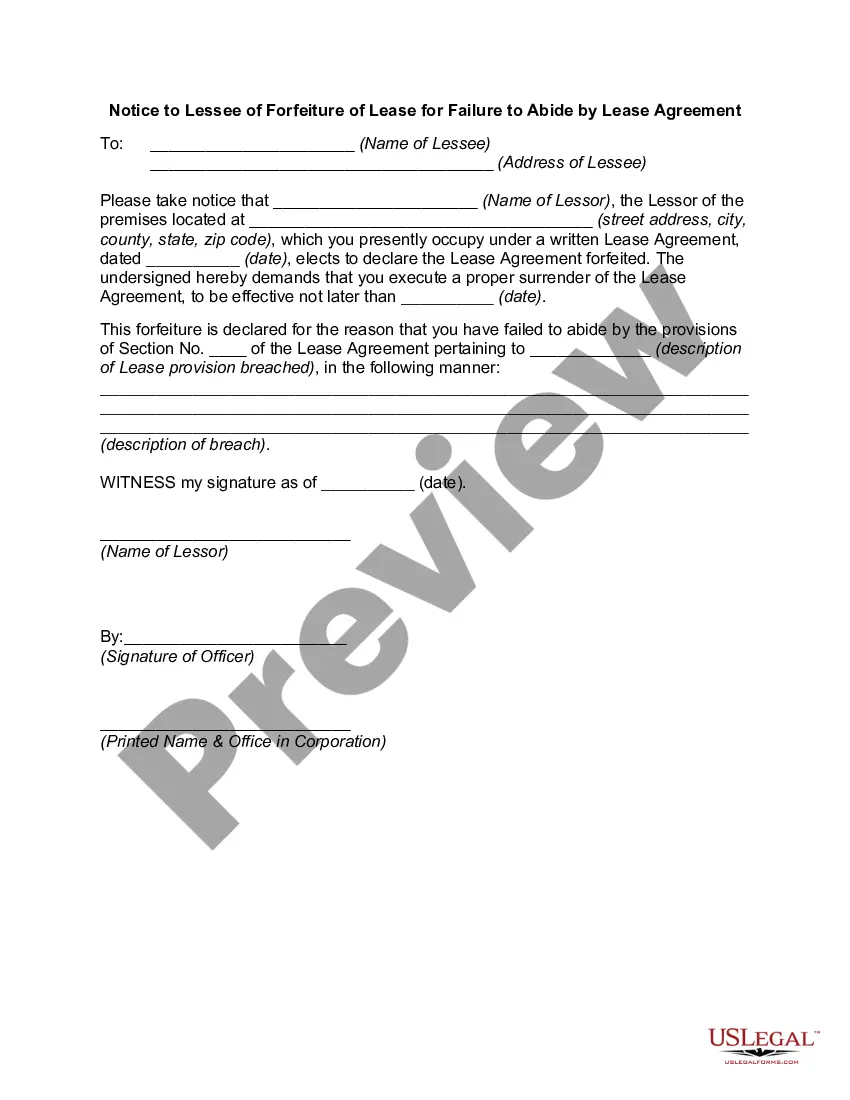

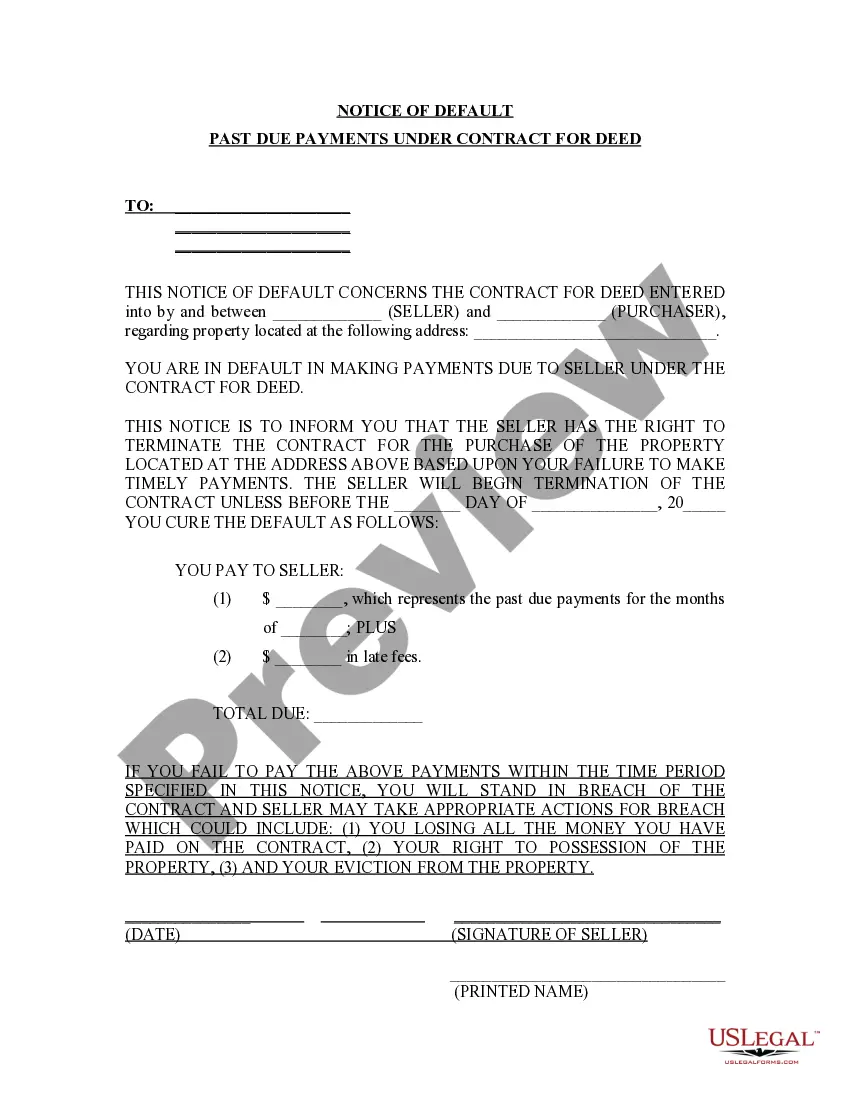

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Florida Notice of Default for Past Due Payments in connection with Contract for Deed

