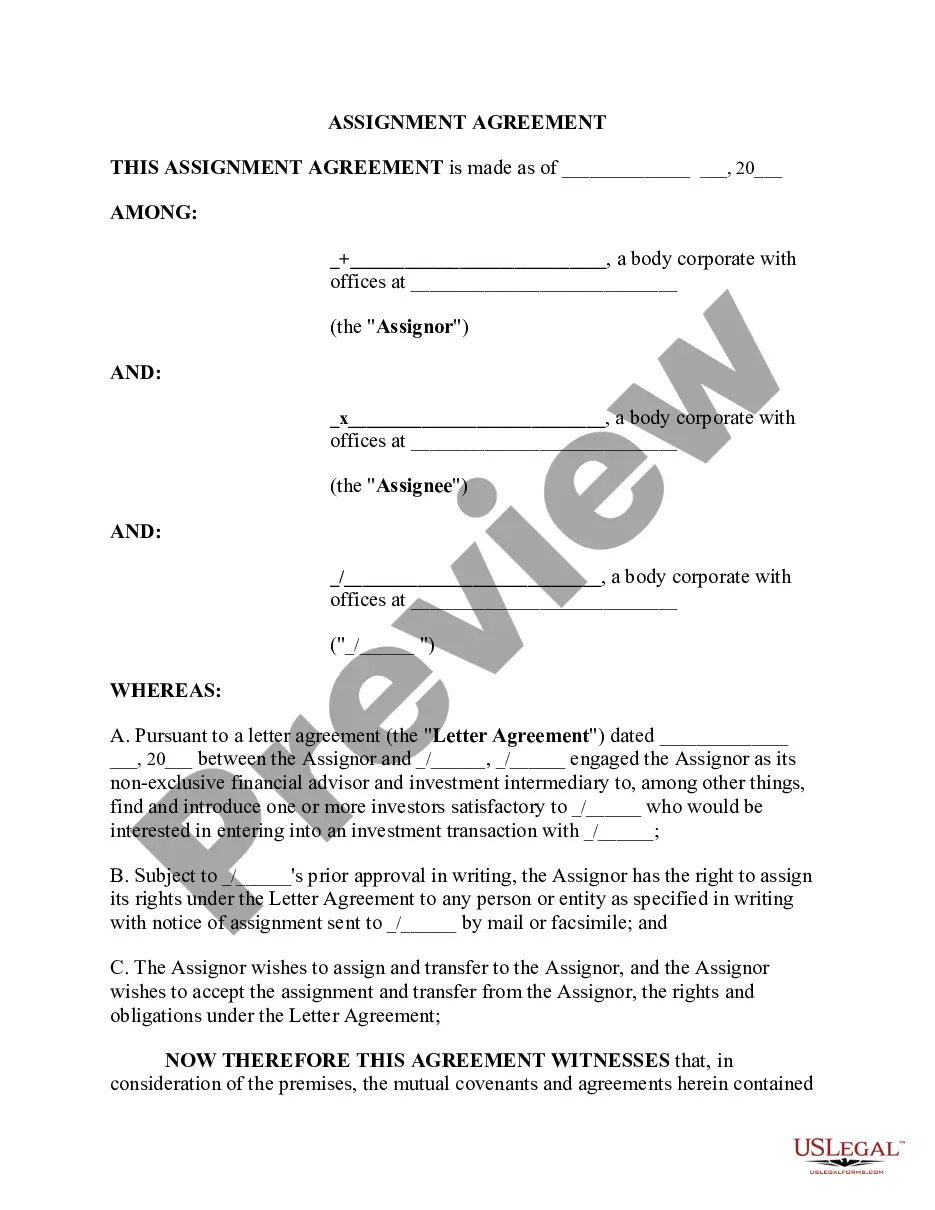

Guam General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a broad selection of legal template designs that you can download or print.

By utilizing the website, you will access countless templates for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of documents like the Guam General Form of Factoring Agreement - Assignment of Accounts Receivable within moments.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking on the Get now button. Next, select the pricing plan you prefer and provide your details to sign up for an account.

- If you already possess a subscription, Log In and acquire the Guam General Form of Factoring Agreement - Assignment of Accounts Receivable from your US Legal Forms library.

- The Download button will appear on each form you examine.

- You can access all previously obtained forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have chosen the correct form for your town/county. Click the Preview button to review the content of the form.

- Read the form description to confirm that you have selected the accurate form.

Form popularity

FAQ

To record accounts receivable factoring, you will need to document the sale of your receivables to the factoring company. Start by creating a journal entry that reflects the sale, including any fees. This process helps you maintain accurate financial records and ensures that you comply with the Guam General Form of Factoring Agreement - Assignment of Accounts Receivable. If you need assistance, consider using uslegalforms for the right documents.

