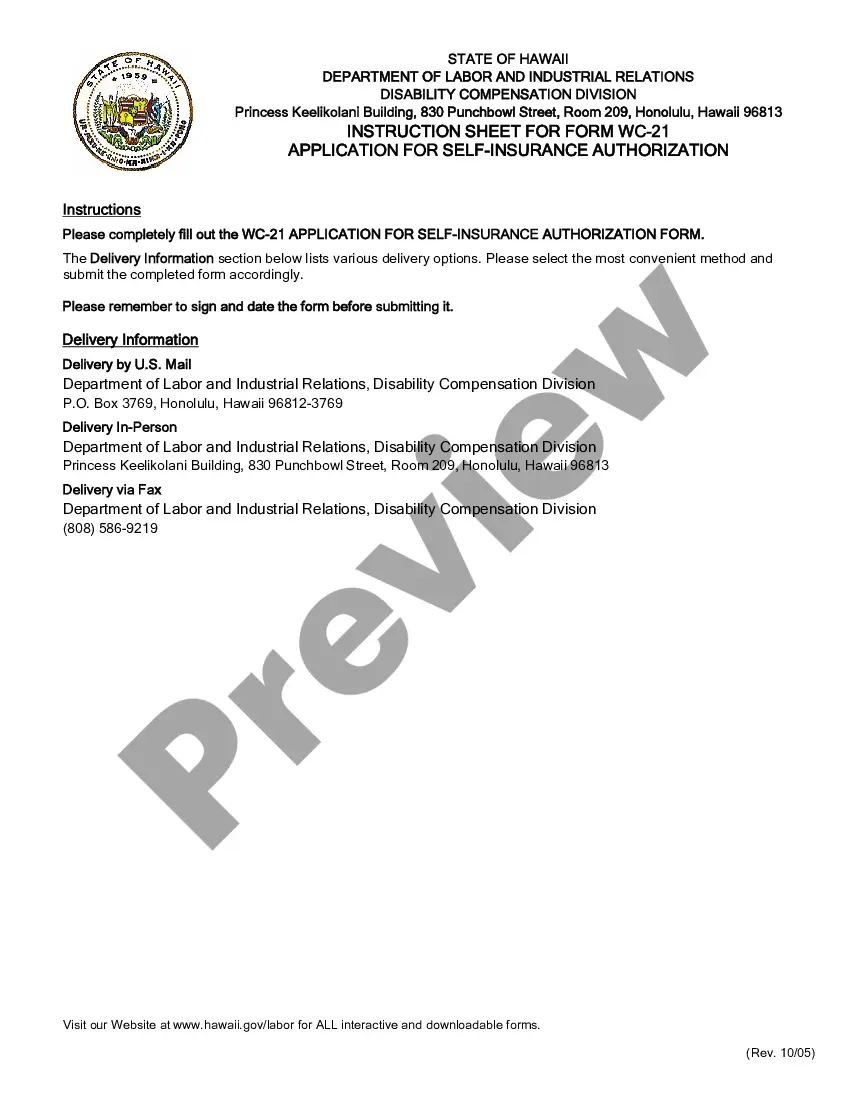

Hawaii Application for Self Insurance Authorization is a document used by employers in the State of Hawaii to apply for authorization to self-insure their workers' compensation insurance. It is a document that must be completed and submitted to the State of Hawaii Department of Labor & Industrial Relations, Division of Employment Security. The application should include the name and contact information of the employer, the type and scope of the self-insurance program, the employer's financial information, and the name and contact information of the independent actuarial consultant. There are two types of Hawaii Application for Self Insurance Authorization: 1. Group Self Insurance Application: This is for employers with more than one employee who wish to self-insure. 2. Individual Self Insurance Application: This is for employers with only one employee who wish to self-insure.

Hawaii Application For Self Insurance Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Application For Self Insurance Authorization?

Handling official documentation necessitates diligence, precision, and utilizing correctly-prepared forms. US Legal Forms has been assisting individuals across the country in doing precisely that for 25 years, so when you select your Hawaii Application For Self Insurance Authorization template from our collection, you can be confident it complies with federal and state laws.

