Iowa Last Will and Testament for Married person with Adult Children from Prior Marriage

Understanding this form

This Last Will and Testament is designed for a married person with adult children from a prior marriage. It details how your assets will be distributed after your death, names an executor to administer your estate, and includes specific provisions for your adult children. Unlike a standard will, this form accounts for blended family dynamics, ensuring that your wishes regarding your spouse and children from previous relationships are clearly expressed.

What’s included in this form

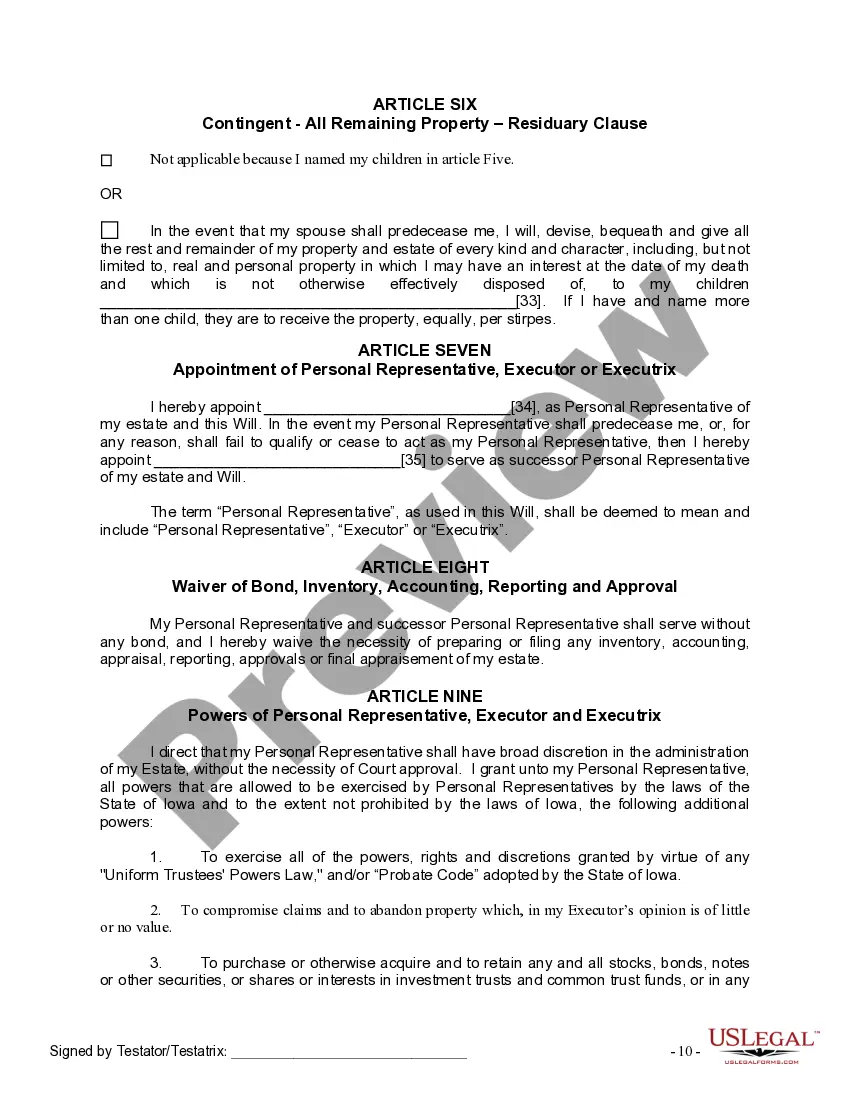

- Appointment of a personal representative to handle your estate.

- Designation of beneficiaries, including provisions for your adult children.

