popularity

FAQ

Reinstatement. Ask the lender to reinstate the loan. Forbearance Agreement. Ask the lender to forgive the debt. Refinance. Sell your home. Short Sale. LLoan modification. Deed in Lieu of Foreclosure. Rescission of loan.

In rare circumstances, you can get a court to set aside (invalidate) a foreclosure sale. Sometimes homeowners aren't aware that a foreclosure sale has been scheduled until after it's already been completed. Even if your home has been sold, you might, in rare circumstances, be able to invalidate the sale.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

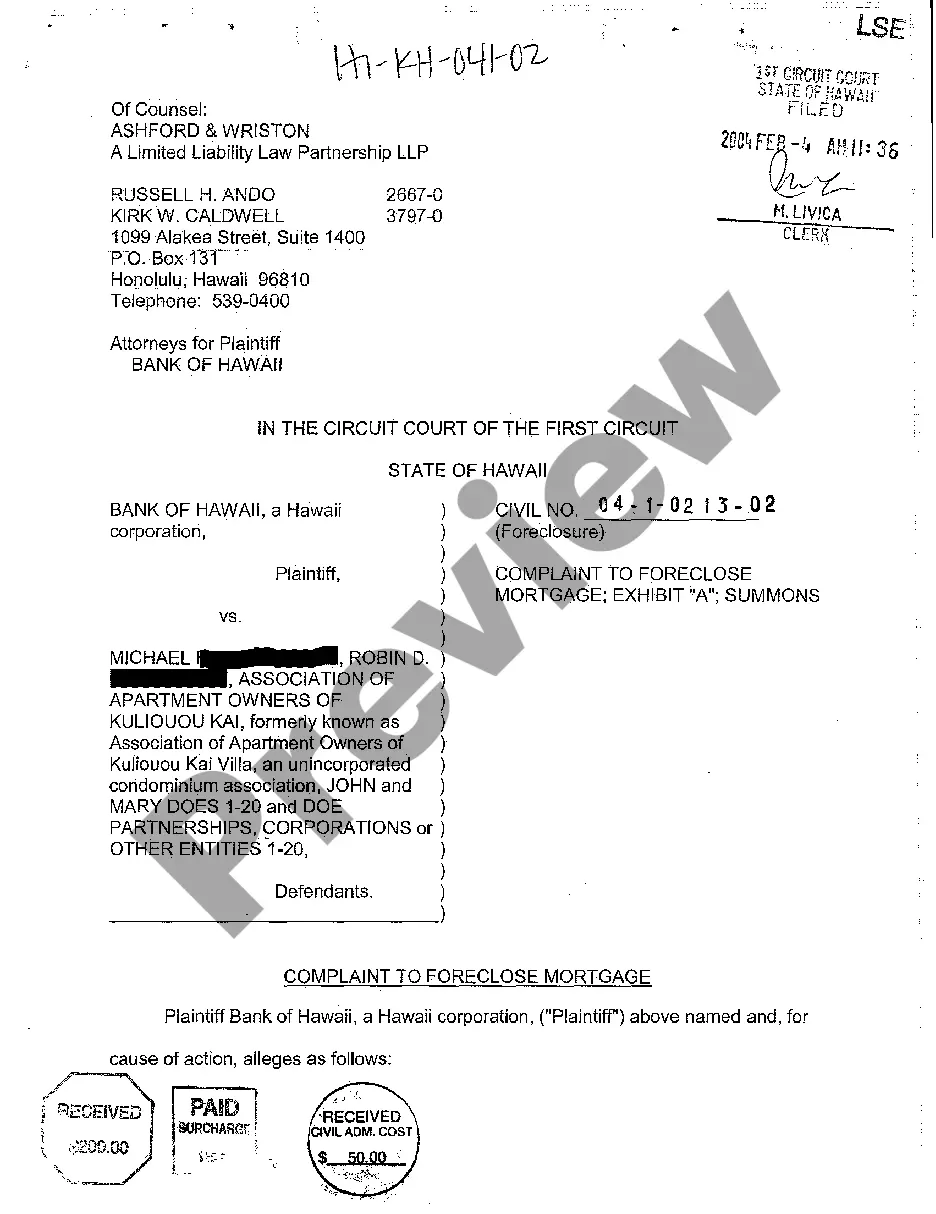

In 22 states, foreclosures are typically accomplished through civil lawsuits and judicial foreclosure orders. The borrower receives a foreclosure complaint and notice of a hearing. In most cases, the hearing is very short because the judge need only determine that the debt is valid and that the borrower is in default.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

