Florida Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

What this document covers

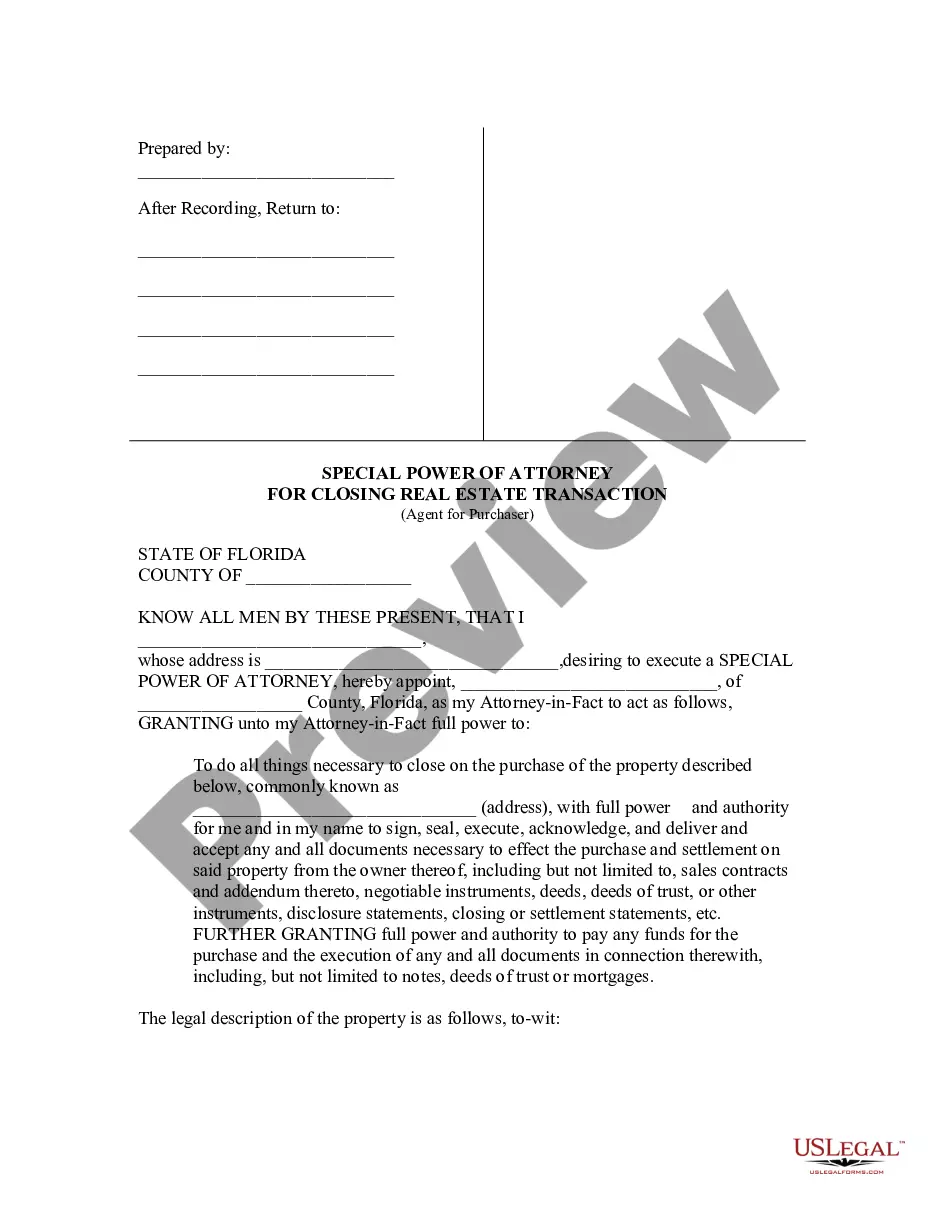

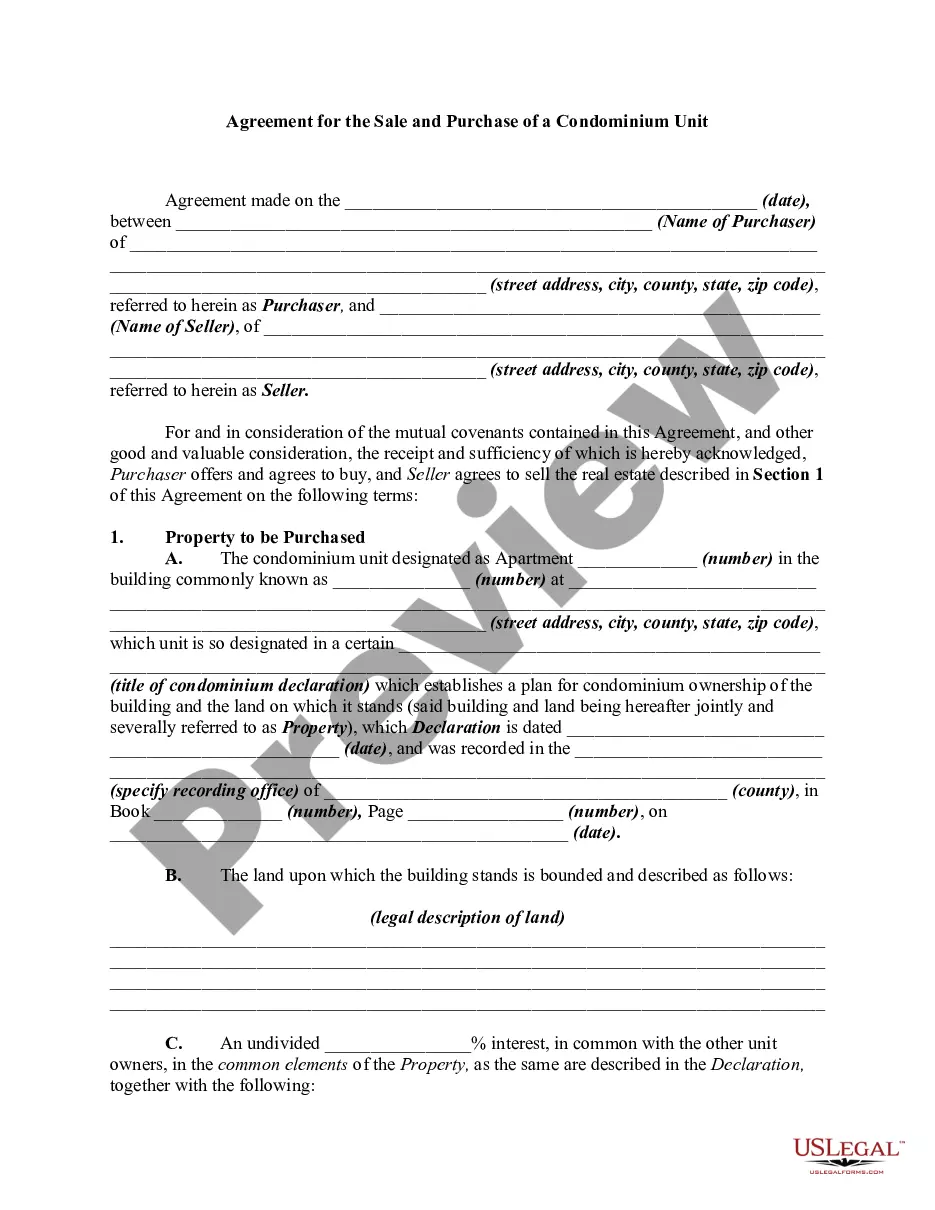

The Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser allows a buyer to appoint an attorney-in-fact to act on their behalf in executing documents related to the purchase of real estate. This form empowers the designated agent to complete the transaction effectively, including signing loan documents and other necessary paperwork. Unlike general powers of attorney, this document is specifically tailored for real estate transactions, providing focused authority for the designated agent to facilitate the purchase.

