North Carolina Performance Evaluation for Nonexempt Employees

Description

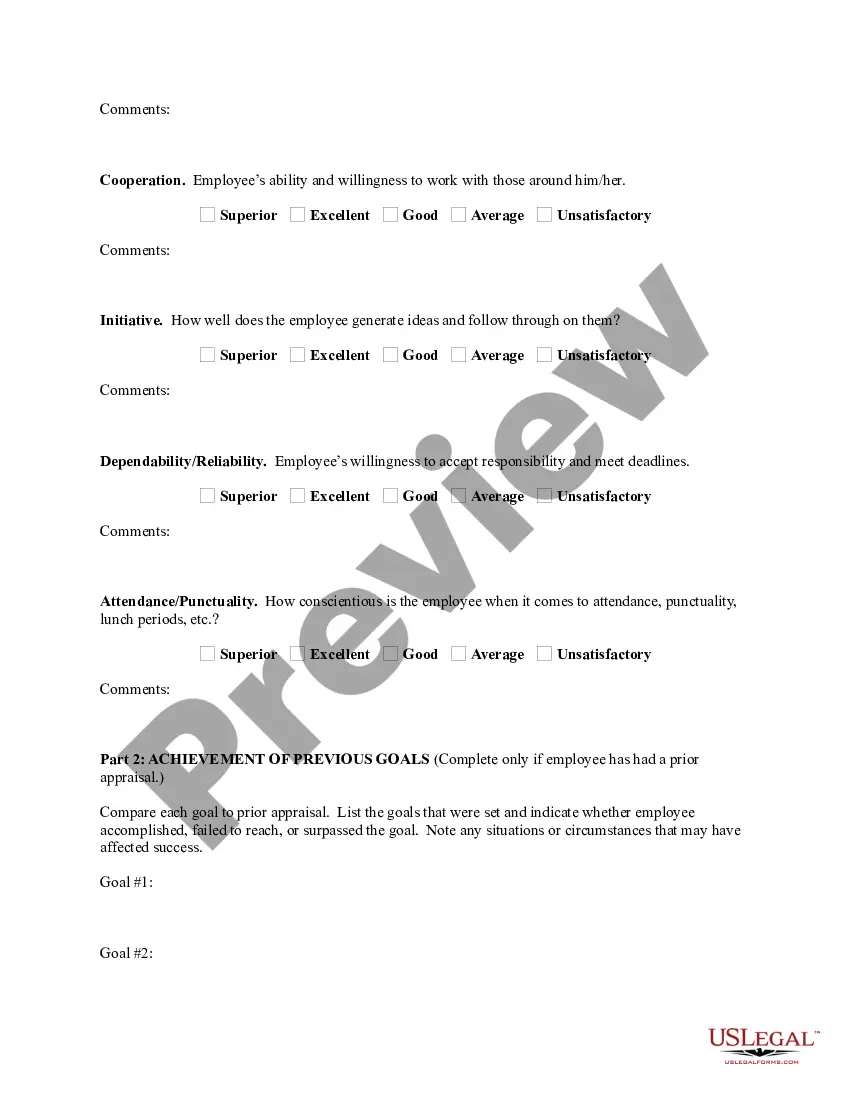

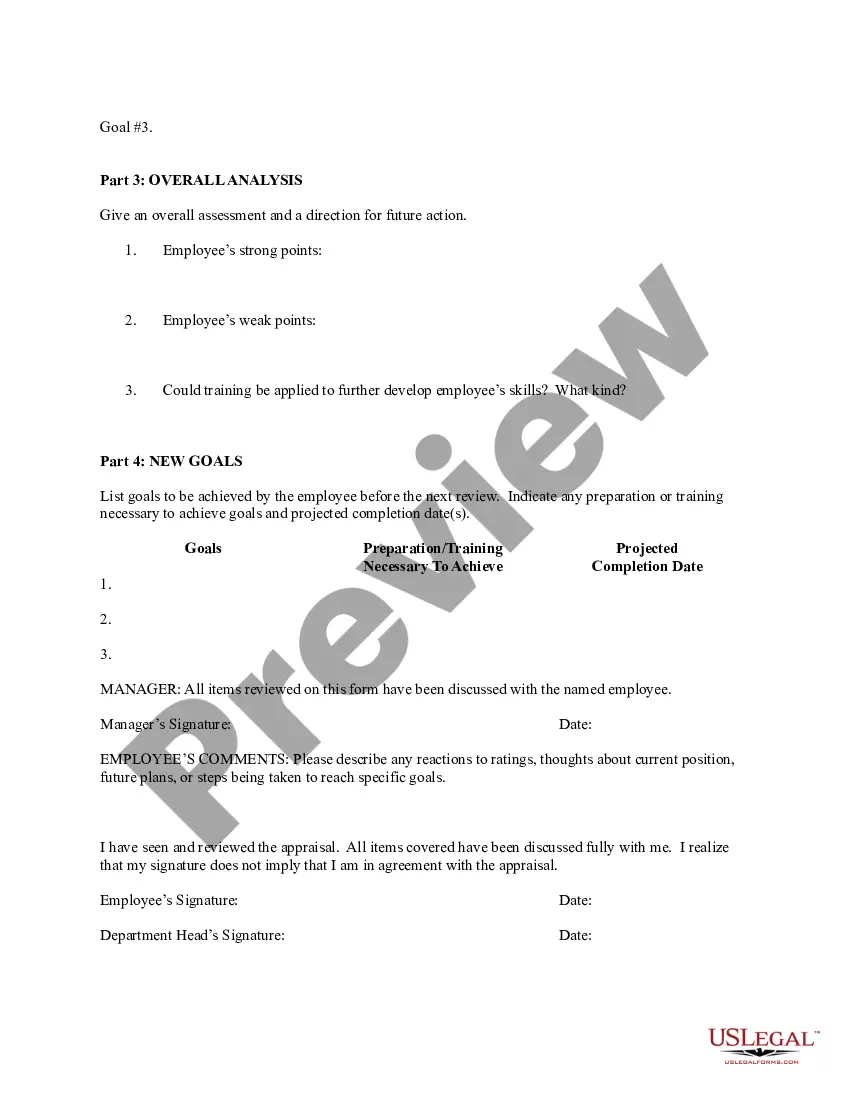

How to fill out Performance Evaluation For Nonexempt Employees?

If you wish to collect, download, or print authentic document templates, utilize US Legal Forms, the leading collection of legal forms accessible online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and input your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the North Carolina Performance Evaluation for Nonexempt Employees in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the North Carolina Performance Evaluation for Nonexempt Employees.

- You can also retrieve forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the document’s content. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Can I Be Entitled to Overtime Pay If I am a Salaried Employee in North Carolina? All nonexempt workers who fall under the rules established by the U.S. Fair Labor Standards Act (FLSA) must receive a minimum wage of not less than $7.25 per hour, as of 2017.

As a State entity, the University of North Carolina (UNC) system is subject to the State Human Resources Act. University positions are administered in accordance with the provisions and requirements of that Act and the positions covered by the Act are referred to as SHRA (Subject to the Human Resources Act) positions.

An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

