Sample Checklist for Contract Term Sheet

What this document covers

The Sample Checklist for Contract Term Sheet is a structured document designed to summarize the key terms and conditions of a business agreement. It provides a clear overview of the essential elements needed for drafting a contract, distinguishing itself from other legal forms by focusing on preliminary discussion points rather than binding commitments. This term sheet serves as a practical guide for legal counsel and parties involved in negotiations, helping them organize their thoughts and expectations prior to creating a finalized contract.

Key parts of this document

- Other party information, including contact details and type of business.

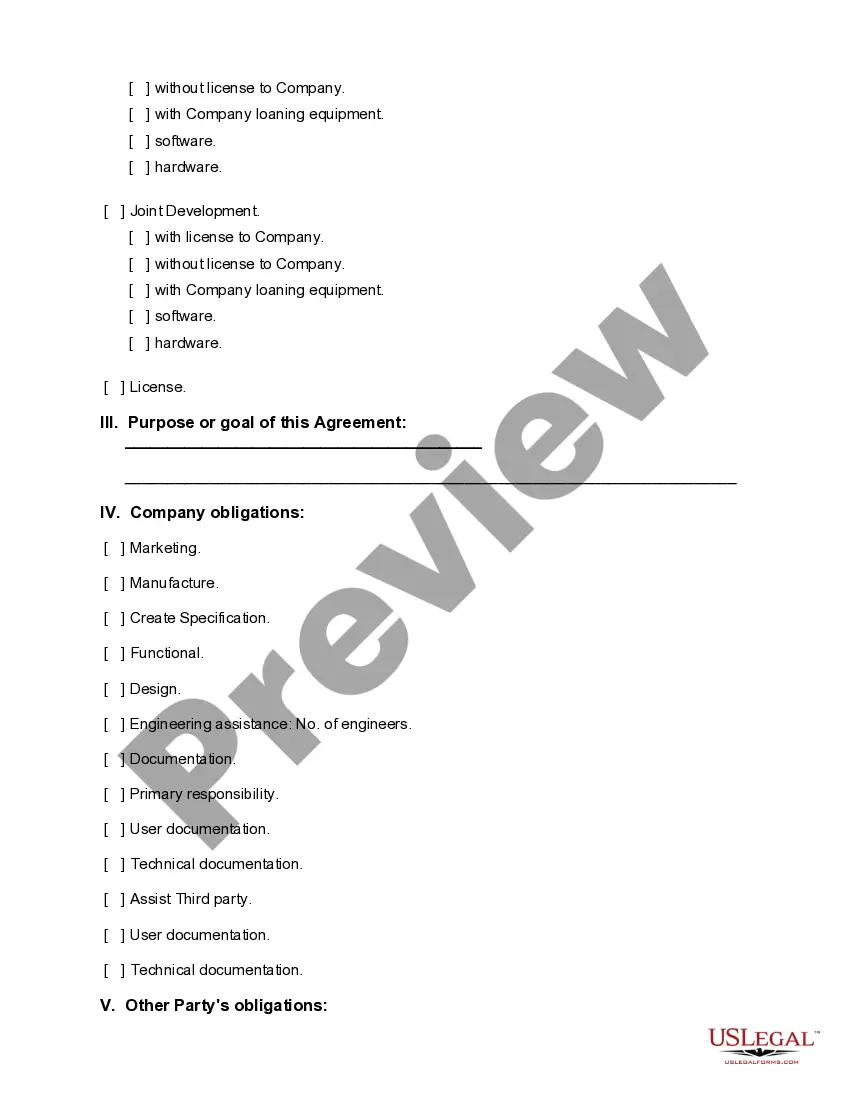

- Type of agreement, covering various business arrangements.

- Purpose or goal of the agreement to clarify the intent.

