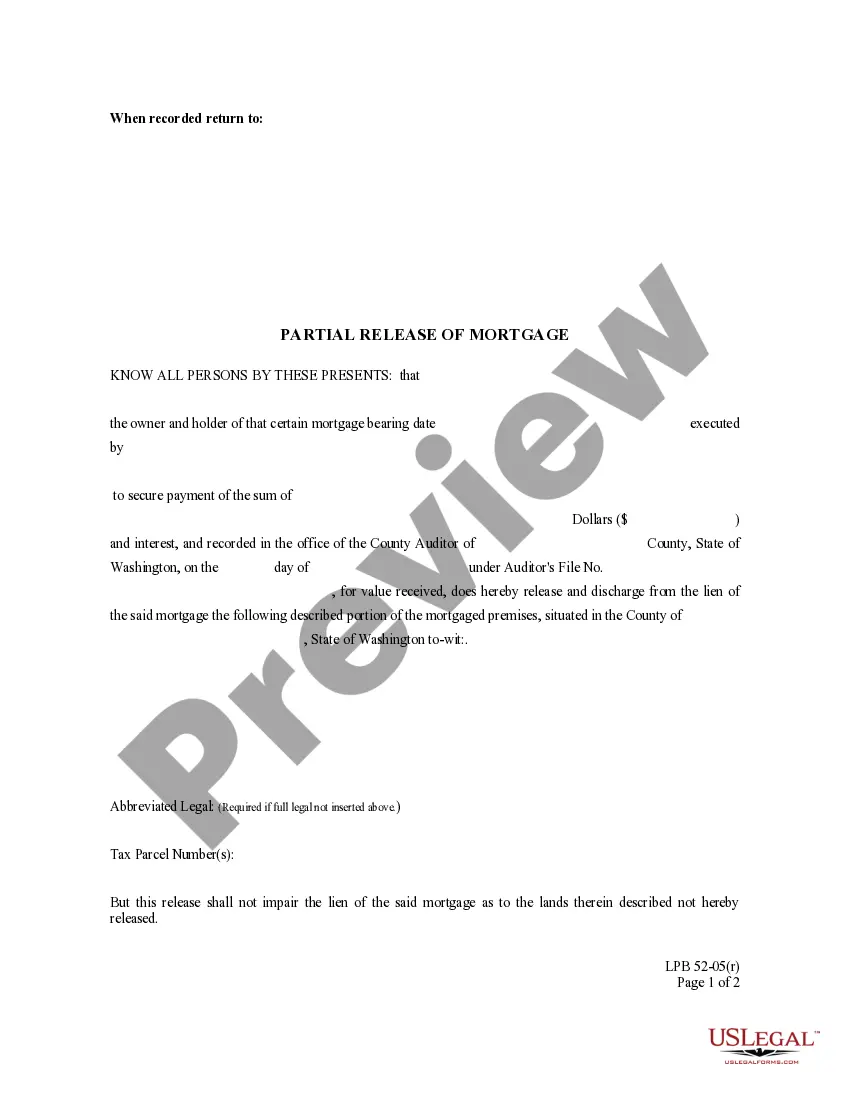

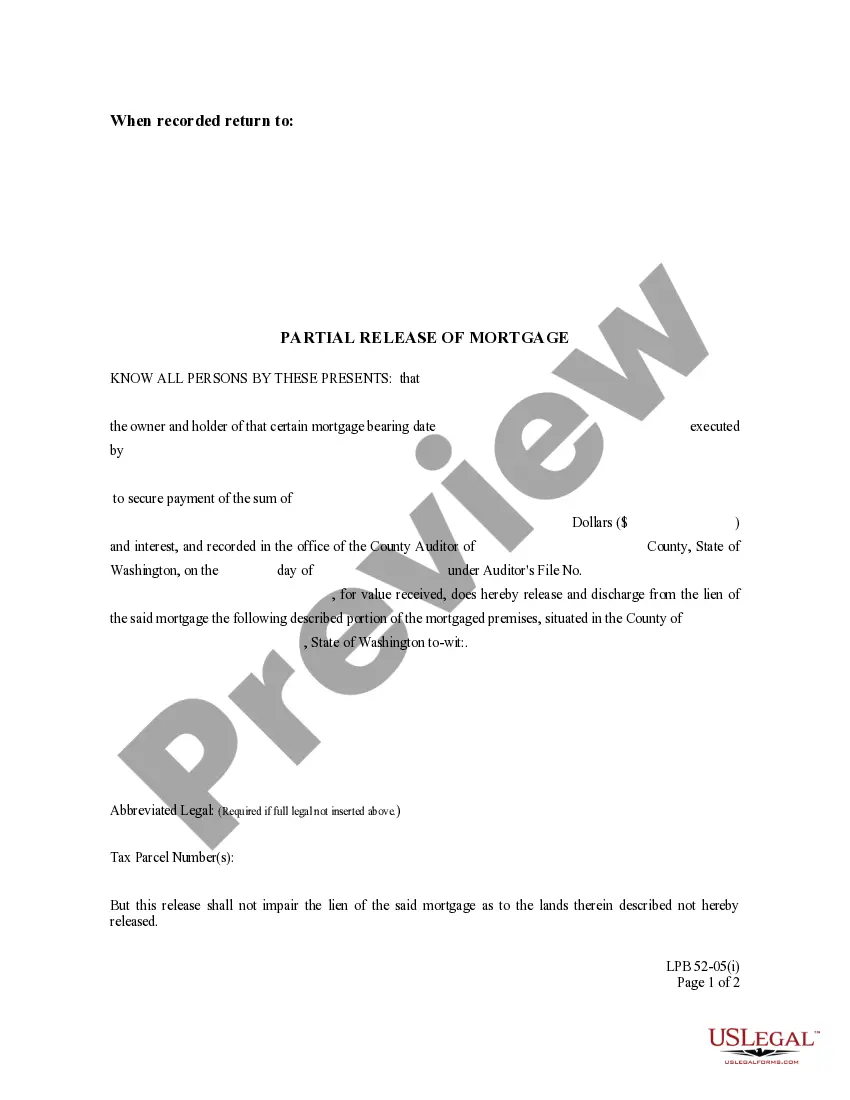

This is an official Washington court form, a Partial Release of Mortgage (with individual acknowledgment).

Washington Partial Release of Mortgage with individual acknowledgment

Description

How to fill out Washington Partial Release Of Mortgage With Individual Acknowledgment?

Out of the great number of platforms that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before purchasing them. Its complete library of 85,000 samples is grouped by state and use for efficiency. All of the forms on the service have been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, hit Download and get access to your Form name in the My Forms; the My Forms tab keeps all your downloaded documents.

Stick to the tips listed below to obtain the document:

- Once you find a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the sample.

- Look for a new sample using the Search field if the one you have already found is not correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

When you’ve downloaded your Form name, you are able to edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service provides easy and fast access to samples that fit both legal professionals as well as their customers.

Form popularity

FAQ

Workers cannot exceed a total of eight weeks of standby on a claim.

(a) "Standby" means you are temporarily unemployed because of a lack of work but: (i) You expect to return to work with your regular employer within four weeks; or. (ii) You expect to begin full-time work with a new employer within two weeks; or. (iii) You are temporarily unemployed due to natural disaster.

Workers whose hours are cut may qualify for partial unemployment benefits. The more money the employee earns at work, the greater the reduction from an employee's weekly benefit amount. Employment Security uses an earning deduction chart to determine a part-time worker's benefit amount.

If you did not work more than 17 hours in any week in your base period, you may need to look for only part-time work. Working part-time usually extends the number of weeks you can draw benefits. Additional earnings also may help you qualify for a new claim when your benefit year ends.

In Washington state, the maximum weekly benefit amount is $844. The minimum is $201. No one who is eligible for benefits will receive less than this, regardless of his or her earnings. The actual amount you are eligible to receive depends on the earnings in your base year.