Irrevocable Trust which is a Qualifying Subchapter-S Trust

What this document covers

An Irrevocable Trust which is a Qualifying Subchapter-S Trust is a legal arrangement that permanently transfers assets into a trust managed by a trustee. Once established, the terms cannot be changed or terminated without the beneficiary's consent. This type of trust is designed to benefit specific beneficiaries while providing tax advantages under the Internal Revenue Code, distinguishing it from other forms of trusts that may allow for modifications or revocation.

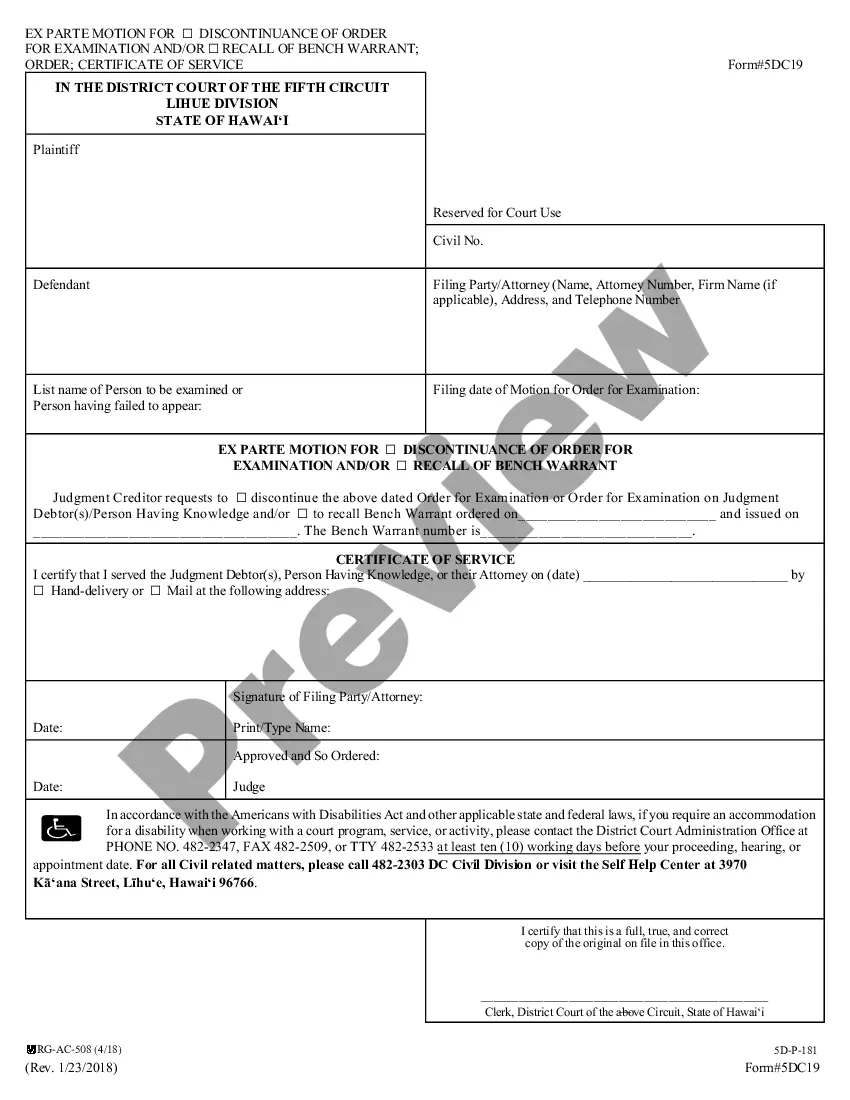

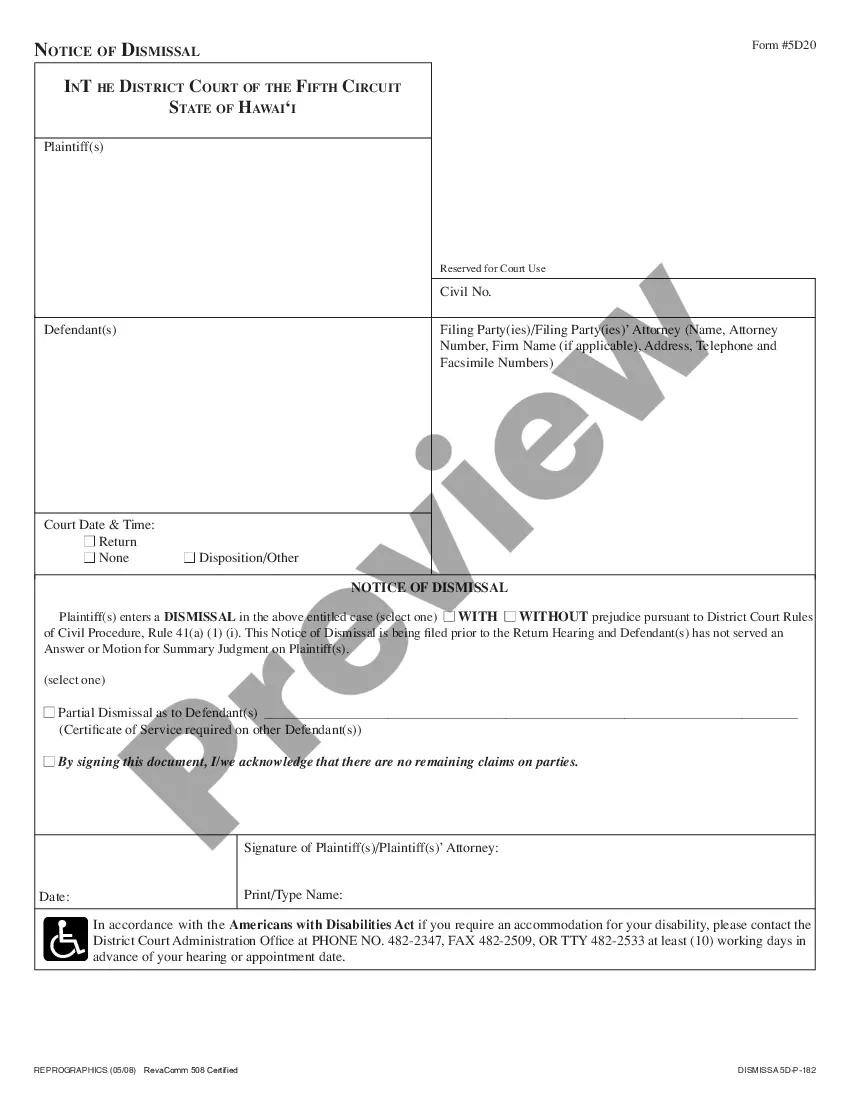

