Retail Installment Contract and Security Agreement

Overview of this form

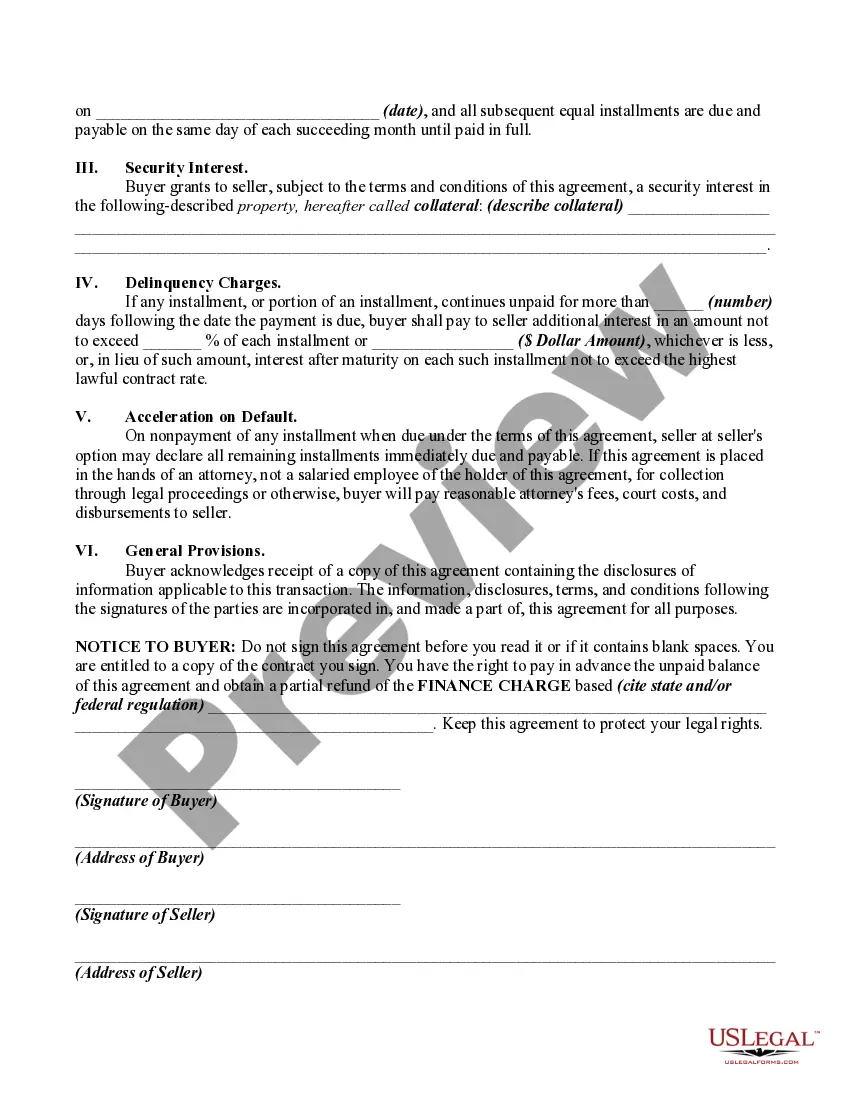

The Retail Installment Contract and Security Agreement is a legal document used in retail installment sales to outline the terms of credit provided to a buyer. This form is necessary for compliance with federal regulations, specifically Regulation Z of the Federal Trade Commission, which mandates clear disclosure of finance charges, payment schedules, and buyer rights. This form differs from other sales agreements by including specific disclosures required under the Truth in Lending Act, ensuring that buyers are adequately informed about the cost of financing their purchases.

