Delaware Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

You are able to spend several hours on-line searching for the legitimate papers template that meets the state and federal needs you will need. US Legal Forms offers a huge number of legitimate varieties which are evaluated by professionals. You can easily obtain or produce the Delaware Affidavit of Heirship for Real Property from the services.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire button. Afterward, you may comprehensive, modify, produce, or signal the Delaware Affidavit of Heirship for Real Property. Each and every legitimate papers template you get is your own permanently. To acquire one more copy of the acquired develop, visit the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms site the very first time, stick to the easy recommendations under:

- First, make certain you have chosen the proper papers template to the region/city that you pick. Look at the develop information to ensure you have picked out the correct develop. If accessible, use the Preview button to search from the papers template too.

- If you wish to locate one more edition in the develop, use the Research discipline to get the template that fits your needs and needs.

- When you have discovered the template you need, click on Buy now to carry on.

- Pick the costs prepare you need, key in your qualifications, and register for an account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal bank account to fund the legitimate develop.

- Pick the structure in the papers and obtain it to your product.

- Make alterations to your papers if needed. You are able to comprehensive, modify and signal and produce Delaware Affidavit of Heirship for Real Property.

Acquire and produce a huge number of papers themes utilizing the US Legal Forms web site, that provides the most important assortment of legitimate varieties. Use professional and express-certain themes to deal with your company or individual requires.