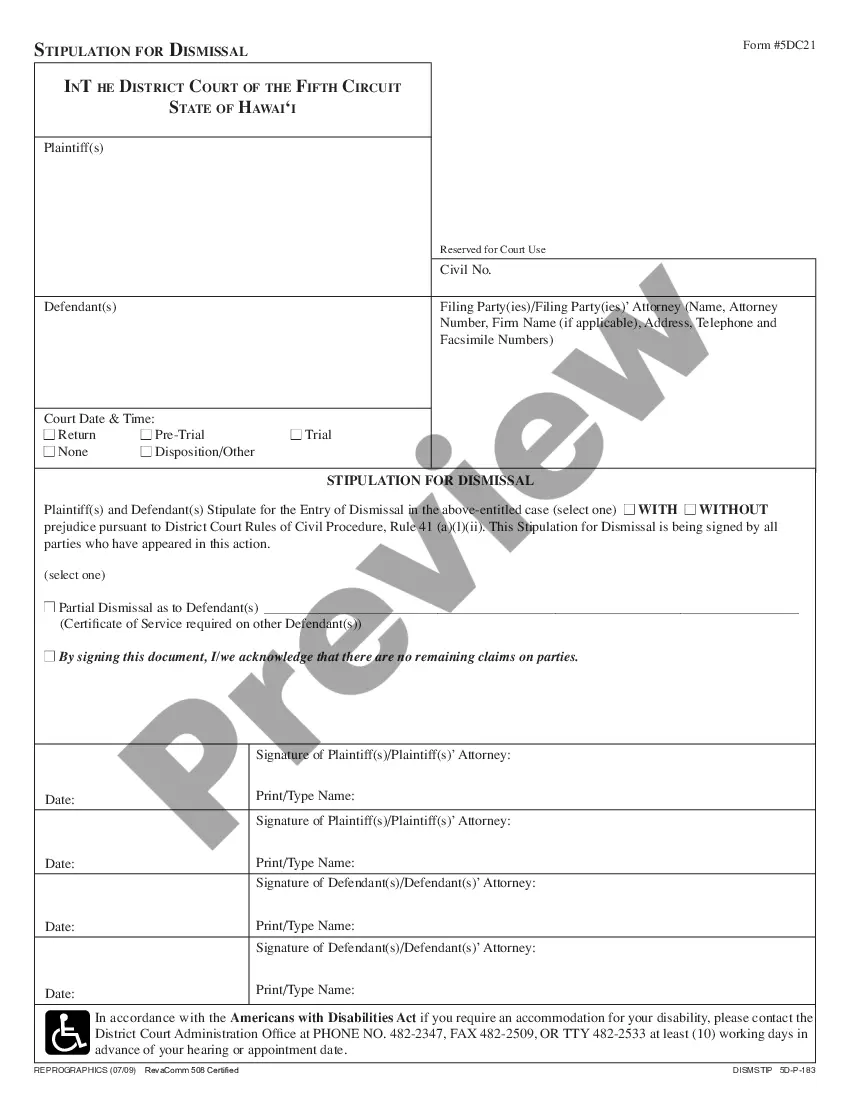

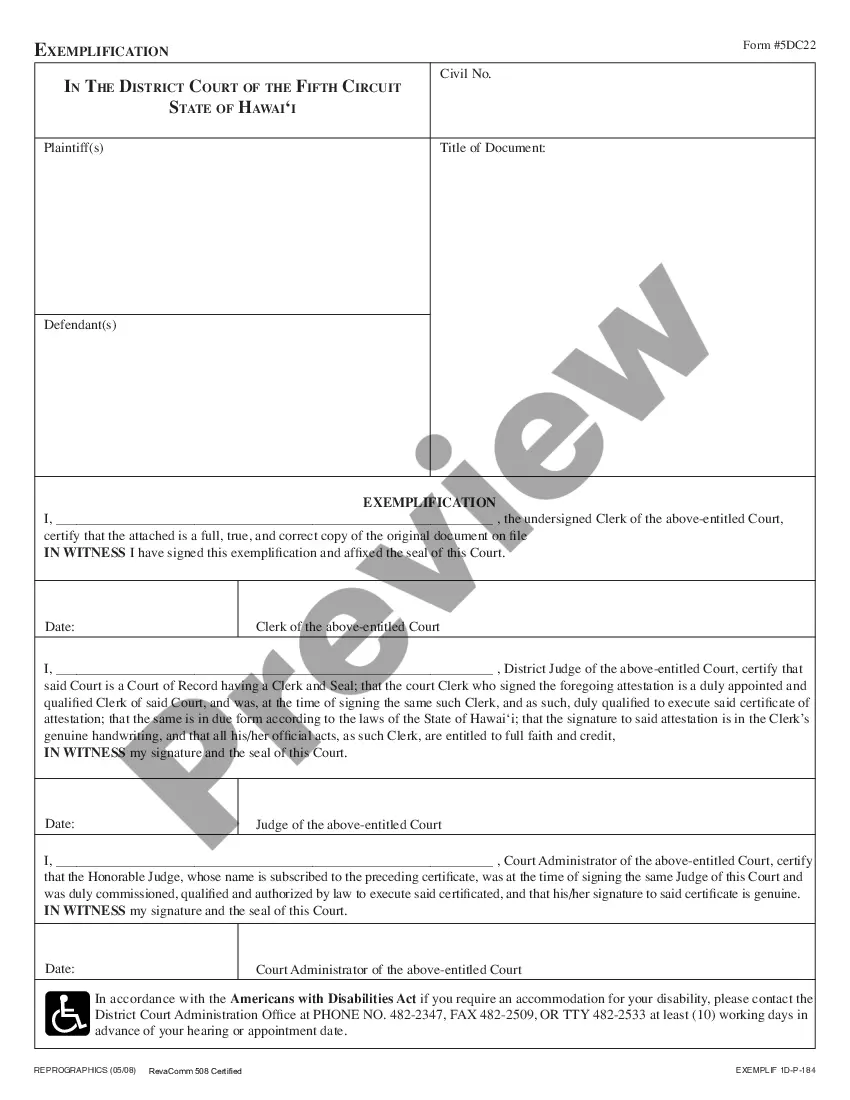

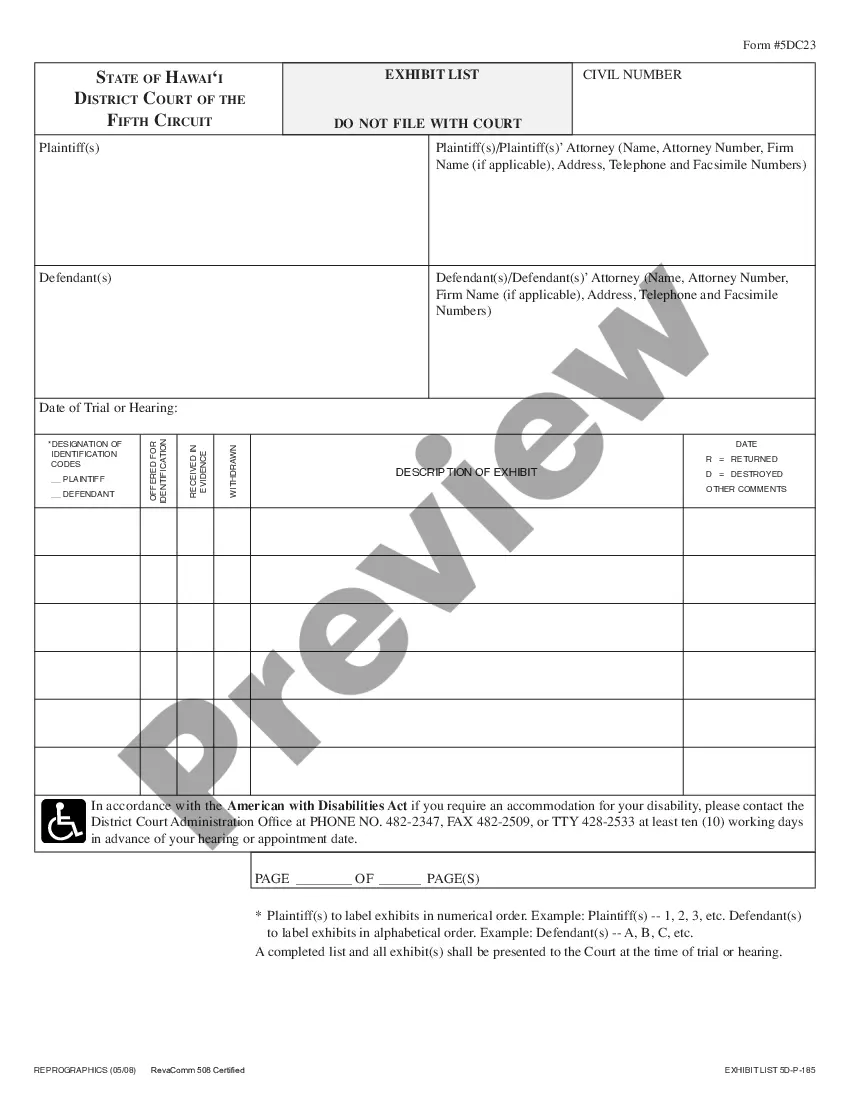

Form components explained

- Identification of the Grantor and Trustee with necessary contact details.

