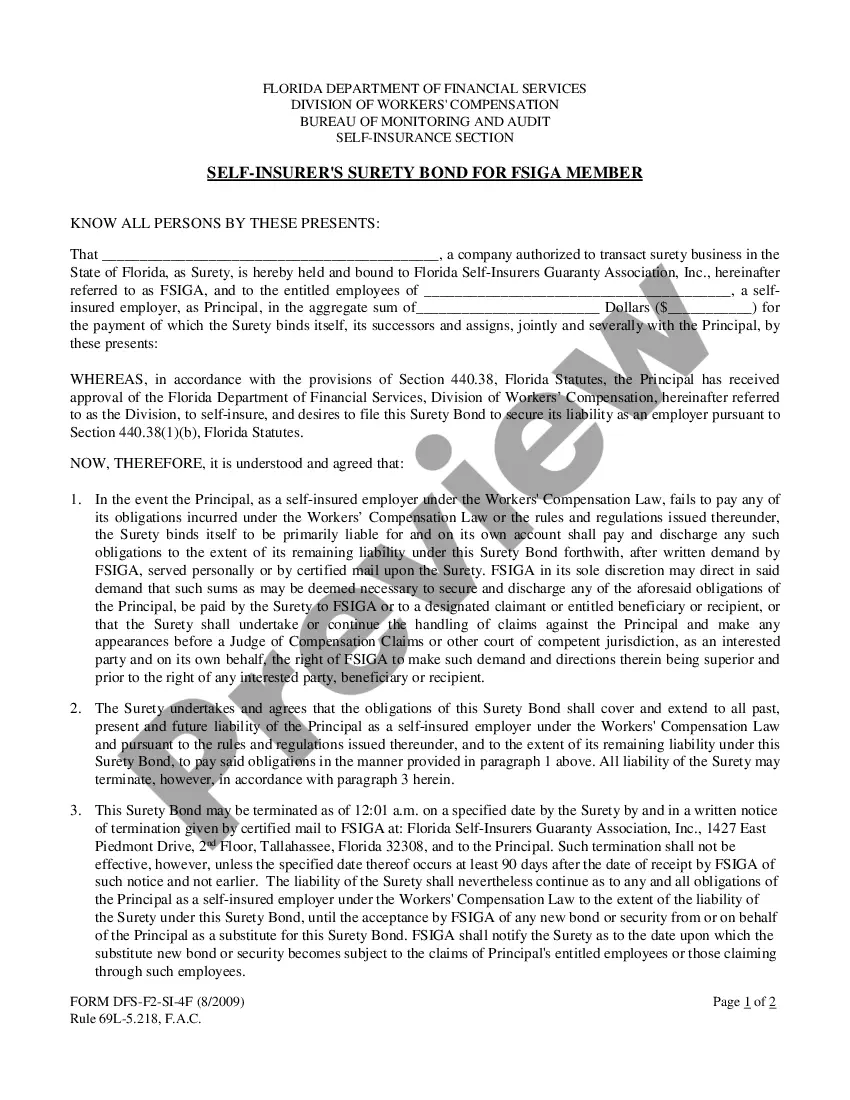

Florida Self-Insurers Surety Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Florida Self-Insurers Surety Bond?

Obtain one of the most comprehensive collections of approved forms. US Legal Forms serves as a resource to locate any state-specific documentation in just a few clicks, including Florida Self-Insurers Surety Bond templates.

No need to waste time searching for a court-approved sample. Our certified experts guarantee you receive current examples at all times.

To access the forms library, choose a subscription and create an account. If you have completed that, simply Log In and click Download. The Florida Self-Insurers Surety Bond template will promptly be saved in the My documents tab (a section for each form you download on US Legal Forms).

Download the template to your device by clicking the Download button. That's it! You just need to complete the Florida Self-Insurers Surety Bond form and check out. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily browse through over 85,000 useful templates.

- To establish a new profile, follow the simple instructions below.

- If you plan to use a state-specific template, ensure you select the correct state.

- If possible, examine the description to understand all the details of the document.