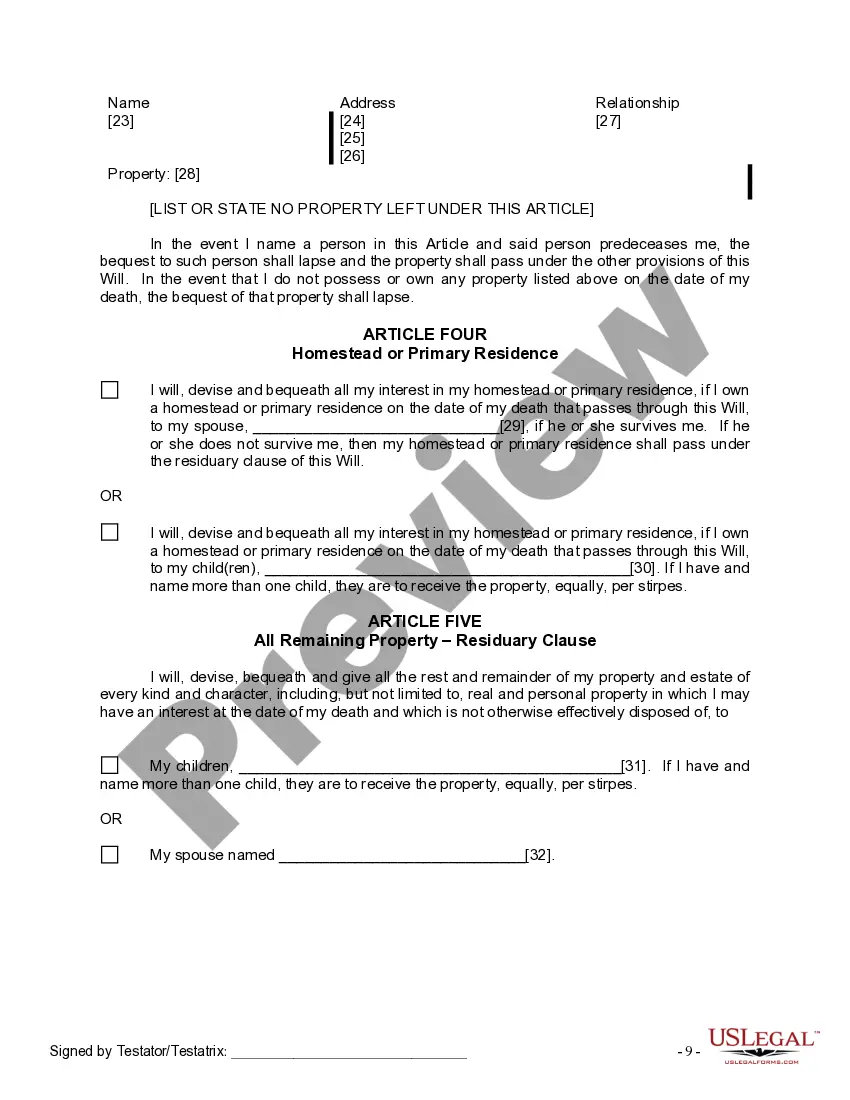

- Instructions for specific bequests and the distribution of property.

- Homestead designation to specify your primary residence.

- Residuary clause to manage any remaining assets not specifically mentioned elsewhere in the will.

- Signature and witness requirements for legal validity.

Legal requirements by state

This form is applicable in any U.S. state with minor state-specific adjustments needed based on local laws regarding wills and estates. Ensure you are familiar with your state's requirements for signing and witnessing a will, as these can vary.

When to use this form

This form should be used when you are a married individual with adult children from a prior relationship and want to create a legally binding will that recognizes the complexities of your family situation. It is particularly important if you want to ensure your children from a prior marriage are included in your estate planning and clearly state how your assets are to be divided among your spouse and children.

Who should use this form

- Married persons with adult children from a prior marriage.

- Individuals seeking to clarify their estate distribution intentions.

- Anyone wanting to appoint a personal representative to manage their estate.