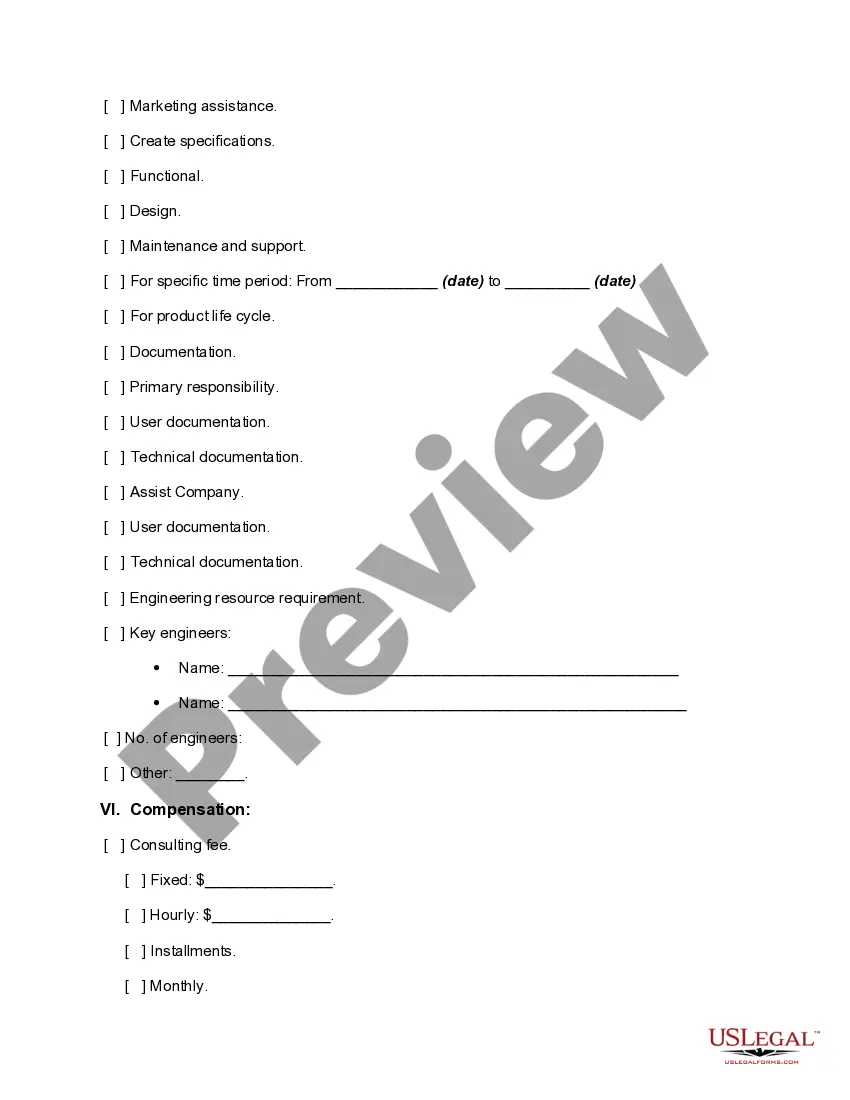

- Company and other party obligations, outlining responsibilities.

