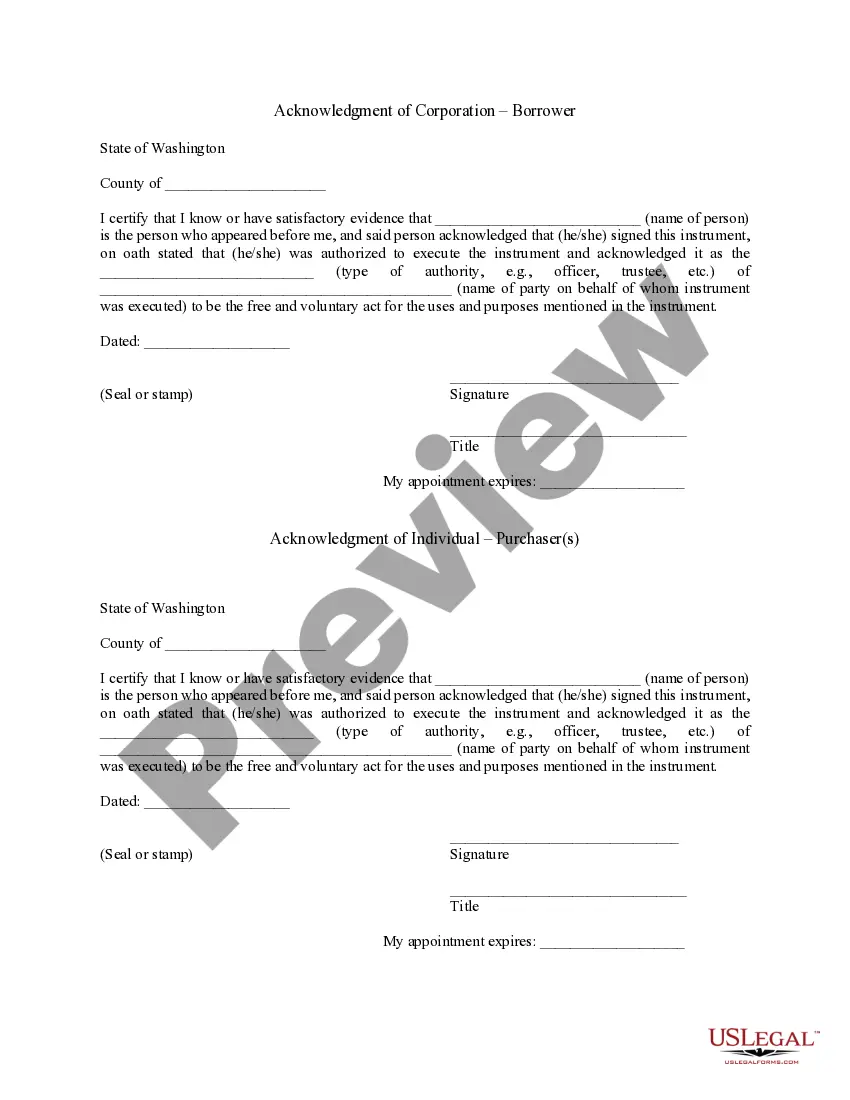

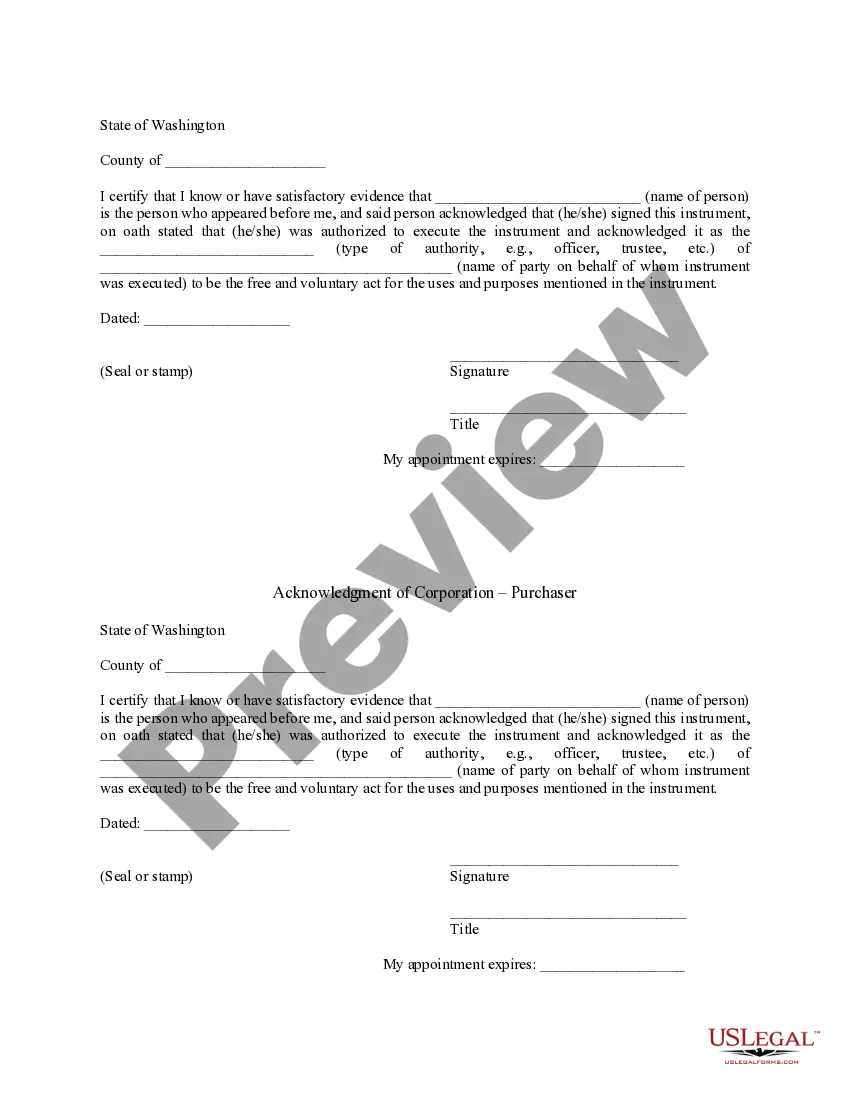

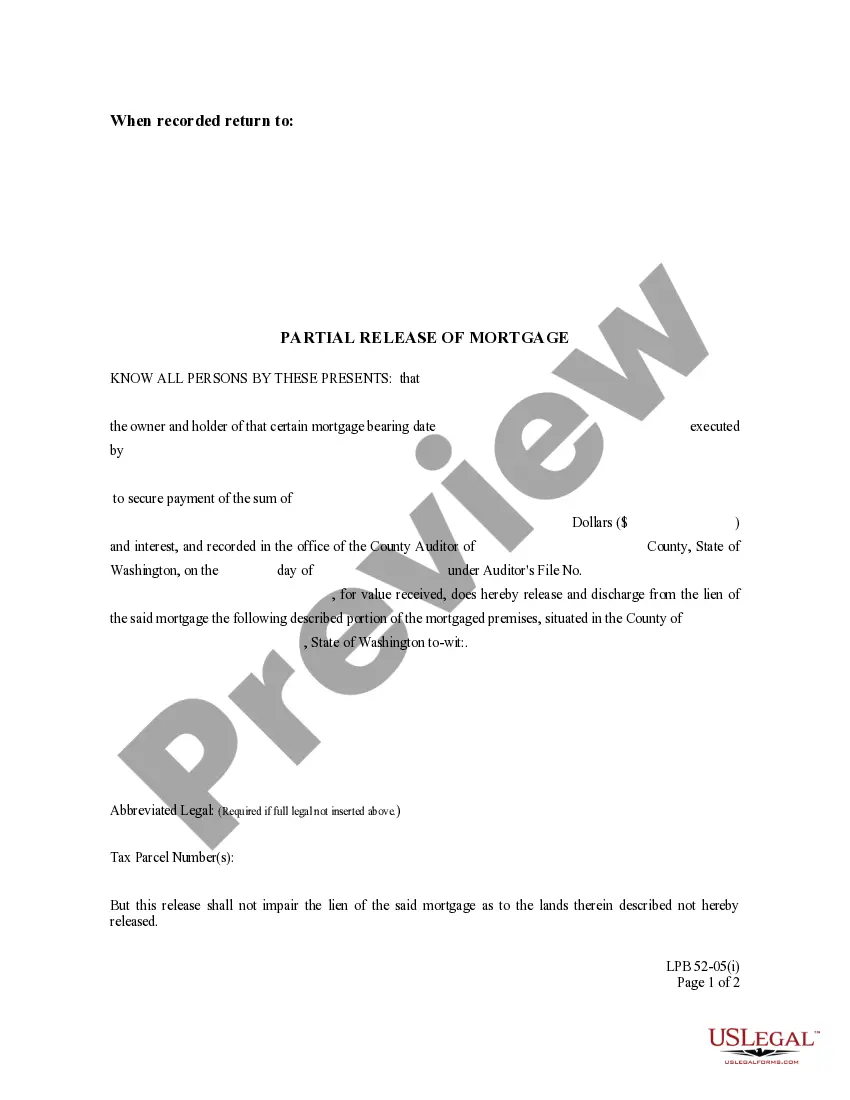

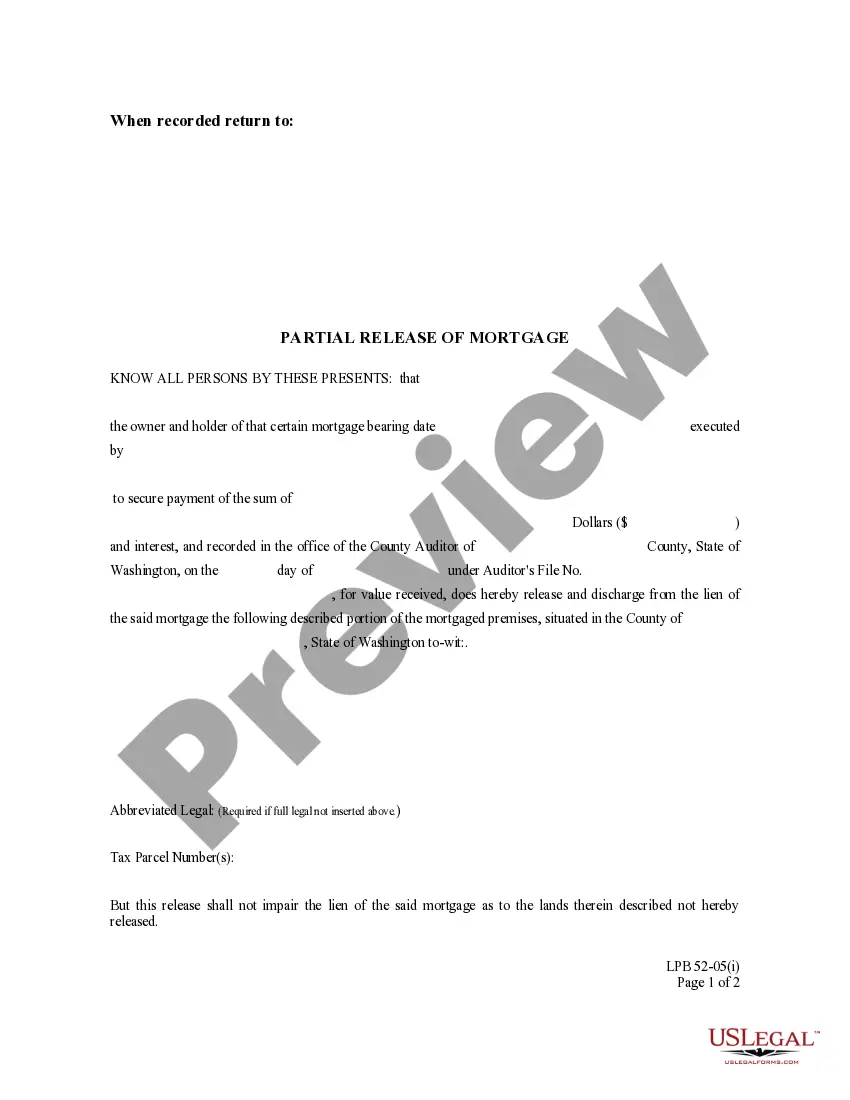

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Washington Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Out of the great number of platforms that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms prior to buying them. Its extensive catalogue of 85,000 templates is categorized by state and use for efficiency. All of the forms available on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, look for the template, press Download and get access to your Form name from the My Forms; the My Forms tab keeps your downloaded forms.