Description

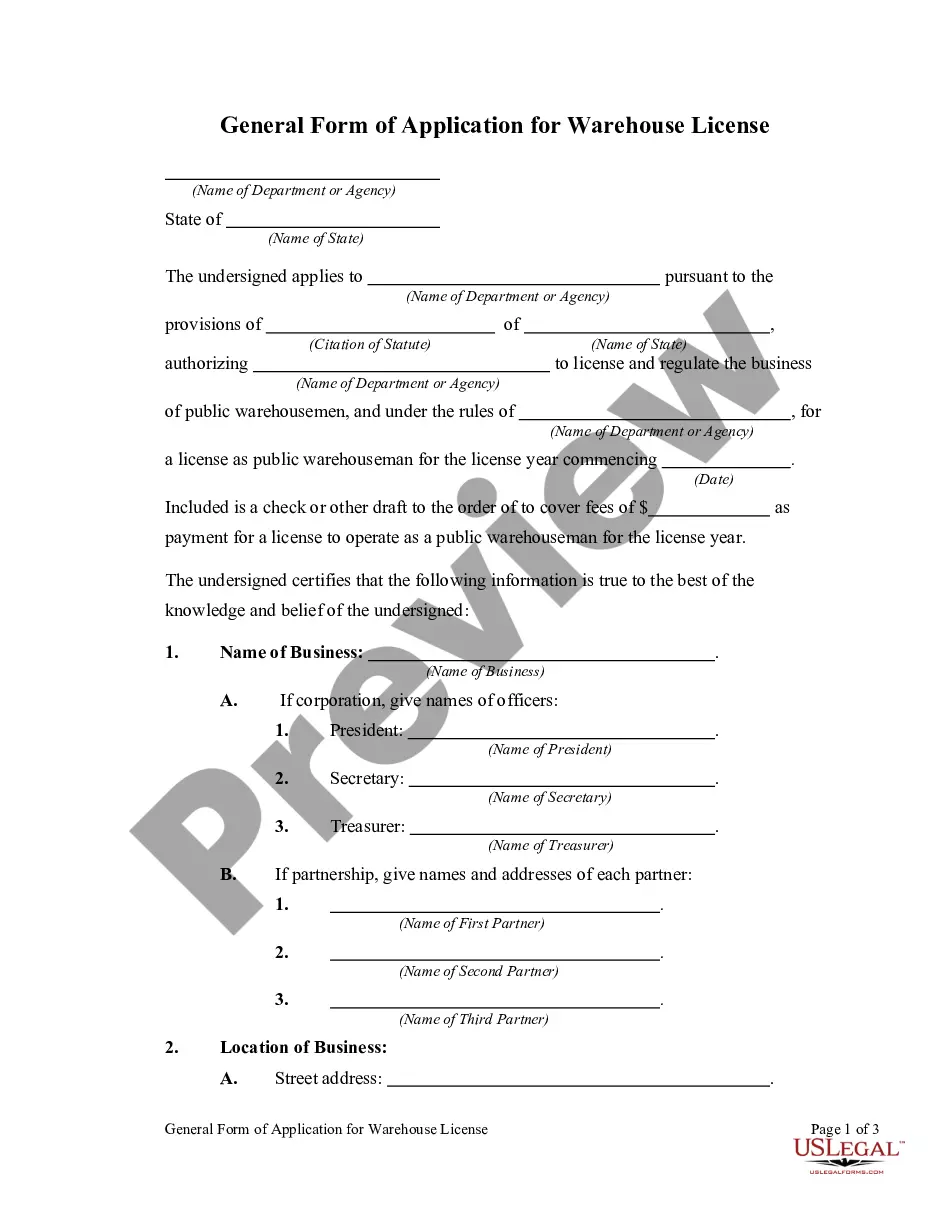

How to fill out Florida Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Florida Notice of Default for Unpaid Payments related to Contract for Deed.

Our court-acceptable forms are created and frequently updated by skilled attorneys.

Ours is the largest Forms library on the web and offers competitively priced and precise samples for consumers, lawyers, and small to medium-sized businesses.

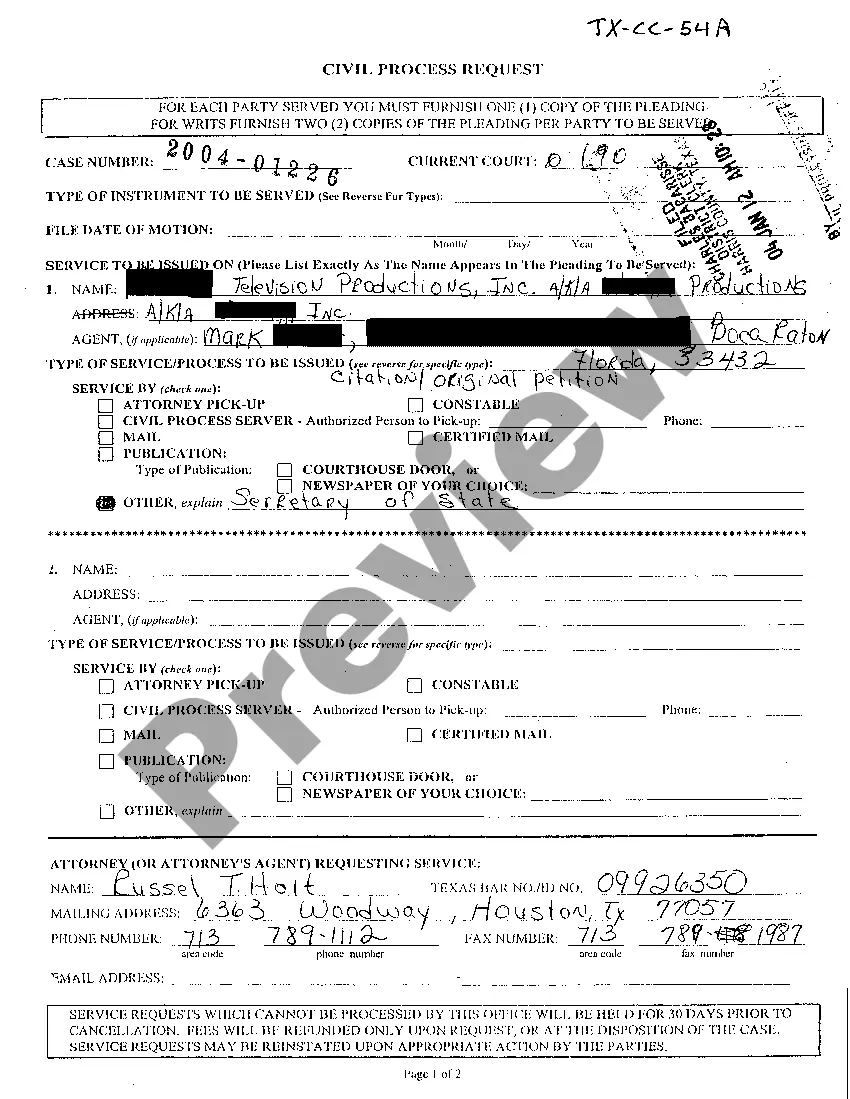

Click Buy Now if it is the document you seek. Create your account and pay via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search field if you need to find another document template. US Legal Forms offers a vast array of legal and tax documents and packages for both business and personal needs, including Florida Notice of Default for Unpaid Payments in connection with Contract for Deed. Over three million users have successfully used our service. Select your subscription plan and receive high-quality forms in just a few clicks.

