Georgia Limited Warranty Deed

Definition and meaning

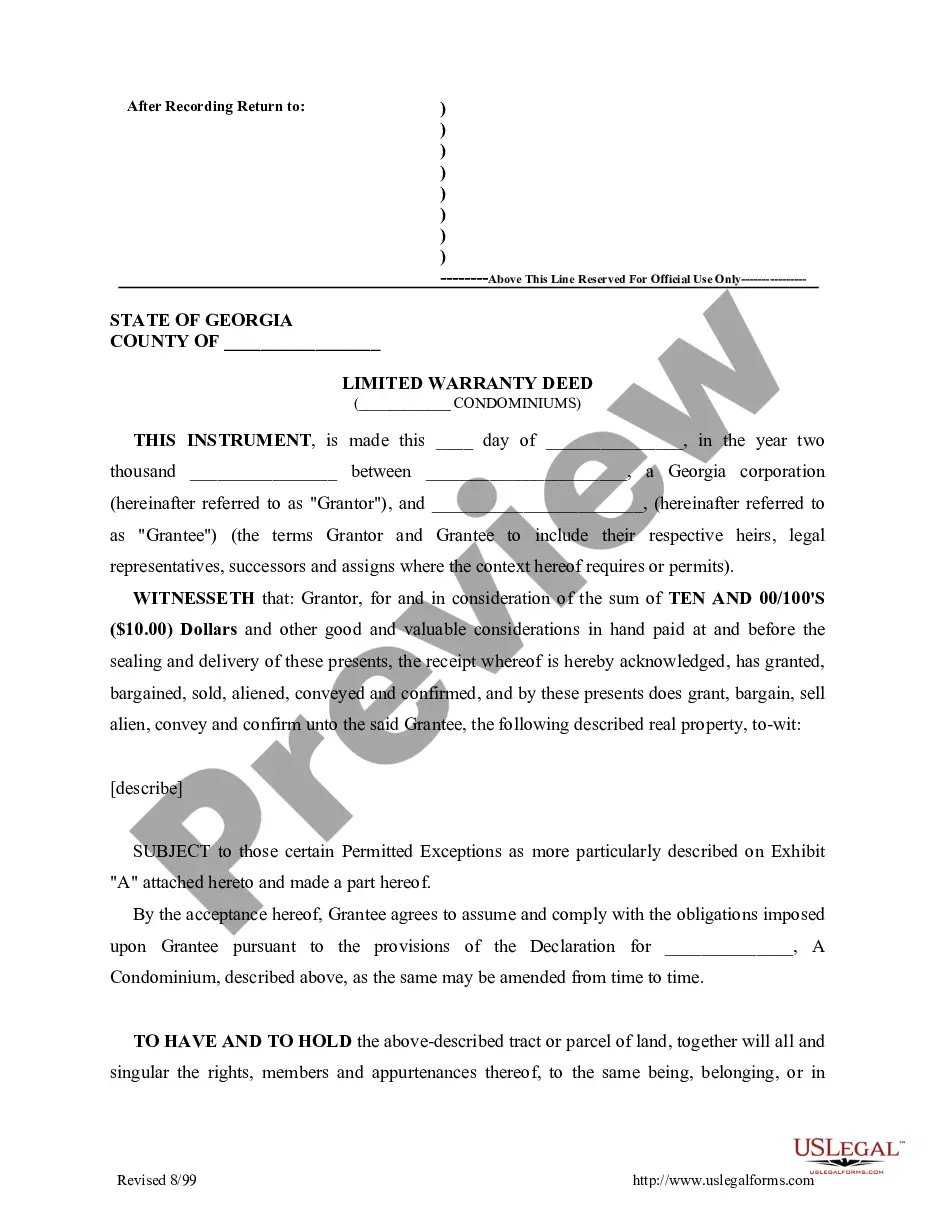

A Georgia Limited Warranty Deed is a legal document used to transfer ownership of real estate properties in Georgia. This deed offers a limited guarantee from the seller, referred to as the Grantor, ensuring that they hold clear title to the property being conveyed. Unlike an absolute warranty deed, this type does not guarantee against defects in title that may have existed before the Grantor acquired the property.

