New Mexico Triple Net Lease for Sale

Description

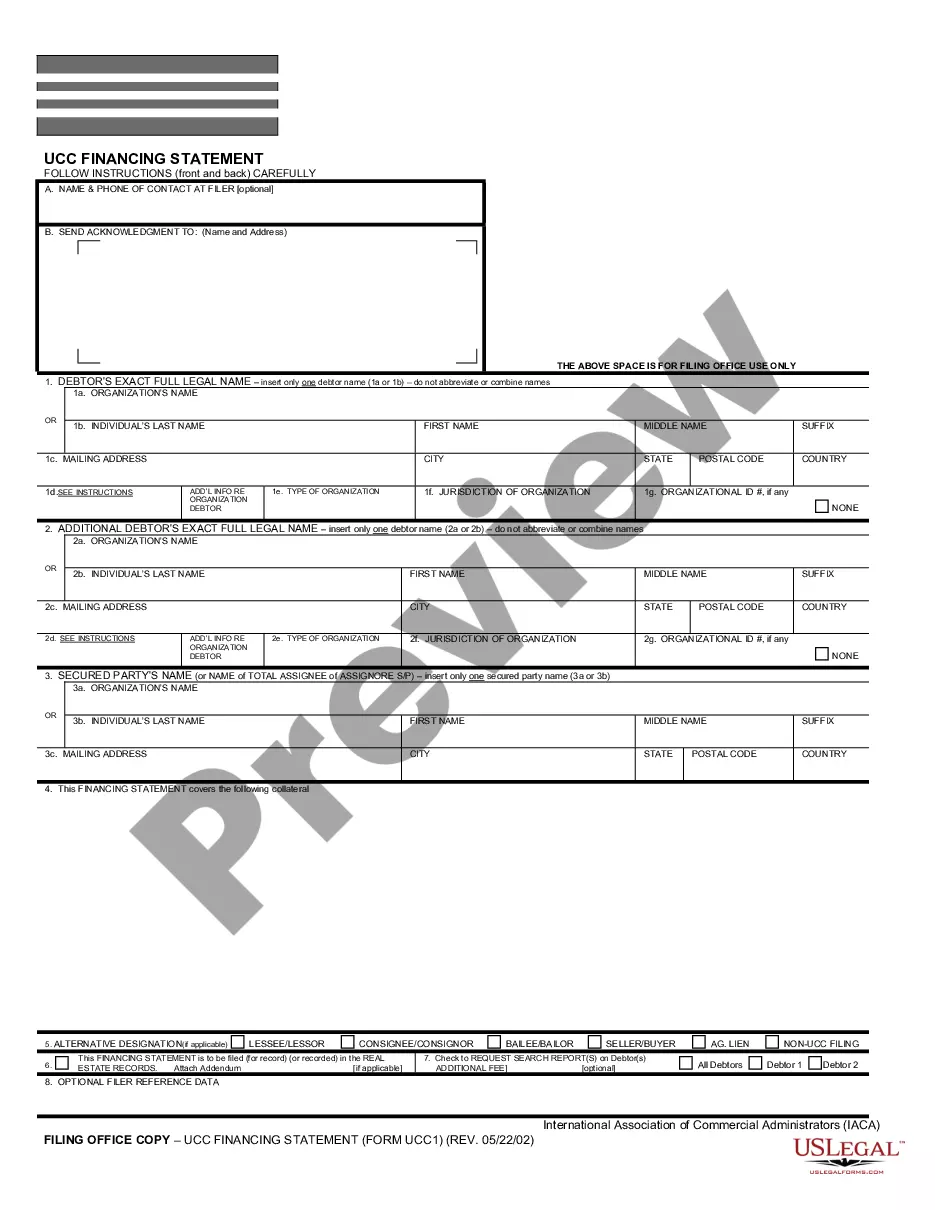

How to fill out Triple Net Lease For Sale?

Selecting the finest authentic document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the authentic form you require.

Use the US Legal Forms website.

- The service offers thousands of templates, such as the New Mexico Triple Net Lease for Sale, that can be utilized for both business and personal purposes.

- All forms are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the New Mexico Triple Net Lease for Sale.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

Form popularity

FAQ

In a triple net lease, the tenant generally assumes responsibility for operating expenses, which may include property taxes, insurance, and maintenance costs. These expenses can vary significantly based on the property type and location, so it’s essential to fully understand the associated costs when considering a New Mexico Triple Net Lease for Sale. This arrangement provides landlords with predictable income and helps tenants better manage expenses. Always review the lease agreement for clarity on what specific costs you will cover.

To acquire a triple net lease, you typically start by searching for properties listed as New Mexico Triple Net Lease for Sale. Working with a real estate agent who understands triple net leases can simplify the process. You'll want to evaluate the terms and conditions of the lease to ensure it aligns with your investment goals. The right platform, like uslegalforms, can offer valuable resources and templates to guide you through the paperwork needed for a successful transaction.

Calculating a triple net lease involves determining the base rent and estimating expected costs for taxes, insurance, and maintenance. You can add these expenses to the base rent to achieve a total monthly payment. If you’re considering a New Mexico Triple Net Lease for Sale, using reliable tools or platforms like uslegalforms can help streamline this calculation for clearer financial planning.

A triple net lease typically includes the base rent as well as obligations for property taxes, insurance, and maintenance costs. This arrangement ensures that landlords receive a steady income while transferring various operational expenses to the tenant. For those interested in a New Mexico Triple Net Lease for Sale, understanding these components is key to a successful investment.

Structuring a triple net lease involves assigning tenants the responsibility for property expenses, including taxes, insurance, and maintenance. This agreement typically outlines the rental amount, the duration of the lease, and details about the property. When considering a New Mexico Triple Net Lease for Sale, it is crucial to clearly define these terms to ensure both parties understand their obligations.

Seniors in New Mexico can qualify for property tax relief once they turn 65. This can include exemptions that reduce their taxable value, thereby lowering their property tax burden. If you own a New Mexico Triple Net Lease for Sale, this could impact your overall investment strategy, so it’s crucial to explore these available benefits.

Yes, if you earn income in New Mexico, you are generally required to file a state tax return. This includes income from properties under a New Mexico Triple Net Lease for Sale. Make sure to consult a tax professional to ensure you meet all necessary filing obligations and understand any deductions available to you as a landlord.

To get an NTT certification in New Mexico, you need to apply through the New Mexico Taxation and Revenue Department. Start by gathering the necessary documentation and information about the specific property under the New Mexico Triple Net Lease for Sale. Once your application is processed, you will receive your certification, allowing for certain tax benefits related to leases.

Triple net leases can offer excellent value for investors seeking steady income with minimal management needs. They allow landlords to focus on other aspects of their portfolio while tenants take care of property expenses. Considering a New Mexico Triple Net Lease for Sale may enhance your investment strategy and provide a reliable revenue stream.

A triple net lease can be a beneficial investment for many property owners and investors. With this structure, tenants handle property expenses, reducing management responsibilities for the landlord. If you're evaluating a New Mexico Triple Net Lease for Sale, weigh the pros and cons, keeping in mind your financial goals and risk tolerance.