- The templates are categorized by state and some can be previewed prior to download.

- To access templates, customers must have a subscription and Log In to their account.

- Click Download next to any form of interest and locate it in My documents.

- For users without a subscription, follow these steps to effortlessly find and download Florida Notice of Default for Unpaid Payments related to Contract for Deed.

- Ensure you have the correct template for the relevant state.

- Examine the document by reading the description and using the Preview feature.

Form popularity

FAQ

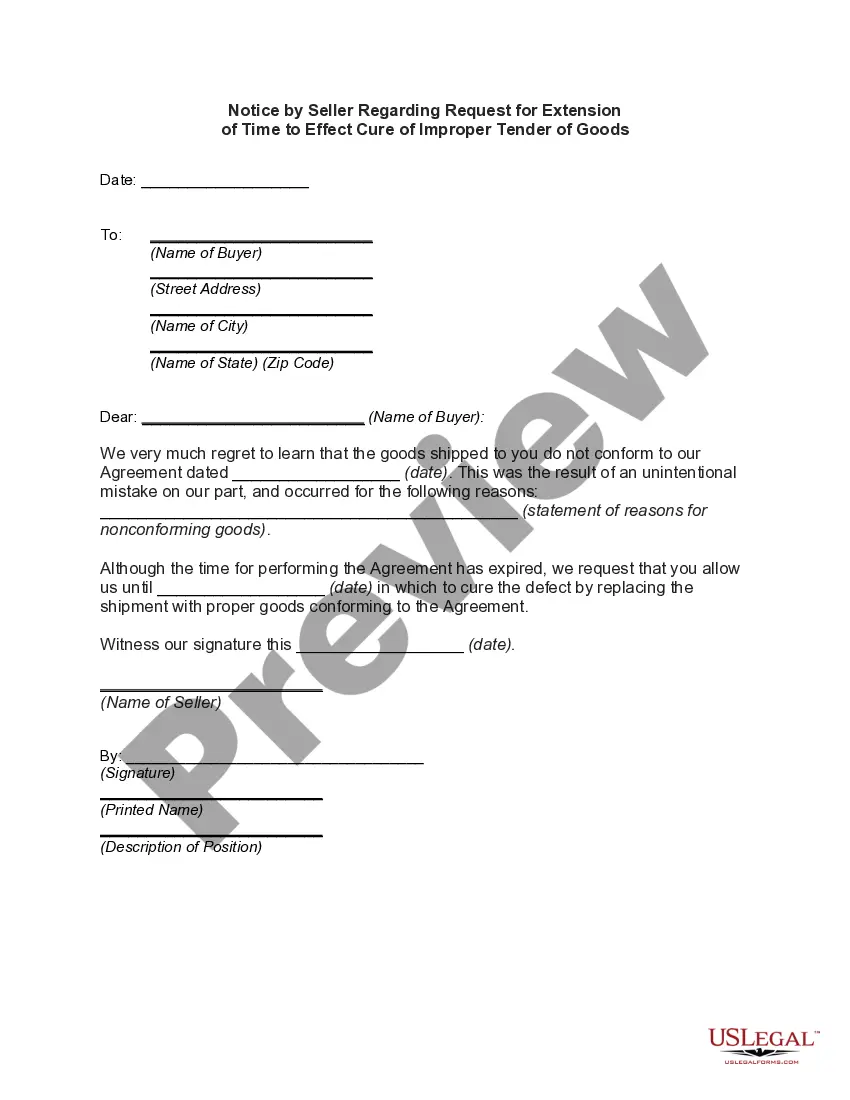

After a buyer pays back the debt established by a land sale contract, they obtain a clear title to the property, signifying full ownership. The seller must fulfill any obligations to transfer ownership formally. It is a significant milestone for buyers, marking the end of their installment payments. For assistance with executing the final steps efficiently, platforms like USLegalForms can be invaluable.