Steps to complete this form

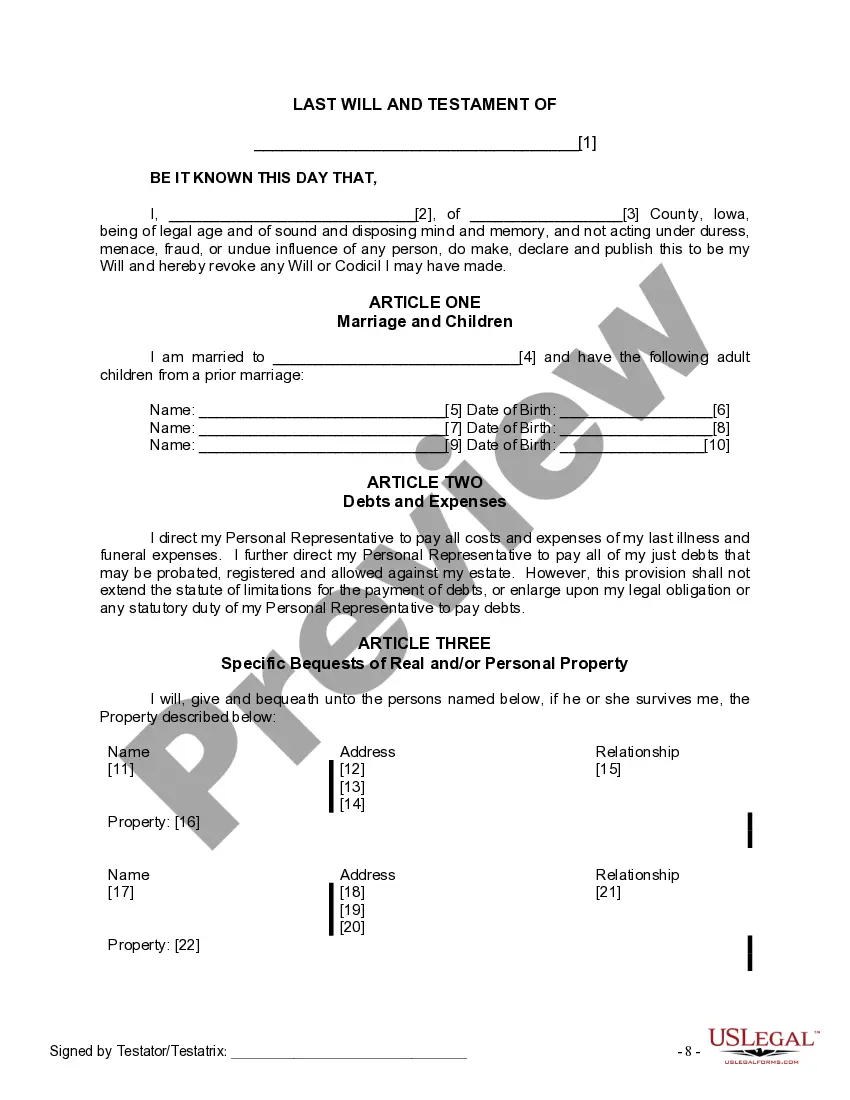

- Enter your full name and county of residence.

- Specify your spouse's name and list all your adult children along with their birth dates.

- Detail any specific property you wish to bequeath to individuals or designate the distribution of your homestead.

- Name your personal representative and, if desired, a successor representative.

- Sign the document in the presence of two witnesses who are not related to you.

- If applicable, complete the self-proving affidavit to facilitate probate.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Forgetting to sign the will in front of the required witnesses.

- Not including important details about specific bequests.

- Failing to update the will after major life events, such as marriage or the birth of children.

- Neglecting to keep the executed will in a safe location.

Benefits of completing this form online

- Easy to fill out on your computer, reducing the chance of errors.

- Access to legally vetted templates drafted by attorneys.

- Convenient storage options for your completed will.

- Ability to make edits as your circumstances change.

Form popularity

FAQ

In Iowa, a will does not entirely override the rights of a spouse. However, a legally executed will can specify how your assets should be distributed, even if you have a spouse. It's essential to understand Iowa law surrounding spousal rights, especially when dealing with adult children from a prior marriage. Consulting with a legal expert can help clarify these complexities.

1Create the initial document. Start by titling the document Last Will and Testament" and including your full legal name and address.2Designate an executor.3Appoint a guardian.4Name the beneficiaries.5Designate the assets.6Ask witnesses to sign your will.7Store your will in a safe place.

Include personal identifying information. Include a statement about your age and mental status. Designate an executor. Decide who will take care of your children. Choose your beneficiaries. List your funeral details. Sign and date your Last Will and Testament.

1Include personal identifying information.2Include a statement about your age and mental status.3Designate an executor.4Decide who will take care of your children.5Choose your beneficiaries.6List your funeral details.7Sign and date your Last Will and Testament.

A simple will is made up of a basic set of components.Names an executor, or person who will be responsible for distributing the assets to the beneficiaries. Contains the signature of the testator. Contains witness signatures.

You can make your own will in California, using Nolo's do-it-yourself online will or will software. You may, however, want to consult a lawyer in some situations; for example, if you suspect your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

You don't have to have a lawyer to create a basic will you can prepare one yourself. It must meet your state's legal requirements and should be notarized.But be careful: For anything complex or unusual, like distributing a lot of money or cutting someone out, you'd do best to hire a lawyer.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Create the initial document. Start by titling the document Last Will and Testament" and including your full legal name and address. Designate an executor. Appoint a guardian. Name the beneficiaries. Designate the assets. Ask witnesses to sign your will. Store your will in a safe place.

Decide if you want to get help or use a do-it-yourself software program. Select your beneficiaries. Choose the executor for your will. Pick a guardian for your kids. Be specific about who gets what. Be realistic about who gets what. If there's more you want to say, attach a letter to the will.