Hawaii Letter of Receipt

Description

How to fill out Hawaii Letter Of Receipt?

Amid a multitude of paid and complimentary specimens available online, you cannot guarantee their trustworthiness.

For instance, who developed them or if they possess the expertise required for your needs.

Always remain composed and utilize US Legal Forms!

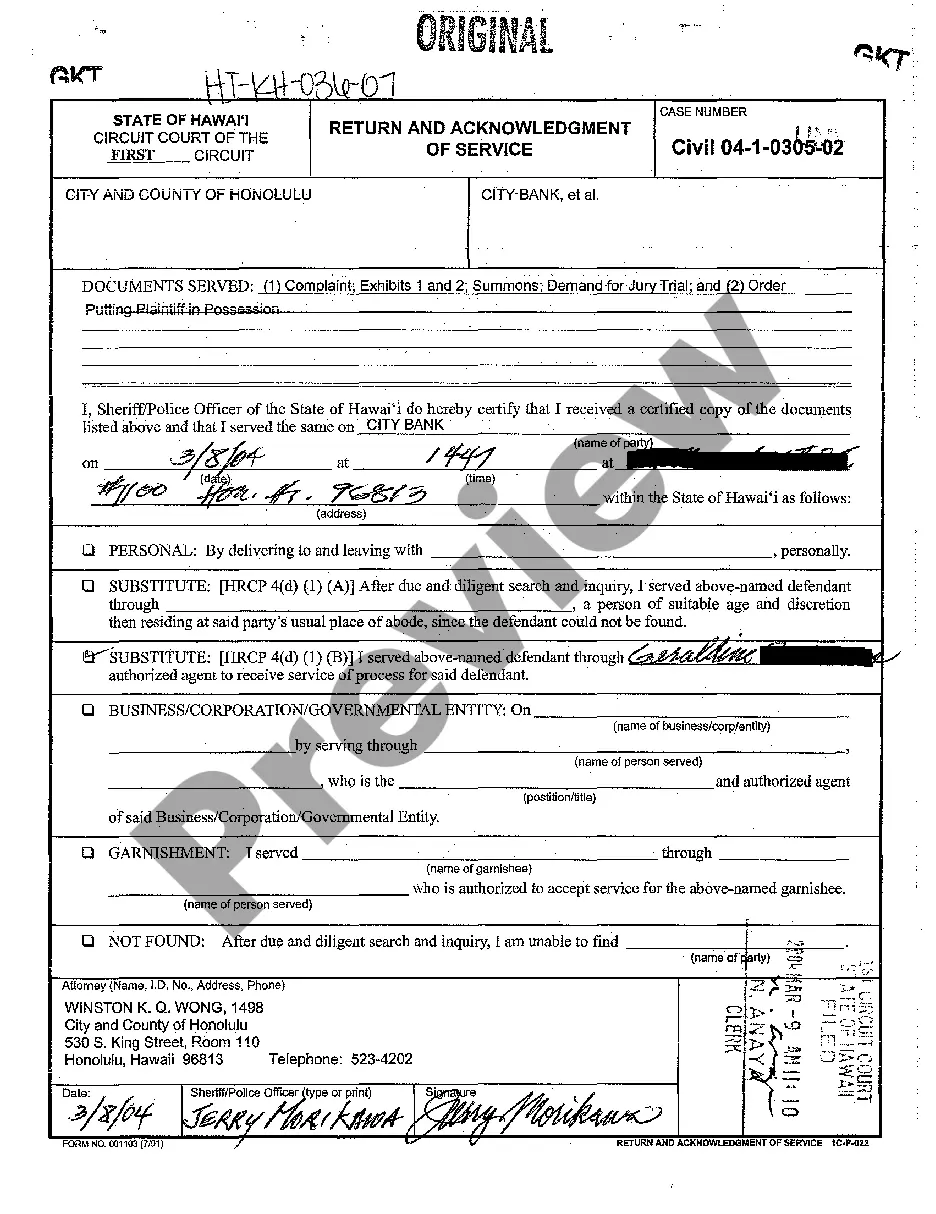

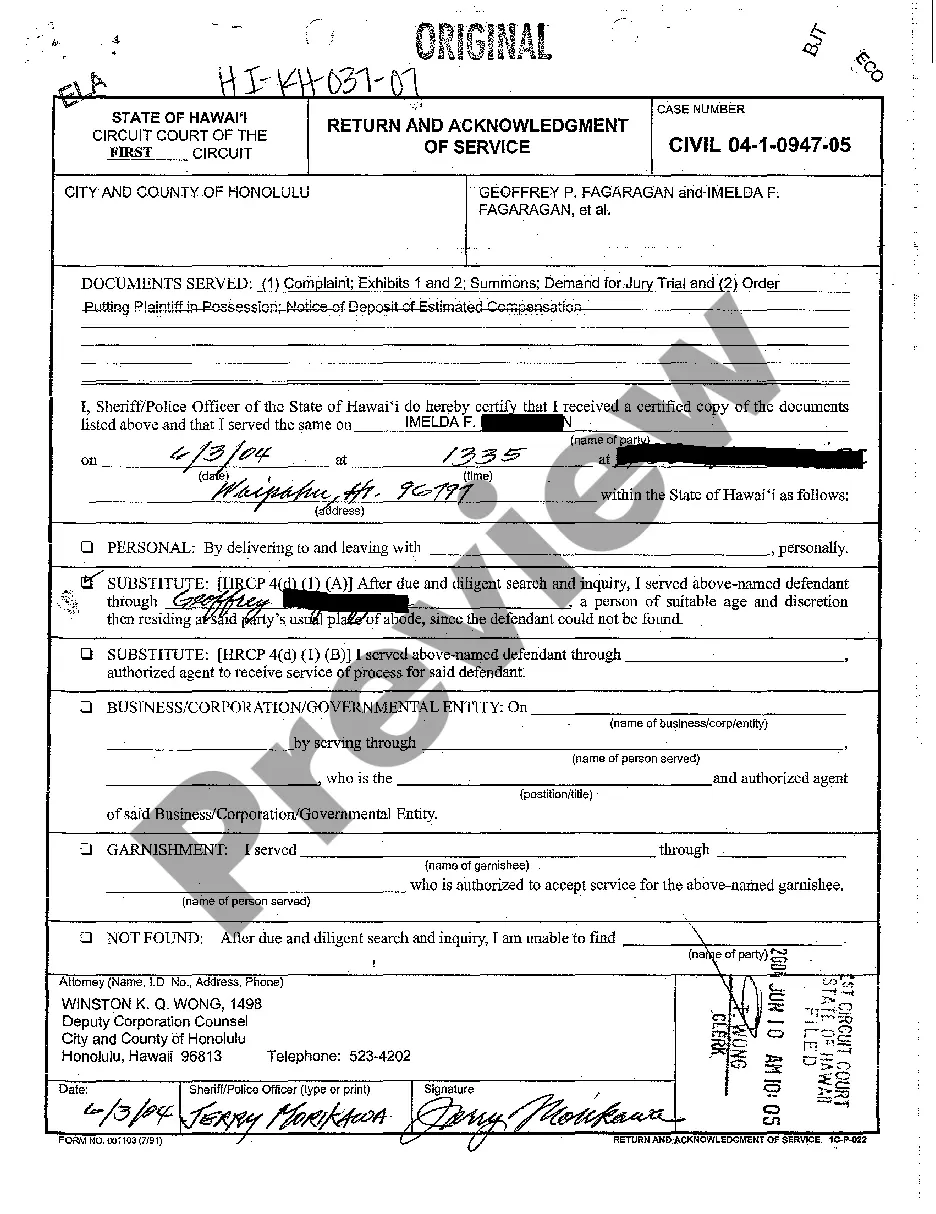

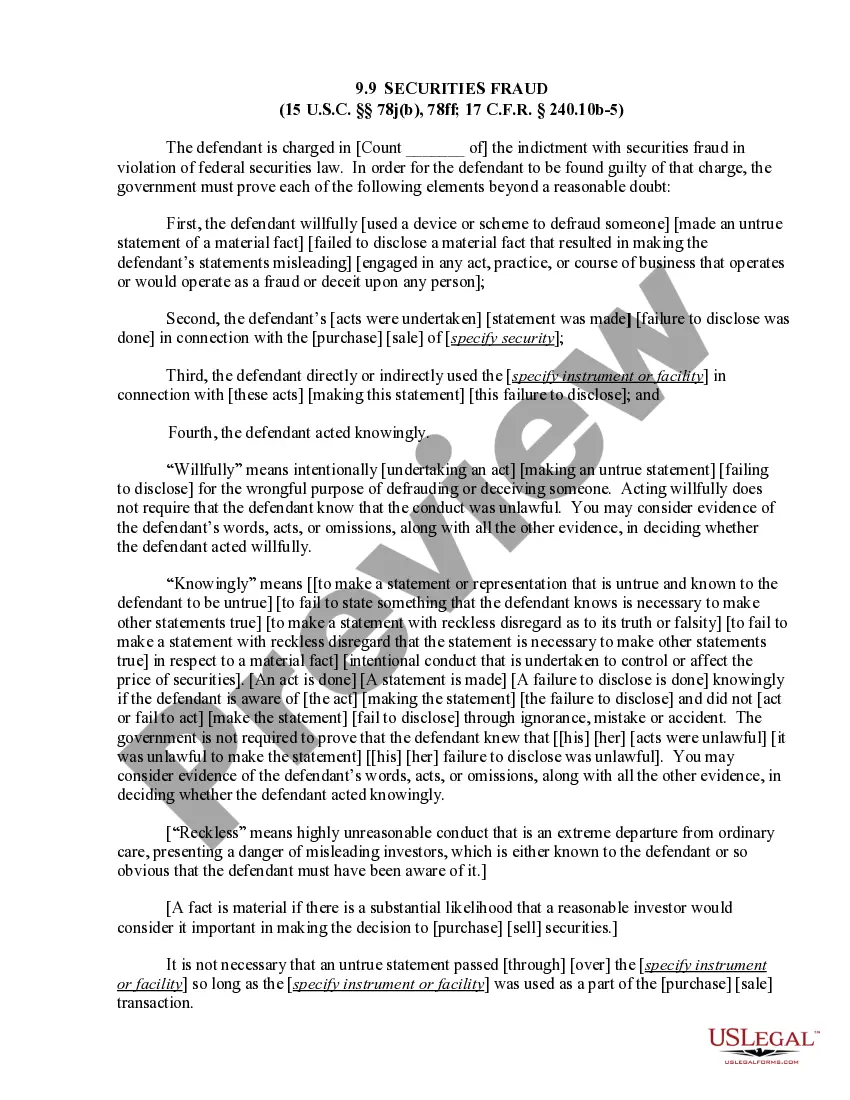

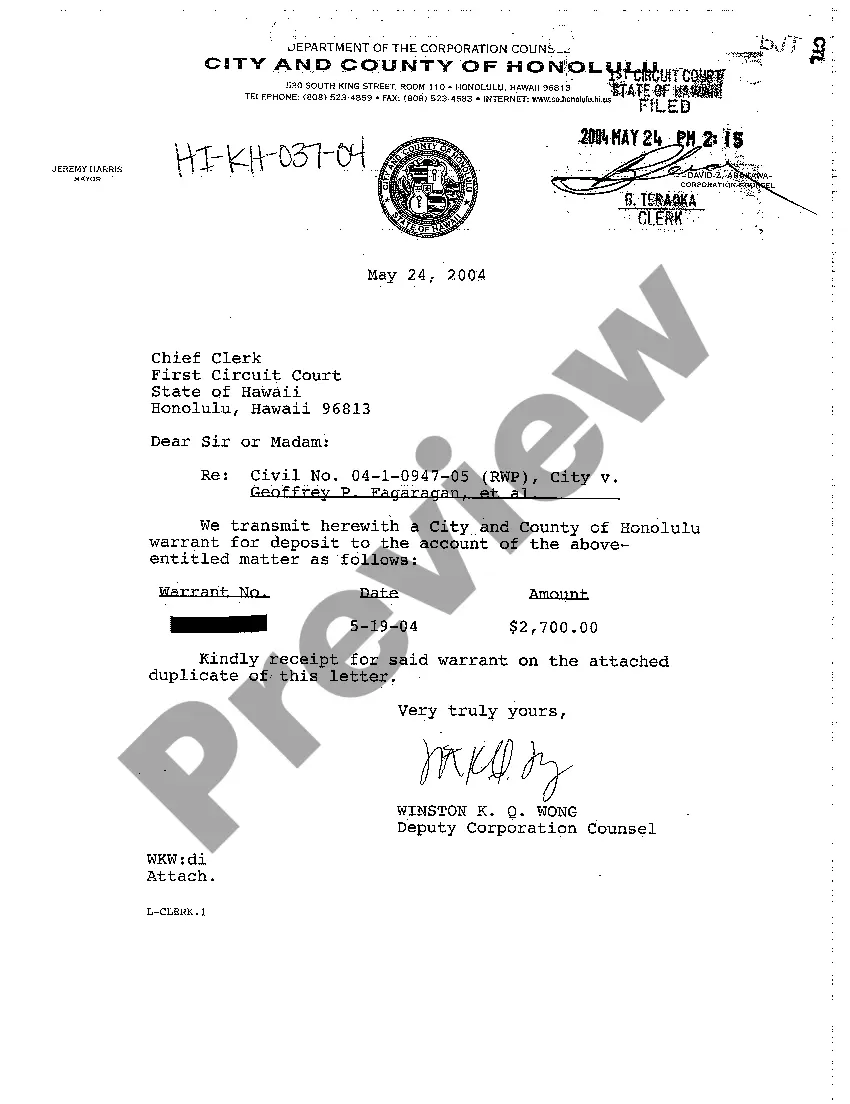

Examine the document by reviewing the description via the Preview feature.

- Locate Hawaii Letter of Receipt templates crafted by proficient attorneys and avoid the costly and time-consuming task of searching for a lawyer.

- Then, subsequently paying them to draft a document that you can procure yourself.

- If you hold a subscription, Log In to your account and locate the Download button beside the form you seek.

- You will also gain access to all your previously obtained documents in the My documents section.

- If you are using our site for the first time, follow the instructions below to obtain your Hawaii Letter of Receipt effortlessly.

