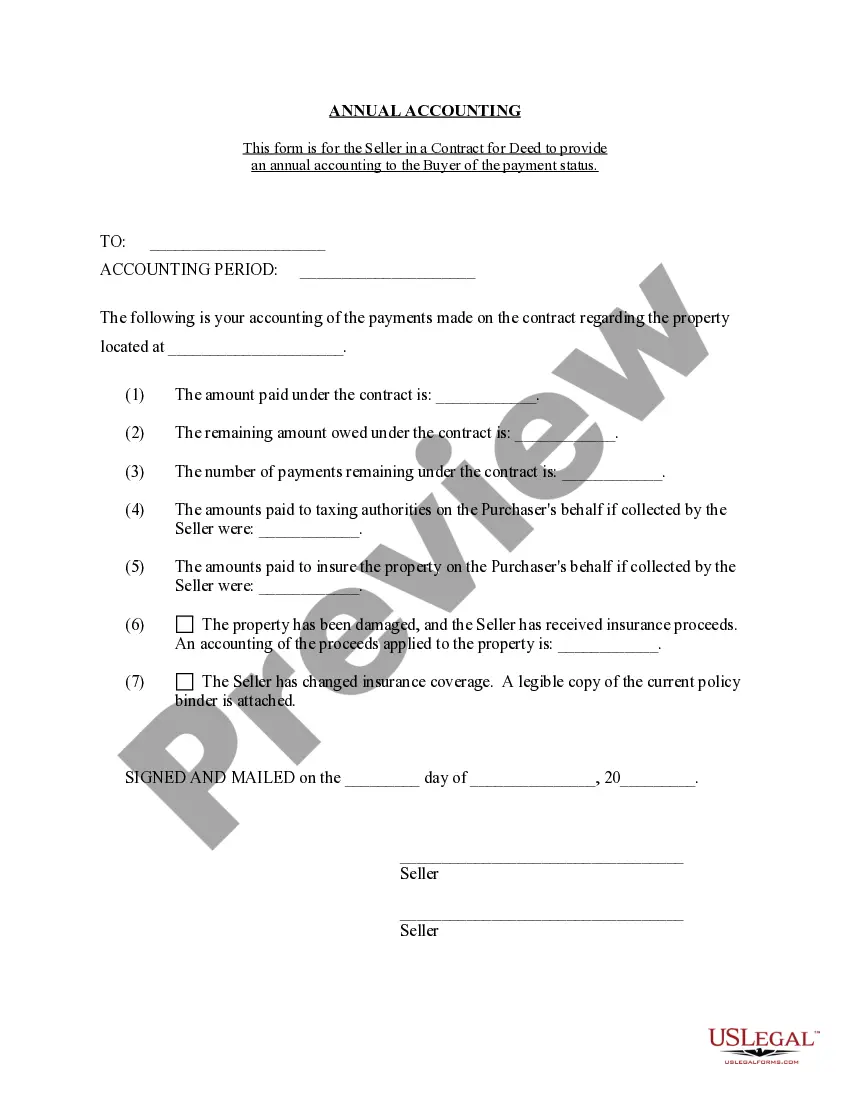

This is a statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Hawaii Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Hawaii Contract For Deed Seller's Annual Accounting Statement?

Utilize US Legal Forms to acquire a downloadable Hawaii Contract for Deed Seller's Annual Accounting Statement.

Our legally-valid forms are created and routinely refreshed by expert attorneys.

Ours is the most extensive collection of Forms available online and provides budget-friendly and precise templates for clients, legal professionals, and small to medium-sized businesses.

Click Buy Now if it’s the form you need. Create your account and pay through PayPal or by card; download the template to your device and reuse it multiple times. Utilize the Search field if you need to find another document template. US Legal Forms provides numerous legal and tax templates and packages for business and personal requirements, including the Hawaii Contract for Deed Seller's Annual Accounting Statement. Over three million users have successfully benefitted from our service. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- The templates are organized into state-specific categories and some can be previewed before downloading.

- To access samples, users must possess a subscription and sign in to their account.

- Click Download next to any template required and locate it in My documents.

- For those without a subscription, consider the following tips to effortlessly find and download the Hawaii Contract for Deed Seller's Annual Accounting Statement.

- Ensure you select the correct template according to the state it’s required for.

- Examine the form by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

The interest rate on a contract for deed loan is typically 3% - 6% higher than the rate on regular mortgage. A higher interest rate means a higher monthly mortgage payment plus you are also responsible for property taxes and insurance even though you do not own the property.

Yes, recording is not required to make the land contract valid. It just makes third parties aware of its existence.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Interest rates on land contracts can vary dramatically, and buyers and sellers ultimately call the shots on the loan's rate. That said, interest rates typically stay under 12%, Smith said. Federal loan regulations, as well as state usury laws, restrict sellers from overcharging interest fees.