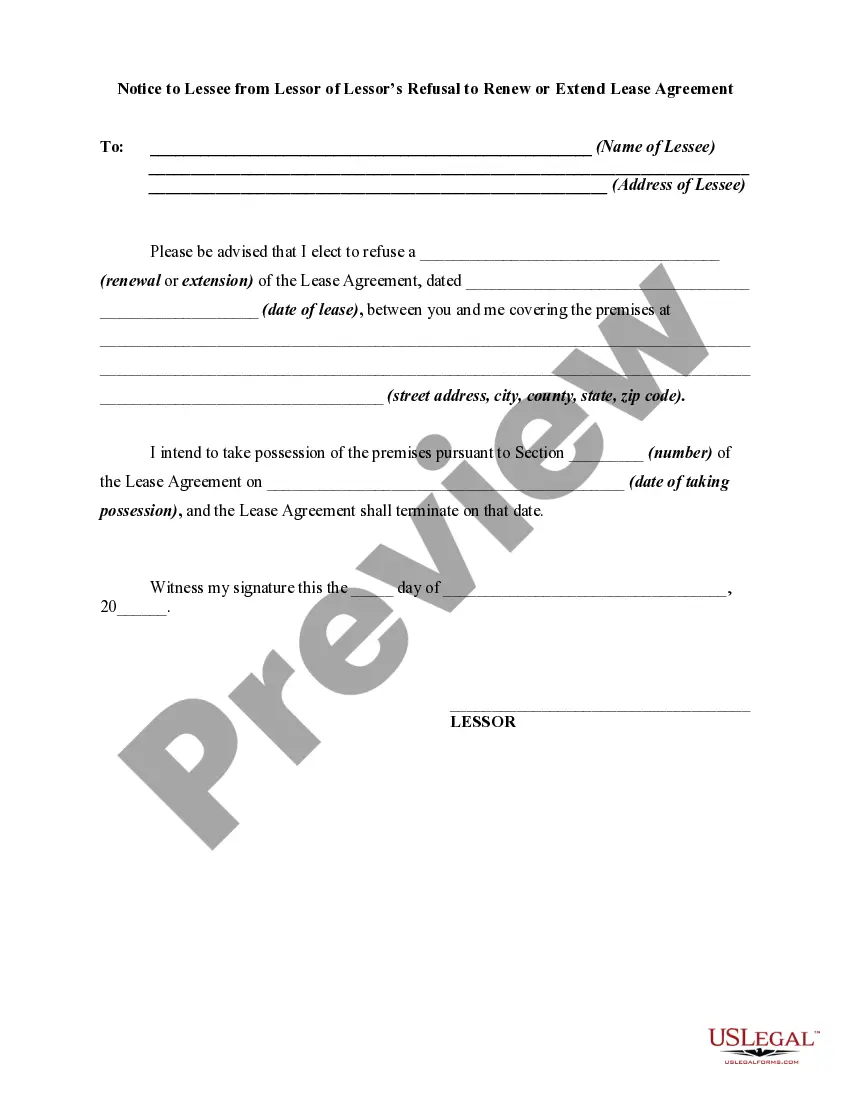

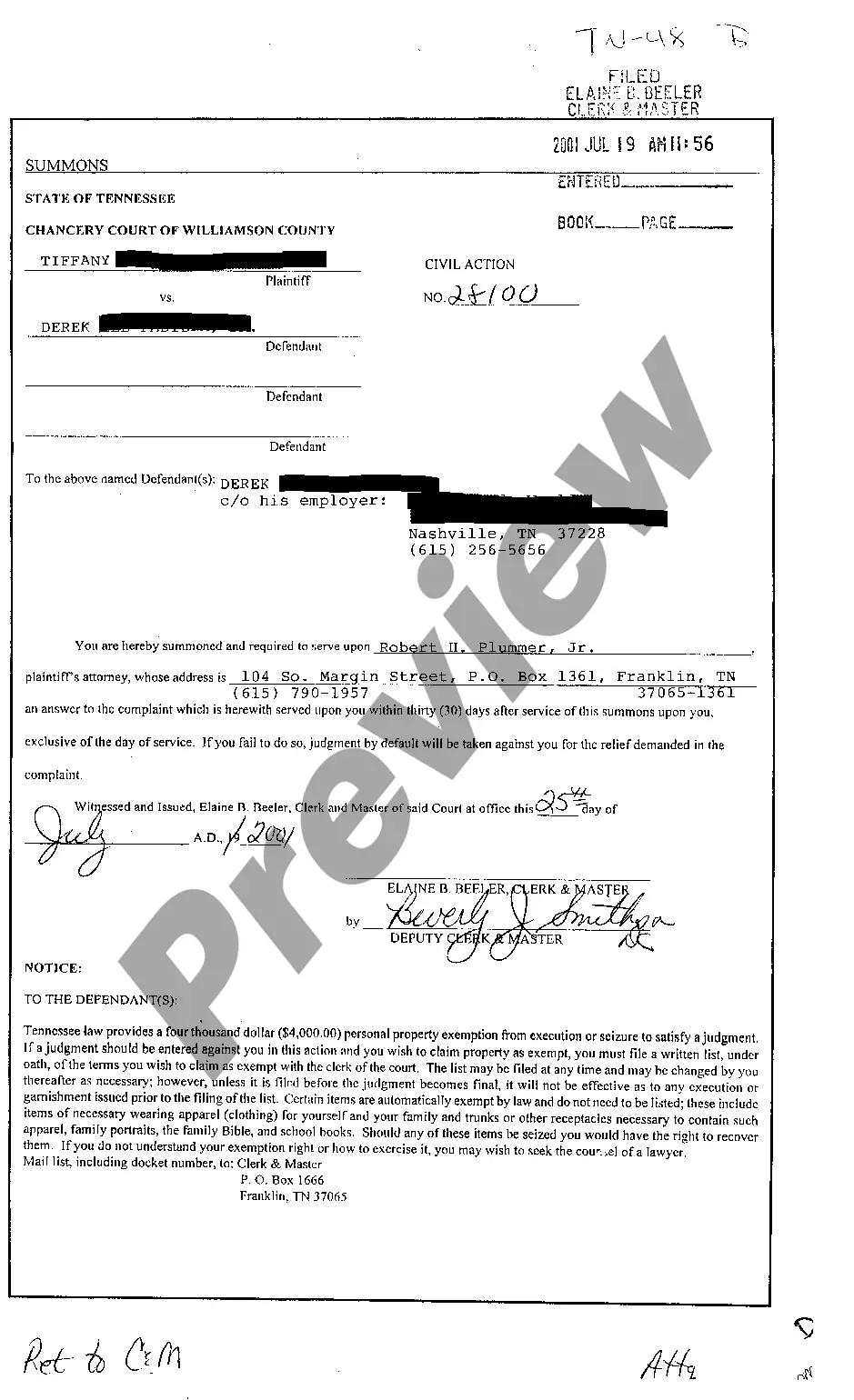

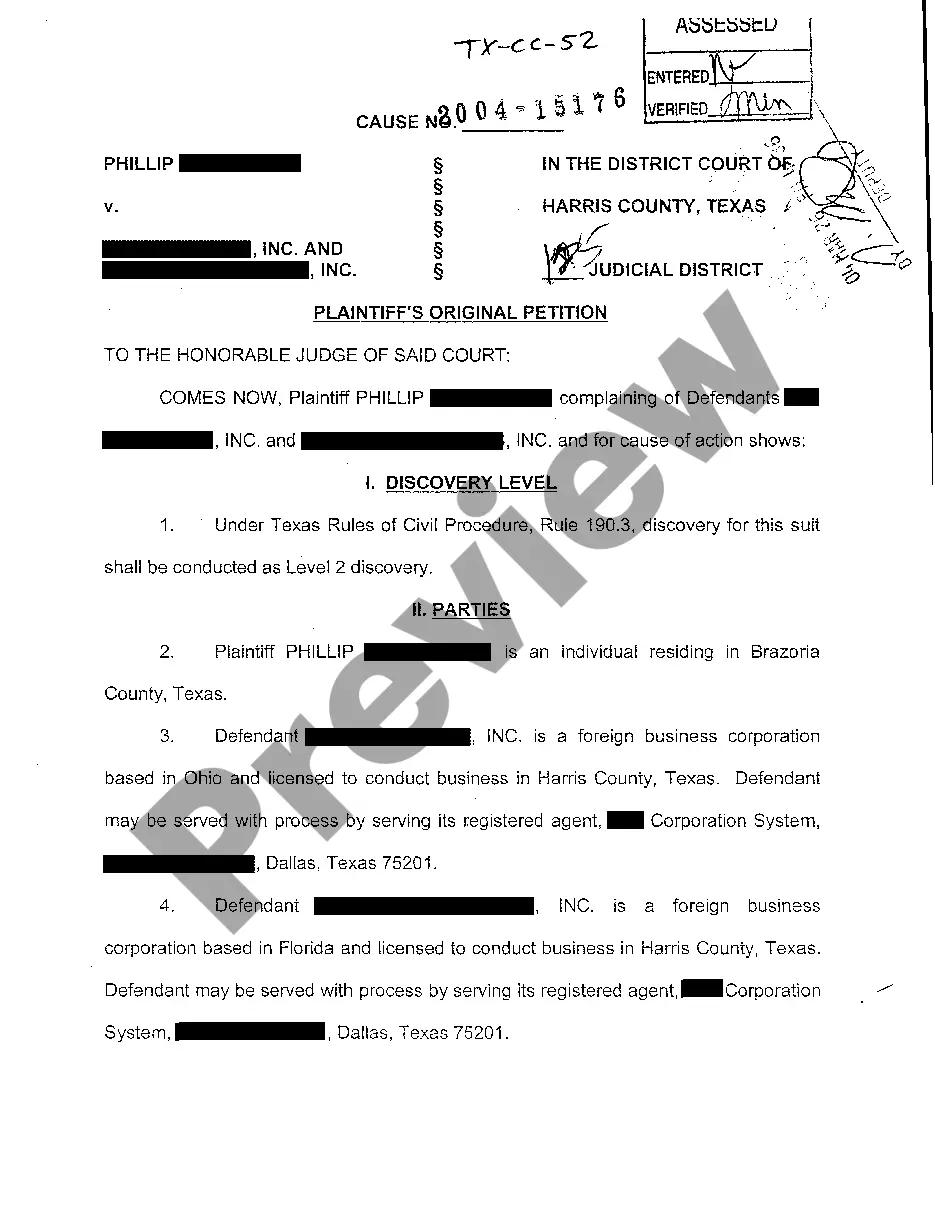

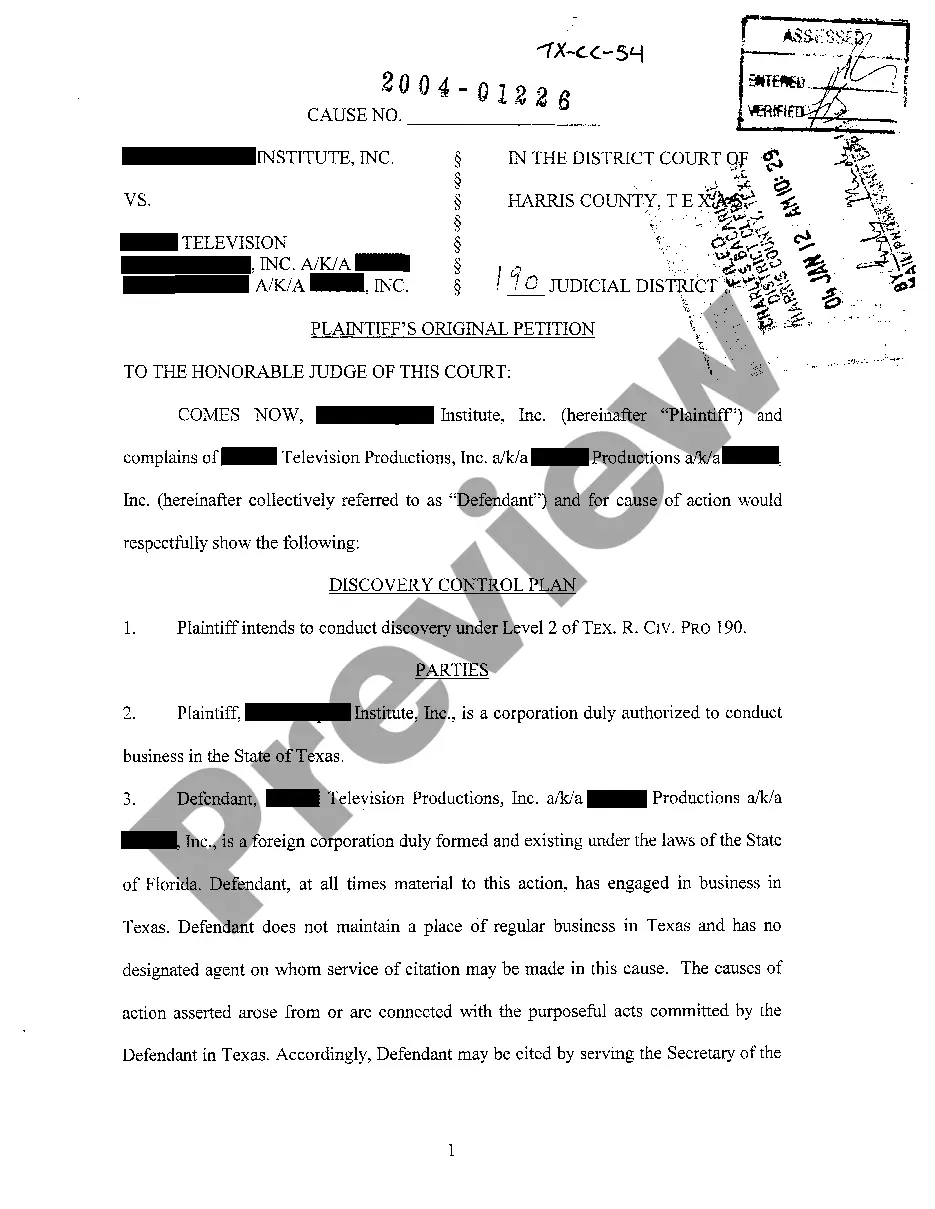

When a buyer defaults on payments under a land contract, the seller usually has to follow specific legal procedures, which may include issuing a Florida Notice of Default for Past Due Payments. This formal notice alerts the buyer about their overdue status, providing an opportunity to rectify the situation. Failure to respond may lead to further action, including foreclosure. Thus, staying proactive and informed is important to navigate this process.

The default clause in a land contract specifies the conditions under which a buyer may be considered in default, such as failing to make timely payments. This clause outlines the seller's rights, including issuing a Florida Notice of Default for Past Due Payments if the buyer does not comply. Understanding this clause can help buyers avoid pitfalls and protect their interests. Always read contracts thoroughly and consider legal advice if needed.