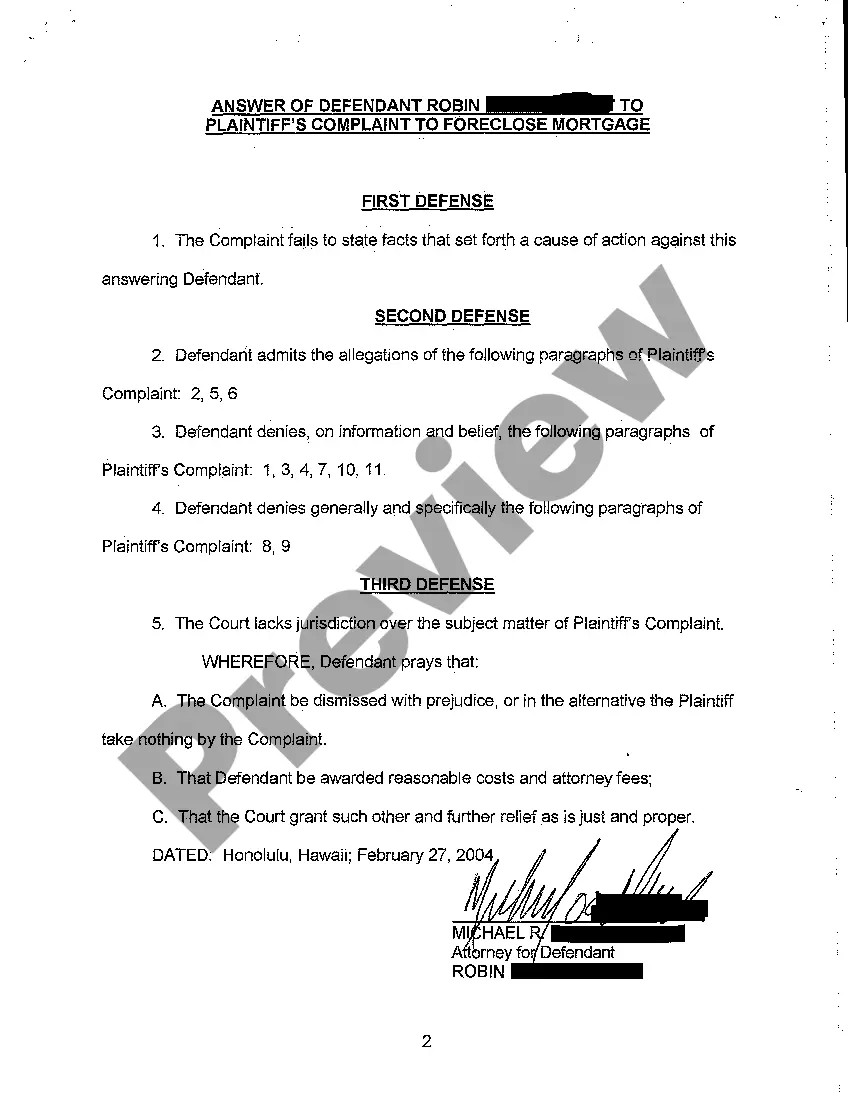

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

In a judicial foreclosure, the lender files a lawsuit against you in court.So, you'll get the chance to file an answer in a judicial foreclosure, but not in a nonjudicial one. If you want to fight a nonjudicial foreclosure in court, you'll have to start your own lawsuit.

Deficiency Judgments and Nonjudicial Foreclosures in California.Because almost all residential foreclosures in California are nonjudicial, most borrowers won't face a deficiency judgment after the foreclosure.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.