Georgia Assignment of Overriding Royalty Interest For A Term of Years

Description

How to fill out Assignment Of Overriding Royalty Interest For A Term Of Years?

Finding the right legitimate papers design can be quite a have difficulties. Obviously, there are tons of themes available online, but how do you obtain the legitimate develop you need? Take advantage of the US Legal Forms website. The services provides thousands of themes, for example the Georgia Assignment of Overriding Royalty Interest For A Term of Years, that you can use for organization and private demands. Each of the varieties are checked by professionals and fulfill federal and state specifications.

When you are currently authorized, log in to your accounts and click on the Acquire button to get the Georgia Assignment of Overriding Royalty Interest For A Term of Years. Use your accounts to search throughout the legitimate varieties you have ordered formerly. Proceed to the My Forms tab of your accounts and have yet another version of your papers you need.

When you are a whole new end user of US Legal Forms, listed below are easy recommendations that you can stick to:

- Very first, make sure you have chosen the appropriate develop for your metropolis/county. You are able to examine the form utilizing the Preview button and look at the form outline to guarantee this is basically the right one for you.

- In case the develop does not fulfill your needs, make use of the Seach area to discover the proper develop.

- When you are positive that the form would work, click the Purchase now button to get the develop.

- Choose the pricing prepare you want and enter in the necessary info. Make your accounts and pay for the transaction with your PayPal accounts or credit card.

- Opt for the file structure and obtain the legitimate papers design to your product.

- Full, edit and print out and sign the received Georgia Assignment of Overriding Royalty Interest For A Term of Years.

US Legal Forms is definitely the biggest local library of legitimate varieties where you can find numerous papers themes. Take advantage of the company to obtain professionally-produced papers that stick to state specifications.

Form popularity

FAQ

To calculate the NMA, you need the gross number of acres and the percentage of your mineral interest. To complete the calculation, simply multiply the gross acreage by your mineral interest. For example, if you owned 25% interest on the minerals under a 400-acre tract of land, you would have 100 NMA.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

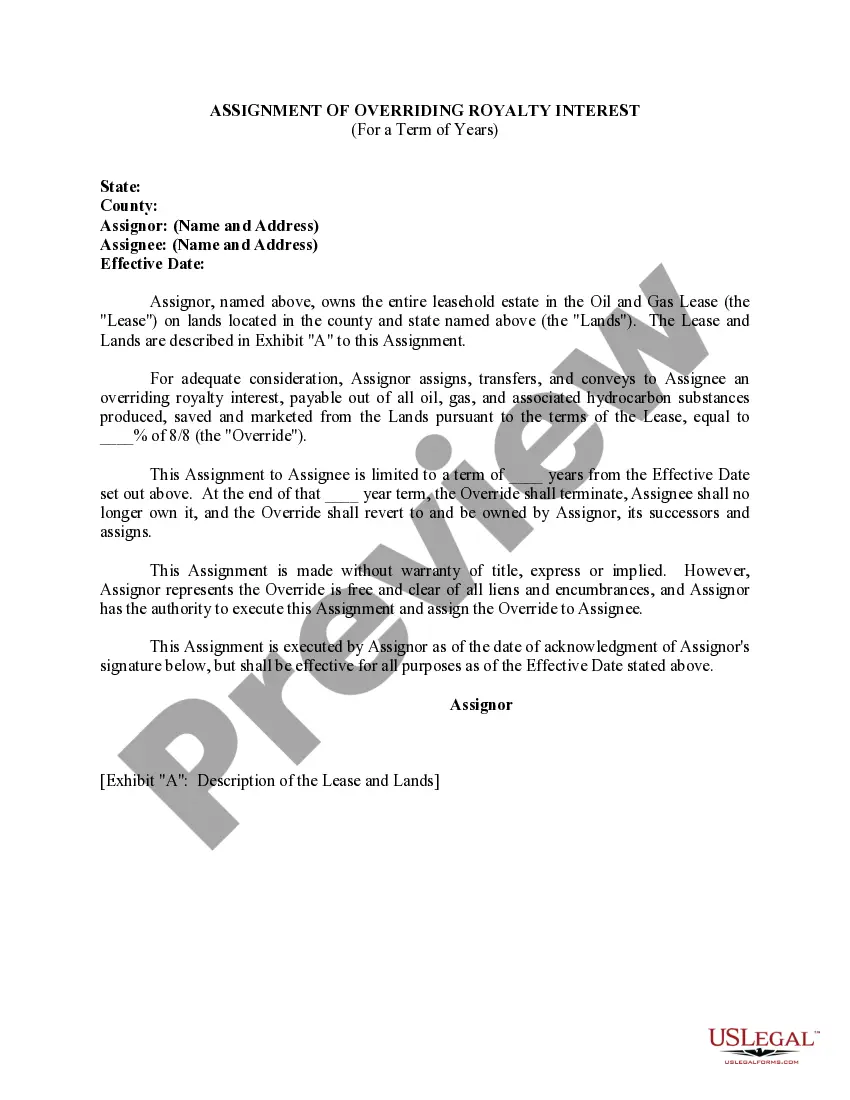

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

If there is an NPRI that exists, you would have to determine the # of net royalty acres by taking your royalty rate and subtracting the NPRI from it and then dividing by 12.5%.