Delaware Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

Are you presently within a place in which you need papers for either organization or personal functions virtually every day time? There are a lot of legal papers web templates accessible on the Internet, but getting versions you can depend on is not simple. US Legal Forms offers thousands of kind web templates, such as the Delaware Affidavit of Heirship - Descent, which are published to satisfy state and federal demands.

When you are presently informed about US Legal Forms website and also have an account, simply log in. Next, you may download the Delaware Affidavit of Heirship - Descent format.

Unless you provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is for the correct area/county.

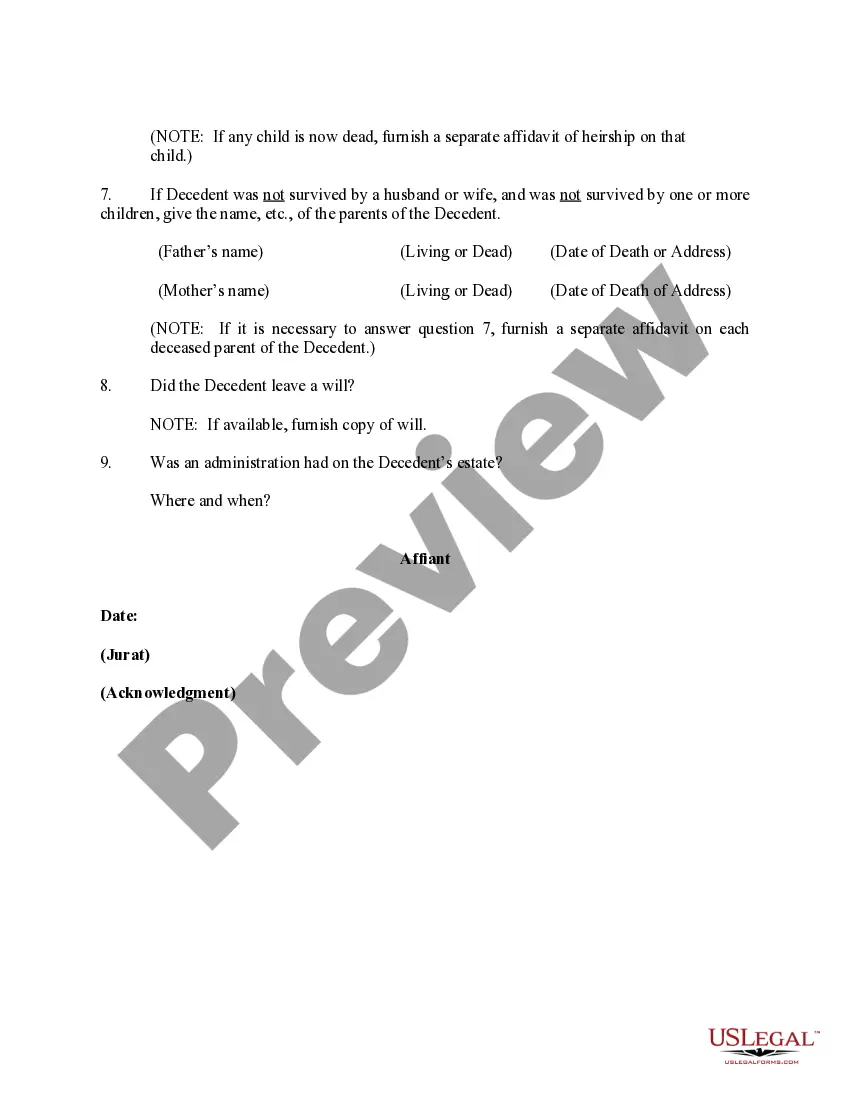

- Make use of the Review switch to review the shape.

- See the explanation to ensure that you have selected the appropriate kind.

- In case the kind is not what you are seeking, utilize the Research discipline to obtain the kind that meets your requirements and demands.

- Whenever you discover the correct kind, click Buy now.

- Pick the costs prepare you want, fill out the necessary details to create your account, and pay money for an order utilizing your PayPal or charge card.

- Choose a handy file formatting and download your backup.

Locate every one of the papers web templates you may have purchased in the My Forms food list. You may get a additional backup of Delaware Affidavit of Heirship - Descent at any time, if needed. Just click the necessary kind to download or printing the papers format.

Use US Legal Forms, probably the most comprehensive assortment of legal types, to conserve time as well as stay away from blunders. The support offers skillfully made legal papers web templates which you can use for an array of functions. Create an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

The presence or absence of a valid will after death does not determine whether an estate must be opened. Whenever there is a death in New Castle County, an estate must be probated if: The decedent had more than $30,000 in personal property in his/her name alone, or.

Despite the lack of statutory guidance on executor fees in Delaware, the general consensus among legal professionals is that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can fluctuate based on the specifics of the estate and the executor's responsibilities.

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

If the deceased's assets are less than $30,000, and there is no real estate in his/her name alone, the Register of Wills Office issues a Small Estate Affidavit to transfer the assets of your loved one.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

An estate is only eligible for a small estate affidavit if it meets state requirements and qualifications which are as follows: Thirty (30) days have passed since the deceased's date of death. The estate is valued at $30,000 or less.

A Delaware small estate affidavit is a document that allows inheritors to take possession of a deceased individual's estate without going through probate. To obtain the affidavit, the executor, relative, or next-of-kin of the deceased person will need to submit a request to the register of wills in their county.