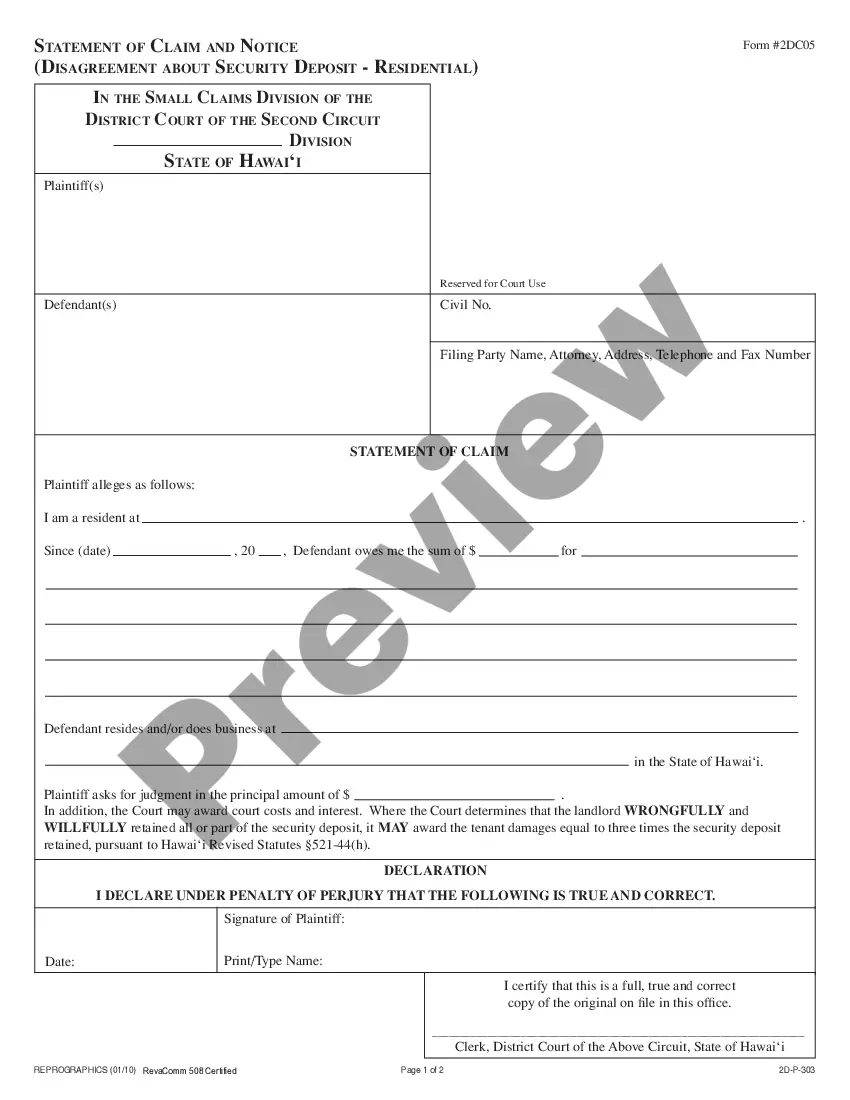

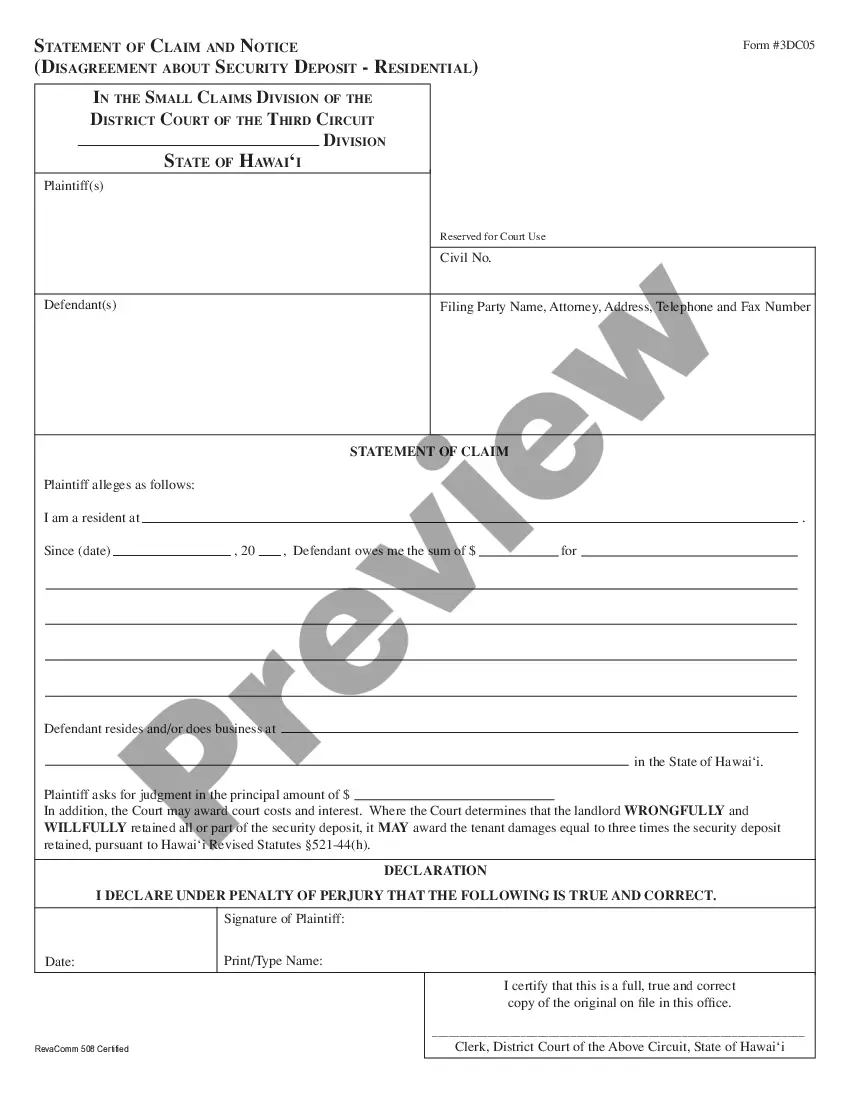

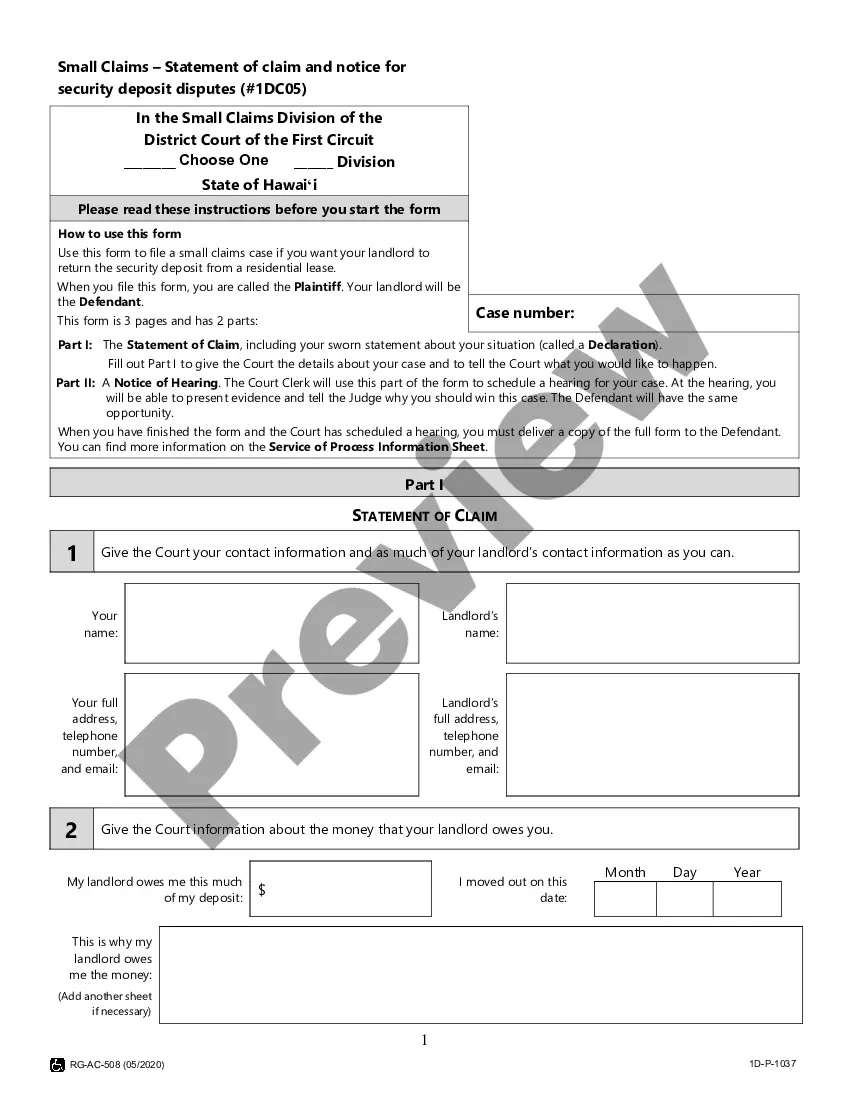

This official form may be completed and filed by either a landlord or a tenant to institute a lawsuit against the other when there is a disagreement over the security deposit to rent a residence.

Hawaii Statement of Claim - Security Deposit

Description

How to fill out Hawaii Statement Of Claim - Security Deposit?

Obtain one of the largest collections of sanctioned documents. US Legal Forms is truly a platform where you can locate any state-specific form with just a few clicks, including examples of Hawaii Statement of Claim - Security Deposit.

There is no need to waste hours of your time searching for a court-acceptable specimen. Our certified experts guarantee that you receive current examples every time.

To benefit from the forms library, select a subscription and create your account. If you are already registered, simply Log In and then click Download. The sample of the Hawaii Statement of Claim - Security Deposit will automatically be saved in the My documents section (a section for all forms you download from US Legal Forms).