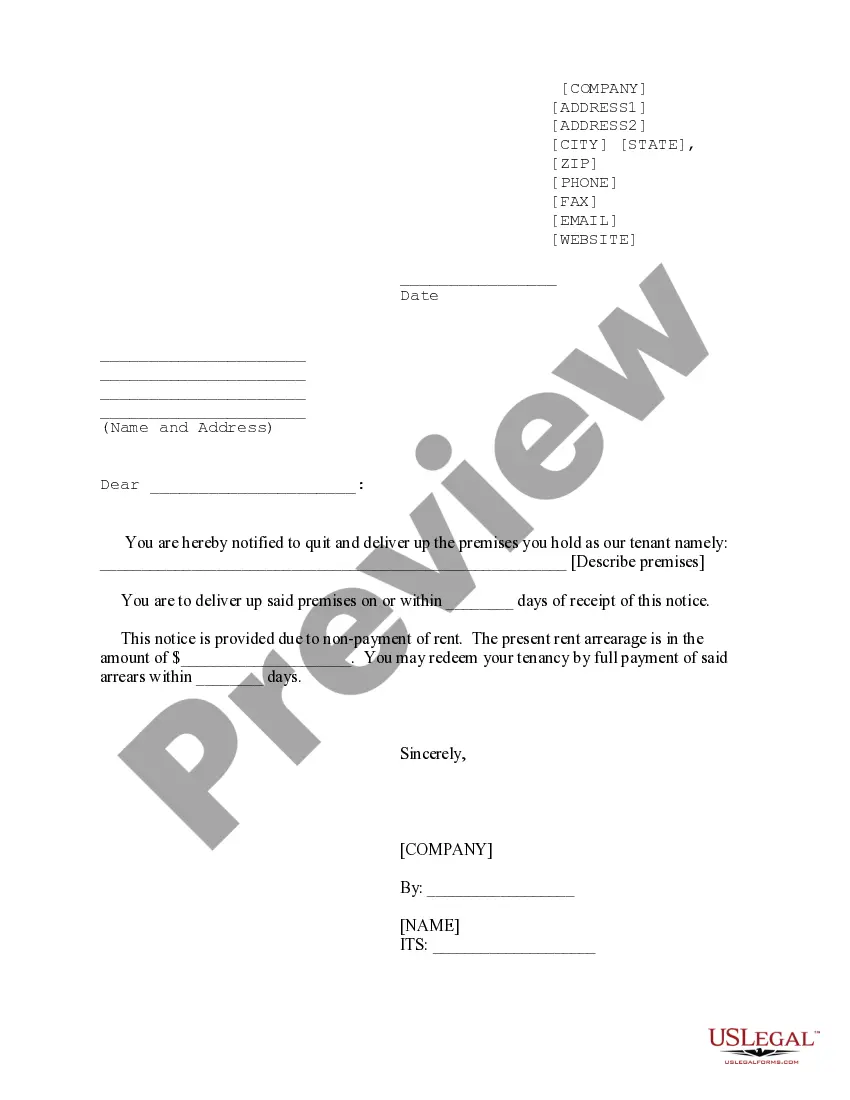

A Notice of Assignment (NoA) in factoring serves as a formal notification to customers that their account has been assigned to a factor. This document clarifies that payments should now be directed to the factor instead of the original creditor. The NoA plays a significant role in the collection process and is crucial for establishing the legal rights of the factor. Utilizing the Guam General Form of Factoring Agreement - Assignment of Accounts Receivable can help streamline this notification process.

Deed of Assignment means one or more general deed of assignment in respect of any Charterparty, to be executed by the relevant Borrower in favour of the Security Agent (on behalf of the Finance Parties and the Hedging Banks), in form and substance acceptable to the Security Agent (on behalf of the Finance Parties and

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

The four main types of factoring are the Greatest common factor (GCF), the Grouping method, the difference in two squares, and the sum or difference in cubes.

Debt factoring arrangements take place when a business sells its accounts receivables to a factor at a discount. The factor then collects the receivables from the customers. This arrangement is used to improve cash flow for a business. Factoring begins when a factor evaluates a business and its receivables.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

Follow these tips to ensure efficient and effective accounts receivable management.Use Electronic Billing & Payment.Outline Clear Billing Procedures.Set Credit & Collection Policies and Stick to Them.Be Proactive.Set up Automations.Make It Easy for Customers.Use the Right KPIs.Involve All Teams in the Process.06-May-2021

In algebra, 'factoring' (UK: factorising) is the process of finding a number's factors. For example, in the equation 2 x 3 = 6, the numbers two and three are factors.

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing.