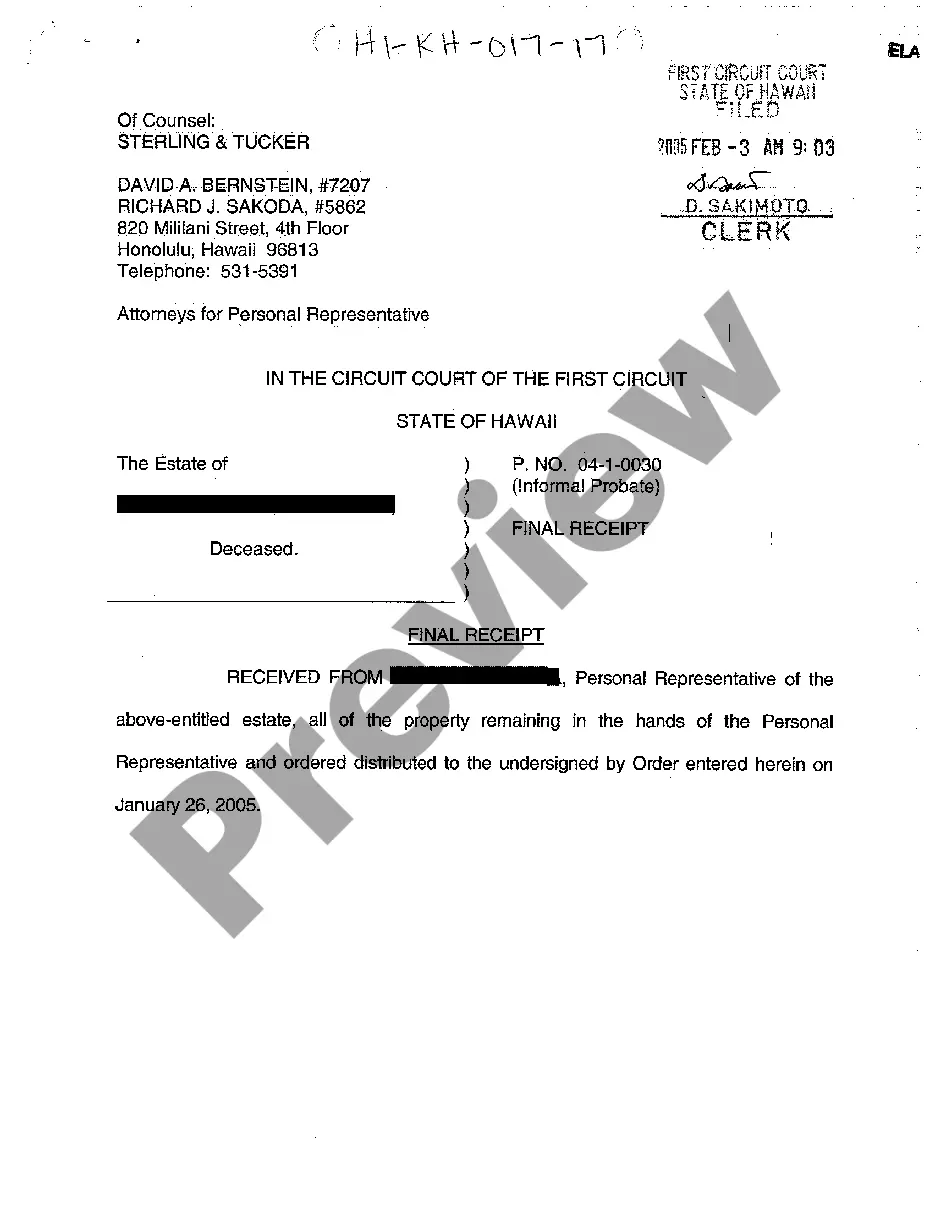

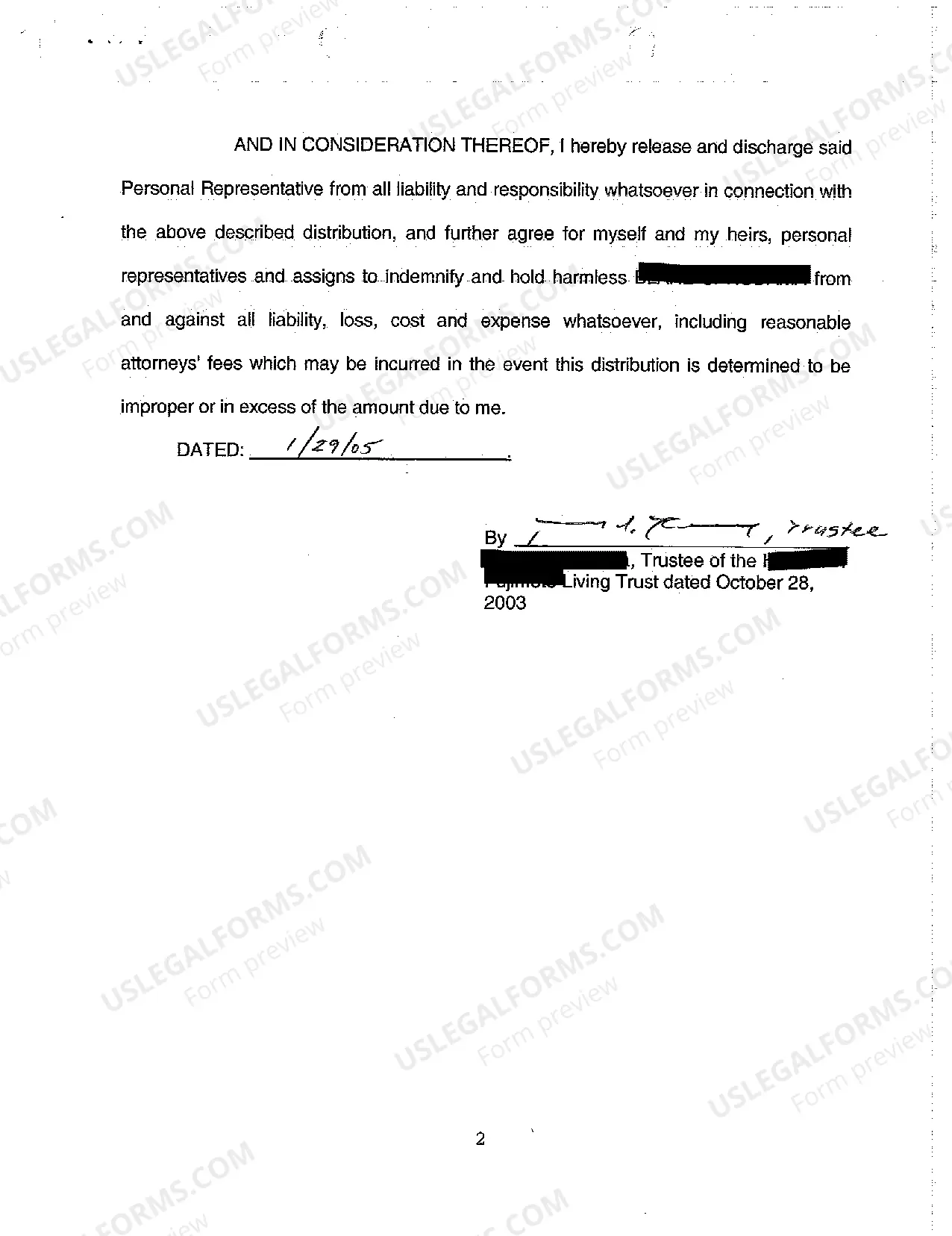

Hawaii Final Receipt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Final Receipt?

Among the various paid and complimentary instances available online, you cannot guarantee their precision and dependability.

For instance, who developed them or if they possess the expertise necessary to handle your requirements.

Always remain composed and make use of US Legal Forms!

Once you’ve enrolled and purchased your subscription, you can utilize your Hawaii Final Receipt whenever necessary or as long as it remains valid in your state. Modify it in your chosen editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Obtain Hawaii Final Receipt samples crafted by qualified legal professionals and bypass the expensive and time-consuming task of searching for an attorney and subsequently compensating them to draft documents for you that you can obtain independently.

- If you already hold a subscription, Log In to your account and locate the Download button adjacent to the form you seek.

- You will also have the ability to retrieve your previously saved samples in the My documents section.

- If this is your first time using our platform, adhere to the instructions outlined below to effortlessly obtain your Hawaii Final Receipt.

- Ensure that the document you find is legitimate in the jurisdiction where you reside.

- Review the document by consulting the description via the Preview function.

Form popularity

FAQ

You can file your Hawaii state tax online or by mailing your completed forms, depending on your preference. The Hawaii Department of Taxation provides clear instructions on where to send your forms if you choose to mail them. Don’t forget to keep your Hawaii Final Receipt for confirmation of your filing.

Yes, you can file your taxes by yourself online using various reliable tax preparation software or the Hawaii Department of Taxation’s e-filing option. This process allows you to have complete control over your filings while ensuring accuracy. Remember to save your Hawaii Final Receipt once the process is complete.

You should mail form N-20 to the appropriate address indicated by the Hawaii Department of Taxation, depending on whether you are including a payment. Make sure to send your form well before the deadline to avoid any late fees. Retaining your Hawaii Final Receipt will help you verify your submission.

You should file your Hawaii general excise tax based on your business structure, which can be monthly, quarterly, or annually. The deadlines are set by the Hawaii Department of Taxation, so be sure to check their calendar for specific dates. Keep your Hawaii Final Receipt from your filings for future reference.

Absolutely, a Hawaii tax return can be filed electronically using the authorized e-filing platforms. This option provides a straightforward way to submit your return and reduces the time you spend on paperwork. After filing, ensure you print or download your Hawaii Final Receipt for your records.

Yes, you can file your Hawaii state tax online through the Hawaii Department of Taxation’s e-filing system. This method is convenient and allows you to submit your tax returns quickly. Once you complete your filing, you will receive a Hawaii Final Receipt confirming your submission.

To close a Hawaii General Excise tax license, you must complete the necessary forms provided by the Hawaii Department of Taxation. You will need to file your final tax return and report any outstanding taxes owed. Make sure to keep a copy of your final filings as you will need the Hawaii Final Receipt for your records.

You should mail Hawaii tax forms to the Department of Taxation, specifically to the address indicated on the form you are submitting. Each form may have a unique mailing address, so be sure to verify it. Proper mailing ensures that your submissions are processed in a timely manner, contributing to the smooth issuance of your Hawaii Final Receipt. If needed, the US Legal Forms platform provides clear mailing instructions for all tax forms.

Hawaii gross receipts refer to the total revenue earned by a business before any deductions. It is a key metric for calculating your tax obligations in Hawaii. Understanding your gross receipts helps you accurately file necessary forms, ultimately leading to your Hawaii Final Receipt. For detailed explanations, check out the resources available on the US Legal Forms platform.

Filing the AG 49 in Hawaii involves submitting the appropriate tax information to the Department of Taxation. Ensure you have the required documentation ready to complete your filing accurately. A timely and correct submission is crucial for obtaining your Hawaii Final Receipt without complications. Consider using US Legal Forms for guidance and ease in the filing process.