Florida Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

Are you in a position where you require documents for either a business or specific tasks almost on a daily basis.

There are numerous authentic document templates accessible online, but locating forms you can trust is not easy.

US Legal Forms offers a vast selection of form templates, including the Florida Department Time Report for Payroll, crafted to satisfy federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you need, complete the required information to create your account, and submit the payment using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Florida Department Time Report for Payroll at any time if needed. Simply click on the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Department Time Report for Payroll template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

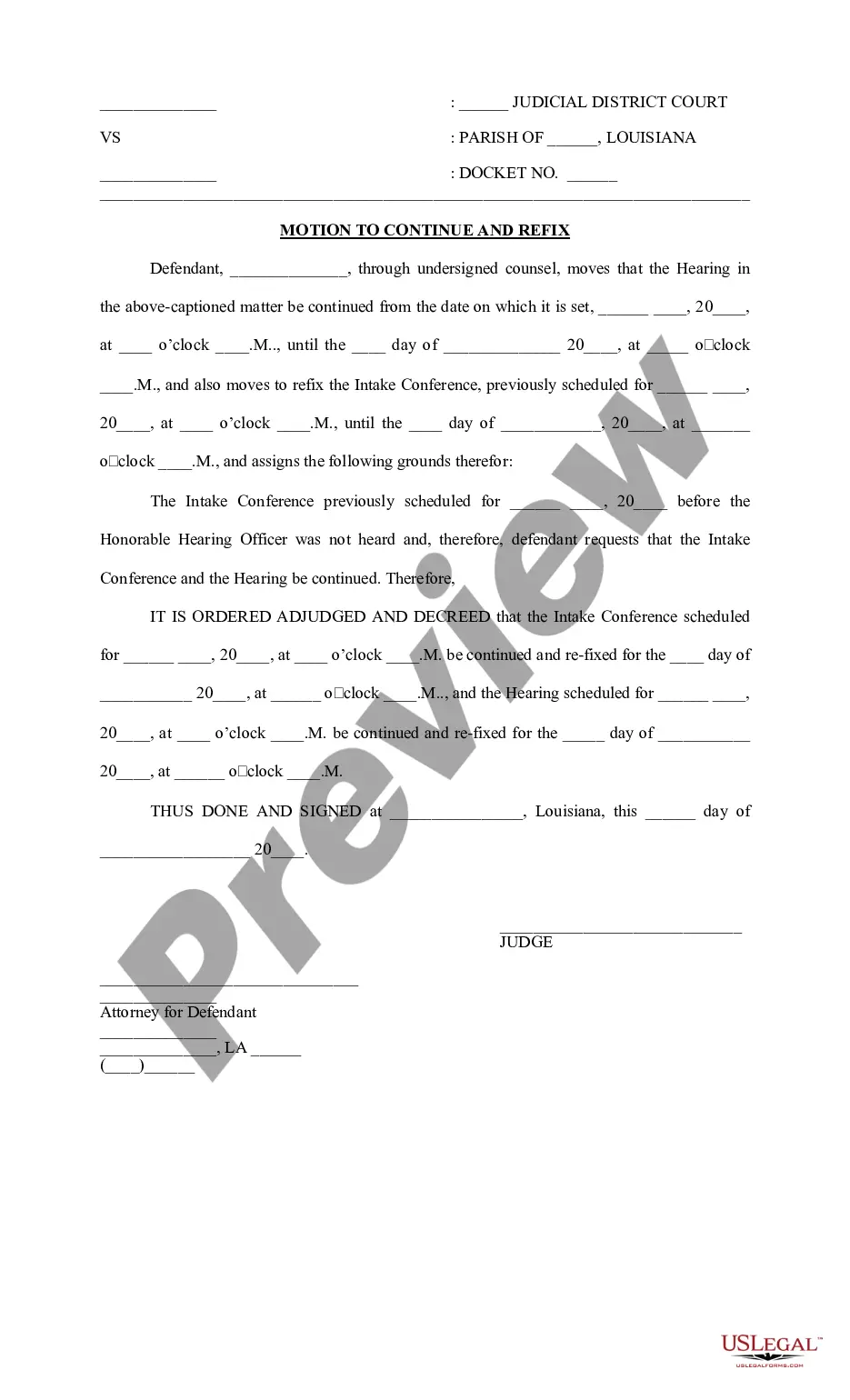

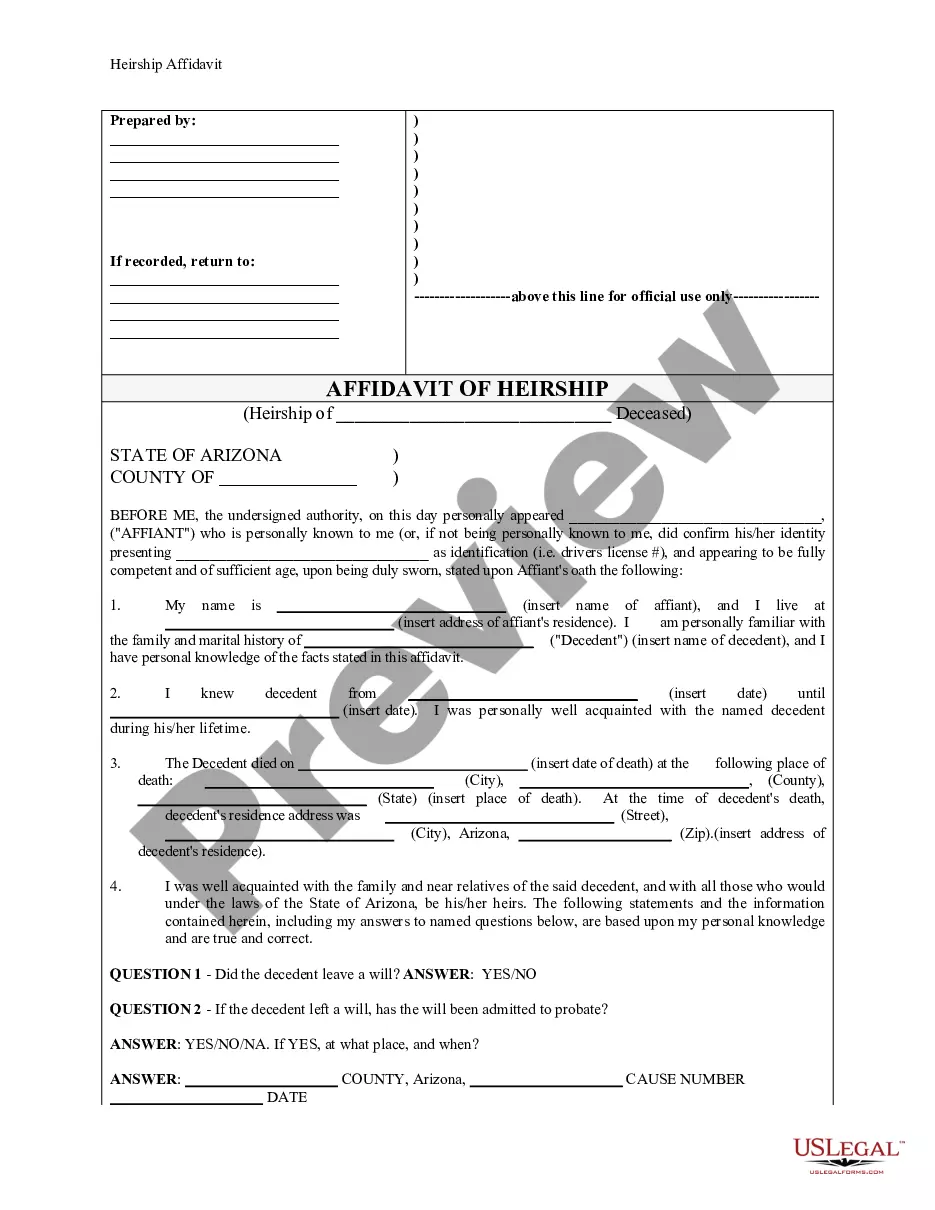

- Use the Preview button to review the form.

- Check the details to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

To register online, go to our website at floridarevenue.com and select Register to collect and/or pay taxes. Filing Reports Every employer who is liable for filing quarterly under the Florida reemployment assistance program law, must complete and file the Employer's Quarterly Report (RT-6).

What payroll reports do employers need to file?Wages paid to employees.Federal income tax withheld from employee wages.Medicare and Social Security taxes deducted from employee wages.Employer contributions to Medicare and Social Security taxes.

The Florida Department of Revenue will issue you a Reemployment account number and tax rate. The number will be 7 digits, and you can find it on your Florida Quarterly Tax Return (form RT-6). You can find your current tax rate on your most recent Reemployment Tax Rate Notice (Form RT-20).

Form RT-6, Employer's Quarterly Report, is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

Four Steps In Setting Up Your Small Business Payroll SuccessUnderstanding the responsibilities of your managing your payroll.Choosing the right payroll system for your particular company.Ensuring that your employees are paid correctly.Paying payroll taxes and filing tax forms.

A payroll report is a document that includes specific financial and tax information, including pay rates, hours worked, federal and state income taxes withheld, vacation or sick days used, overtime incurred, tax withholdings, and benefit costs.

The UCT-6 FormPayroll taxes paid by employers to fund programs like reemployment assistance, Social Security and Medicare.

Use IRS Form W-2, Wage and Tax Statement, to report information about employees' annual wages. Do not use Form W-2 to report independent contractor compensation. File Form W-2 for each employee that you had during the calendar year (including the employees who no longer work for you).

A payroll report is a document that employers use to verify their tax liabilities or cross-check financial data. It may include such information as pay rates, hours worked, overtime accrued, taxes withheld from wages, employer tax contributions, vacation balances and more.