Florida Cash Register Payout

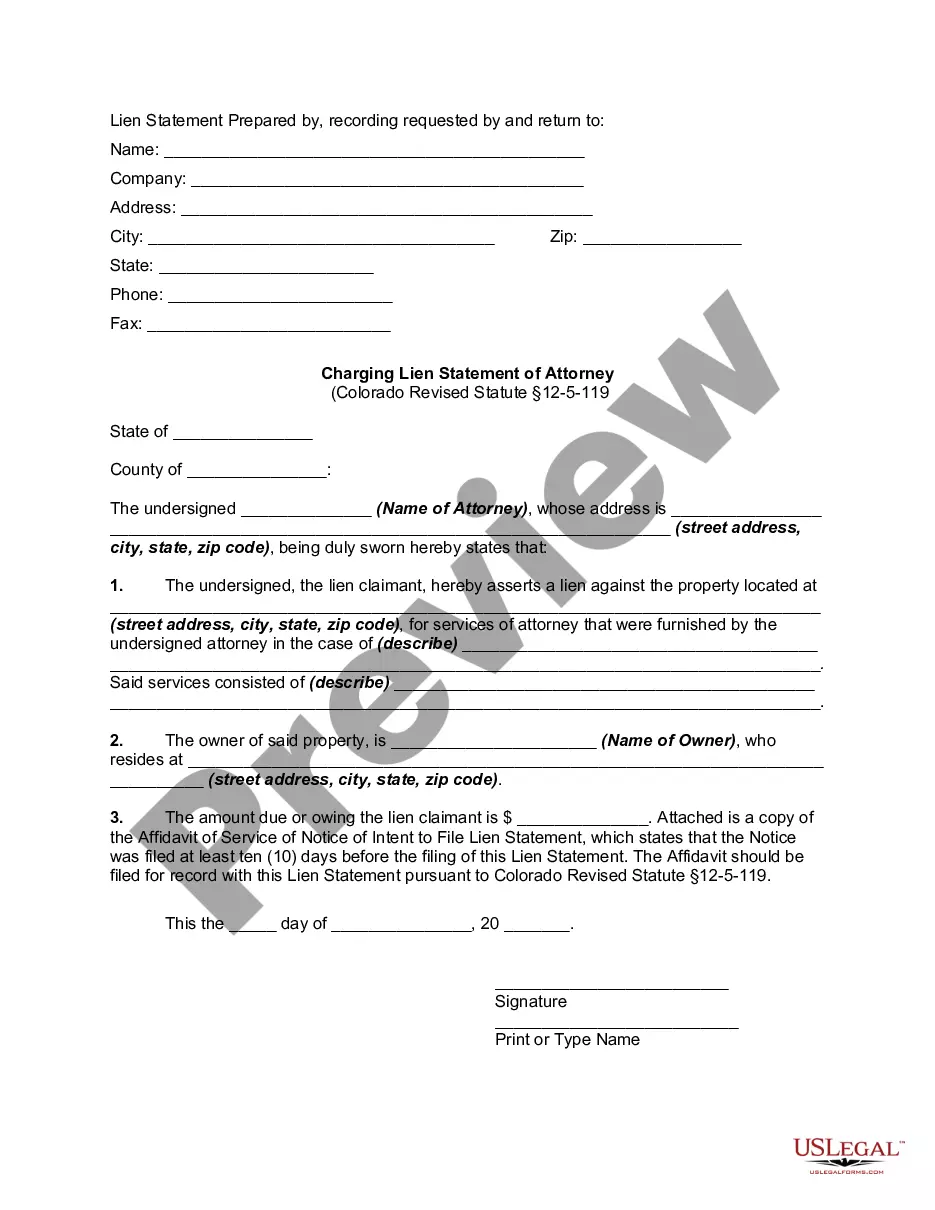

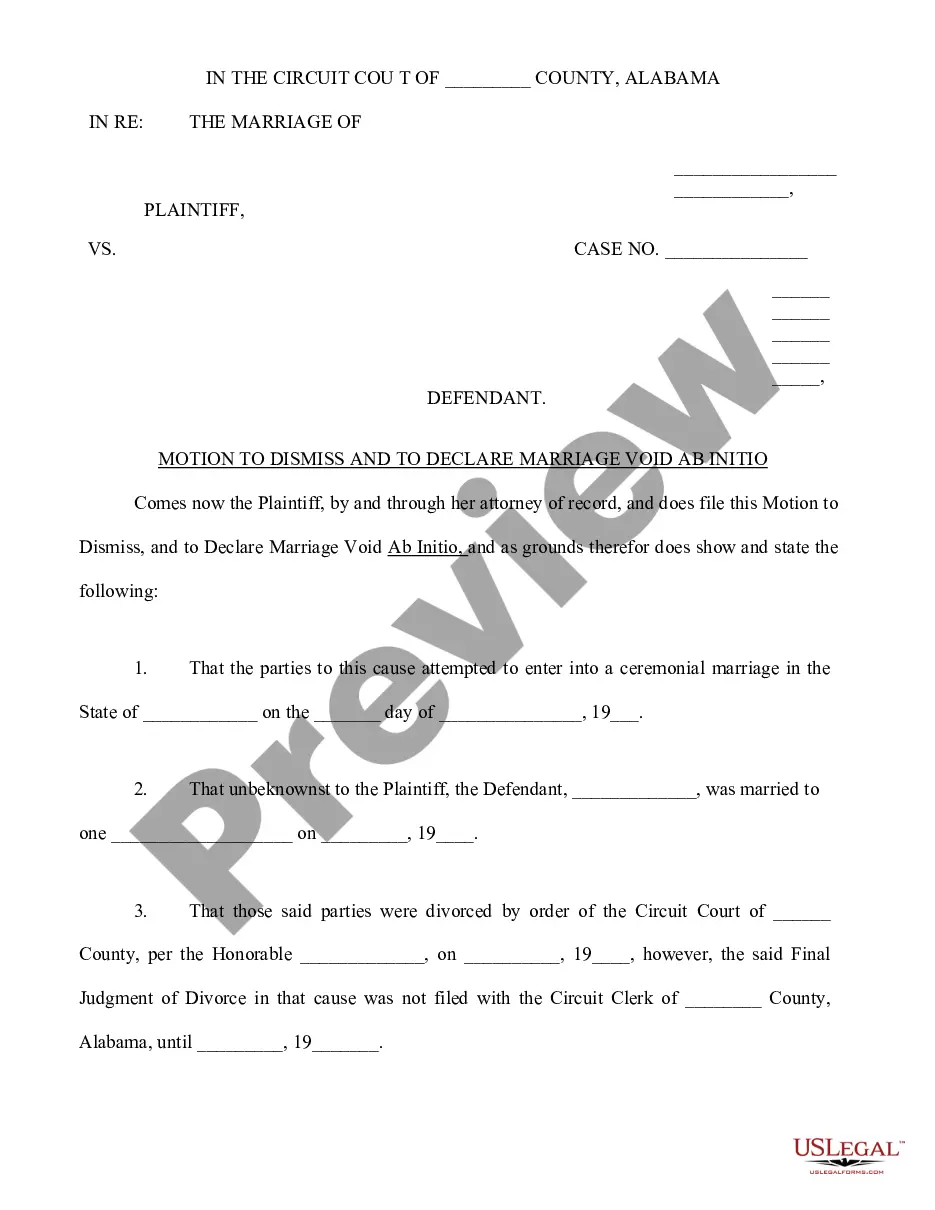

Description

How to fill out Cash Register Payout?

It is feasible to invest time online searching for the valid document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of valid forms that can be assessed by experts.

You can conveniently obtain or print the Florida Cash Register Payout through the service.

If available, utilize the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Florida Cash Register Payout.

- Every valid document template you receive is yours for a long time.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the right document.

Form popularity

FAQ

Florida is one of six states with no state income tax. This will save you millions if you win the big jackpot. But you'll still be responsible for federal taxes, which can be quite hefty. The federal government requires Florida winners to deduct 24 percent from any winnings of more than $5,000.

The Internal Revenue Service requires that the Florida Lottery withhold 24 percent federal withholding tax from prizes greater than $5,000 if the winner is a citizen or resident alien of the U.S. with a Social Security number.

If your six numbers match the six winning numbers drawn in the official FLORIDA LOTTO drawing for the date played, you win the jackpot. Match three, four, or five of the winning numbers to win other cash prizes that are automatically multiplied by the multiplier number printed on the ticket.