- Transfer of specified property to the trust and acknowledgment of receipt by the Trustee.

- Guidelines for income distribution to the beneficiary and provisions for principal access.

- Terms regarding the management and investment of trust assets by the Trustee.

- Acknowledgment that the trust is irrevocable and the rights of the Grantor in relation to the trust property.

- Procedures for appointing successor Trustees and handling Trustee resignation.

When this form is needed

This form is appropriate when a Grantor wishes to establish an irrevocable trust that provides for beneficiaries while ensuring tax advantages. It is often used to safeguard assets, eliminate estate taxes, or provide for the financial support of minors or dependents. Situations may include estate planning, charitable giving, or managing assets for family members with special needs.

Who should use this form

- Individuals planning to establish a trust to manage and allocate their assets irrevocably.

- Parents or guardians looking to secure financial support for their dependents.

- Individuals seeking tax advantages and asset protection for their heirs.

- Anyone looking to ensure specific outcomes upon their death or incapacitation regarding asset distribution.

Instructions for completing this form

- Identify the Grantor and Trustee, including their complete names and addresses.

- Specify the assets being transferred into the trust as outlined in Schedule A.

- Determine the beneficiary and outline the terms of income and principal distribution.

- Include provisions for the appointment of successor Trustees and their responsibilities.

- Sign and date the agreement in the presence of a notary, if required.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide complete and accurate information for all parties involved.

- Not properly executing the document, including missing signatures or dates.

- Neglecting to include all necessary property details in Schedule A.

- Ignoring state-specific requirements that might affect the trust's validity.

Why use this form online

- Convenience of accessing and downloading the form at any time.

- Editability allows for customization to suit individual circumstances.

- Reliability as all forms are drafted by licensed attorneys ensuring legal compliance.

Legal use & context

- This trust is legally enforceable and must adhere to IRS requirements for a Qualified Subchapter-S Trust.

- Failure to comply with the regulations can lead to tax disadvantages or invalidation of trust provisions.

- Consulting legal counsel is advisable to ensure compliance with specific state laws and regulations.

Summary of main points

- An irrevocable trust cannot be altered or revoked without the beneficiary's consent.

- This form provides tax advantages and protects assets for beneficiaries.

- Accurate completion and notarization are crucial for the formâs validity.

Looking for another form?

Form popularity

FAQ

Generally, estates and six types of trusts are eligible as S corporation shareholders, these include grantor trusts, electing small business trusts (ESBTs), qualified subchapter S trusts (QSSTs), and testamentary trusts (for two years after funding.

Only estates, individuals, and certain trusts can own shares in an S corp. Corporations, partnerships, and non-resident aliens cannot own stock.If the trust is a grantor trust, testamentary trust, qualified Subchapter S trust (QSST), revocable trust, or retirement account trust, the trust counts as one shareholder.

Generally, estates and six types of trusts are eligible as S corporation shareholders, these include grantor trusts, electing small business trusts (ESBTs), qualified subchapter S trusts (QSSTs), and testamentary trusts (for two years after funding.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

While there can only be one income beneficiary, a QSST may designate successor beneficiaries. With an ESBT, you can set up one trust that includes all of the income beneficiaries. However, note that any ESBT designated beneficiaries must be an individual, estate or charity eligible to own S corporation stock.

Only estates and certain types of trusts can own shares of an S corporation.An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.

Testamentary trusts. This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

A trust can hold stock in an S corp only if it (1) is treated as owned by its grantor for income tax purposes under us grantor trust rules, (2) was a grantor trust immediately before its grantor's death (the trust can be a shareholder only for two years from that date), (3) received stock from the will of a decedent (