This office lease clause deals with the mandatory obligation of the landlord to rebuild; time periods for reconstruction; continuation of abatement periods; the appropriate "what ifs" in the event portions of the premises cannot be restored and are deemed to be indispensable; and circumstances when the landlord or tenant can elect to terminate the lease.

Georgia Clause Dealing with Fire Damage

Description

How to fill out Clause Dealing With Fire Damage?

Have you been inside a placement where you need documents for sometimes organization or specific purposes nearly every time? There are tons of lawful papers themes available online, but getting versions you can depend on isn`t simple. US Legal Forms provides thousands of type themes, just like the Georgia Clause Dealing with Fire Damage, that are published to meet state and federal demands.

When you are presently acquainted with US Legal Forms website and have an account, basically log in. After that, it is possible to download the Georgia Clause Dealing with Fire Damage format.

Should you not come with an account and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you want and make sure it is for the correct town/state.

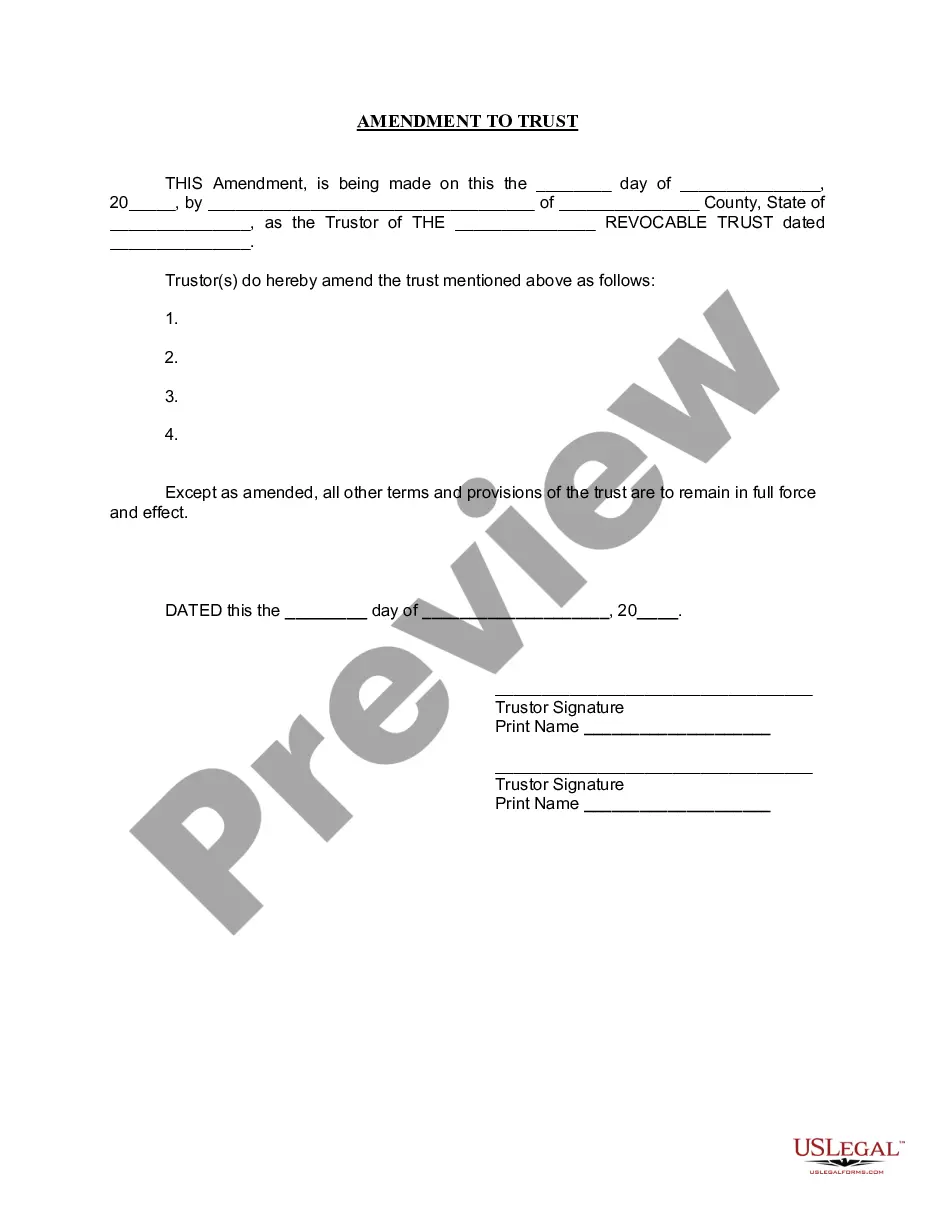

- Make use of the Preview option to analyze the form.

- Look at the explanation to actually have selected the right type.

- When the type isn`t what you`re trying to find, take advantage of the Search field to find the type that meets your requirements and demands.

- Whenever you obtain the correct type, just click Acquire now.

- Opt for the costs prepare you need, fill out the required information to make your account, and pay for an order utilizing your PayPal or bank card.

- Pick a hassle-free document file format and download your backup.

Locate all of the papers themes you possess bought in the My Forms menu. You may get a further backup of Georgia Clause Dealing with Fire Damage anytime, if possible. Just click the essential type to download or print out the papers format.

Use US Legal Forms, the most extensive variety of lawful forms, in order to save time and stay away from mistakes. The services provides professionally created lawful papers themes which can be used for a selection of purposes. Create an account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Following are the 12 perils of the standard fire insurance policy: 1) Perils of Fire: 2) Standard Fire Insurance against Lightning Insurance: 3) Explosion/Implosion: 4) Aircraft Damage: 5) Riot, Strike, Malicious Damage insurance: 7) Impact Damage: 8) Subsidence and Landslide including Rockslide:

Average policy refers to a policy followed in fire insurance which states that the insurance company will only pay the rate able proportion of loss which means that if the sum insured is less than the actual amount of loss then the insurance company will only pay to sum of the assets which were insured and occurred ...

16-7-60 addresses the charge of arson in the first degree.

Fire insurance policies provide payment for the loss of use of the property as a result of a fire. They also often provide additional living expenses if the fire caused uninhabitable conditions. Finally, they provide for damage to personal property and nearby structures.

A type of insurance in which an insurance company agrees to pay for damage caused by fire, or the document in which the details of the insurance are recorded: A building owner who installs a sprinkler system can expect a drop in the cost of a fire policy.

The standard fire policy (SFP) is a basic insurance policy that provides coverage against losses caused by fire. It is a widely recognized and accepted form of insurance, serving as the foundation for fire insurance policies across the industry.

The Standard Fire Policy has four sections: declarations-description and location of property, insured amount, name of insured. insuring agreement-premium amount, obligations of the insured, actions the insured must take in the event of loss and resultant claim.

A fire insurance policy has an average clause mentioned in it which takes care of the cases of under-insurance. If insured the assets in the fire insurance policy, for less than their full value, the insured requires to bear a proportion of the loss ing to the average clause mentioned in the policy document.