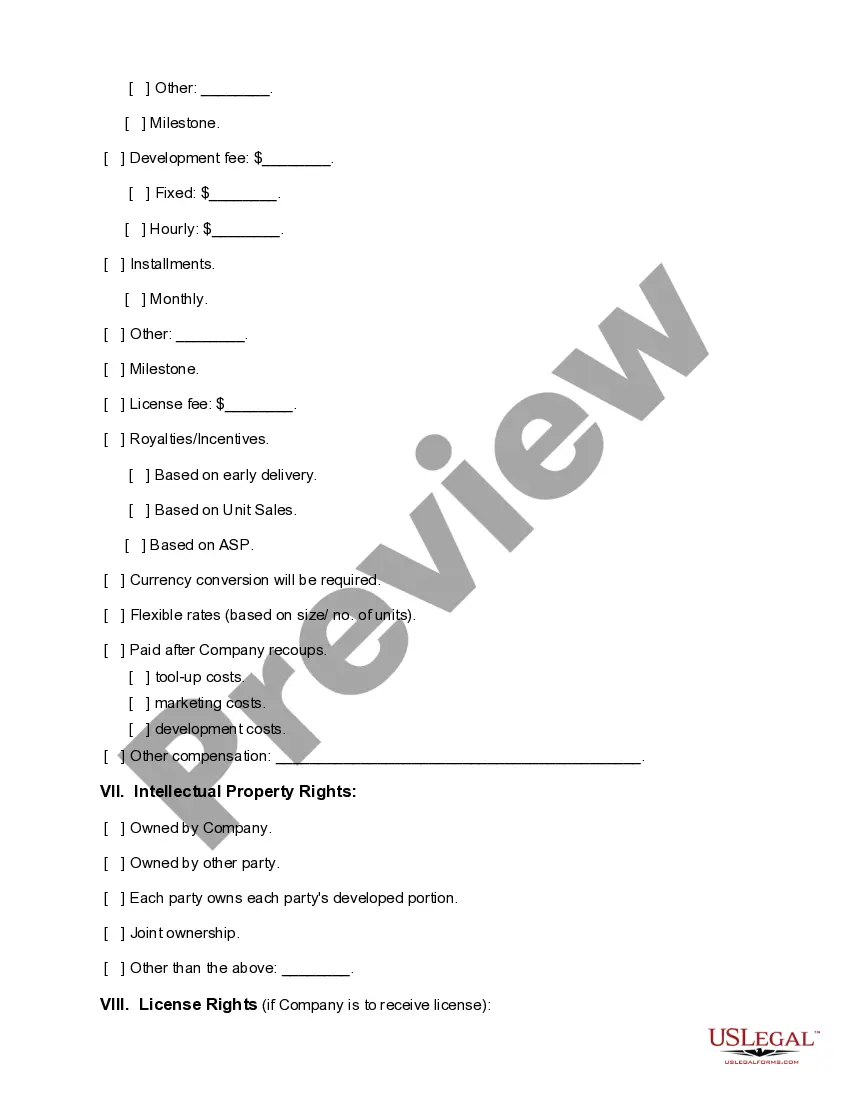

- Compensation details, including fees and payment structures.

- Intellectual property rights, clarifying ownership of content developed.

