Guam Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

Are you currently in a circumstance where you require documentation for business or personal purposes almost every time.

There are numerous legitimate document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers a vast selection of form templates, such as the Guam Employee Evaluation Form for Farmer, designed to meet state and federal requirements.

Upon finding the appropriate form, click Get now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and make your payment using PayPal or a credit card. Select a convenient file format and download your copy. Access all the document templates you've purchased in the My documents section. You can obtain another copy of the Guam Employee Evaluation Form for Farmer at any time. Click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Guam Employee Evaluation Form for Farmer template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/region.

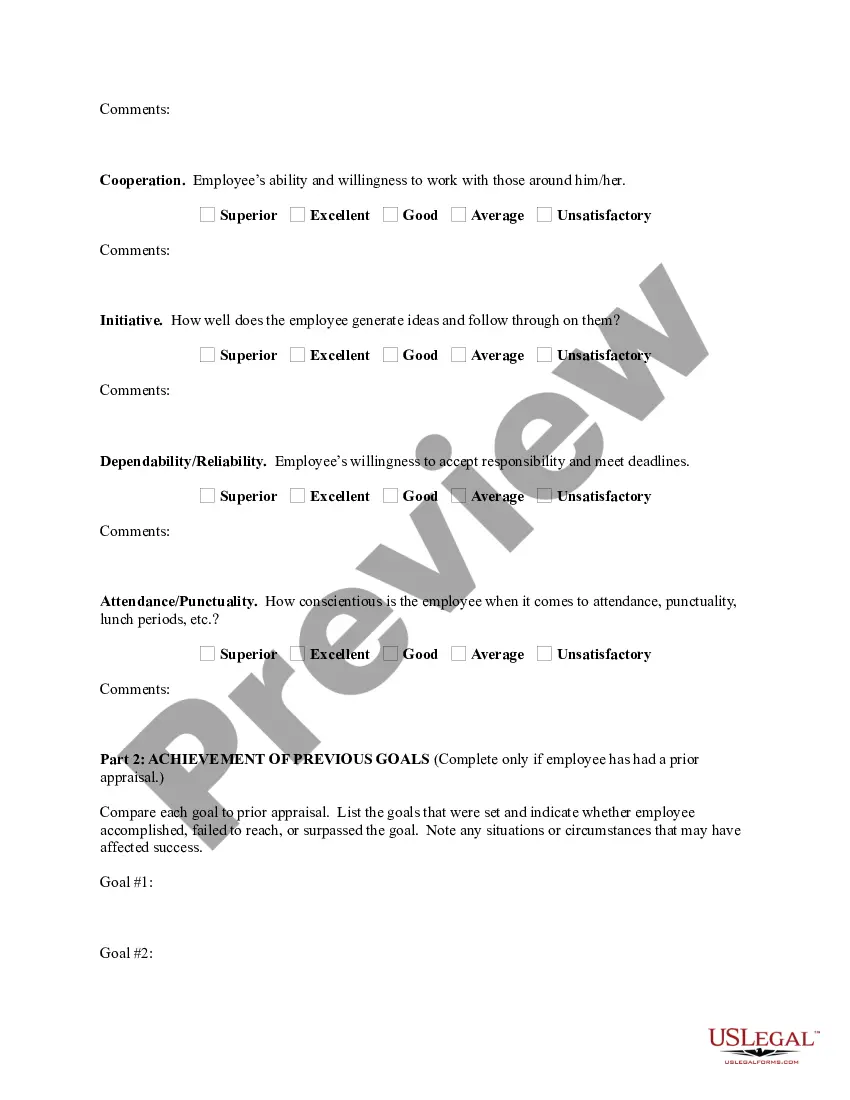

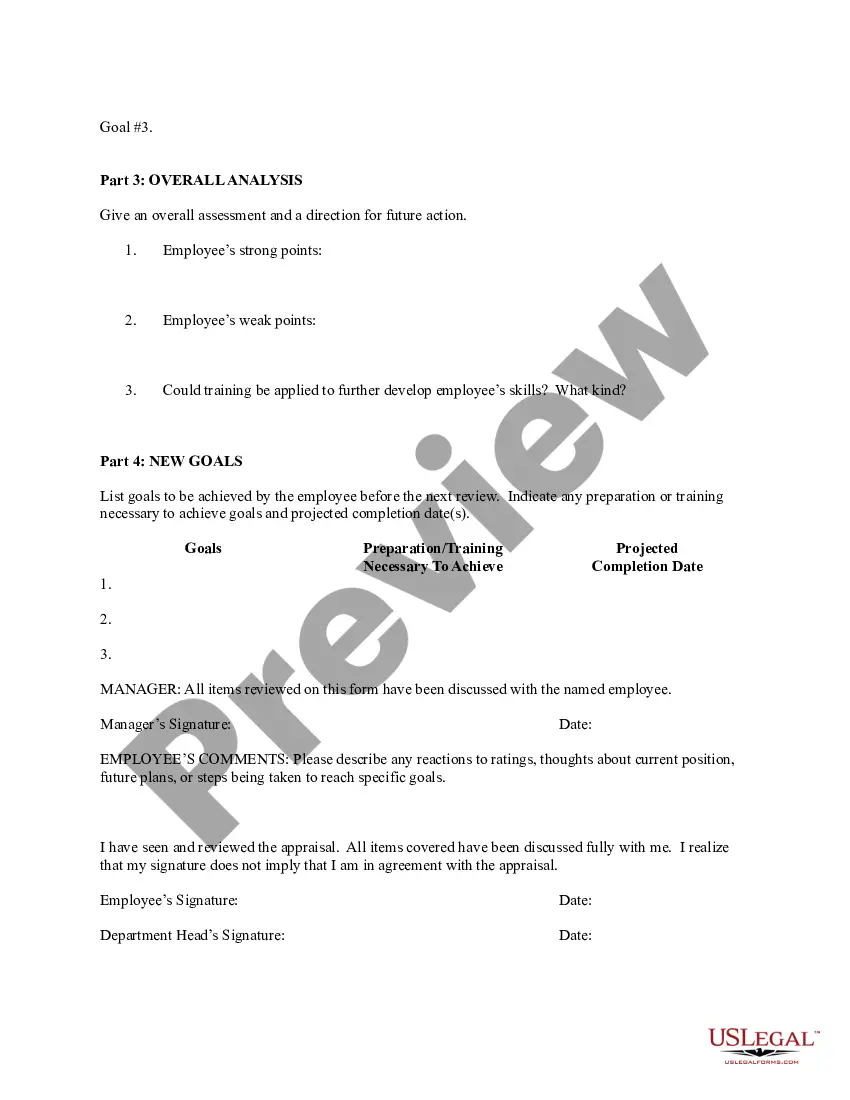

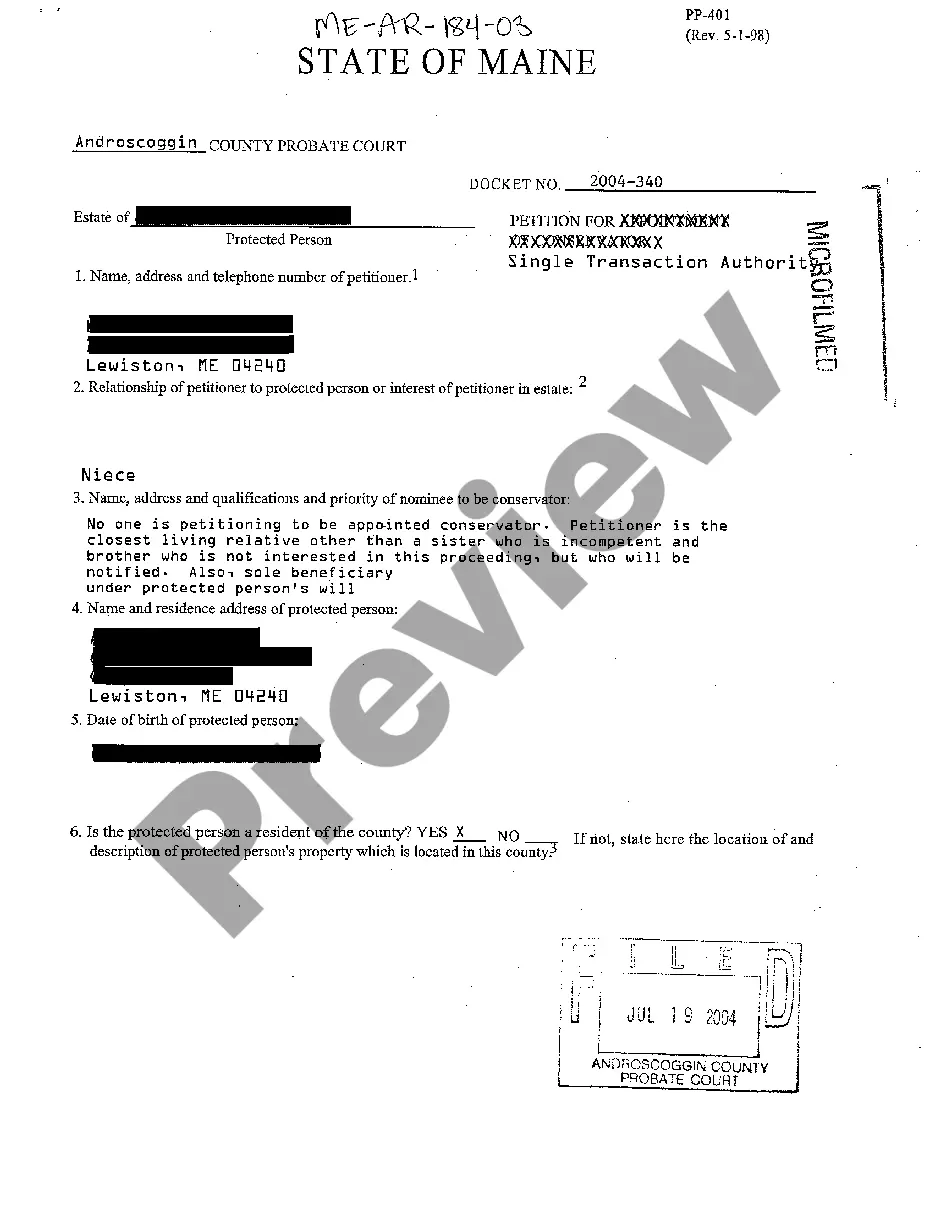

- Utilize the Preview feature to review the form.

- Examine the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