Stopping payments on a land contract can lead to serious consequences. The seller may issue a Florida Notice of Default for Past Due Payments, allowing them to take legal action to reclaim the property. This situation can result in losing the home and any investment made. It is important to communicate with the seller and explore options rather than allowing the situation to escalate.

If a buyer defaults on a land contract in Florida, the seller typically has the right to initiate a Florida Notice of Default for Past Due Payments. This notice serves to inform the buyer of their overdue payments and the potential consequences. The seller may reclaim the property if the buyer does not remedy the default within the specified timeframe. Therefore, staying informed about your rights and obligations is essential.

When a contract for deed is in default, the seller must follow a legal process to regain possession of the property. This typically involves issuing a Florida Notice of Default for Past Due Payments and allowing a specific period for the buyer to remedy the default. If the buyer fails to correct the issue, the seller may need to initiate legal proceedings to reclaim possession and equitable title. It's advisable for sellers to consult with legal professionals or platforms like uslegalforms to ensure all procedures are followed correctly.

When you receive a notice of default, it triggers a series of critical steps you should take. First, review the notice carefully to understand the specifics of the missed payments and timelines involved. Next, contact your lender or the entity that issued the Florida Notice of Default for Past Due Payments in connection with Contract for Deed to discuss your options. Prompt communication can sometimes lead to alternatives that prevent escalation to foreclosure.

Default refers to the failure to fulfill the payment obligations outlined in a contract for deed or mortgage agreement. Foreclosure, on the other hand, is the legal process initiated by the lender or seller to reclaim the property after a default notice has been issued. In Florida, a Notice of Default for Past Due Payments is often the precursor to foreclosure proceedings, signaling that serious legal actions may follow if payments are not made. Understanding this distinction helps you to navigate the situation more effectively.

Receiving a default notice is a serious matter that should not be taken lightly. This notice indicates that you are at risk of losing your property if payments are not made. In Florida, a Notice of Default for Past Due Payments in connection with Contract for Deed can lead to foreclosure proceedings if the issue is not addressed swiftly. It is crucial to act quickly to discuss your options and potentially resolve the situation before it escalates.

A notice of default is a formal declaration issued when a borrower fails to meet the obligations of their mortgage or contract for deed. In the context of Florida, a Notice of Default for Past Due Payments signals that payments have not been made as agreed upon. This document serves as a warning and indicates that the lender or seller intends to take further action if the situation remains unresolved. It is important to address this notice promptly to avoid further legal complications.