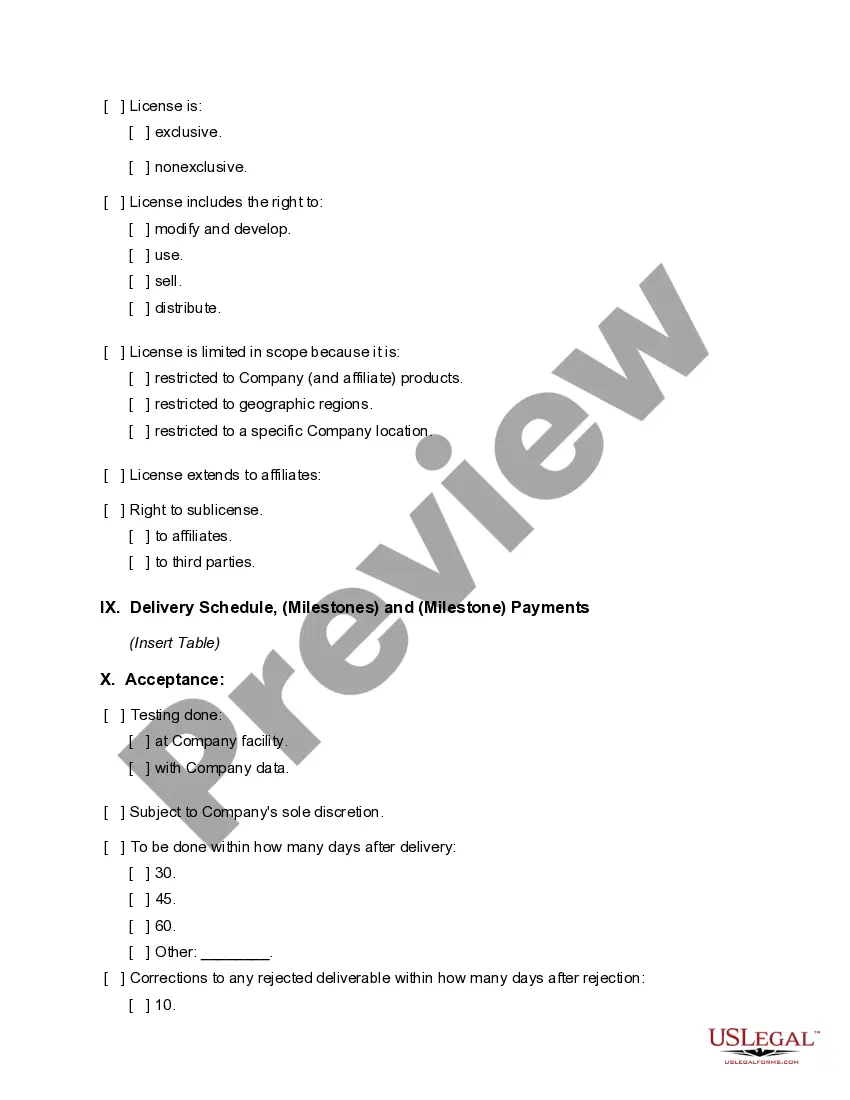

- License rights, specifying the scope of any agreements regarding licensing.