It's designed to be used in place or in addition to Form 941 for businesses that routinely pay farm workers. Form 943 is only used by companies that employ and pay farmworkers wages by cash, checks, or money orders. Non-cash wages are food and lodging, or payment for services other than farm work.

Weekly, monthly, and bi-monthly payments should be paid online ( ). A farmer is required to file Form 943 annually to verify payments were correct. All non-farmers are required to file Form 941 quarterly. A new employer must apply for a KY Withholding Account number.

If you have agricultural employees, you will only file Form 940 if you either paid cash wages of $20,000 or more to farmworkers or employed 10 or more farmworkers during some part of the day for 20 or more weeks.

Gross Cash Income: the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. Gross Farm Income: the same as gross cash income with the addition of non-money income, such as the value of home consumption of self-produced food.

Net Farm Income from Operations (NFIFO) is calculated once these adjustments are made and depreciation is accounted for. Net Farm Income (NFI) is calculated after changes in capital assets are accounted for. Net Farm Income is the last calculation made, after gain (or loss) of capital assets is recognized.

The Internal Revenue Service's classification of "Agricultural Employees" includes farm workers that raise or harvest agricultural or horticultural products on a farm, including raising livestock.

It is important to evaluate potential farmland before signing agreements to lease or own the property. Land use planning involves considering what your goals are for the land and if zoning and other local regulations allow for you to carry out your plans.

Subtract interest expense, then add capital gains or subtract capital losses from net farm income from operations to calculate net farm income. This represents the income earned by the farm operator's own capital, labor, and management ability.

Gross Income of a Farm It is calculated by multiplying the physical Output (how many tons of maize was produced, for example) with the price of the product (R/ton). Gross income for a year is the sum of all the crops, or livestock, produced in each season of a year.

Gross farm income reflects the total value of agricultural output plus Government farm program payments. Net farm income (NFI) reflects income after expenses from production in the current year and is calculated by subtracting farm expenses from gross farm income.