Florida Assignment to Living Trust

About this form

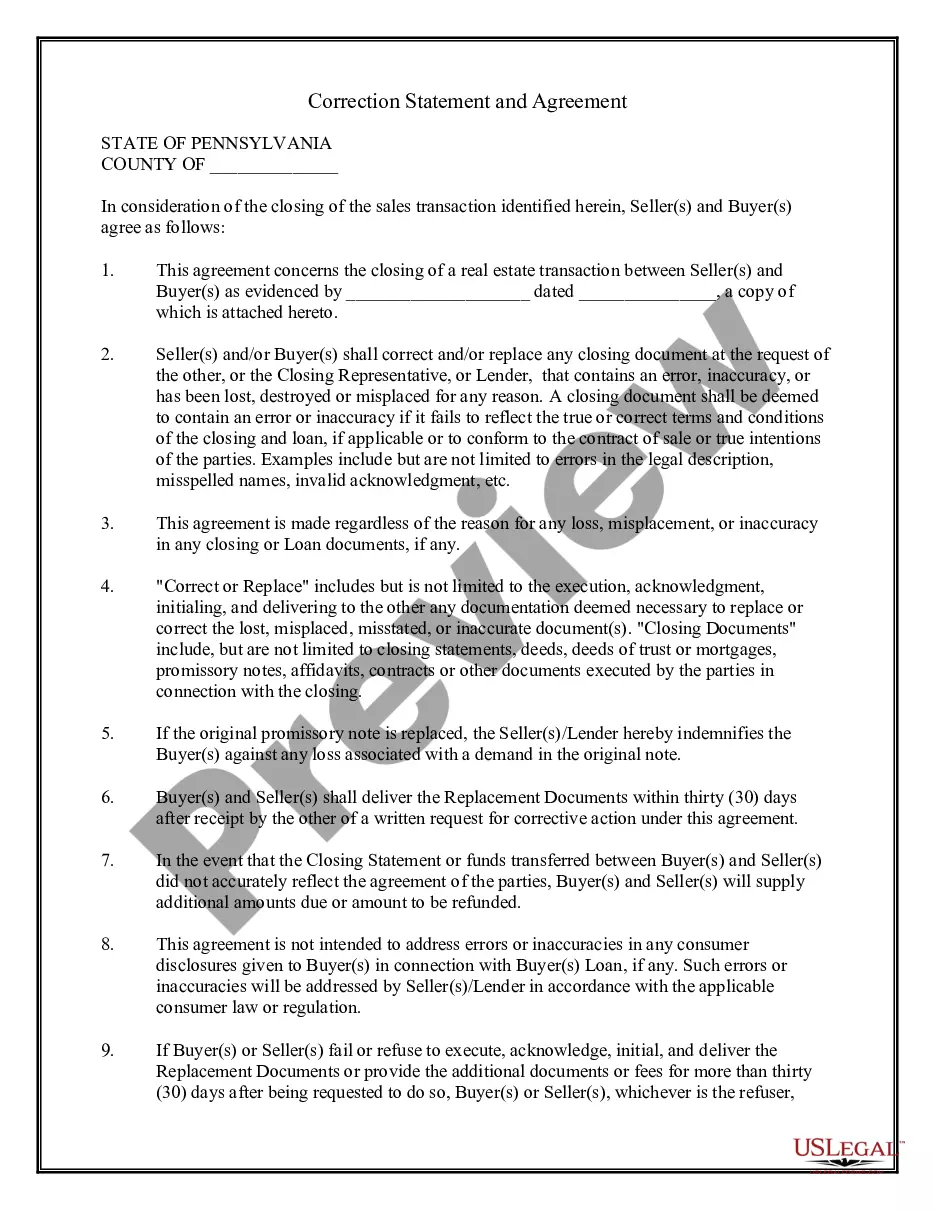

The Assignment to Living Trust form is used to transfer ownership of specific property to a Living Trust. This type of trust is created during a person's lifetime and allows assets to be managed for estate planning purposes. By assigning property to a living trust, individuals can streamline the distribution of their assets after death and potentially avoid probate, enhancing the privacy and efficiency of estate management.

Form components explained

- Date of assignment.

- Name and address of the Assignor (the individual transferring the property).

- Identification of the Trustee and details of the Living Trust.

- Signatures of the Assignor and the Trustee.

