Florida Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

Are you in a situation where you require documents for both business and personal purposes almost every time.

There are numerous legal document templates available online, but locating trustworthy ones isn't simple.

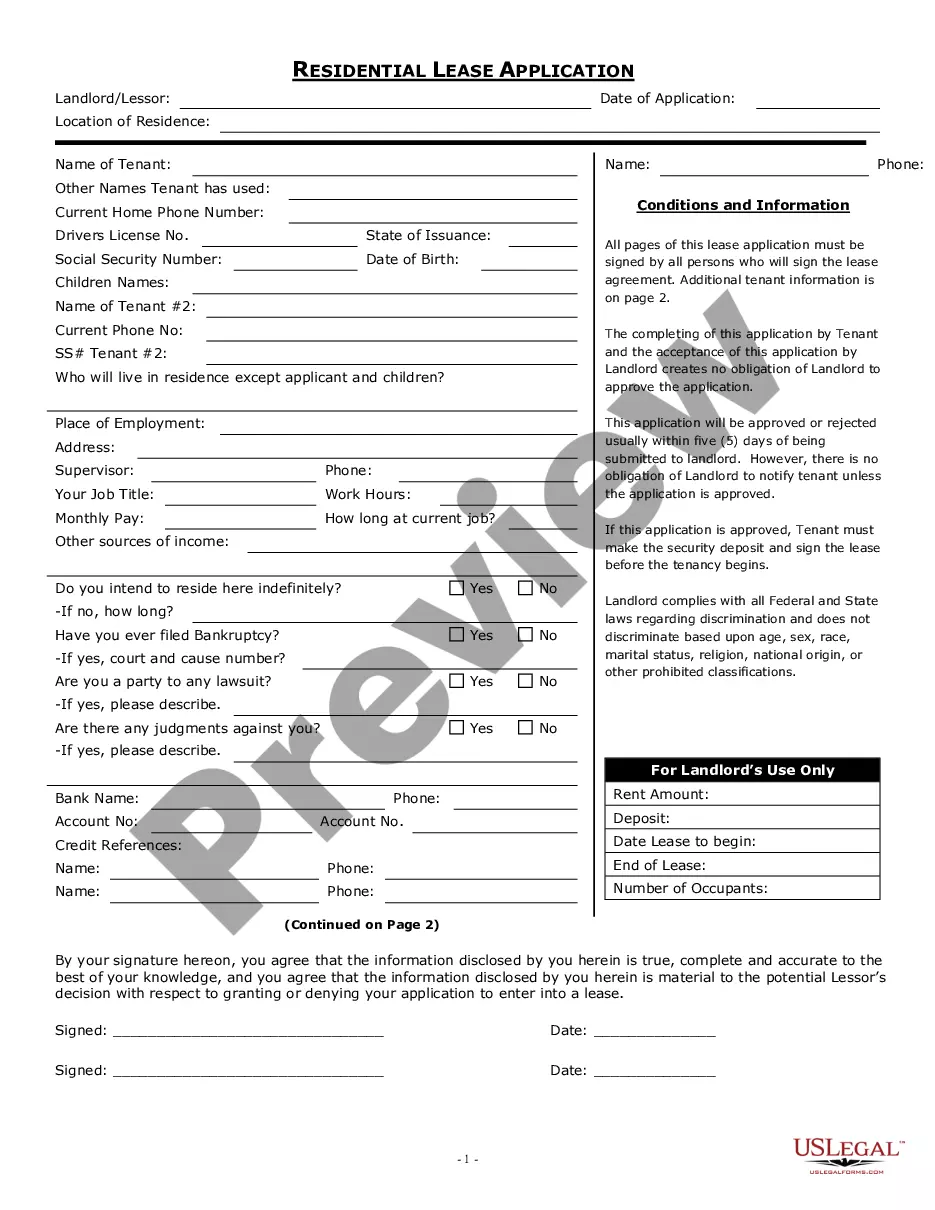

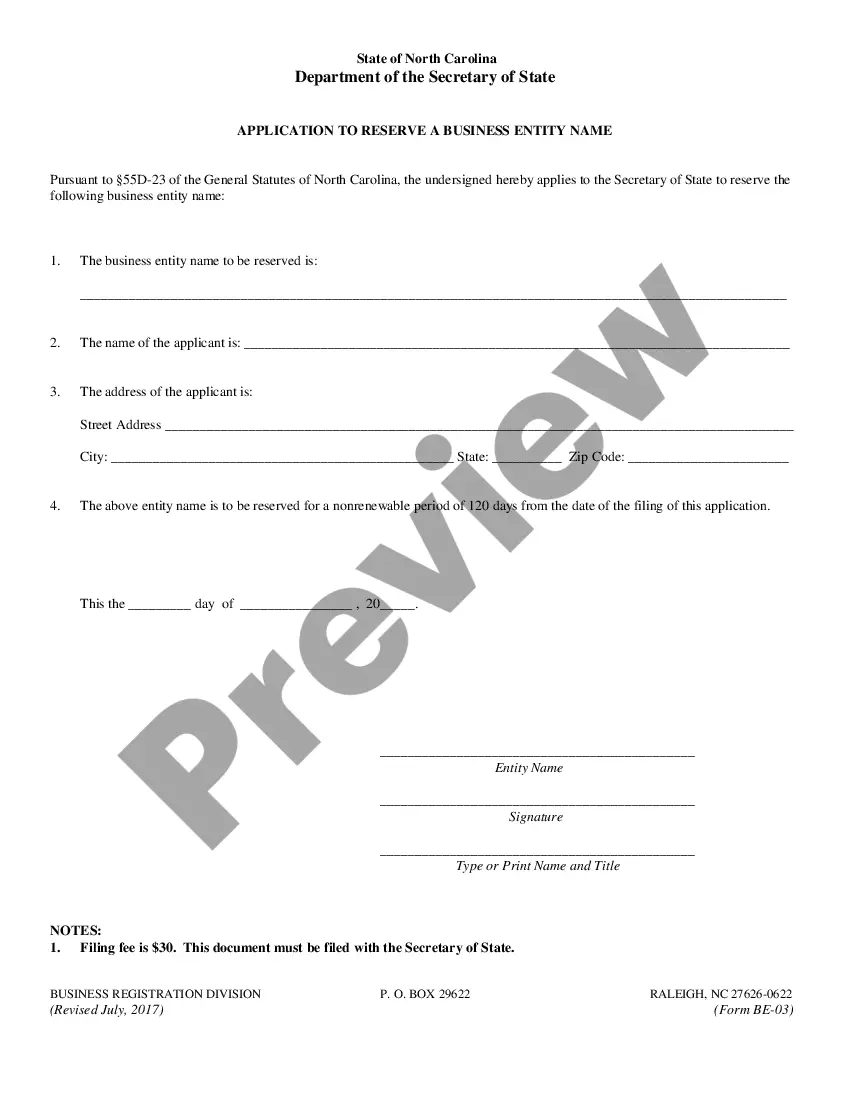

US Legal Forms provides a wide range of form templates, including the Florida Revocable Trust for Minors, designed to meet federal and state requirements.

You can obtain another copy of the Florida Revocable Trust for Minors at any time, if needed. Just select the necessary form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes. The service provides professionally created legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Florida Revocable Trust for Minors template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to evaluate the form.

- Read the details to ensure you have selected the appropriate document.

- If the document isn't what you need, use the Search box to find the form that meets your requirements.

- When you find the right form, click Get now.

- Select the pricing plan you prefer, enter the required details to set up your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Visit the My documents section to find all the document templates you have purchased.

Form popularity

FAQ

The negative side of a trust, such as a Florida Revocable Trust for Minors, often includes the complexity and costs involved in its administration. Establishing the trust may require legal expertise and ongoing maintenance, which can be expensive. Additionally, if the trust is not clearly written or actively managed, it might lead to disputes among family members. Consider using platforms like UsLegalForms to simplify the process and ensure clarity in your trust documentation.

One disadvantage of a family trust, including a Florida Revocable Trust for Minors, is the potential for mismanagement of assets. If trust guidelines are vague, it may create confusion on how the assets should be handled. Furthermore, while a family trust can protect assets, it may not shield them entirely from creditors or legal claims. Understanding these nuances can help families make better decisions about trust funds.

Setting up a trust can present various pitfalls, especially if the Florida Revocable Trust for Minors is not structured correctly. One common challenge is failing to fund the trust properly, which can render it ineffective for its intended purpose. Additionally, unclear instructions may lead to disputes among beneficiaries down the line. It's crucial to consult professionals who understand trust dynamics and can help align the trust with your family's goals.

