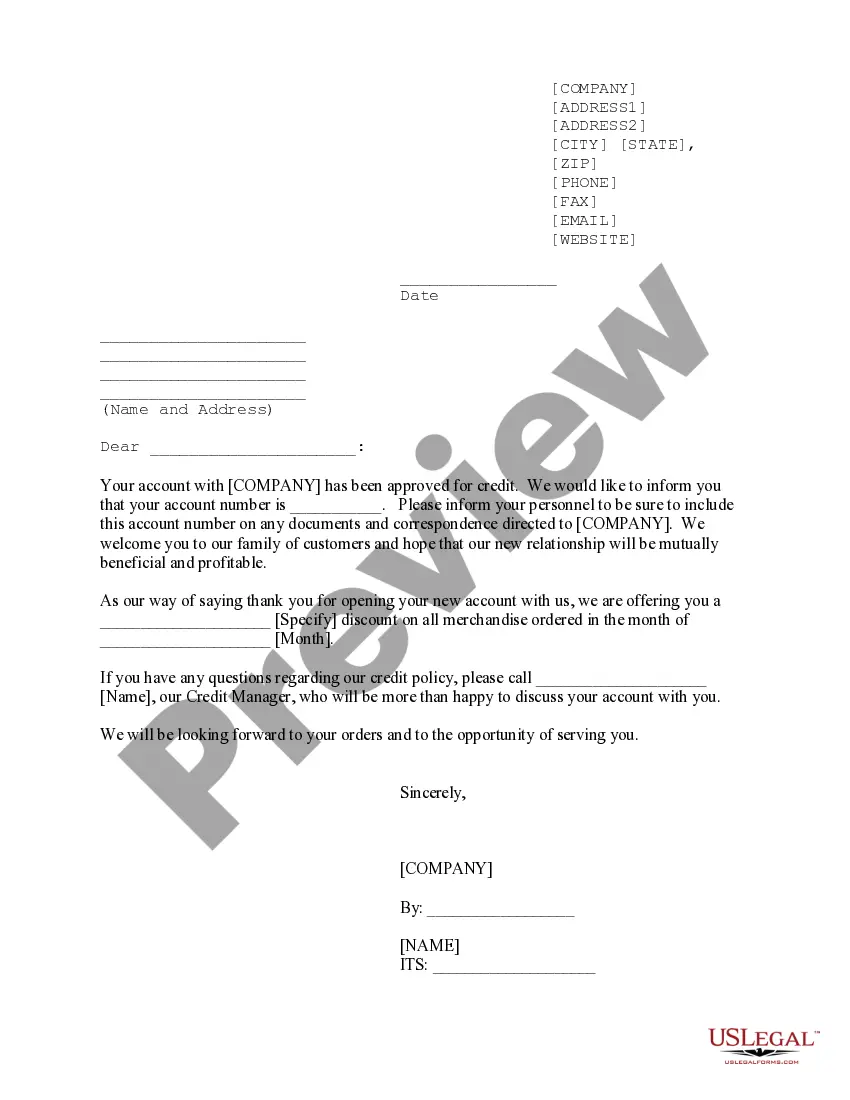

This form is a sample letter in Word format covering the subject matter of the title of the form.