- Ensure the document you find is relevant to your location.

Form popularity

FAQ

Yes, you can request copies of your tax return online through the Hawaii Department of Taxation's website. Just follow the prompts and ensure you have the right information handy to expedite the process. Once you submit your request, you will receive confirmation and a Hawaii Letter of Receipt once your documents are processed.

To obtain a copy of your Hawaii General Excise (GE) tax license, you should contact the Hawaii Department of Taxation directly. They provide assistance in retrieving lost or misplaced documents, including your Hawaii Letter of Receipt. Make sure to provide any necessary identification to facilitate the process.

Requesting a copy of your Hawaii state tax return can be done online, by mail, or in person. The Hawaii Department of Taxation allows you to submit necessary forms to receive your Hawaii Letter of Receipt quickly. Keep an eye on your mail or online account for updates on your request.

A Hawaii tax ID and an Employer Identification Number (EIN) serve different purposes. The Hawaii tax ID is specifically for state tax purposes, while the EIN is used for federal tax identification. If you need both, remember to apply separately and keep track of your Hawaii Letter of Receipt for future reference.

The typical processing time for a Hawaii state tax return is about 10 to 12 weeks during peak season. However, digital submissions often lead to faster processing times, which could help you receive your Hawaii Letter of Receipt sooner. Always check the latest updates on the Hawaii Department of Taxation website for current timelines.

You can check the status of your Hawaii tax return online through the Hawaii Department of Taxation’s website. By entering your details, you can track the progress of your return and the issuance of your Hawaii Letter of Receipt. If you prefer, you may also call their office for assistance.

To obtain a copy of your Hawaii state tax return, you should visit the Hawaii Department of Taxation website. They provide a detailed guide on how to request documents, including the Hawaii Letter of Receipt. You can also request a copy by mail or in person at your local tax office.

To write a state tax check for Hawaii, begin by writing the current date at the top. On the line for the payee, clearly print 'State of Hawaii,' and indicate your payment amount in both numbers and words. Include any relevant tax identification number or other details in the memo to ensure that your payment is accurately recorded. This careful process helps you secure a Hawaii Letter of Receipt for your records.

You should mail the Hawaii form G-49 to the Hawaii Department of Taxation. The address is provided on the form itself, but generally, it is sent to the local district office. Ensure the form is filled out correctly to avoid delays in receiving your Hawaii Letter of Receipt. If you prefer, electronic filing options may be available for added convenience.

Obtaining a Hawaii tax ID number involves completing an application with the Hawaii Department of Taxation. You can apply online or submit a paper form, providing necessary details about your business. Once approved, you will receive your tax ID number, which is vital for filing taxes and obtaining a Hawaii Letter of Receipt upon completion of your tax obligations. Using platforms like uslegalforms can streamline this process for you.