What’s included in this form

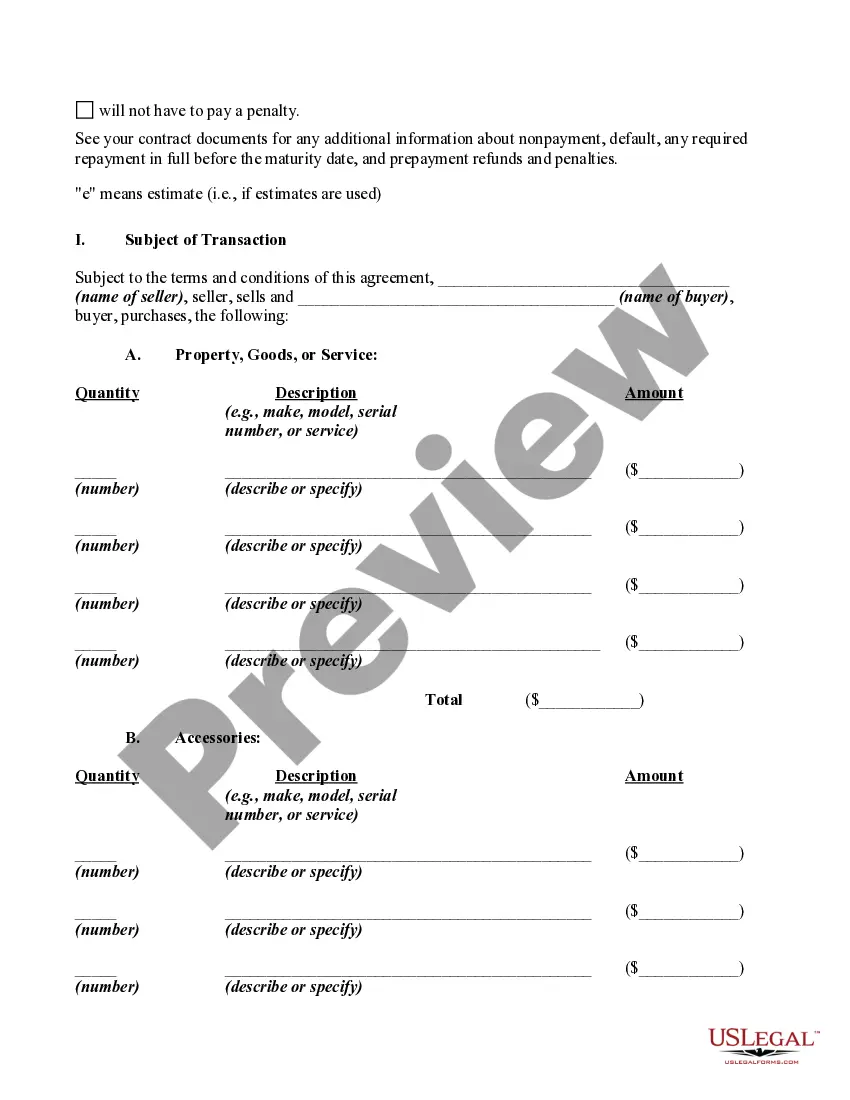

- Contract number and date fields for record-keeping.