Georgia Sample Letter for Exemption - Relevant Information

Description

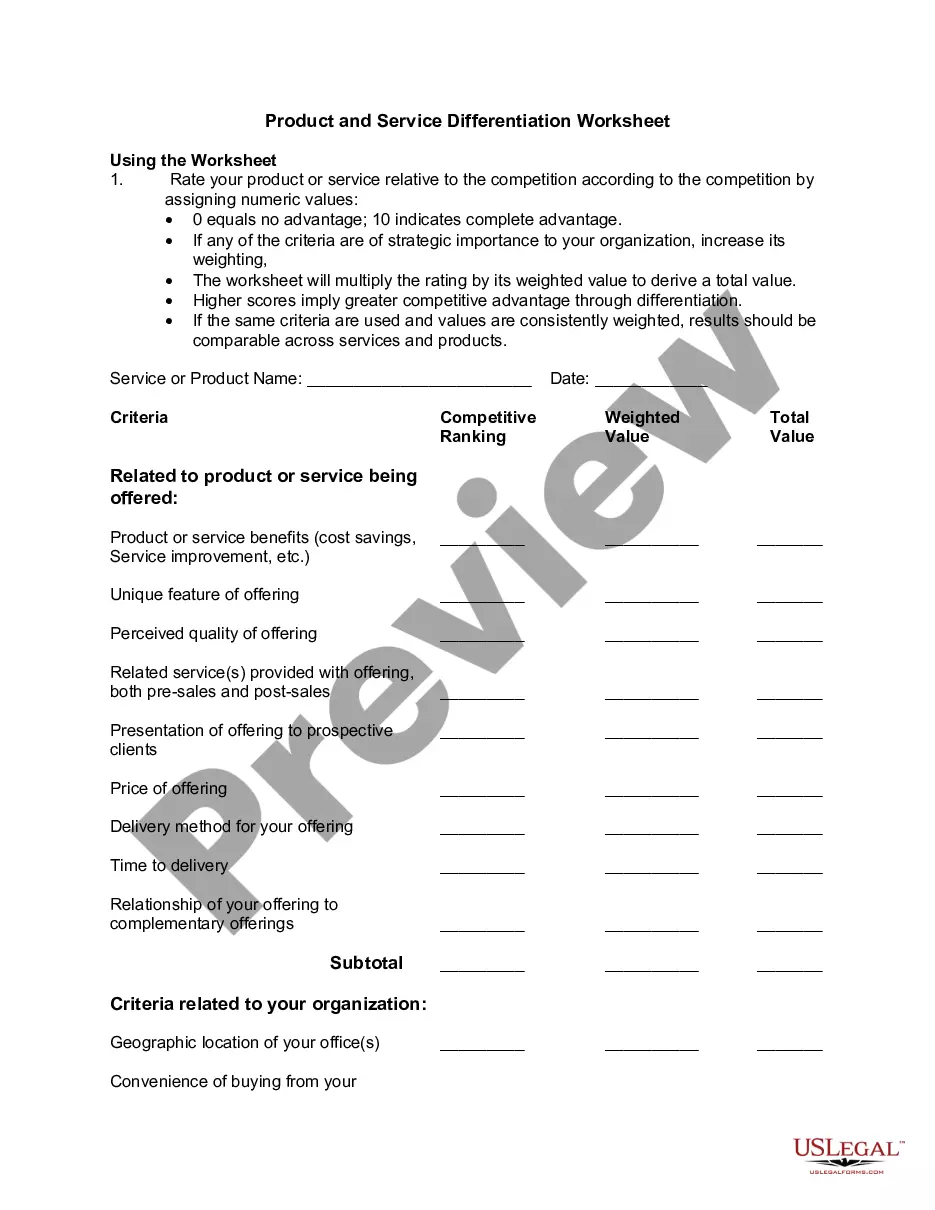

How to fill out Sample Letter For Exemption - Relevant Information?

If you wish to obtain, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's simple and convenient search to find the documents you need. A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Georgia Sample Letter for Exemption - Relevant Information with just a few clicks. If you are already a US Legal Forms user, Log In to your account and click the Download option to retrieve the Georgia Sample Letter for Exemption - Relevant Information. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct region/country. Step 2. Utilize the Preview feature to review the form's content. Don't forget to check the summary. Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other templates in the legal form format. Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Georgia Sample Letter for Exemption - Relevant Information.

- Every legal document template you download is yours permanently.

- You can access every form you acquired in your account.

- Visit the My documents section and select a form to print or download again.

- Complete and obtain, and print the Georgia Sample Letter for Exemption - Relevant Information using US Legal Forms.

- There are countless professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

A tax exempt determination letter typically includes your organization's name, address, and the specific tax code under which the exemption is granted. This letter serves as official confirmation from the IRS that your organization qualifies for tax-exempt status. It is important to keep this letter on file as it can be essential for claiming your exemption. For examples and templates, explore our Georgia Sample Letter for Exemption - Relevant Information to see how such letters are structured.

When crafting your exemption letter, it is essential to include specific details to support your request. Start with your contact information, followed by a clear statement of your intention to seek an exemption. Additionally, provide a thorough explanation of your circumstances and any relevant documentation that validates your claim. For further guidance, you can refer to our Georgia Sample Letter for Exemption - Relevant Information to ensure your letter meets all necessary criteria.

Filling out a certificate of exemption requires accurate information about your organization, including its legal name and tax identification number. Make sure to indicate the specific type of exemption you are applying for, as this can vary by category. For step-by-step guidance on completing this form, resources like uslegalforms can provide helpful templates and examples, including a Georgia Sample Letter for Exemption - Relevant Information.

When writing a request letter for tax exemption, clearly state your purpose and include relevant details about your organization, such as its mission and activities. It's important to reference any applicable laws or regulations supporting your request. For examples and templates, consider visiting uslegalforms to find a Georgia Sample Letter for Exemption - Relevant Information that suits your needs.

To obtain a clearance letter from Georgia, you need to submit a request to the Georgia Department of Revenue. This request often requires you to provide specific information about your tax status and any outstanding obligations. Utilizing the resources available at uslegalforms can guide you through this process, ensuring you have the proper documentation for your Georgia Sample Letter for Exemption - Relevant Information.

exempt determination letter typically includes the organization's name, the IRS's approval of its taxexempt status, and the specific tax code section under which the exemption is granted. This letter serves as official documentation that the organization is recognized as taxexempt. For those seeking a Georgia Sample Letter for Exemption Relevant Information, understanding this format can be helpful when preparing your own letters.

How can you get a resale certificate in Georgia? To get a resale certificate in Georgia, you will need to fill out the Georgia Certificate of Exemption (ST-5). If you are not required to be registered in Georgia, you should fill out the Multistate Tax Commission's Uniform Sales and Use Tax Certificate.

Churches, religious, charitable, civic and other nonprofit organizations are required to pay Georgia sales tax on all purchases of tangible personal property.

Georgia Sales Tax Holidays Yes, there are two sales tax holidays in Georgia each year. Back-to-School Sales Tax Holiday: This holiday is held in July and allows shoppers to purchase certain school supplies, clothing, and computers tax-free. The holiday runs from Friday, July 29, 2023 to Sunday, July 31, 2023.

Services in Georgia are generally not taxable. Tangible products are taxable in Georgia, with a few exceptions. These exceptions include certain groceries, prescription medicine and medical devices, and machinery and chemicals used in research and development.