Florida Revocable Living Trust for Minors

Description

How to fill out Revocable Living Trust For Minors?

You have the capability to dedicate time online seeking the legal document template that fulfills the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that are examined by professionals.

It is easy to download or print the Florida Revocable Living Trust for Minors from our services.

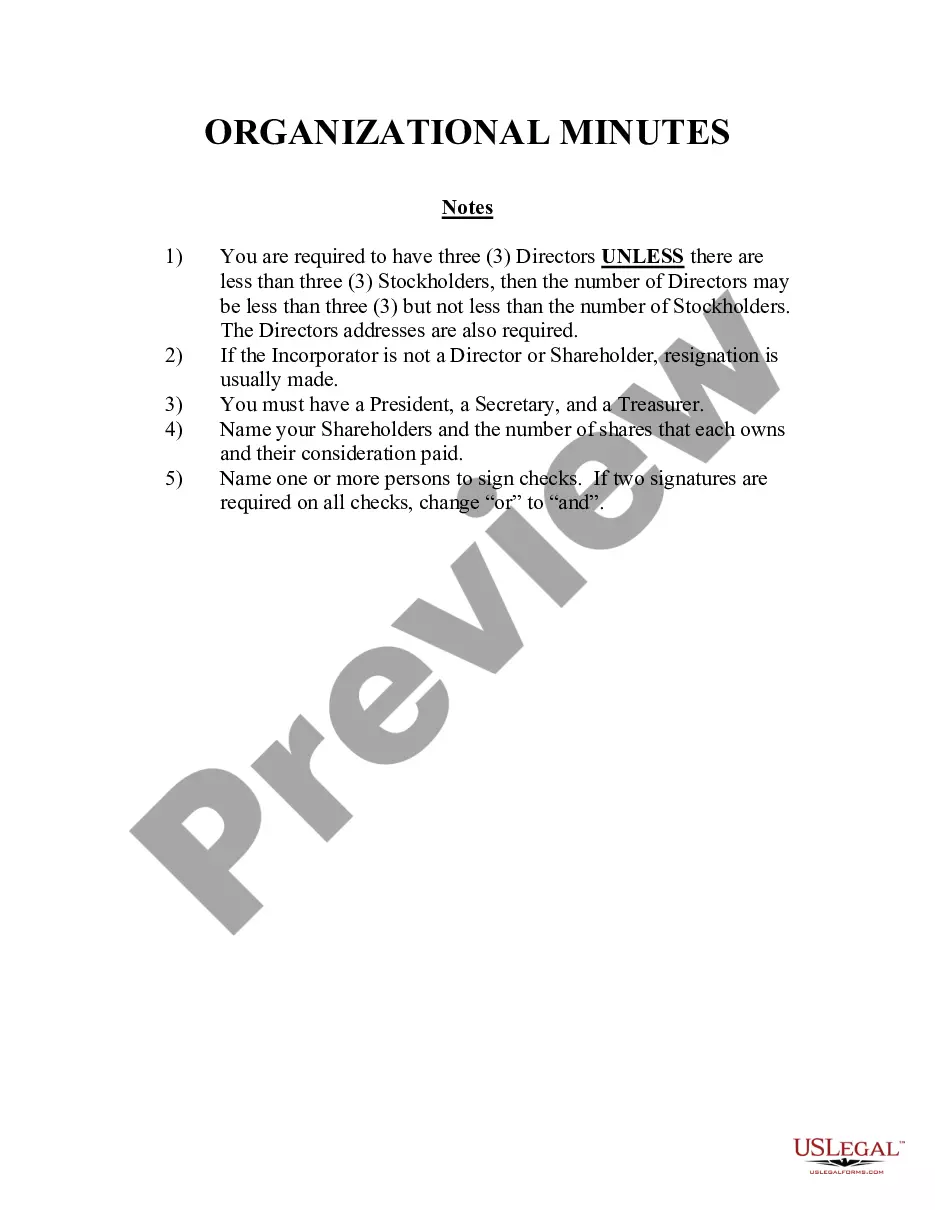

If available, use the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download option.

- After that, you can complete, modify, print, or sign the Florida Revocable Living Trust for Minors.

- Every legal document template you obtain is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your preference.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

To set up a Florida Revocable Living Trust for Minors, start by determining the assets you want to place in the trust. Next, work with a legal professional or utilize online resources, like USLegalForms, to draft the necessary trust documents. You will then designate a trustee who will manage the trust until your minor reaches their designated age of maturity. Finally, ensure you thoroughly review the provisions to align with your wishes for your child's financial future.

While Florida Revocable Living Trusts for Minors offer many benefits, they also have some disadvantages. For instance, they do not provide protection from creditors, and changes to the trust can be made at any time, which may lead to uncertainty. Additionally, setting up and maintaining a trust can incur costs, so it's essential to weigh these factors against your family's financial goals.

The best type of trust for a child often includes a Florida Revocable Living Trust for Minors, offering both flexibility and security. This trust allows parents to dictate how and when the assets will be distributed, ensuring the child's financial future. Parents can customize the trust to address various scenarios, making it a practical choice for responsible asset management.

Choosing the best type of trust involves considering your specific goals and circumstances. For many parents, a Florida Revocable Living Trust for Minors is ideal, as it allows for adaptability and control. This type of trust can effectively manage assets for your children, ensuring that they are used for their intended purposes, such as education and health care.

Trust accounts for minors serve to hold and manage a child's assets until they are legally able to access them. With a Florida Revocable Living Trust for Minors, assets can be placed into trust accounts, providing responsible financial oversight. These accounts can help ensure that funds are spent wisely for the child's benefit, contributing to their education, health, and welfare.

The best trust for minors often depends on individual circumstances, but a Florida Revocable Living Trust for Minors typically offers flexibility and control. This type of trust allows parents to change its terms as needed, adapting to the child's changing needs. Additionally, it provides a clearer management structure for assets, ensuring proper handling until the child reaches a suitable age.

A minor trust is designed to manage and protect the assets of a child until they reach adulthood. In the context of a Florida Revocable Living Trust for Minors, this allows parents to control how assets are distributed and used for the child's benefit. These trusts can provide financial support for education, healthcare, and other needs, while ensuring the child's best interests are prioritized.

Yes, a minor can have a revocable trust, such as a Florida Revocable Living Trust for Minors. This type of trust allows you to control and manage the assets for the minor's benefit until they reach adulthood. Establishing a revocable trust gives parents or guardians peace of mind, knowing the minor’s inheritance is secure and well-managed. US Legal Forms can help you navigate the legal requirements and ensure the trust is set up correctly.

To open a trust account for a minor, start by selecting a bank or financial institution that offers trust services. You will need to provide documentation, such as the minor's birth certificate and Social Security number, along with the trust agreement. A Florida Revocable Living Trust for Minors allows you to manage the minor's assets until they reach maturity. Consider exploring platforms like US Legal Forms for guidance in creating the necessary legal documents.

A Florida Revocable Living Trust for Minors helps manage and protect assets for your children until they reach adulthood. When you establish this trust, you designate a trustee responsible for managing the assets according to your instructions. This structure provides financial security for your minors, ensuring they receive their inheritance under your terms. You can find helpful resources and templates on the US Legal Forms platform to assist you in setting up this trust effectively.