Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

Choosing the best legal record web template could be a battle. Needless to say, there are a lot of themes available on the net, but how would you get the legal form you require? Utilize the US Legal Forms internet site. The services delivers a large number of themes, for example the Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor, which can be used for enterprise and private requires. All of the kinds are examined by experts and meet state and federal requirements.

Should you be presently authorized, log in for your bank account and click on the Down load switch to get the Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor. Utilize your bank account to check with the legal kinds you possess bought earlier. Proceed to the My Forms tab of the bank account and obtain an additional copy from the record you require.

Should you be a brand new end user of US Legal Forms, listed here are easy recommendations that you can comply with:

- Initially, make sure you have chosen the proper form to your town/state. It is possible to examine the shape using the Review switch and read the shape outline to guarantee it will be the best for you.

- In case the form does not meet your requirements, utilize the Seach area to get the proper form.

- When you are certain that the shape would work, go through the Purchase now switch to get the form.

- Opt for the pricing strategy you would like and type in the essential information. Make your bank account and purchase the order utilizing your PayPal bank account or charge card.

- Opt for the file format and obtain the legal record web template for your product.

- Comprehensive, edit and printing and indicator the attained Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

US Legal Forms is definitely the most significant collection of legal kinds where you can see a variety of record themes. Utilize the company to obtain expertly-made paperwork that comply with status requirements.

Form popularity

FAQ

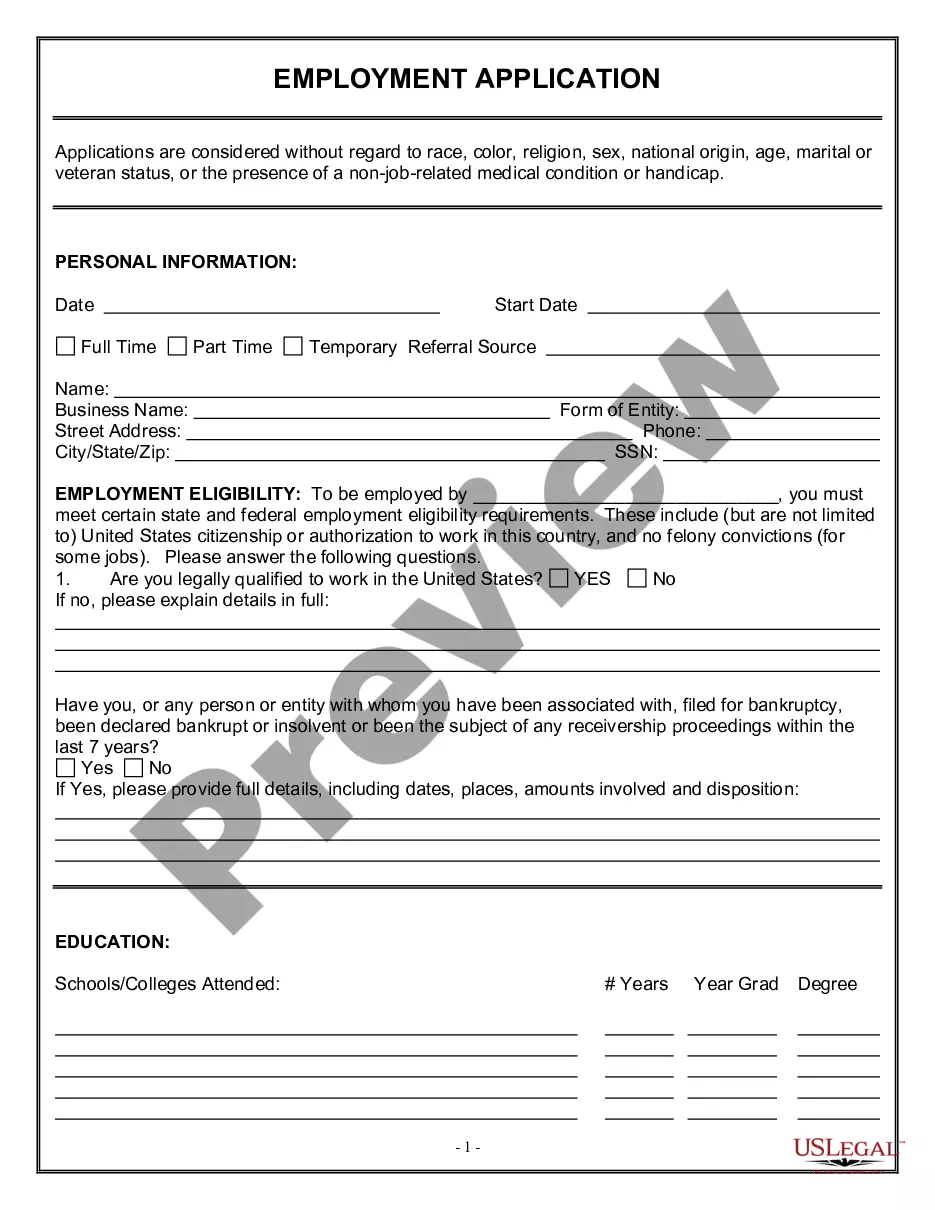

Independent contracts must have work authorization to work in the U.S. It is a requirement under U.S. law, and the immigration system provides various options to work legally in the country. One of those options is the O-1 visa for independent contractors, however, it is not the only one.

Independent contracts must have work authorization to work in the U.S. It is a requirement under U.S. law, and the immigration system provides various options to work legally in the country.

How to Be an Independent Contractor Step 1) Name Your Business. Step 2) Register Your Business Entity. Step 3) Obtain a Contractor's License. Step 4) Open Your Business Bank Account. Step 5) Start Marketing. More Freedom and Flexibility. More Clients and Projects. More Time for Your Personal Life.

Form I-9 is not required for casual domestic services. An independent contractor is not considered an employee for Form I-9 purposes and does not need to complete Form I-9.

All immigrants regardless of legal status are able to earn a living as independent contractors, or start a business using an ITIN or SSN. An independent contractor must pay self-employment tax and income tax. An independent contractor may use an ITIN to file and pay taxes instead of a SSN.