That's it! You need to complete the Hawaii Statement of Claim - Security Deposit form and review it. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily access around 85,000 useful forms.

- If you plan to use a state-specific document, make sure to specify the correct state.

- If possible, review the description to grasp all the details of the document.

- Utilize the Preview feature if available to examine the document's details.

- Once everything is accurate, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Pay with a credit card or PayPal.

- Download the document to your device by clicking Download.

Form popularity

FAQ

A security deposit refund is not categorized as an expense; it is a liability when initially recorded. When you refund the deposit, you simply reduce your liability account without impacting your profit and loss statement. Familiarizing yourself with the Hawaii Statement of Claim - Security Deposit can provide you clarity on these financial transactions and help you track your obligations efficiently.

To record a security deposit received, create a journal entry that credits the liability account for the amount of the deposit and debits your bank account. This process ensures that you maintain an accurate record of your financial standing. Adopting the guidelines from the Hawaii Statement of Claim - Security Deposit can streamline your record-keeping process.

When accounting for deposits received, record them as liabilities until they are forfeited or refunded. Ensure that your financial records accurately reflect these transactions to maintain clarity. Using the Hawaii Statement of Claim - Security Deposit can help you establish a clear accounting method that meets legal requirements and secures your financial integrity.

To claim a security deposit, you need to submit a written claim to your landlord or property manager. Make sure to provide the reasoning for the claim, including any justifications for the amount you are requesting. The Hawaii Statement of Claim - Security Deposit can assist you in structuring your claim effectively to ensure your rights are protected.

