New Jersey Triple Net Lease for Sale

Description

How to fill out Triple Net Lease For Sale?

Are you in a situation where you need documents for both professional or personal purposes on a daily basis? There are numerous legal document templates available on the web, but locating trustworthy ones can be challenging.

US Legal Forms provides a vast array of form templates, including the New Jersey Triple Net Lease for Sale, which are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the New Jersey Triple Net Lease for Sale template.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents list. You can obtain another copy of the New Jersey Triple Net Lease for Sale at any time, simply select the form needed to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and eliminate errors. The service provides well-crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

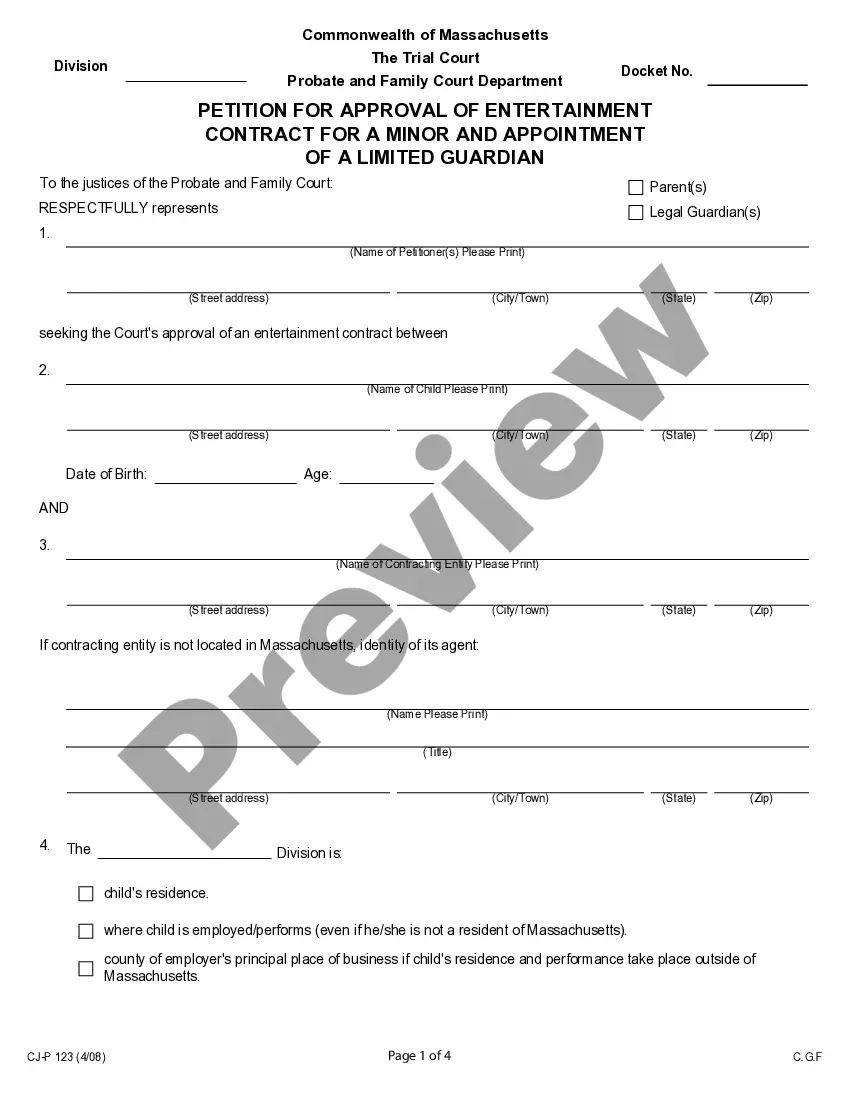

- Use the Preview button to review the document.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fulfills your requirements.

- Once you find the right form, click on Get now.

- Choose the pricing plan you prefer, complete the required information to create your account, and purchase your order using your PayPal or credit card.

Form popularity

FAQ

Structuring a triple net lease involves clearly defining the responsibilities of both the landlord and tenant. The lease should outline that the tenant will be responsible for property taxes, insurance, and maintenance, in addition to rent. It is crucial to set terms for each expense and to include provisions for regular reviews and adjustments. Using a platform like USLegalForms can streamline the creation of this lease and ensure compliance with local regulations, especially for a New Jersey Triple Net Lease for Sale.

Getting approved for a New Jersey Triple Net Lease for Sale involves presenting a strong application that highlights your financial reliability. You should include documentation such as tax returns, business financials, and credit reports to showcase your ability to meet lease obligations. Furthermore, building a relationship with landlords can significantly help in the approval process. Engaging with knowledgeable platforms like uslegalforms can make navigating this process easier.

To qualify for a New Jersey Triple Net Lease for Sale, you need to demonstrate financial stability and a solid credit profile. Landlords typically look for tenants with reliable income and a good credit score to ensure timely rent payments. Additionally, being prepared to provide relevant documentation will streamline the qualification process. Thorough preparation can enhance your chances of securing the lease.

Investing in a New Jersey Triple Net Lease for Sale can be a lucrative opportunity. These leases typically offer stable, long-term income streams with lower management concerns since tenants handle most property expenses. By choosing wisely, you can ensure consistent returns while minimizing risks. Many investors find that the benefits of a triple net lease outweigh the initial hurdles.

To value a triple net lease, you should consider factors like the lease terms, tenant's creditworthiness, and property location. Additionally, you can analyze the net operating income generated by the property, which provides insight into its profitability. Using tools and resources from platforms like uslegalforms can help you better understand the intricacies of valuing a New Jersey Triple Net Lease for Sale. This knowledge can aid you in making an informed investment decision.

A triple net lease in New Jersey is a lease agreement where tenants take on most of the property expenses. This includes property taxes, insurance, and maintenance costs, allowing landlords to collect rent without worrying about additional expenses. Such leases are common with commercial properties. If you're looking for a New Jersey Triple Net Lease for Sale, this structure offers a stable income stream for property owners.

Here are the benefits of NNN investments: Low-risk investment: since they are often leased by investment-grade tenants. Reliable income stream: since the tenants pay their rent and expenses each month. Guaranteed, long-term tenancy: NNN tenants often sign 7 to 10+ year leases.

The landlord usually covers the building expenses, but the tenant takes on the expense in a triple net lease instead. NNN is a good investment vehicle because it's a source of passive income with minimal responsibilities for the landlord. Tenants also benefit from a lower base rental rate than a gross lease agreement.

The first step is to calculate the NOI according to the actual income and expenses, not the proforma given by the owner. Next, try calculating what the NOI would be if the offer price were the actual price of the property. In this case, divide the NOI by the cap rate to get your middle offering price.

Cons of a Triple Net Lease-TenantsTax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.