Georgia Sample Letter for Exemption of Ad Valorem Taxes

Description

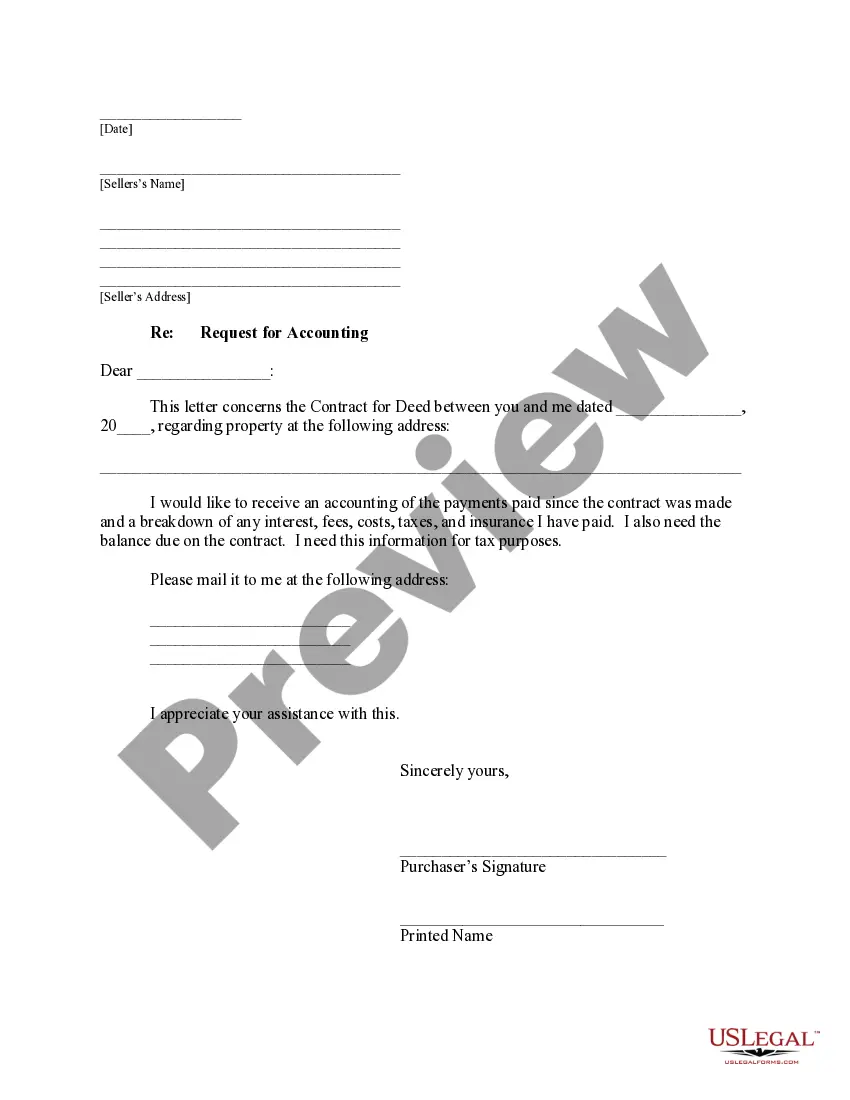

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

If you want to comprehensive, acquire, or print out legitimate file templates, use US Legal Forms, the largest assortment of legitimate types, which can be found on-line. Utilize the site`s easy and hassle-free search to find the documents you will need. Numerous templates for organization and personal functions are categorized by classes and suggests, or keywords. Use US Legal Forms to find the Georgia Sample Letter for Exemption of Ad Valorem Taxes with a couple of mouse clicks.

When you are presently a US Legal Forms client, log in in your bank account and click the Download switch to obtain the Georgia Sample Letter for Exemption of Ad Valorem Taxes. You can even accessibility types you earlier saved inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for your appropriate area/region.

- Step 2. Make use of the Preview choice to look over the form`s content. Never neglect to read the outline.

- Step 3. When you are not happy with the develop, make use of the Research discipline near the top of the screen to discover other variations from the legitimate develop web template.

- Step 4. When you have identified the form you will need, click the Buy now switch. Select the prices prepare you choose and include your credentials to sign up for the bank account.

- Step 5. Procedure the transaction. You can use your charge card or PayPal bank account to perform the transaction.

- Step 6. Choose the structure from the legitimate develop and acquire it on the gadget.

- Step 7. Full, edit and print out or indication the Georgia Sample Letter for Exemption of Ad Valorem Taxes.

Each and every legitimate file web template you buy is the one you have forever. You have acces to every develop you saved inside your acccount. Select the My Forms segment and select a develop to print out or acquire once again.

Be competitive and acquire, and print out the Georgia Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms. There are thousands of professional and express-distinct types you can utilize for your organization or personal needs.

Form popularity

FAQ

Buyers must pay this Title Fee on all vehicle sales, including private sales, and the Title Fee applies to all vehicles registered in Georgia, regardless of where you purchased the vehicle. The Title Fee is paid to the county where the buyer registers the motor vehicle.

If you do not register your vehicle within 30 days, penalties and fines are assessed. If you are a new Georgia resident, you are required to pay a one-time title ad valorem tax (title tax) of 3%. The full amount is due upon titling any motor vehicle.

Any vehicle purchased from a dealer or individual on or after March 1, 2013, is subject to a one-time title tax based on the value of the vehicle. The title tax replaces the annual ad valorem tax and the sales and use tax on most vehicles titled in Georgia.

Explanation of Property Taxes The basis for ad valorem taxation is the fair market value of the property, which is established January 1 of each year. The tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value.

The new Title Ad Valorem Tax (TAVT) does not appear to be deductible for Federal or Georgia purposes. In order to be deductible as a personal property tax, it must be imposed on an annual basis.

Motor vehicles purchased on or after 1 March 2013 are exempt from property taxes. The annual tax is replaced with a one-time state and local Title Ad Valorem Tax paid when the ownership of the vehicle is transferred. These revenues are shared with the state, county, school district and cities.

To be eligible for a homestead exemption: You must have owned the property as of January 1. The home must be considered your legal residence for all purposes. You must occupy the home. You cannot already claim a homestead exemption for another property in Georgia or in any other state.

A Georgia business can purchase tangible personal property for resale without paying sales tax by providing the supplier with a properly completed Form ST-5 Certificate of Exemption. Are casual sales subject to sales tax? A sale that meets the definition of ?casual sale? is not subject to sales tax.