Wisconsin Conveyance of Deed to Lender in Lieu of Foreclosure

Description

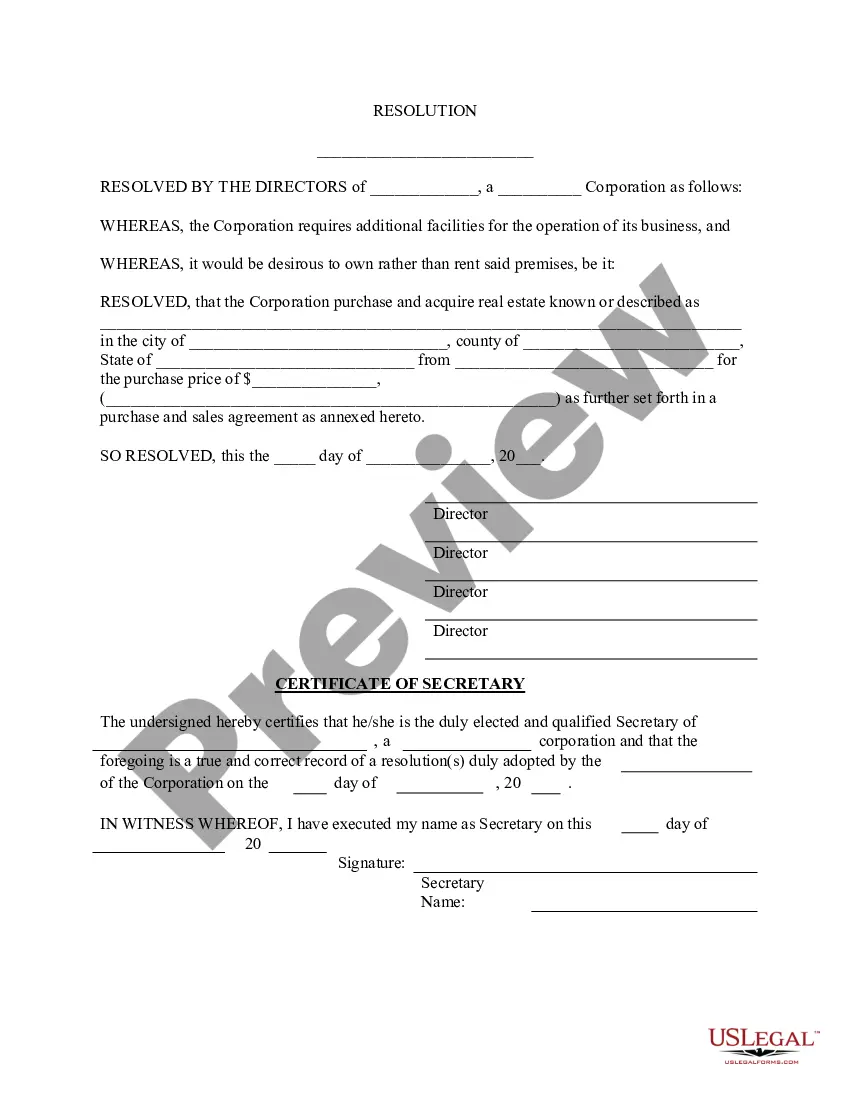

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Choosing the right lawful papers format might be a have difficulties. Of course, there are tons of templates available on the net, but how would you find the lawful form you will need? Utilize the US Legal Forms site. The assistance provides 1000s of templates, including the Wisconsin Conveyance of Deed to Lender in Lieu of Foreclosure, that you can use for company and personal needs. Each of the varieties are inspected by experts and meet federal and state requirements.

Should you be currently signed up, log in in your profile and click on the Obtain switch to find the Wisconsin Conveyance of Deed to Lender in Lieu of Foreclosure. Use your profile to search with the lawful varieties you have ordered earlier. Proceed to the My Forms tab of the profile and obtain one more version from the papers you will need.

Should you be a whole new customer of US Legal Forms, allow me to share simple instructions that you should follow:

- Initially, make certain you have selected the appropriate form to your town/region. You may examine the form using the Preview switch and browse the form explanation to ensure this is the right one for you.

- In case the form is not going to meet your requirements, use the Seach industry to discover the appropriate form.

- When you are sure that the form is proper, click the Buy now switch to find the form.

- Choose the costs plan you need and type in the necessary information and facts. Make your profile and buy your order using your PayPal profile or credit card.

- Choose the submit format and obtain the lawful papers format in your system.

- Full, edit and print and signal the attained Wisconsin Conveyance of Deed to Lender in Lieu of Foreclosure.

US Legal Forms will be the largest collection of lawful varieties that you can discover different papers templates. Utilize the service to obtain skillfully-made files that follow condition requirements.

Form popularity

FAQ

The purchaser has no responsibility because the purchaser receives the property title without the mortgage and junior liens. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? The lender takes the real estate subject to all junior liens.

This means that mortgages take much more time and money to foreclose on. Therefore, many mortgage lenders will use a deed of trust instead of a mortgage if your state allows it and nonjudicial foreclosures. In this scenario, your lender will almost always spend less time and money reclaiming your property.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

A deed in lieu of foreclosure involves signing a property over to the lender rather than going through a formal foreclosure process. If you can't get a short sale or a loan modification approved, this may be the next best option.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

A deed in lieu of foreclosure still has a negative impact on the borrower's total credit rating. The greatest risk to a lender making a real estate loan is that a property pledged as collateral will be abandoned by the borrower.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.