What’s included in this form

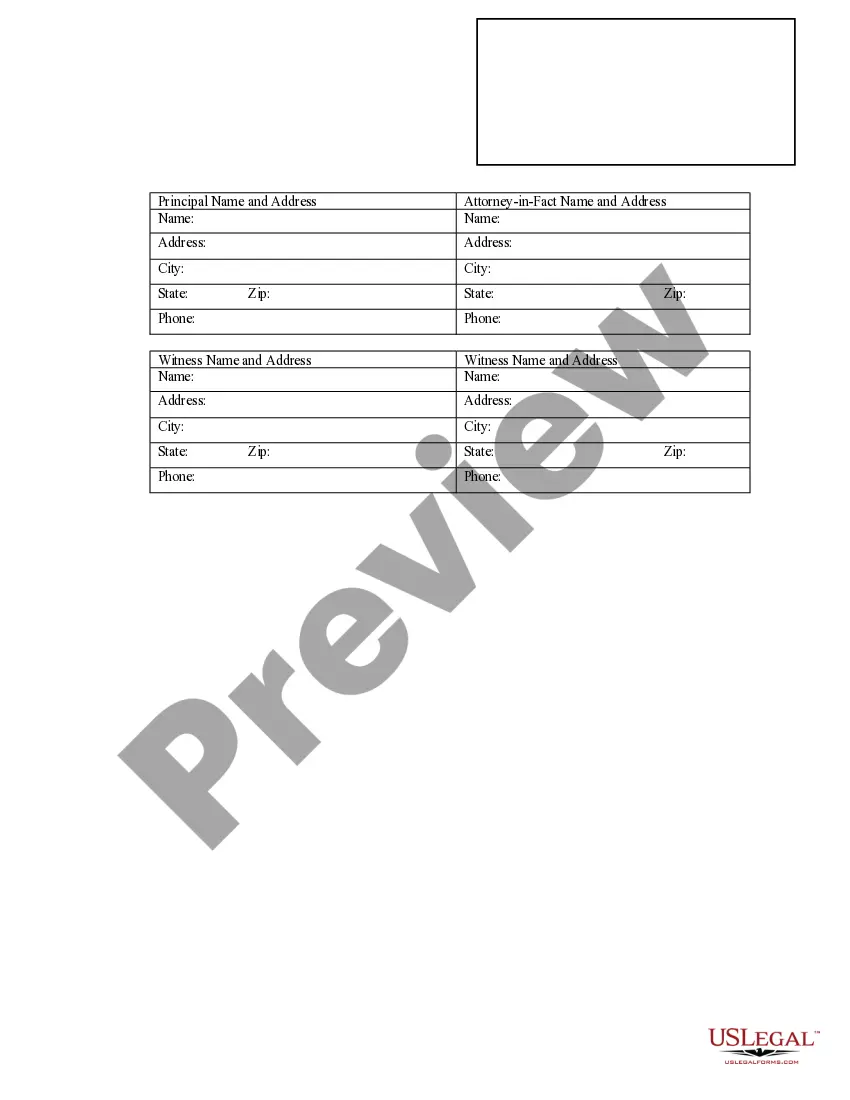

- Principal's and attorney-in-fact's names and addresses

- Specific property description and identification

- Authorization for the agent to sign various legal documents

- Ability to manage funds necessary for the real estate purchase

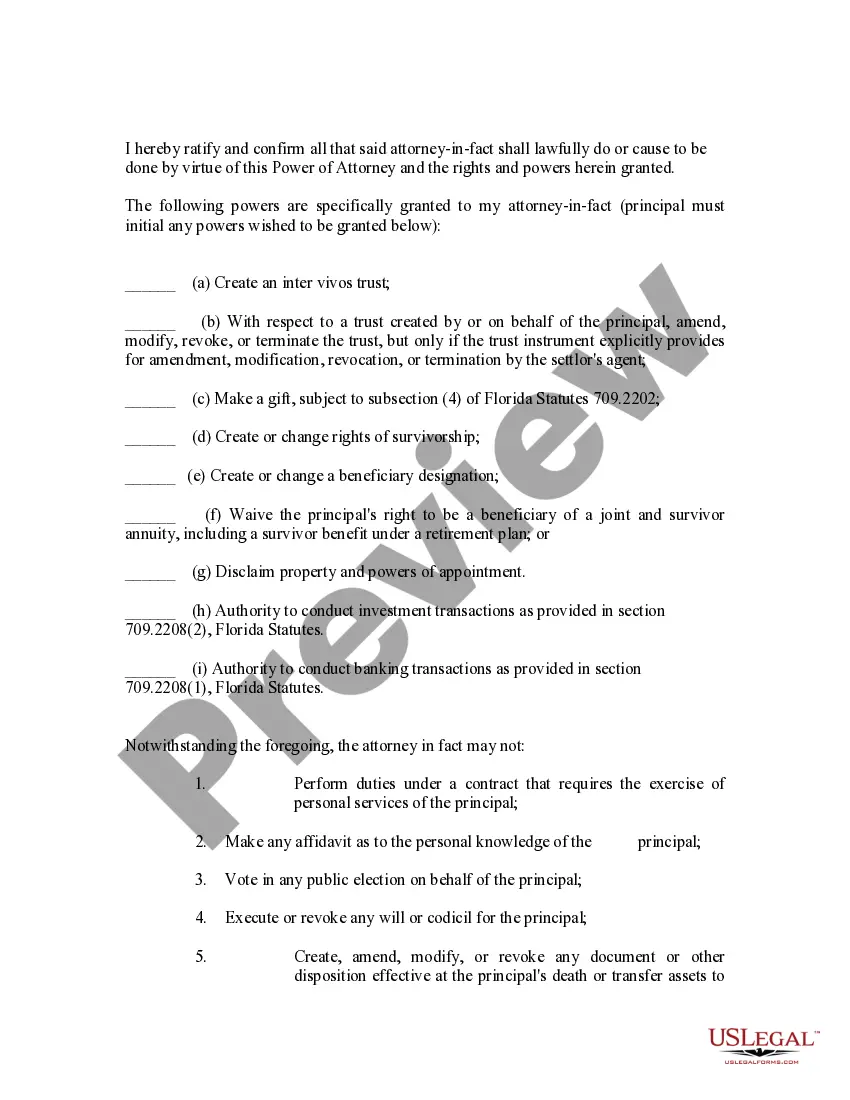

- Initials for specific powers granted to the attorney-in-fact

- Notary acknowledgment section

When to use this document

This form is needed when a purchaser intends to buy a property but cannot be physically present to manage the purchase process. It is particularly useful in situations where the buyer is out of state or otherwise unable to attend closing appointments. By granting this power, the buyer ensures the transaction can be completed without delay.