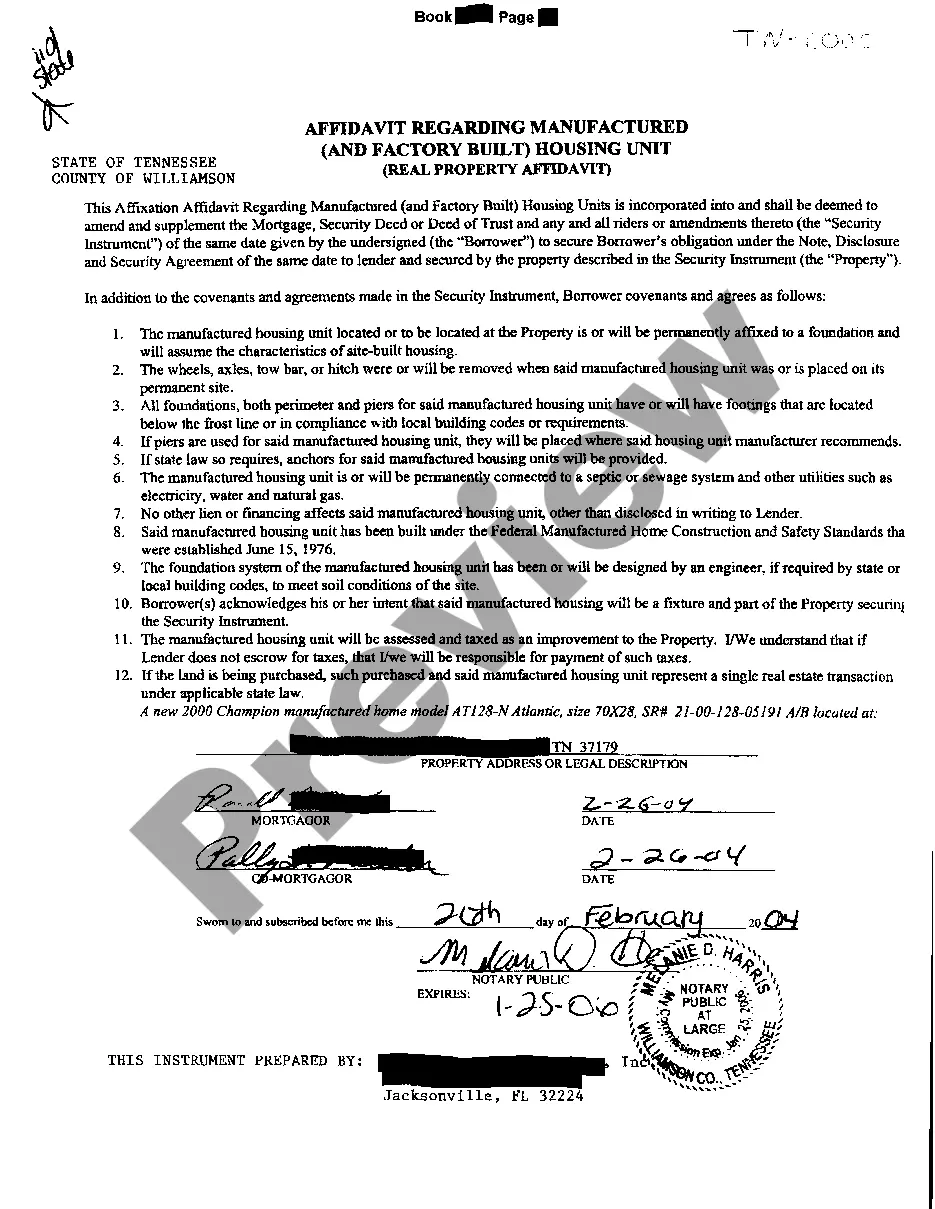

- Use the Preview function if available to verify the document's details.

- If everything appears correct, click Buy Now.

- After selecting a pricing option, create an account.

- Make payment via card or PayPal.

Form popularity

FAQ

To become a self-insured driver in Florida, you must first apply for self-insurance through the Florida Department of Highway Safety and Motor Vehicles. This process requires demonstrating financial responsibility by providing proof of a Florida Self-Insurers Surety Bond. Once you are approved, you can enjoy the flexibility of self-insurance while maintaining compliant auto coverage. Utilizing our platform, USLegalForms, can simplify your application by providing the necessary forms and guidance to ensure a smooth process.

To obtain a surety bond in Florida, you typically need to fill out an application and provide financial documentation that demonstrates your ability to fulfill bond obligations. Working with an experienced provider who understands the Florida Self-Insurers Surety Bond can streamline the process for you. For added convenience, uslegalforms offers resources and assistance to help guide you through obtaining the right bond for your needs.

insured bond is a specific type of bond that allows a business to selfinsure its financial obligations, asserting that it has sufficient resources to cover any potential liabilities. This is particularly common among larger businesses that prefer to manage risks internally. In Florida, companies can choose the Florida SelfInsurers Surety Bond to meet regulatory requirements while minimizing premiums compared to traditional insurance.

Self-insurance involves a business setting aside funds to cover its own potential losses rather than purchasing a traditional insurance policy. This method can be beneficial, as it allows businesses in Florida to retain more control over their finances. By utilizing a Florida Self-Insurers Surety Bond, companies can demonstrate their financial stability and responsibility to clients, enhancing their credibility in the marketplace.

An insurance bond serves as a guarantee that a party will fulfill their obligations or duties, such as complying with laws and agreements. For businesses in Florida, securing a Florida Self-Insurers Surety Bond helps ensure creditors and clients can recover damages if a business fails to meet its commitments. This bond acts as a safety net, providing financial protection and fostering trust within the business community.

Yes, a surety bond is often required for self-insurers in Florida. The Florida Self-Insurers Surety Bond acts as a financial guarantee that you will comply with all applicable regulations and obligations. This bond provides protection for any potential claims against you, ensuring that funds are available if needed. Understanding this requirement is essential when navigating the self-insurance landscape in Florida.

To become self-insured in Florida, you must meet specific financial criteria set by the state. This typically includes providing proof of financial stability and securing a Florida Self-Insurers Surety Bond. Additionally, you should submit your application to the Department of Financial Services for approval. Ensuring that you have the right documentation and resources is crucial for a smooth self-insurance process.

Yes, you can complete your own surety bond application if you have the necessary information and understanding of the process. However, it is often beneficial to seek help from professionals or platforms like US Legal Forms. They provide valuable guidance and specific forms for the Florida Self-Insurers Surety Bond, ensuring you submit accurate and complete applications.

In simple terms, a surety bond works as a promise between three parties. It guarantees that a principal will fulfill their obligations to the obligee, while the surety backs this promise. If the principal fails to meet their duties, the surety pays the obligee, but the principal must reimburse the surety. Understanding the Florida Self-Insurers Surety Bond helps businesses maintain compliance and protect their interests.

Filling out a surety bond form requires gathering relevant business information, such as your company's legal name, address, and type of business. You will also need to provide details about the specific bond you are applying for, including the required amount and duration. For assistance, consider using the US Legal Forms platform, which offers comprehensive resources and templates for completing your Florida Self-Insurers Surety Bond application.