Hawaii Application for Self-Insurance Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Application For Self-Insurance Authorization?

Obtain the most comprehensive collection of legal documents.

US Legal Forms serves as a resource to locate any state-specific forms with just a few clicks, including samples for the Hawaii Application for Self-Insurance Authorization.

There’s no need to squander countless hours trying to find a court-acceptable sample.

After selecting a pricing plan, create your account. Pay via credit card or PayPal. Download the document to your device by clicking the Download button. That’s it! You should complete the Hawaii Application for Self-Insurance Authorization form and submit it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily browse through approximately 85,000 valuable templates.

- To access the forms library, choose a subscription and set up an account.

- If you have already completed this, simply Log In and click Download.

- The Hawaii Application for Self-Insurance Authorization file will automatically be saved in the My documents tab (a section for each form you save on US Legal Forms).

- To create a new account, refer to the brief instructions provided below.

- If you need a state-specific form, make sure to select the correct state.

- If possible, read the description to understand all details of the document.

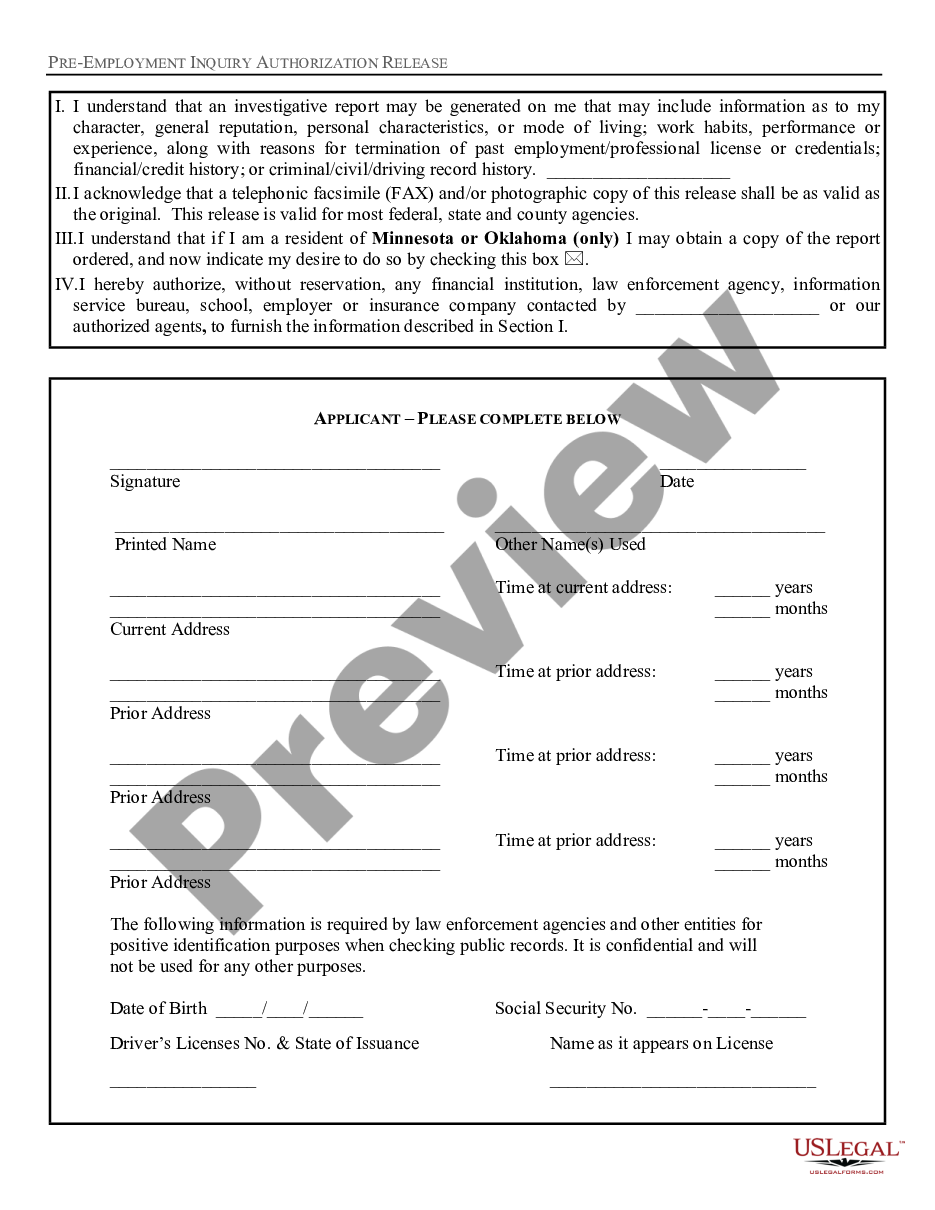

- Utilize the Preview function if available to check the information contained in the document.

- If everything appears correct, click on the Buy Now button.

Form popularity

FAQ

In Hawaii, employees typically need to work at least 20 hours a week to qualify for employer-sponsored health insurance. However, specific companies may have varying policies regarding eligibility and coverage. As you navigate this landscape, the Hawaii Application for Self-Insurance Authorization can indeed cover health-related liabilities for your workforce. Being informed about your rights and obligations in terms of health coverage is essential.

Certification of self-insurance confirms that a business has fulfilled all requirements to operate a self-insured program. This certification is essential for compliance with state regulations and protects both the business and its employees. When submitting your Hawaii Application for Self-Insurance Authorization, this certification proves your business's commitment to managing risk effectively. By obtaining this certification, you bolster your business's standing.

The certificate of insurance serves as proof that your business has an active insurance policy or self-insurance. It outlines the type and extent of coverage your business holds, offering peace of mind to clients and partners. When applying for self-insurance, including this document can enhance your Hawaii Application for Self-Insurance Authorization. It helps demonstrate your credibility and reliability in business dealings.

To qualify for self-insurance in Hawaii, a business typically needs to have at least two employees. This requirement ensures that the business can adequately manage its self-insured program. When applying for self-insurance, it's important to complete the Hawaii Application for Self-Insurance Authorization accurately. Consulting with professionals on this matter can streamline your process.

Yes, Hawaii mandates that businesses have workers' compensation insurance for their employees. This requirement plays a crucial role in protecting your workforce and your business. As you navigate the Hawaii Application for Self-Insurance Authorization, understanding these obligations is vital. Utilizing uslegalforms can simplify the compliance process and provide you with the necessary tools for successful insurance authorization.

Obtaining insurance authorization requires careful attention to the requirements specified for the Hawaii Application for Self-Insurance Authorization. You'll need to complete specific forms and provide various documents. By following the established guidelines, you can enhance your chances of approval. Our platform, uslegalforms, offers tailored solutions to streamline this process.

The business owner is typically responsible for obtaining preauthorization. It’s important for you to understand how the Hawaii Application for Self-Insurance Authorization works. You must manage the application process to ensure compliance with state regulations. Leveraging our resources at uslegalforms can provide you with the support you need for a successful application.

To obtain insurance authorization, you must start with the Hawaii Application for Self-Insurance Authorization. This involves gathering the necessary documentation and submitting your application to the relevant regulatory body. Understanding the specific requirements ahead of time can save you effort and time. Our platform offers guidance and resources to help ensure your application is complete and accurate.

Getting prior authorization can sometimes feel challenging, but it’s manageable with the right approach. You need to prepare and submit the proper documentation as part of the Hawaii Application for Self-Insurance Authorization. With thorough preparation and attention to detail, the process can be smoother. If you need assistance, consider using our platform, uslegalforms, which simplifies the application process.