Florida Revocable Living Trust for Grandchildren

Description

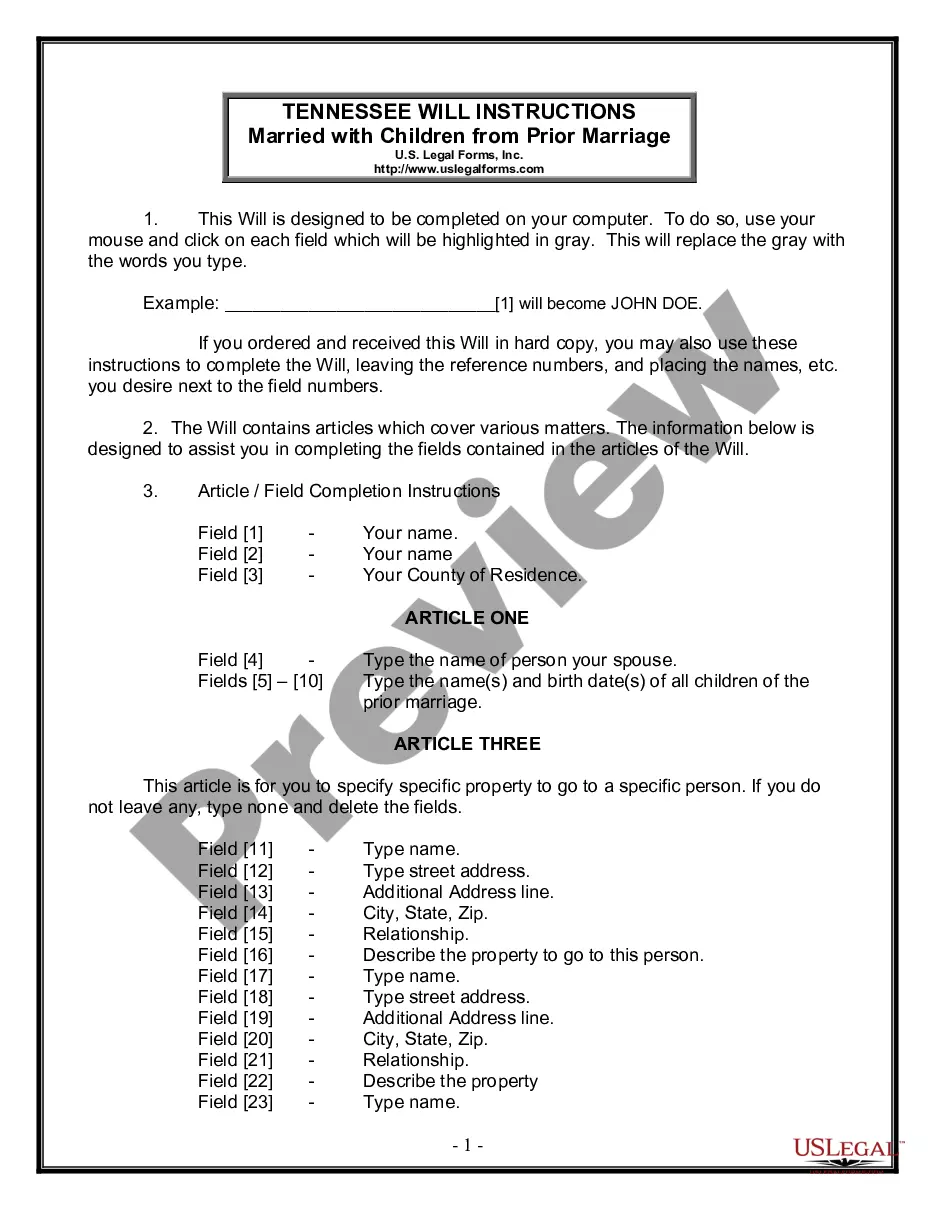

How to fill out Revocable Living Trust For Grandchildren?

If you need exhaustive, obtain, or printing sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are available online.

Employ the site's simple and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the document you want, select the Download now button. Choose the payment plan you prefer and provide your information to sign up for the account.

- Utilize US Legal Forms to locate the Florida Revocable Living Trust for Grandchildren in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Florida Revocable Living Trust for Grandchildren.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the document's content. Be sure to read the description.

Form popularity

FAQ

Yes, you can create your own Florida Revocable Living Trust for Grandchildren, but it requires careful attention to detail to ensure it meets state law requirements. Many individuals turn to platforms like US Legal Forms, which provide user-friendly templates and guidance to simplify the process. Creating your own trust allows you to customize the terms, but having the right resources can also minimize mistakes and help ensure your estate planning goals are met.

A sample trust for grandchildren typically includes provisions that outline how assets will be managed and distributed to them. In a Florida Revocable Living Trust for Grandchildren, you can specify ages or milestones that trigger distributions, ensuring that they receive support when they need it the most. By establishing clear guidelines, you can help safeguard your grandchildren's financial future. Templates are available to give you an idea of the structure and language used in these trusts.

To fill out a Florida Revocable Living Trust for Grandchildren, start by gathering essential information about your assets and beneficiaries. Next, you create the trust document, which includes details such as your name, the trustee's name, and the beneficiaries, which in this case are your grandchildren. After drafting, you need to sign the document in the presence of a notary public. Finally, transfer your assets into the trust to ensure they are protected and managed according to your wishes.

It is highly advisable to consult an attorney when setting up a Florida Revocable Living Trust for Grandchildren. An attorney can help ensure that the trust meets all legal requirements and aligns with your specific needs. They can also guide you through the documentation and ensure that your assets are properly titled in the trust.

While a Florida Revocable Living Trust for Grandchildren offers many benefits, it does have some disadvantages. One key point is that, unlike wills, trusts do not provide a public record, so some information about your estate may remain private. Additionally, while revocable trusts avoid probate, they do not offer protection from creditors, which could impact your grandchildren’s inheritance.

A Florida Revocable Living Trust for Grandchildren is particularly beneficial, as it allows flexibility and offers control over how your assets are distributed. You can specify when and how your grandchildren receive their inheritance, ensuring that they are financially supported while also encouraging responsible management of their inheritance. It can help you align your estate planning goals with their needs.

Putting your house in a Florida Revocable Living Trust for Grandchildren can be a smart way to manage your assets. This strategy allows your property to bypass probate, making it easier for your grandchildren to inherit. Additionally, you maintain control of the property during your lifetime, and you can make changes to the trust as your circumstances change.

While a Florida Revocable Living Trust for Grandchildren provides flexibility, it is essential to recognize potential dangers. If not properly funded or managed, the trust may fail to carry out your estate plan. Furthermore, if the trust document is poorly drafted or not updated, it may lead to conflicts among heirs or unintended consequences regarding the distribution of your assets.

Certain assets cannot be transferred into a Florida Revocable Living Trust for Grandchildren, such as assets that are not subject to probate. For example, jointly owned property or assets with named beneficiaries, like life insurance or retirement accounts, cannot be transferred into the trust. It is crucial to consult with a legal expert to ensure a comprehensive estate plan.

It's often advised not to place retirement accounts, such as IRAs and 401(k)s, in a Florida Revocable Living Trust for Grandchildren. This is primarily because these accounts receive special tax treatment, and holding them in a trust may lead to unintended tax consequences. Furthermore, life insurance policies should typically be owned by individuals to maintain their benefits and tax advantages.