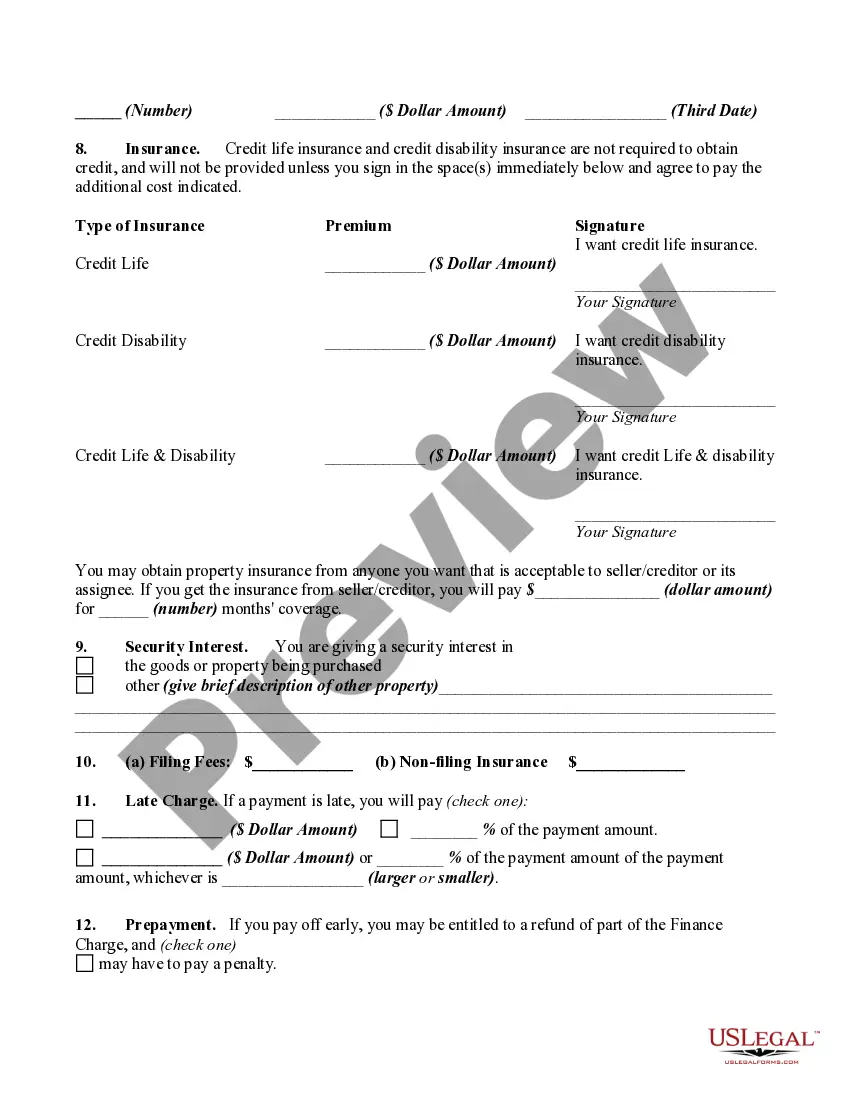

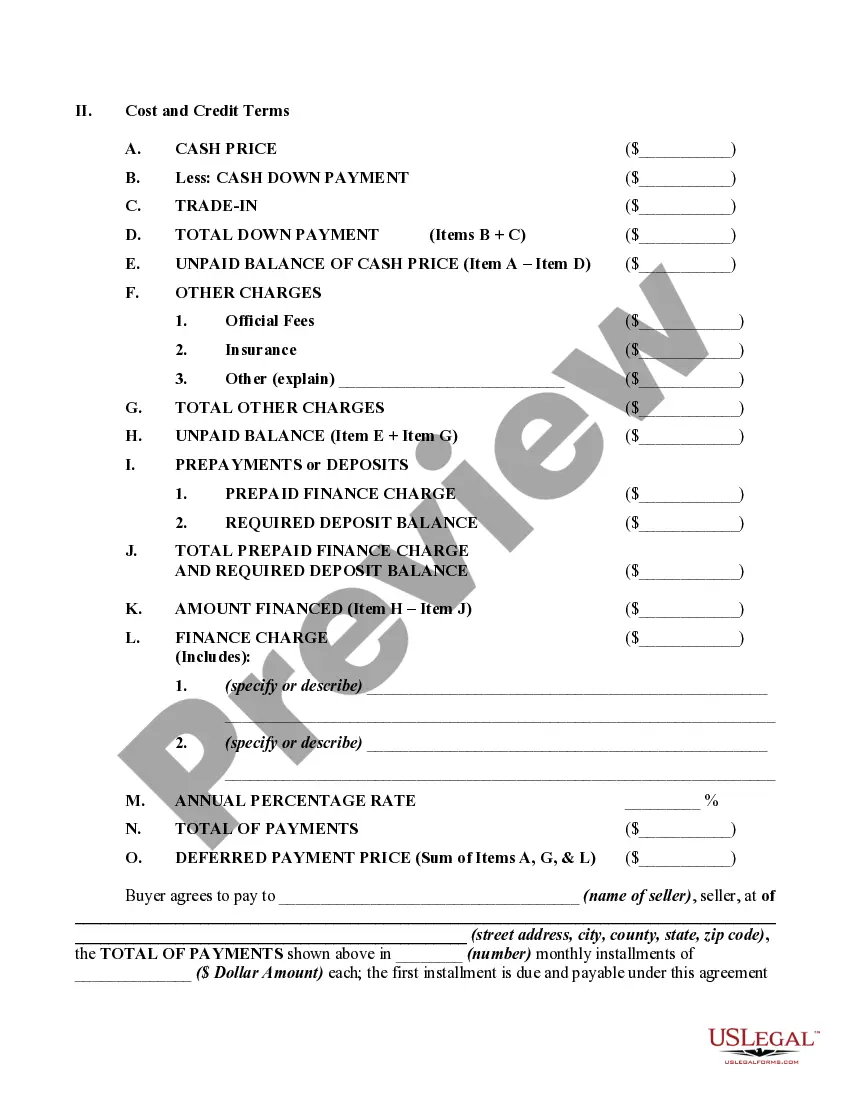

- Disclosure sections outlining the amount financed, finance charge, annual percentage rate, and total payments.