Who this form is for

This form is ideal for:

- Individuals purchasing real estate who are unable to attend the closing

- Real estate investors managing multiple transactions

- Buyers facilitating a property purchase on behalf of another party

How to prepare this document

- Identify the principal and attorney-in-fact by entering their full names and addresses.

- Specify the real estate property being purchased by including its legal description and address.

- Grant specific powers to the attorney-in-fact by initializing the corresponding sections of the form.

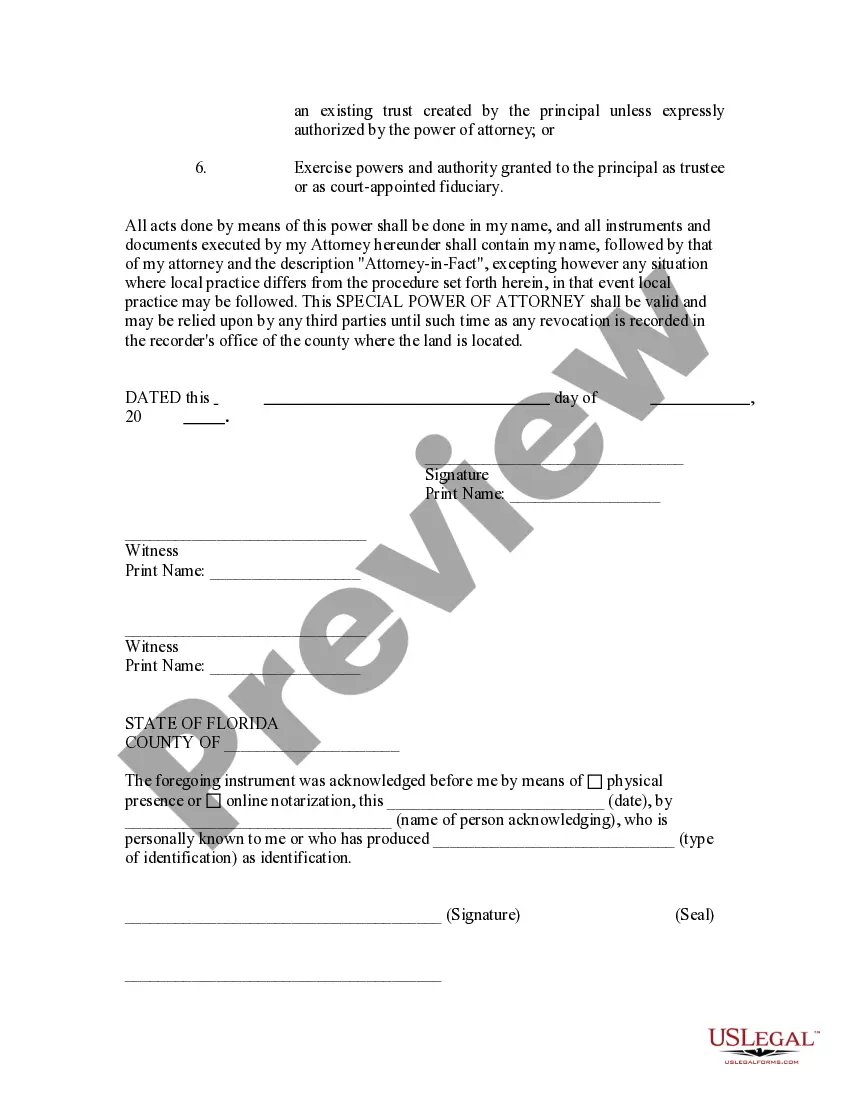

- Ensure the form is signed and dated by the principal.

- Complete the notary acknowledgment section to verify the signature.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Typical mistakes to avoid

- Failing to properly identify the attorney-in-fact.

- Not providing a complete and accurate property description.

- Omitting initials on specific powers granted.

- Neglecting to have the form notarized correctly.

Why complete this form online

- Convenient access from anywhere, allowing you to complete the form at your convenience.

- Editability provides flexibility to customize the form for your specific needs.

- Reliable templates drafted by licensed attorneys, ensuring legal adherence.

Form popularity

FAQ

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

Step 1: Bring Your Power of Attorney Agreement and ID. Step 2: Determine the Preferred Signature Format. Step 3: Sign as the Principal. Step 4: Sign Your Own Name. Step 5: Express Your Authority as Attorney-in-Fact. Step 6: File the Documentation Somewhere Safe.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.