CASH POP2122 drawings are held five times a day, seven days a week. a.m. (Morning), a.m. (Matinee), p.m. (Afternoon), p.m. (Evening), and p.m. (Late Night).

Prizes of $600 $999,999 for games that do not offer an annual payment option can be claimed in-person via walk-in or appointment at any Lottery district office.

Cash Pop at RetailYou can pick just 1 or up to 15 numbers or have Quik Pik (QP) randomly select a number for you. Decide on the dollar amount you want to play per number: $1, $2, or $5. Your dollar amount determines the cash prizes you could win. See Odds and Prizes for details.

How much can I win playing CASH POP? Players can win 5X to 250X their chosen play amount with CASH POP 2010 from $5 up to $1,250.

CASH POP is unique in that one number is all it takes to win! Players select a number(s) from 1 to 15, and the dollar amount they wish to play per number$1, $2, or $5. The dollar amount played determines the cash prize players can win. Tickets print with the prize amount directly below the selected number(s).

Federal Withholding Taxes For non-resident aliens, the Florida Lottery is required to withhold 30 percent federal withholding tax from all prize amounts. For information on Lottery prizes and your Federal tax obligations visit: .

What is CASH POP2122? CASH POP2122 is the Florida Lottery's newest Draw game where matching just one number can win cash prizes of up to $1,250! 2.