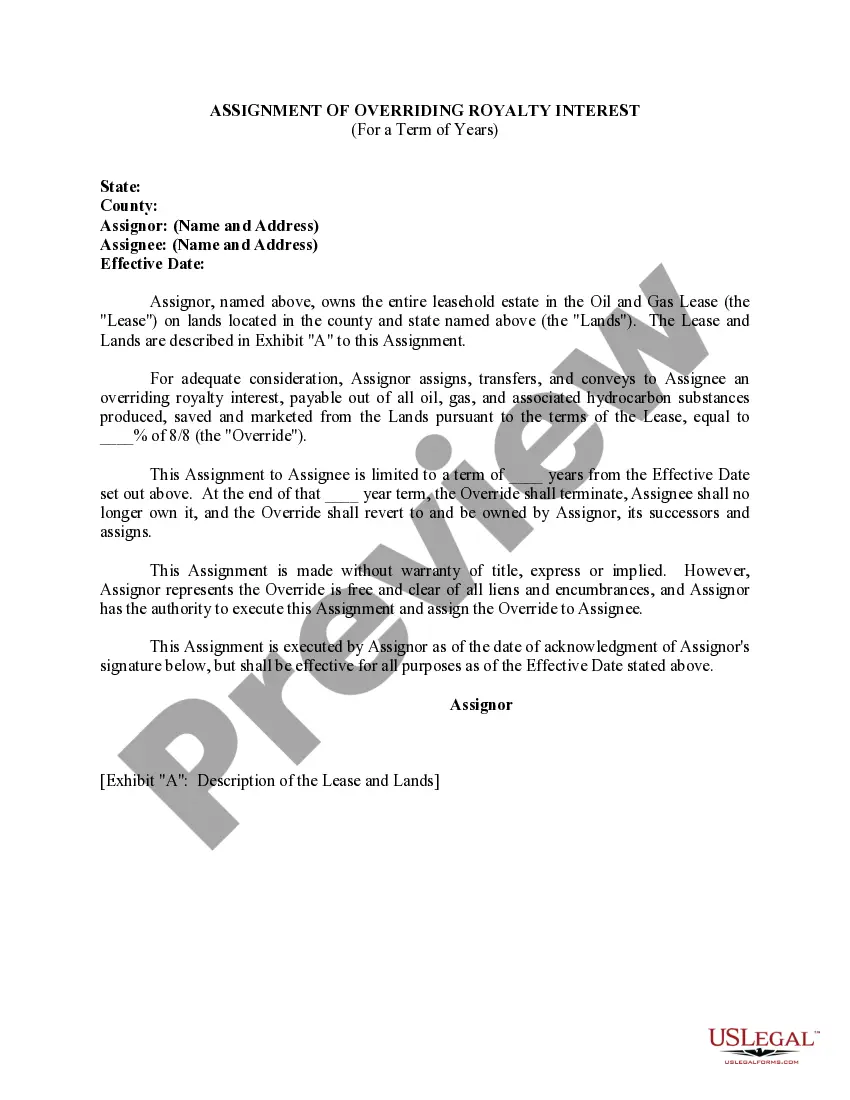

Georgia Assignment of Overriding Royalty Interest Limited As to Depth

Description

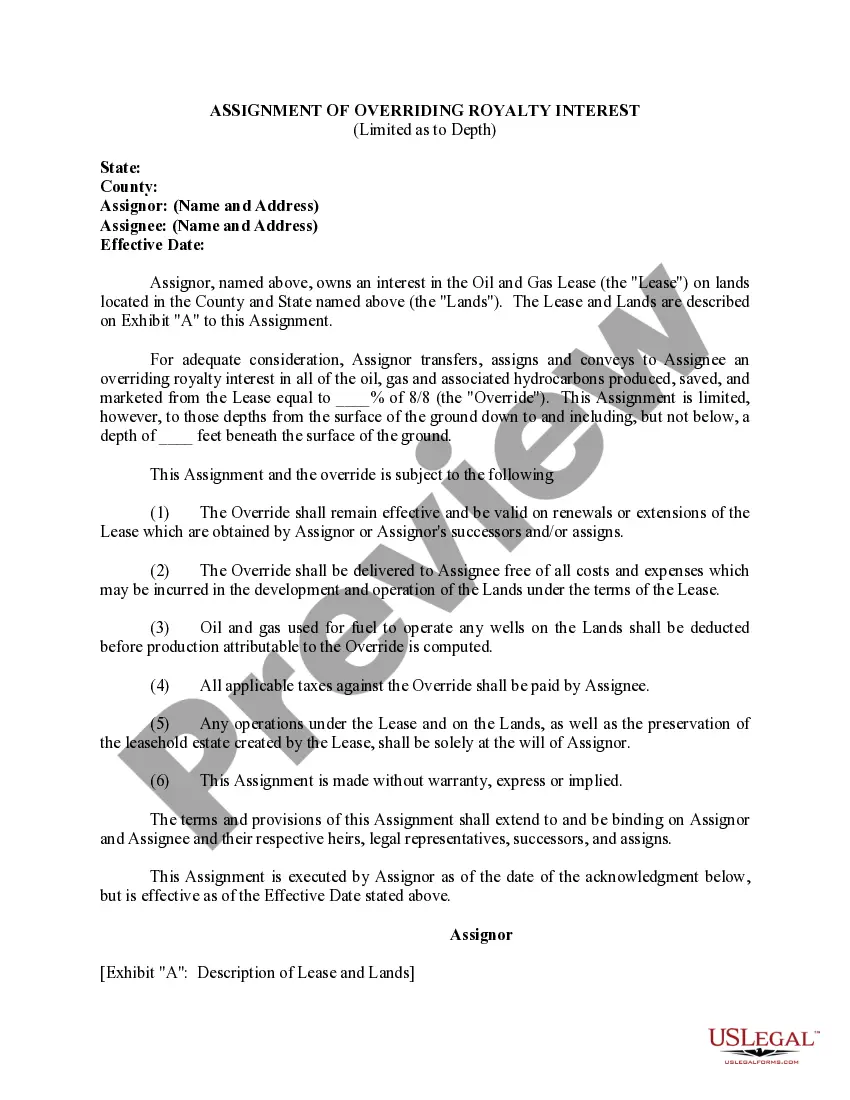

How to fill out Assignment Of Overriding Royalty Interest Limited As To Depth?

Are you presently in the placement in which you will need documents for either enterprise or specific purposes almost every day? There are tons of legal record layouts available online, but getting versions you can depend on isn`t effortless. US Legal Forms delivers thousands of type layouts, like the Georgia Assignment of Overriding Royalty Interest Limited As to Depth, that happen to be written in order to meet state and federal demands.

When you are currently familiar with US Legal Forms web site and get your account, basically log in. After that, you may acquire the Georgia Assignment of Overriding Royalty Interest Limited As to Depth template.

Should you not offer an account and want to begin using US Legal Forms, abide by these steps:

- Discover the type you want and ensure it is for the correct town/county.

- Make use of the Preview switch to analyze the shape.

- Browse the explanation to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you`re seeking, take advantage of the Lookup area to find the type that meets your requirements and demands.

- Once you get the correct type, just click Buy now.

- Pick the rates plan you want, fill out the required information to create your account, and pay money for your order making use of your PayPal or charge card.

- Select a practical paper file format and acquire your copy.

Get every one of the record layouts you possess bought in the My Forms food selection. You can aquire a further copy of Georgia Assignment of Overriding Royalty Interest Limited As to Depth anytime, if necessary. Just click on the essential type to acquire or produce the record template.

Use US Legal Forms, probably the most considerable selection of legal forms, to save lots of efforts and stay away from faults. The services delivers professionally produced legal record layouts that you can use for a range of purposes. Create your account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

