Guam Stock Dividend - Resolution Form - Corporate Resolutions

Description

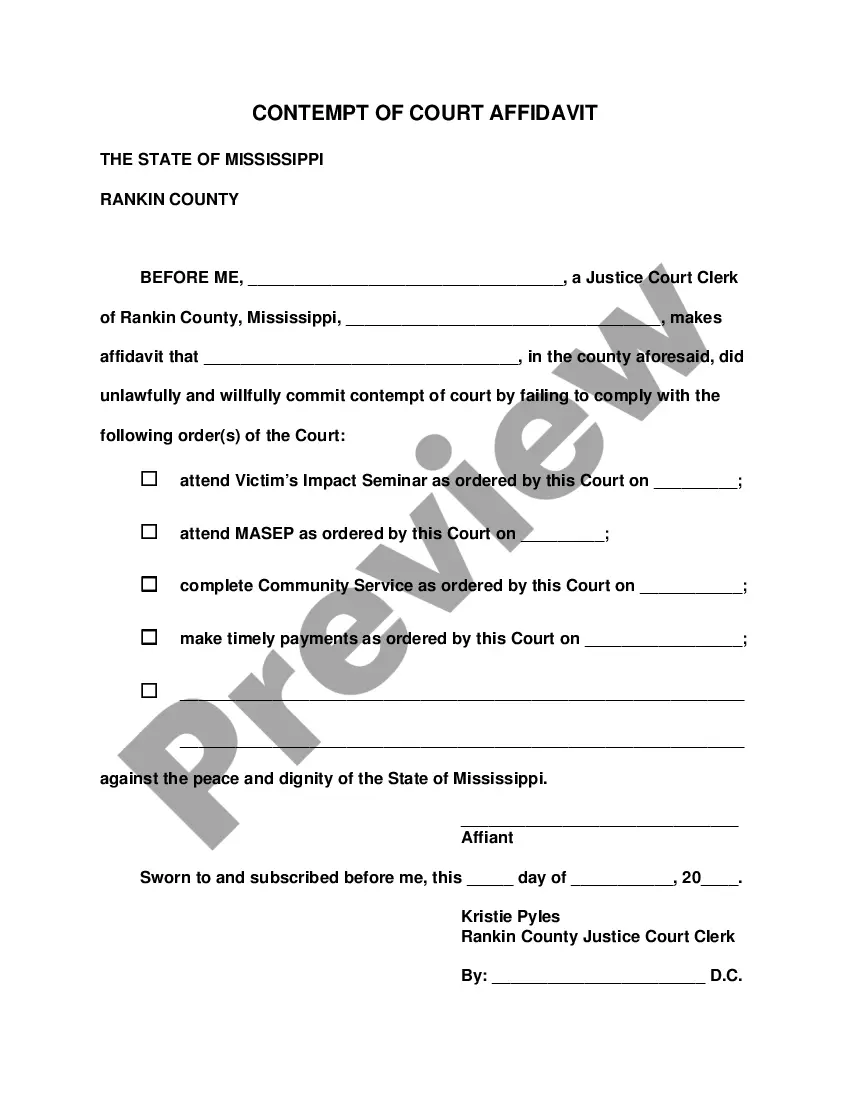

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

If you want to complete, acquire, or download sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and efficient search to locate the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Get now button. Choose the payment plan you prefer and enter your details to sign up for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Guam Stock Dividend - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and click on the Download button to access the Guam Stock Dividend - Resolution Form - Corporate Resolutions.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To declare a dividend, a board of directors' resolution is needed, typically detailed within a formal document. This resolution should specify key details such as the dividend amount, payment date, and eligible shareholders. It aids in establishing a clear understanding of the distribution process within the company. For a seamless experience, consider using a Guam Stock Dividend - Resolution Form - Corporate Resolutions available on our platform.

Yes, a resolution is typically required to declare a dividend. This formal decision provides a clear record of the board's approval, ensuring accountability in financial management. Additionally, it helps prevent misunderstandings among shareholders regarding dividend distribution. By utilizing a Guam Stock Dividend - Resolution Form - Corporate Resolutions, you can ensure your process is compliant and efficient.

To declare a dividend, a corporate resolution from the board of directors is required, specifying the dividend amount and the record date. This resolution is essential in ensuring compliance with corporate laws and transparency in financial matters. Employing a structured Guam Stock Dividend - Resolution Form - Corporate Resolutions aids in this process.

The purpose of a corporate resolution is to document the formal actions and decisions made by a company’s board or shareholders. It serves as a legal record that can provide clarity in corporate governance and accountability. When dealing with Guam Stock Dividend - Resolution Form - Corporate Resolutions, this document ensures that all decisions regarding dividends are officially recognized.

To report stock dividends, a company should disclose them in the financial statements as part of shareholder equity. Typically, this includes detailing the allocation to retained earnings and the increase in issued shares. Utilizing a Guam Stock Dividend - Resolution Form - Corporate Resolutions simplifies this reporting process and ensures compliance.

A corporate resolution to authorized signature is a document that designates individuals in a company who have the authority to sign contracts and other binding documents. This resolution provides legal backing for transactions and ensures proper governance within the company. It’s particularly important when executing a Guam Stock Dividend - Resolution Form - Corporate Resolutions.

The resolution form signifies a legally binding document that records decisions made by a corporate board. It outlines actions taken, ensuring transparency and compliance with governance policies. In the context of Guam Stock Dividend - Resolution Form - Corporate Resolutions, it plays a crucial role in the formal declaration of dividends.

To record stock dividends received, a business should increase its investment account and adjust the retained earnings accordingly. This process reflects the transfer from the company's earnings to shareholders in the form of additional shares. A proper entry ensures accurate financial documentation in the context of Guam Stock Dividend - Resolution Form - Corporate Resolutions.

Another name for a corporate resolution is a corporate action or board resolution. This term emphasizes the decision-making aspect of the document, which often affects company operations or finances. Using accurate terminology is crucial for understanding Guam Stock Dividend - Resolution Form - Corporate Resolutions.

A corporate resolution form is a legal document that captures the decisions made by a corporation’s board of directors or shareholders. This form details actions such as appointing officers, approving financial transactions, or declaring dividends. It serves as a vital record for companies, especially when dealing with Guam Stock Dividend - Resolution Form - Corporate Resolutions.