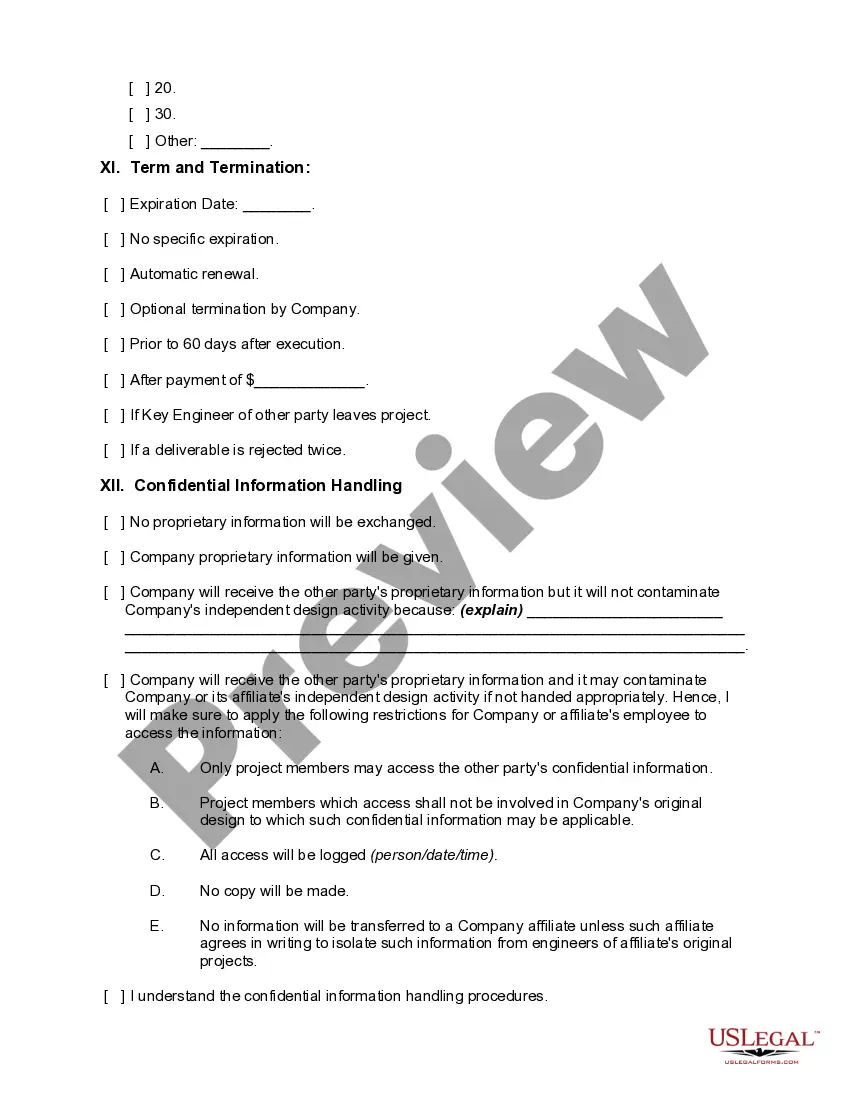

- Confidential information handling procedures to protect sensitive data.

When this form is needed

This form is useful in several business scenarios, such as when entering negotiations for consulting services, development projects, or joint ventures. It helps both parties organize critical information and align on essential terms before creating a full contractual agreement. Whether you are a company drafting a contract or a consultant seeking to establish terms, using this checklist can streamline the negotiation process and ensure that no key points are overlooked.

Intended users of this form

The Sample Checklist for Contract Term Sheet is ideal for:

- Business owners looking to draft clear agreements with partners or clients.

- Consultants wanting to establish terms for service delivery.

- Legal professionals assisting clients in negotiations for contracts.

- Project managers coordinating with external parties on joint ventures.

How to complete this form

- Identify and enter information about the other party, including contact details.

- Select the type of agreement to be made and outline its primary purpose.

- Clearly state the obligations for each party involved in the agreement.

- Detail the compensation structure, including any fees or milestones.

- Address intellectual property rights and license agreements if applicable.

- Include terms for confidentiality and identify who will handle proprietary information.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly define the obligations of each party.

- Not specifying the compensation terms, which can lead to disputes later.

- Overlooking the importance of intellectual property rights in collaborative agreements.

- Neglecting to include confidentiality terms, exposing sensitive information.

Advantages of online completion

- Convenience of downloading and editing the form as needed.

- Access to templates drafted by licensed attorneys, ensuring legal reliability.

- Streamlined organization of information, which aids in negotiation preparation.

- Environmentally friendly: digital forms reduce paper waste.

Summary of main points

- The Sample Checklist for Contract Term Sheet is a crucial tool for organizing business agreements.

- It helps clarify roles and responsibilities, reducing the potential for misunderstandings.

- Use this form when drafting various types of business contracts to ensure completeness.

- Being thorough in completing the checklist can prevent common legal pitfalls.

Looking for another form?

Form popularity

FAQ

How much money is expected from the VC, or venture capitalist, to the founder of the startup, A detailed overview of the financial side of the investment, and. The power and controls given to the VCs.

What is a term sheet? A term sheet is a mostly non-binding document signed by the target and the prospective buyer that describes the major terms of the proposed acquisition. While most term sheets are non-binding, they often contain binding provisions regarding non-soliciation, exculsivity and confidentiality.

Although term sheets are not generally legally binding, other than in respect of confidentiality, exclusivity (if applicable), costs and jurisdiction, they evidence the intent of the parties to them. Therefore, once something is agreed in a term sheet, it may be difficult for either side to renegotiate.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment.Once the parties involved reach an agreement on the details laid out in the term sheet, a binding agreement or contract that conforms to the term sheet details is drawn up.

The approach to the final and binding agreement includes negotiating and signing the terms sheet, conducting due diligence, having legal counsel draft the final documents, and having a closing where all parties sign.

A term sheet usually has some provisions that are called out as being binding even though the rest of the term sheet is typically not binding. These binding provisions give the non-breaching party a right to sue for breach of those "binding" provisions.

Take the Time to Woo Multiple Investors. Do Your Due Diligence When Finding Investors. Negotiate A Term Sheet Better by Understanding the Terminology. Hire a Good Lawyer to Assist You. Prioritize the Non-Negotiables of Your Term Sheet. Be Prepared to Negotiate with Your Investor. Watch for Red Flags.

Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.