- Payment schedule detailing the number of payments, amounts, and due dates.

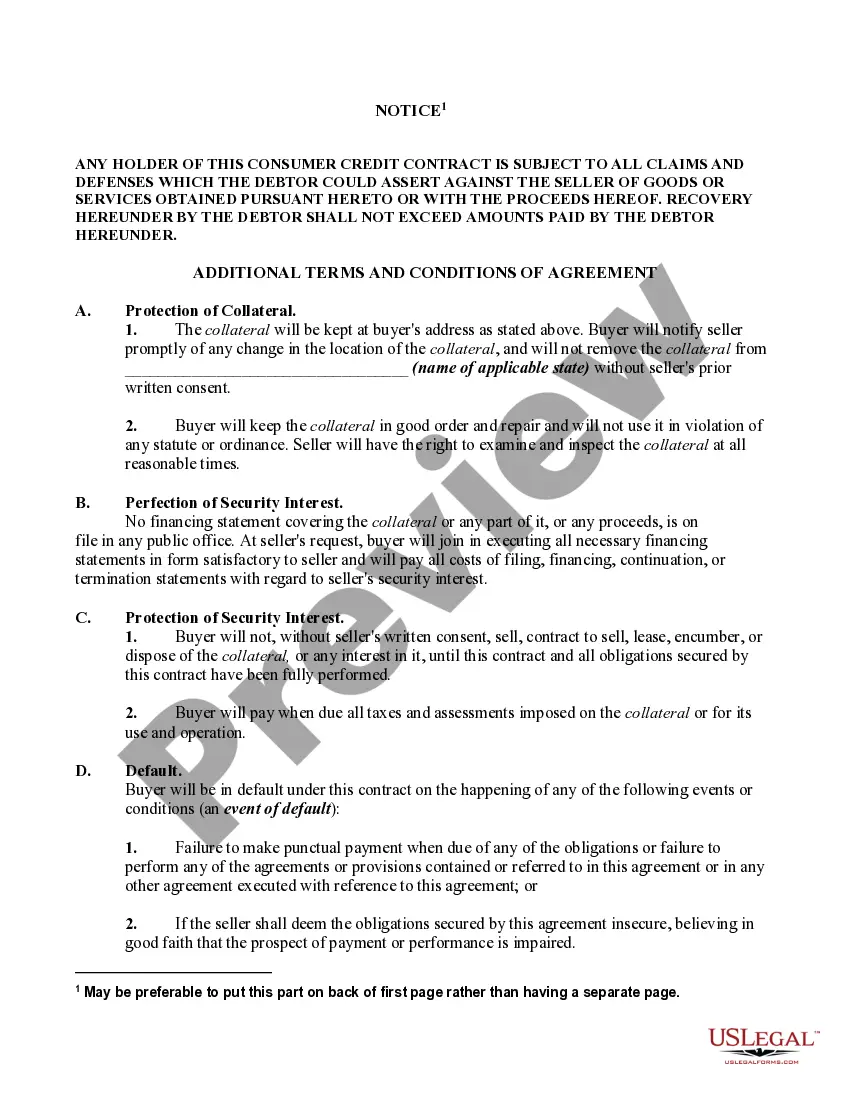

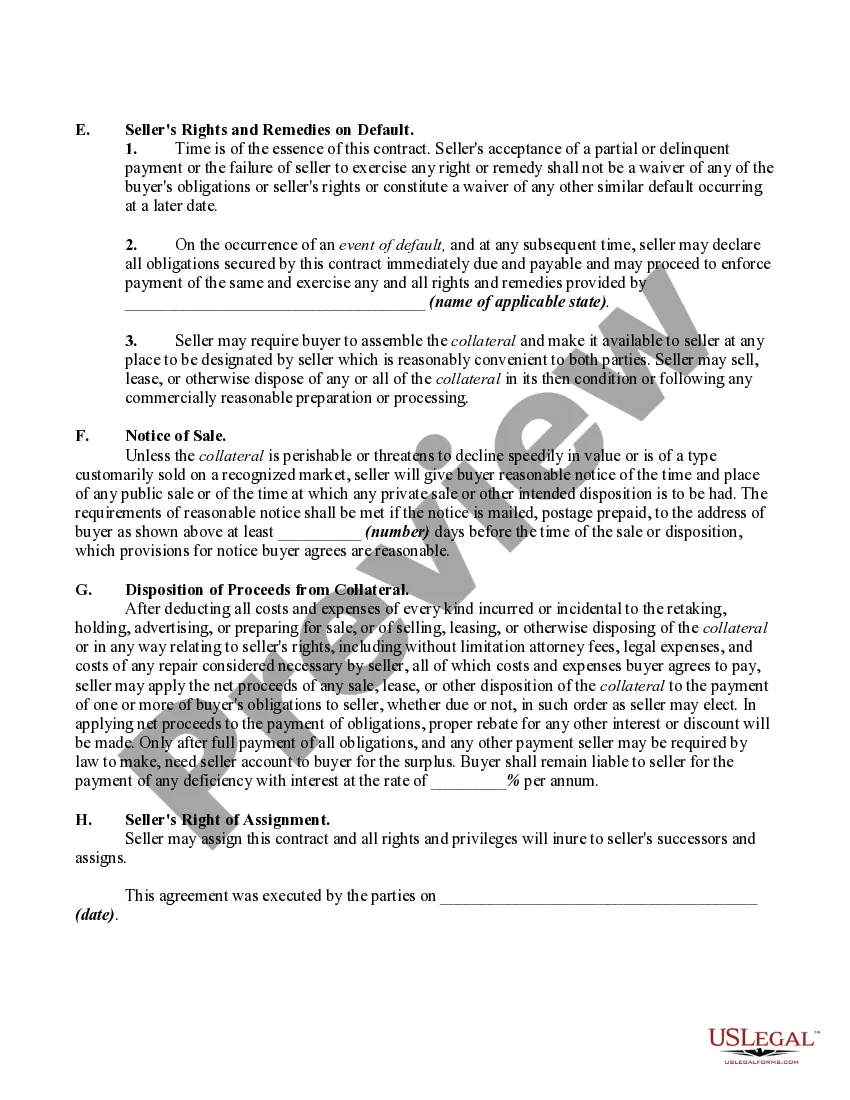

- Clauses regarding security interests in the purchased property.

- Compliance notices required by federal regulations.

- Signatures of both the buyer and seller, confirming agreement to the terms.

Common use cases

This form should be used during retail installment transactions where goods or services are sold to a consumer with financing as part of the purchase. It is essential when the seller provides credit to the buyer rather than requiring full payment upfront. This document ensures that both parties understand the financial obligations and legal rights involved in the transaction.

Who should use this form

This form is intended for:

- Retail sellers offering goods or services on an installment payment plan.

- Consumers looking to finance a purchase through a retail installment agreement.

- Businesses that need to comply with federal regulations on installment sales.

Instructions for completing this form

- Identify the parties involved by entering the seller's and buyer's names and addresses.