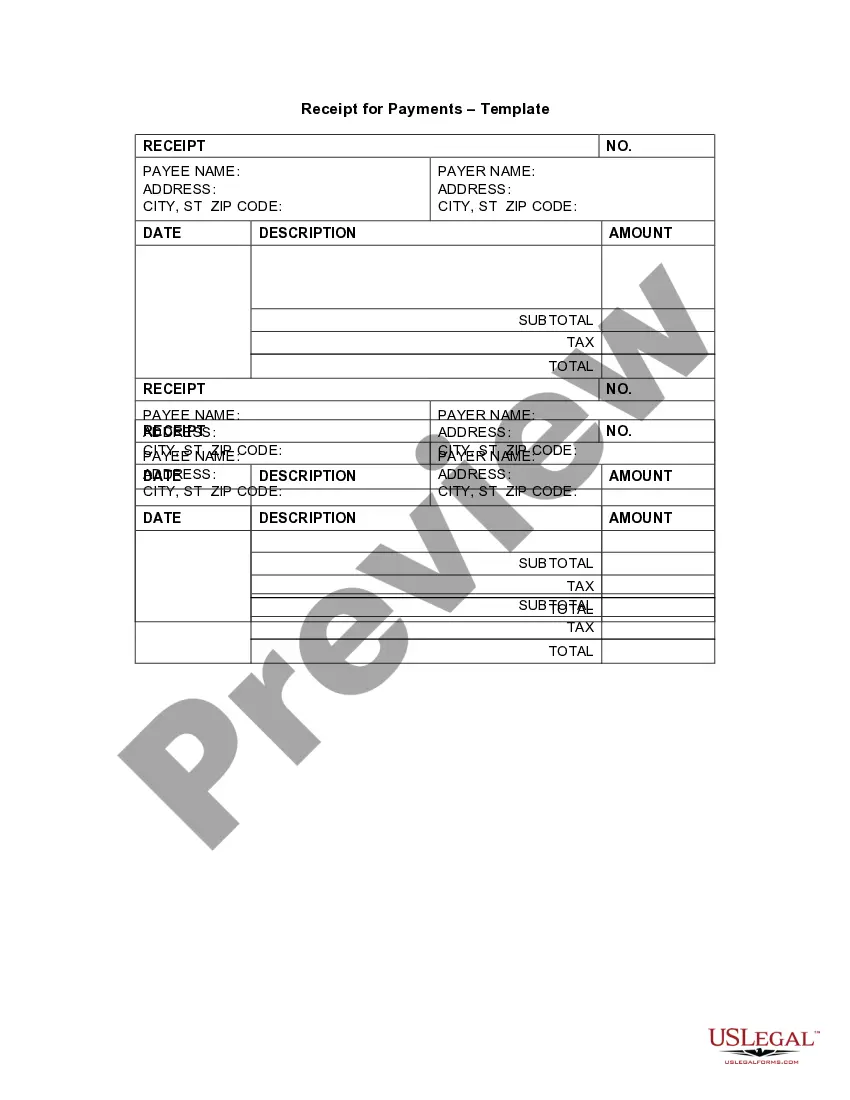

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

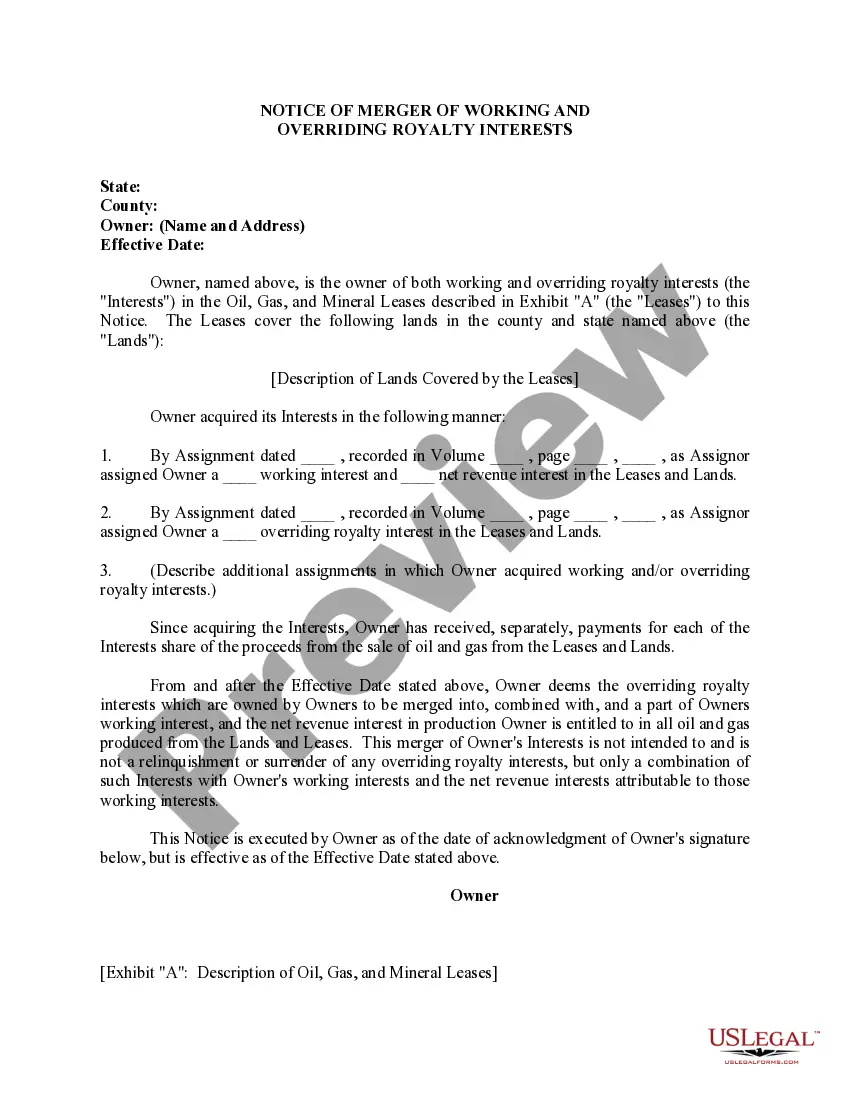

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.