Self-Employed Independent Contractor Payment Schedule

Overview of this form

The Self-Employed Independent Contractor Payment Schedule is a structured document used by employers to outline payment intervals for services rendered by independent contractors. It ensures transparency and clarity about when payments are due, how much will be paid at each stage, and the conditions under which payments are released. This form is essential for managing projects that involve multiple phases, distinguishing it from other payment forms that may not specify these details.

Form components explained

- Down payment details, including the amount due when the contract is signed.

- Payment intervals tied to completed stages of the project, with specific tasks listed for reference.

- Payment confirmation checkboxes to indicate whether payments have been made.

- Clear deadlines for when payments should be made to avoid breaches of contract.

When to use this form

This form is necessary when hiring an independent contractor for a project that will be completed in stages. It is particularly useful in scenarios such as home renovations, software development projects, or freelance services, where payments are contingent upon the completion of specific tasks or milestones. By using this payment schedule, both parties can agree on expectations and avoid potential disputes over payment timing and amount.

Who needs this form

- Employers or businesses hiring independent contractors for project-based work.

- Independent contractors seeking structured payment terms to protect their financial interests.

- Project managers overseeing multiple phases of work who need to track payments.

Instructions for completing this form

- Start by entering the names and contact information of the contracting parties.

- Specify the project name and description to provide context for the agreement.

- List down payment amounts and assign them to specific stages of the project.

- Clearly define the tasks that must be completed at each project stage before payment is made.

- Obtain signatures from both parties to validate the agreement.

Does this form need to be notarized?

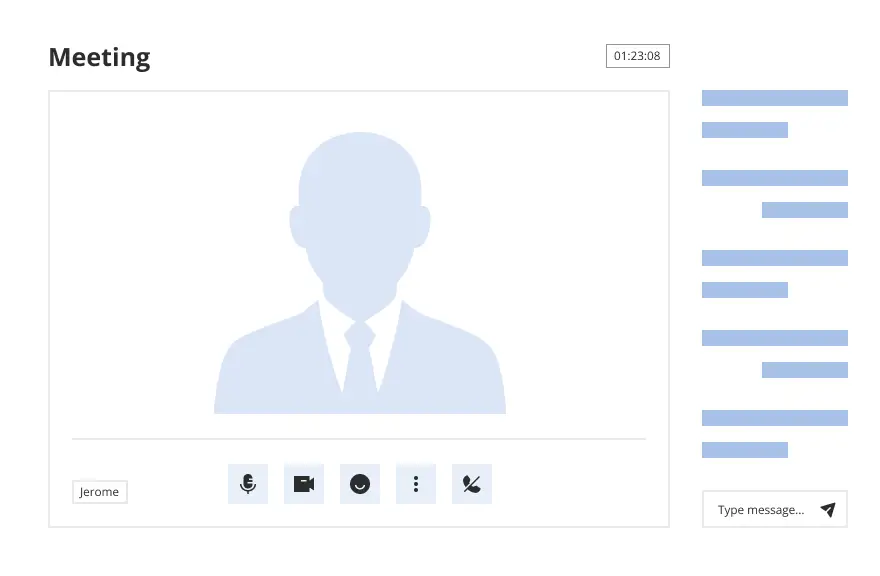

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

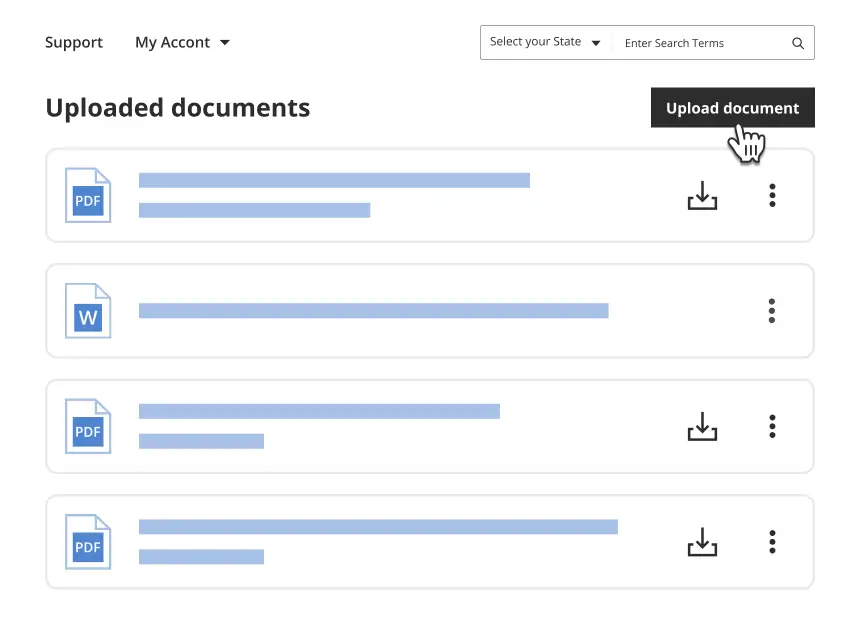

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to specify clear payment terms leading to confusion or disputes.

- Not documenting completed tasks, which may result in disagreements over whether a payment is warranted.

- Neglecting to sign the document, making it legally unenforceable.

Why use this form online

- Convenient access to download and fill out the form at any time.

- Editability allows for adjustments tailored to specific projects or agreements.

- Reliability in having a legally vetted document drafted by licensed attorneys.

Legal use & context

- This form offers clear documentation of payment terms, which can be crucial in legal disputes.

- Using this payment schedule helps both parties understand their obligations, enhancing accountability.

- It supports legal enforceability by clearly outlining agreed-upon terms and conditions.

What to keep in mind

- The Self-Employed Independent Contractor Payment Schedule is essential for managing phased project payments.

- It provides clarity and security for both employers and contractors regarding financial expectations.

- Proper completion and documentation can help prevent payment disputes and ensures both parties are on the same page.

Looking for another form?

Form popularity

FAQ

Is a 1099 the Same as a Schedule C? A form 1099 is not the same as a Schedule C form.It will then file the 1099 with the government, and provide you a copy too so that you can do your personal income tax return using the figure provided.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.You may need to make estimated tax payments.

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return.The employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work.

An owner must pay a direct contractor within 30 days of the contractor's request for payment.

Schedule C is the tax form filed by most sole proprietors. As you can tell from its title, "Profit or Loss From Business," it´s used to report both income and losses. Many times, Schedule C filers are self-employed taxpayers who are just getting their businesses started.

When you first engage with a 1099 worker, you'll also need to consider some additional payment agreements, such as: How often is payment due? Upon receipt of the invoice, net 15 and net 30 days are the most common payment terms.

A 1099 job is a job that is performed by a self-employed contractor or business owner as opposed to an employee hired by a business or self-employed contractor. The 1099 form is the Internal Revenue Service form you fill out for the person doing the work. It denotes how much money was paid for the service.

Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. And If You Have a Business Loss.

When you earn money by performing work, that income is usually subject to social security and Medicare taxes.When you receive a 1099-MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C.