How to complete a form

Completing a Georgia Limited Warranty Deed involves several essential steps. First, accurately fill in the date of the deed at the top of the form. Next, provide the names of both the Grantor and Grantee, ensuring that all details match official documentation. Then, describe the property being transferred, specifying any important information such as boundaries and parcel numbers. It is also necessary to list any permitted exceptions or conditions applicable to the property.

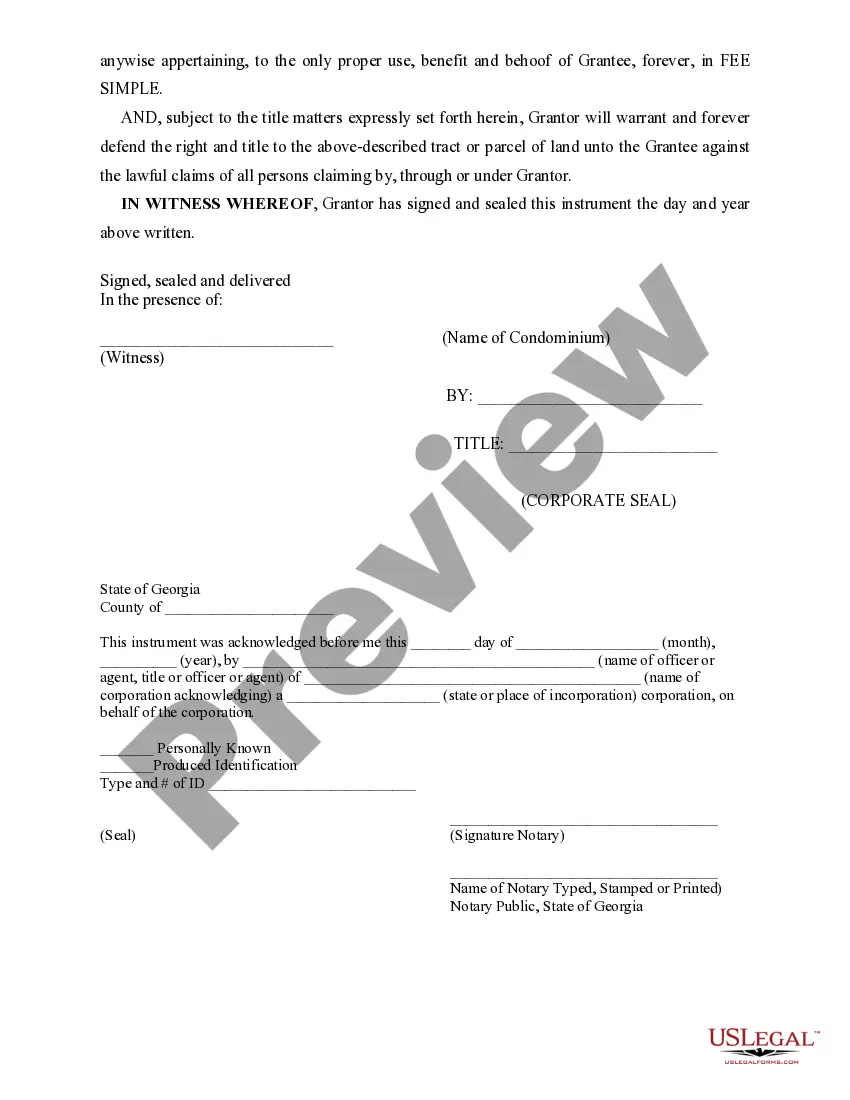

Lastly, both parties should sign the document in the presence of a notary public, who will verify and provide an official seal to validate the deed.