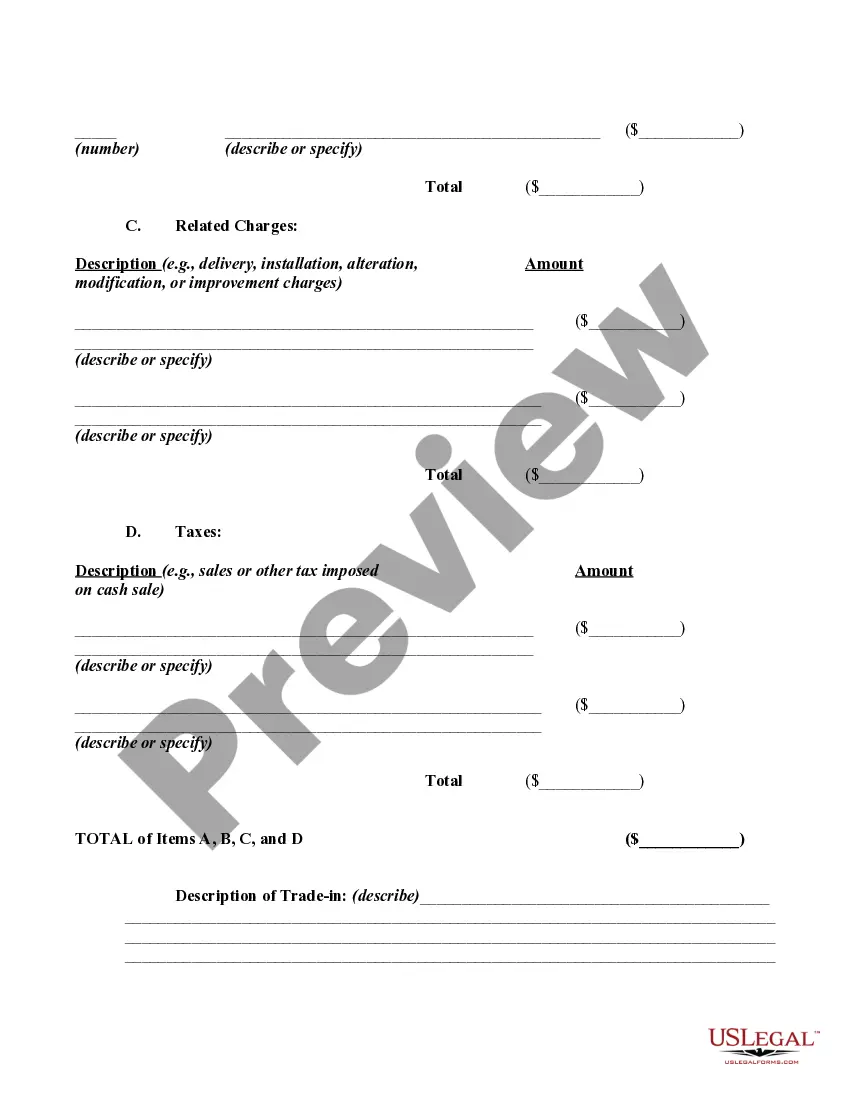

- Fill in the financial terms, including the amount financed, finance charge, and total sales price.

- Specify the payment schedule with amounts and due dates for each payment.

- Describe any insurance options and security interests related to the goods or services sold.

- Ensure both parties sign the contract and retain a copy for their records.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide all required disclosures, which can lead to legal issues.

- Not entering accurate amounts for financing terms, causing confusion about obligations.

- Omitting signatures from both parties, making the contract unenforceable.

- Not keeping a copy of the signed agreement, which is essential for tracking payments and terms.

Why complete this form online

- Convenient access allows you to fill out and customize the form to suit your needs.

- Easy to download and store digitally, reducing physical paperwork.

- Provides templates created by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

A retail installment sales contract agreement is slightly different from a loan. Both are ways for you to obtain a vehicle by agreeing to make payments over time. In both, you are generally bound to the agreement after signing.A dealer could sell the retail installment sales contract to a lender or other party.

The retail instalment contract here is not a negotiable instrument as defined in Code Ann.

A retail installment sale,on the other hand, is a transaction between you and the dealer to purchase a vehicle where you agree to pay the dealer over time, paying both the value of the vehicle plus interest. A dealer could sell the retail installment sales contract to a lender or other party.

When the company buys the contract, the dealer will transfer and assign the contract to that company. The company then becomes what is called an assignee. The company now has the right to receive monthly payments from you.

Buyer's Order or Bill of Sale: Just as with a new vehicle, a used car Buyer's Order or Bill of Sale is the basic sales contract between the buyer and the seller.Finance Agreement or Retail Installment Contract: Just as with new cars, used cars are often financed through the dealership.

Understanding a Purchase Contract. A retail installment sale is a transaction between you and a dealer to purchase a vehicle where, you agree to pay the dealer over time, paying both the value of the vehicle plus interest. A dealer can sell the retail installment contract to a lender or other party.

A retail contract, also known as a retail purchase agreement, is an agreement outlining the details of a transaction of retail goods between a buyer and a seller.