A significant mistake parents often make when setting up a trust fund is not fully understanding their options, particularly when it comes to the Florida Revocable Trust for Minors. Parents may overlook the benefits of a revocable trust, such as flexibility and control over the assets. Without a clear strategy, they might unintentionally create complications for their heirs. Working with legal experts can help parents navigate these complexities and make informed decisions.

Setting up a Florida Revocable Trust for Minors involves several steps. First, you need to draft the trust document, clearly outline your intentions, and designate a trustee. It’s also important to transfer assets into the trust to make them effective. For support through this process, consider utilizing resources from USLegalForms to guide you in fulfilling all legal requirements.

While it is not strictly required to have an attorney to set up a Florida Revocable Trust for Minors, having legal assistance is highly recommended. An attorney can ensure that your trust meets all legal requirements and integrates seamlessly with your overall estate plan. If you prefer to avoid the costs of hiring a lawyer, consider platforms like USLegalForms for valuable guidance.

You can put your house in a Florida Revocable Trust for Minors without a lawyer, but it is not advisable. While you may save on legal fees, the complexities of transferring title and ensuring proper compliance with Florida laws can lead to mistakes. Using a service like USLegalForms can help you navigate these challenges effectively.

One disadvantage of a Florida Revocable Trust for Minors is that it can be more expensive to set up than a simple will. Additionally, maintaining a trust requires regular management and compliance with legal requirements. If you make changes, you must ensure that those changes are properly documented to avoid potential disputes in the future.

Yes, a minor can inherit property in Florida, but special considerations apply. A Florida Revocable Trust for Minors can hold and manage the assets until the child reaches legal age, providing protection and oversight. This arrangement allows parents to ensure that their minor children benefit from the inheritance under safe and guided management.

A Florida Revocable Trust for Minors operates by allowing the grantor to transfer ownership of their assets into the trust while retaining control over them. The grantor can change the terms of the trust, add or remove assets, or dissolve the trust at any point. Upon the grantor's death, the assets are distributed according to the trust's instructions, ensuring that minors inherit their share without delays.