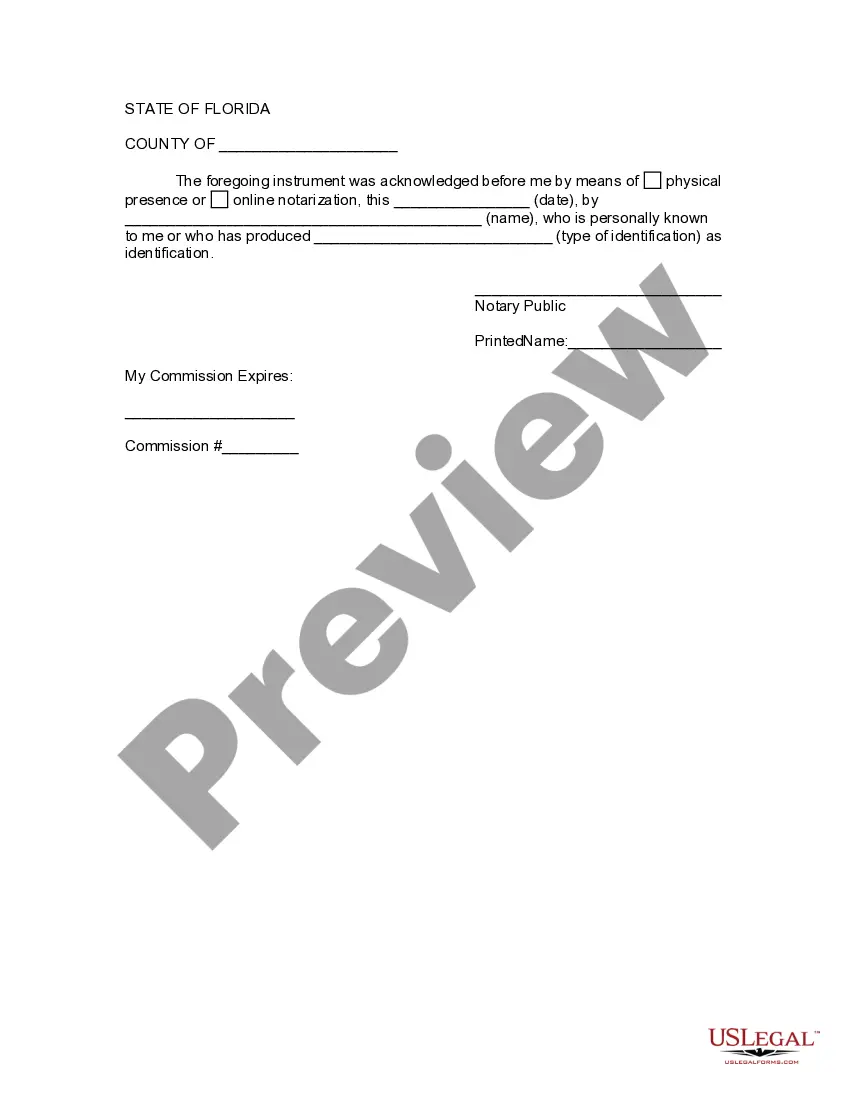

- Notary acknowledgment section to confirm the validity of the signatures.

Common use cases

This form is necessary when an individual wishes to place their property into a Living Trust. It can be used when individuals are planning their estates, transferring property to their Living Trust, or ensuring that their assets are managed according to their wishes during their lifetime and after their passing.

Who can use this document

- Individuals who want to establish a Living Trust for estate planning.

- Property owners who plan to assign their assets to a trust during their lifetime.

- Anyone involved in managing or creating a Living Trust, including family members acting as Trustees.

Completing this form step by step

- Identify and input the date on which the assignment is made.

- Provide the name and address of the Assignor.

- Specify the name of the Trust and the date it was created.

- Ensure both the Assignor and Trustee sign the form where indicated.

- Complete the notary section by having the documentation acknowledged by a notary public.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to sign the form in front of a notary public.

- Not specifying the correct property being assigned to the Living Trust.

- Omitting the date of the assignment.

Benefits of using this form online

- Convenience of accessing and downloading at any time.

- Editability allows for customization to fit specific needs.

- Reliability, as forms are drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

To transfer your property to a living trust in Florida, you will first need to create the trust document, clearly stating your intentions. Next, you should sign the deed transferring the property from your name into the trust's name, which may involve specific legal language. It's important to properly file this deed with the county clerk's office to finalize the Florida Assignment to Living Trust. For assistance, consider using US Legal Forms, which provides easy-to-follow templates and guidance for this process.

You do not necessarily need an attorney to prepare a living trust in Florida, but consulting one can be beneficial. A Florida Assignment to Living Trust involves specific legal requirements that may be complex. While you can use online resources or templates to create a living trust, an attorney can provide personalized guidance and ensure that your trust meets state laws. Using platforms like uslegalforms can simplify the process as they offer user-friendly tools to assist you in drafting a living trust correctly.

The biggest mistake parents often make when setting up a trust fund is failing to communicate with their children about the trust's purpose and terms. This lack of communication can lead to misunderstandings and conflicts down the line. A well-structured Florida Assignment to Living Trust can help alleviate these issues, but discussing your intentions with your family is equally important. Using resources like uslegalforms can guide you through this process and ensure your trust is clear, effective, and beneficial for everyone involved.

Yes, you can prepare your own living trust in Florida. However, it is essential to understand the legal requirements and implications involved in creating a Florida Assignment to Living Trust. While DIY options are available, many people find that using a professional service or platform, like uslegalforms, provides added assurance that the trust meets all state laws and effectively addresses their estate planning needs.

The exact cost will depend on the attorney's fees, but you could end up paying more than $1,000. Before choosing an attorney to work with, make sure you understand the fees they'll charge and also note whether the attorney specializes in trusts.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

If your main goal is to avoid probate court, so long as you have assets that will not pass through probate then you will not need a trust. However, if you have assets that will pass through probate, the a Florida revocable living trust will be a good idea.

A Florida living trustallows you to transfer assets into a trust during your lifetime while you continue to use them, and then have them distributed to your choice of beneficiaries after your death. Living trusts have many benefits and are an appealing estate planning option.

If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

One of the advantages of a revocable living trust as opposed to a will, is that upon your death, all the details of what you leave to who are private.A revocable living trust allows you to buy additional real estate at any time during your lifetime, in the name of the trust, whether in Florida or outside the state.