Engaging with our service is simple and quick. To obtain the required documentation, all you need is an account with an active subscription. Here’s a brief guide to obtain your Hawaii Application For Self Insurance Authorization in minutes.

All documents are crafted for multiple uses, like the Hawaii Application For Self Insurance Authorization you observe on this page. If you require them in the future, you can complete them without additional payment - just access the My documents tab in your profile and finalize your document whenever you need it. Experience US Legal Forms and complete your business and personal documentation swiftly and in full legal adherence!

- Ensure you carefully review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Search for an alternative official template if the one you opened does not fit your situation or state requirements (the tab for that is located at the top page corner).

- Log in to your account and save the Hawaii Application For Self Insurance Authorization in your desired format. If this is your first experience with our site, click Buy now to proceed.

- Establish an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the blank or incorporate it into a professional PDF editor to prepare it digitally.

Form popularity

FAQ

Some states in the U.S. do not require workers' compensation insurance, such as Texas and the state of Idaho. Each state has different regulations, so it is essential to understand the specific laws governing workers' comp in your area. If you are a business in Hawaii, you can explore the Hawaii Application For Self Insurance Authorization to maintain more flexibility in your workers' compensation strategy.

In Hawaii, employees typically need to work at least 20 hours a week to qualify for employer-sponsored health insurance. This threshold helps ensure that part-time workers also have access to essential health coverage. If you are an employer, ensuring compliance with these requirements is crucial, especially when navigating the Hawaii Application For Self Insurance Authorization.

Yes, workers' compensation is mandatory in Hawaii for most employers with one or more employees. This requirement helps protect employees in case of work-related injuries or illnesses. If you want to manage your workers’ comp obligations effectively, consider the Hawaii Application For Self Insurance Authorization. This option allows eligible companies to self-insure their workers' compensation costs.

Yes, Hawaii does require most employers to have workers' compensation insurance to protect employees from work-related injuries. However, businesses that qualify may apply for self-insurance through the Hawaii Application For Self Insurance Authorization. This allows them to manage their own workers' compensation claims if they meet specific financial criteria and risk management practices.

When someone says they are self-insured, it means they have decided to manage their own risk rather than purchasing insurance from a third party. This often involves creating a financial strategy to handle any potential liabilities directly. If you are considering this approach, the Hawaii Application For Self Insurance Authorization will guide you through the necessary steps to establish your self-insured status responsibly and legally.

A letter of self-insurance is similar to a self-insurance letter, as it serves as an official statement declaring that a business chooses to take on its own risk. This letter is crucial when submitting the Hawaii Application For Self Insurance Authorization. By presenting a clear plan for managing risks, the business demonstrates to regulators its capacity to operate safely without conventional insurance.

insurance letter is a document that verifies a business's ability to cover its own risks without relying on traditional insurance policies. When completing the Hawaii Application For Self Insurance Authorization, companies must often submit such a letter. This letter details the financial stability and risk management strategies of the company, assuring authorities that the business can afford any potential losses.

Obtaining insurance authorization involves several key steps starting with filling out the Hawaii Application For Self Insurance Authorization. It's vital to gather all required documents and accurately present your business case. After submission, your application will be evaluated, and you may receive feedback or requests for additional information. Working with platforms like USLegalForms can effectively minimize errors and streamline the entire authorization process.

The difficulty of obtaining prior authorization often depends on the complexity of your application. While the Hawaii Application For Self Insurance Authorization can involve detailed information, many find success by preparing thoroughly. Having all necessary documents and a clear understanding of your needs will enhance your chances. If you need assistance, platforms like USLegalForms are designed to simplify this journey.

To obtain insurance authorization, you must first complete the necessary application process. The Hawaii Application For Self Insurance Authorization forms require specific information about your business operations and risk management strategies. Once submitted, it will undergo a review that evaluates your eligibility. If you wish for a more guided approach, consider using USLegalForms to streamline the process.