Stick to the guidelines listed below to obtain the document:

- Once you find a Form name, ensure it’s the one for the state you need it to file in.

- Preview the form and read the document description before downloading the sample.

- Search for a new template using the Search engine if the one you have already found is not proper.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

After you have downloaded your Form name, you may edit it, fill it out and sign it with an online editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it remains the most updated version in your state. Our platform offers easy and fast access to templates that suit both legal professionals and their clients.

Form popularity

FAQ

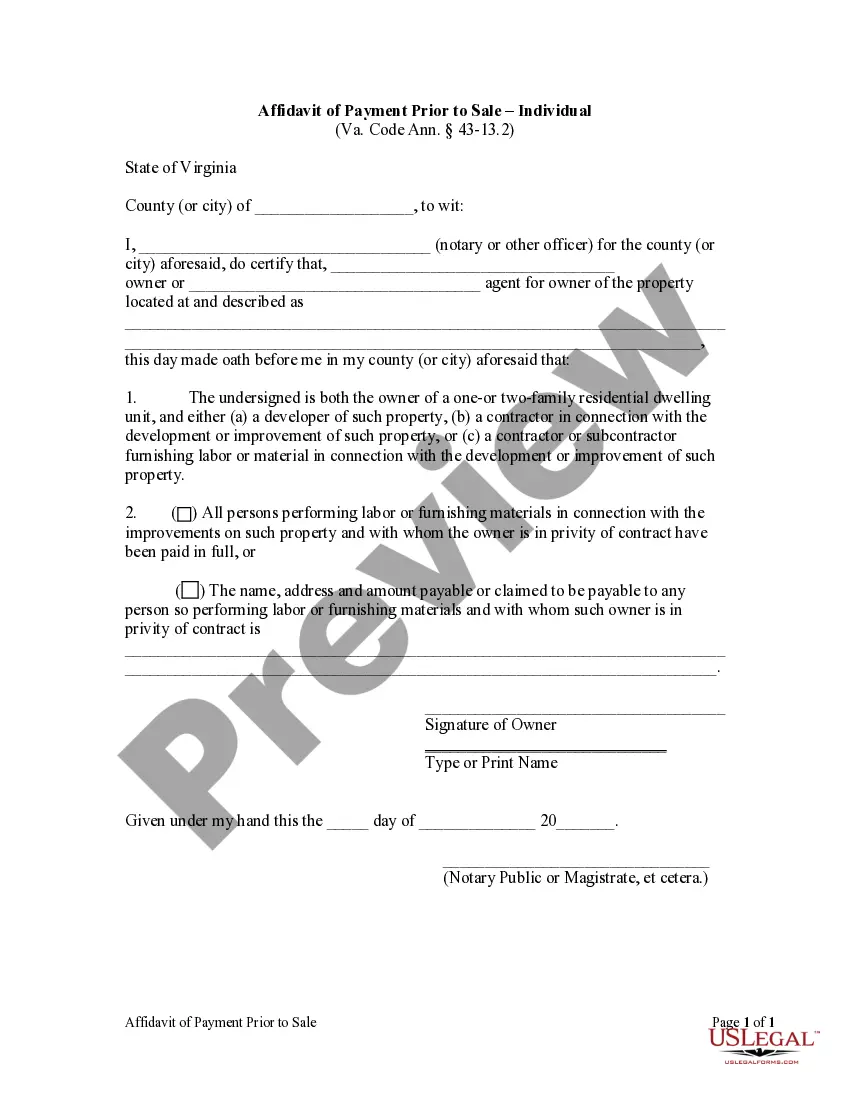

A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

The deed of trust to secure assumption is a document that names the spouse who did not receive the house as the beneficiary. The deed of trust lays out the terms of the parties' agreement for enforcement if the spouse receiving the house defaults on the mortgage.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

Typically in a residential settlement, the signers of the Note and the Deed of Trust are the same, but this is not always the case. The Note itself has virtually nothing to do with the property.The Deed of Trust is the document that grants the lender the rights to take the property if the loan is not repaid.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

A deed of assumption is a single deed that includes both the language of a general warranty or other deed along with the acknowledgement that the buyer is taking over the mortgage on the property.

A deed of trust includes most of the same information as a mortgage, including:A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary. The inception and maturity dates of the loan.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.