Who should use this form

Individuals or entities transferring ownership of real property in Georgia can utilize a Georgia Limited Warranty Deed. This is particularly useful for situations where the Grantor wishes to sell or gift property without providing a full warranty on the title. It is commonly used in transactions between family members, when the property has no known title issues, or in cases of foreclosure sales.

Key components of the form

A Georgia Limited Warranty Deed contains several vital components that must be addressed:

- Grantor and Grantee Information: Names and addresses of the individuals or corporations involved.

- Property Description: A clear legal description identifying the property being transferred.

- Consideration: The amount of money or value exchanged for the property.

- Exceptions and Conditions: Any limitations or specific conditions related to the property.

- Signature and Notary Section: Signatures of the Grantor and witnesses, along with acknowledgment from a notary public.

State-specific requirements

In Georgia, to ensure the validity of a Limited Warranty Deed, specific state laws and regulations must be followed:

- The deed must be in writing and properly executed.

- It must include a legal description of the property.

- Ensure all parties involved sign the document before a notary public.

- File the completed deed with the appropriate county clerk's office where the property is located.

Form popularity

FAQ

Using a Georgia Limited Warranty Deed offers clear benefits in real estate transactions. It strikes a balance between protecting the buyer’s interests and allowing sellers to limit their liability for past ownership issues. This deed is ideal for situations where sellers may not have comprehensive knowledge of the property’s history. Additionally, platforms like US Legal Forms simplify the process of preparing and filing the necessary documents.

One of the disadvantages of a Georgia Limited Warranty Deed is its limited scope of protection. While it covers claims during the seller's ownership, it does not protect the buyer from issues that existed prior to that period. This limitation may leave the buyer vulnerable to unforeseen challenges. Understanding this aspect is crucial when deciding which deed best suits your needs.

The distinction between a Georgia Limited Warranty Deed and a quit claim deed lies in the level of protection offered. A quit claim deed transfers ownership without offering any guarantees about the property title’s quality. In contrast, a limited warranty deed provides some assurance against claims arising during the seller's ownership, thus offering more protection to the buyer. This makes a limited warranty deed a more secure option for real estate transactions.

To acquire your home’s Georgia Limited Warranty Deed, start by checking your local county clerk's office. You can also use online platforms like US Legal Forms, which offer easy access to legal documents. By navigating their platform, you can find the necessary forms and guidelines to secure your home warranty deed effortlessly.

Finding your Georgia Limited Warranty Deed online is often straightforward. Simply go to your county's property records website, input your details, and search. Many counties provide searchable databases where you can locate and view your warranty deed conveniently.

If you lose your Georgia Limited Warranty Deed, don’t worry; you can obtain a replacement. Start by contacting the county clerk's office where the deed was initially filed. They can assist you in retrieving a new copy, ensuring that you maintain proper documentation for your property.

Yes, many counties in Georgia offer online access to property records, including your Georgia Limited Warranty Deed. You can visit your county's website and look for the property records section. By entering details such as your name or property address, you can easily find and download your warranty deed.

In Georgia, the difference between a warranty deed and a limited warranty deed centers on the extent of seller liability. A warranty deed provides comprehensive protection for the buyer, guaranteeing freedom from past claims. Conversely, a limited warranty deed limits seller liability to issues arising during their ownership only. Understanding these differences is important for both buyers and sellers when navigating real estate transactions.

To execute a warranty deed in Georgia, you need to start by obtaining the correct form and gathering the necessary information about the property and parties involved. Complete the warranty deed form with these details, ensuring everything is accurate and clear. Once filled out, have the document signed by both parties in the presence of a notary public. Finally, file the deed with the county clerk's office to record the transfer of ownership officially.

The primary difference lies in the level of protection offered. A warranty deed provides full protection, assuring the buyer against all past and future claims on the property. In contrast, a Georgia Limited Warranty Deed only covers issues that arose during the seller's ownership. This means that sellers have less liability, while buyers assume more risk regarding the property's title.