EHRA employees are Exempt from the North Carolina Human Resources Act. EHRA positions are classified into one of three categories established by the UNC Board of Governors: Senior Academic and Administrative Officers (SAAO), Tier I and Tier II. Instruction, Research, and Information Technology (IRIT)

One of the general requirements is that the salaried-exempt employee must be paid a guaranteed salary of at least $684 a workweek (no salary test for outside sales), which would also be the promised rate of pay for the employee.

The law categorizes all employees as exempt or non-exempt. Non-exempt employees are entitled to overtime pay, whereas exempt employees are not. There are certain types of employees that are more likely to be non-exempt.

Exempt refers to not being eligible to receive overtime pay or qualify for minimum wage. To be exempt, your job must meet the $684/week minimum requirement and meet the duties tests described above, in addition to being salaried. There is a common misperception that all non-exempt employees are paid on an hourly basis.

To be exempt according to FLSA and NCWAHA, employees must meet all the following criteria: Earn a guaranteed minimum of at least $23,600 per year or $455 per week. Get paid on a salaried basis, rather than hourly. Carry out exempt job duties at the FLSA defines.

To be exempt according to FLSA and NCWAHA, employees must meet all the following criteria: Earn a guaranteed minimum of at least $23,600 per year or $455 per week. Get paid on a salaried basis, rather than hourly. Carry out exempt job duties at the FLSA defines.