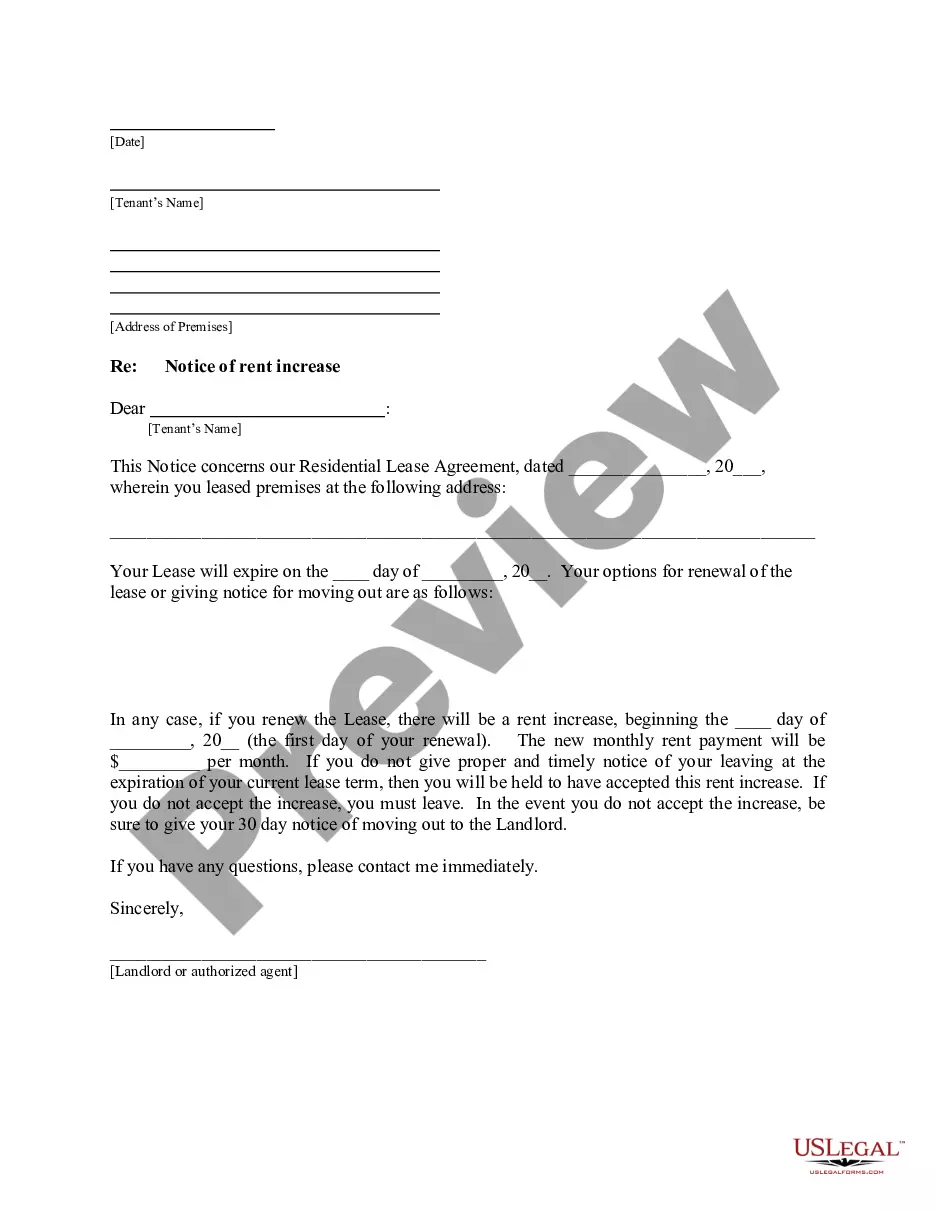

To return a security deposit letter, first, ensure it includes essential details such as the tenant's name, the property address, and the amount being refunded. Clearly state the reasons for any deductions if applicable, and attach necessary documentation. Utilizing the Hawaii Statement of Claim - Security Deposit can guide you in drafting a legally sound letter that meets state requirements.

A security deposit is presented under current assets on the balance sheet. This classification is crucial for accurately reflecting liquid assets available to your business. Properly representing this information is important, particularly in relation to a Hawaii Statement of Claim - Security Deposit.

A security deposit release form is a document that outlines the terms for releasing a security deposit back to the tenant. This form confirms that any conditions for the return have been met, such as property inspections. Using uslegalforms can simplify this process when managing a Hawaii Statement of Claim - Security Deposit.

In Hawaii, a landlord must return a security deposit within 14 days after the tenant moves out. This timeframe allows for any necessary inspections and deductions for damages if applicable. Adhering to this regulation is essential when preparing a Hawaii Statement of Claim - Security Deposit.

A security deposit is not classified as an expense; it is treated as a current asset. This distinction is important because it affects your overall financial reporting. When filing a Hawaii Statement of Claim - Security Deposit, recognizing this classification helps clarify your financial standing.

You can locate security deposits on the balance sheet within the current assets section. Look for line items labeled 'Deposits' or 'Security Deposits.' Understanding these entries is essential, especially if you are preparing a Hawaii Statement of Claim - Security Deposit.