Form popularity

FAQ

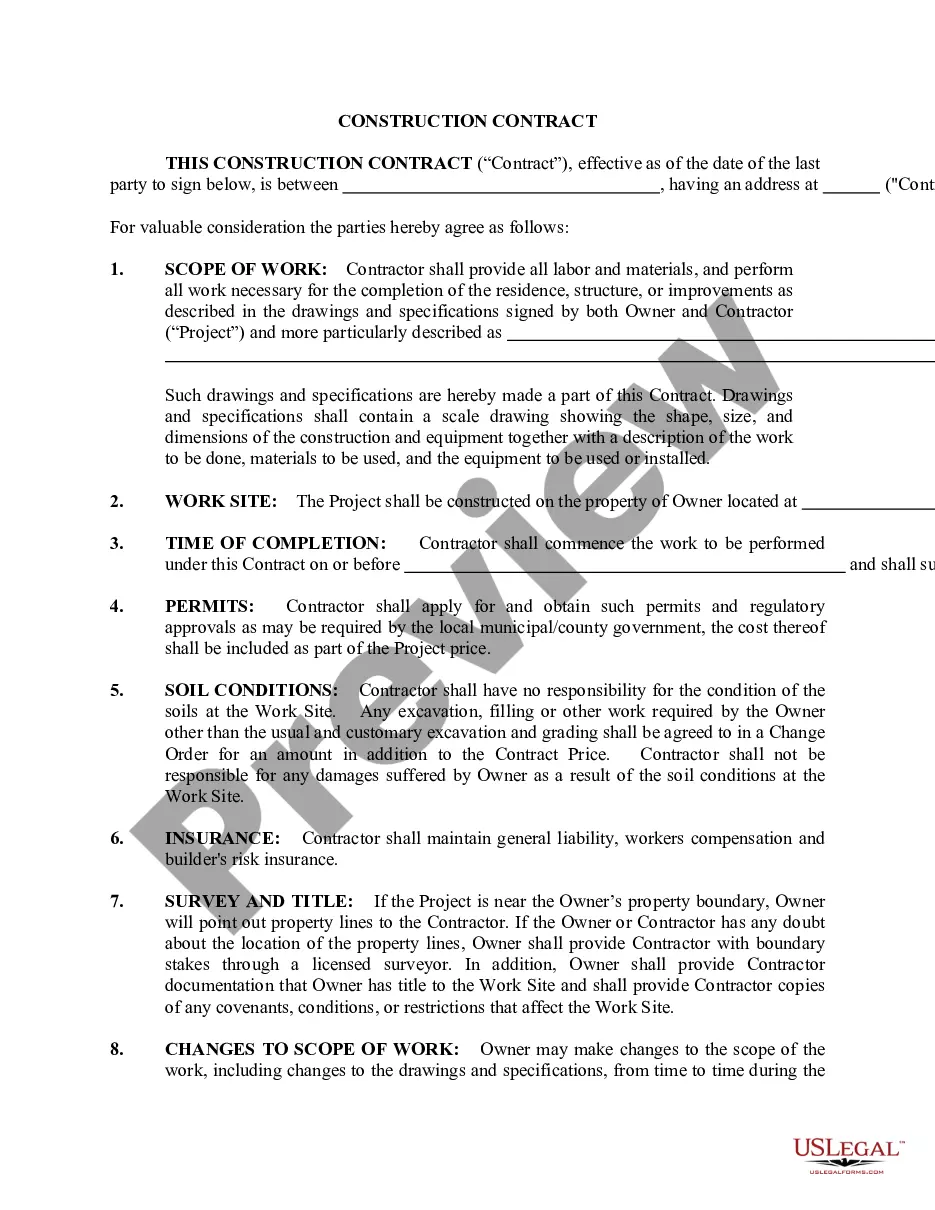

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.

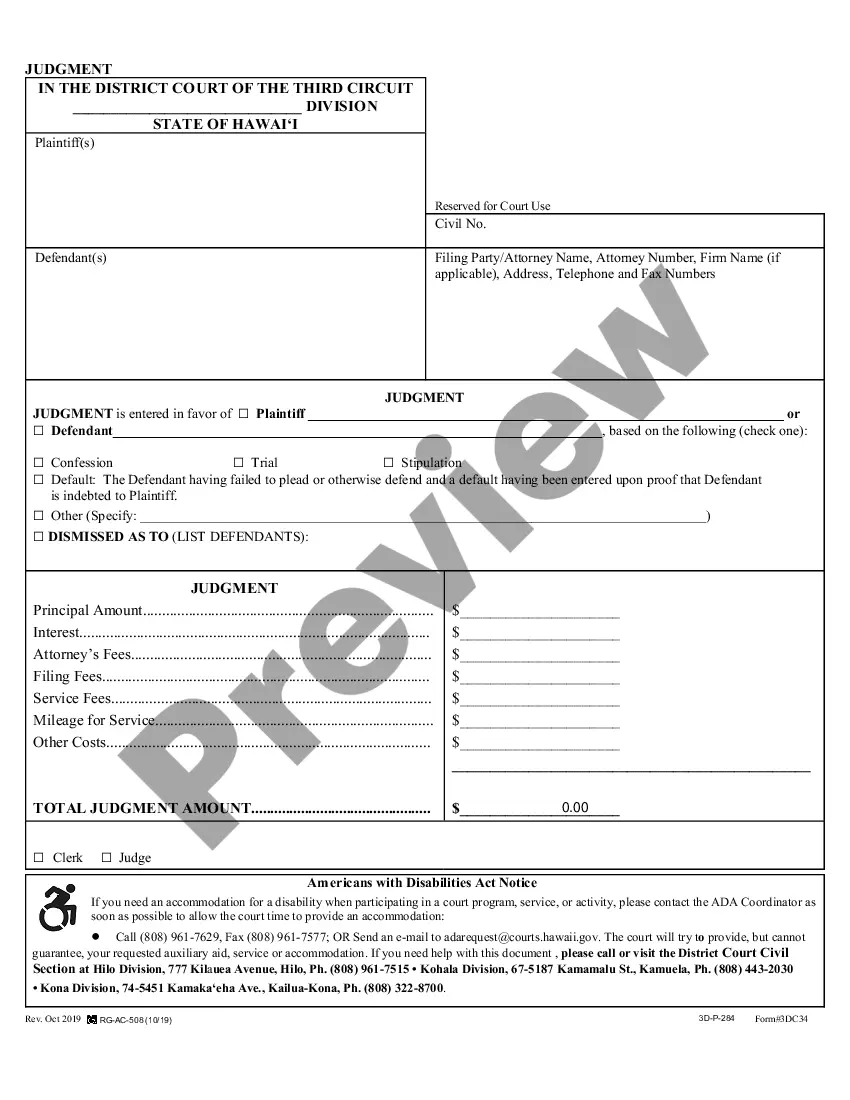

A small estate affidavit is a document issued by the Register of Wills office. It allows you to take possession of a deceased person's solely owned personal property, provided that these assets are less than $30,000 and there is no real estate.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

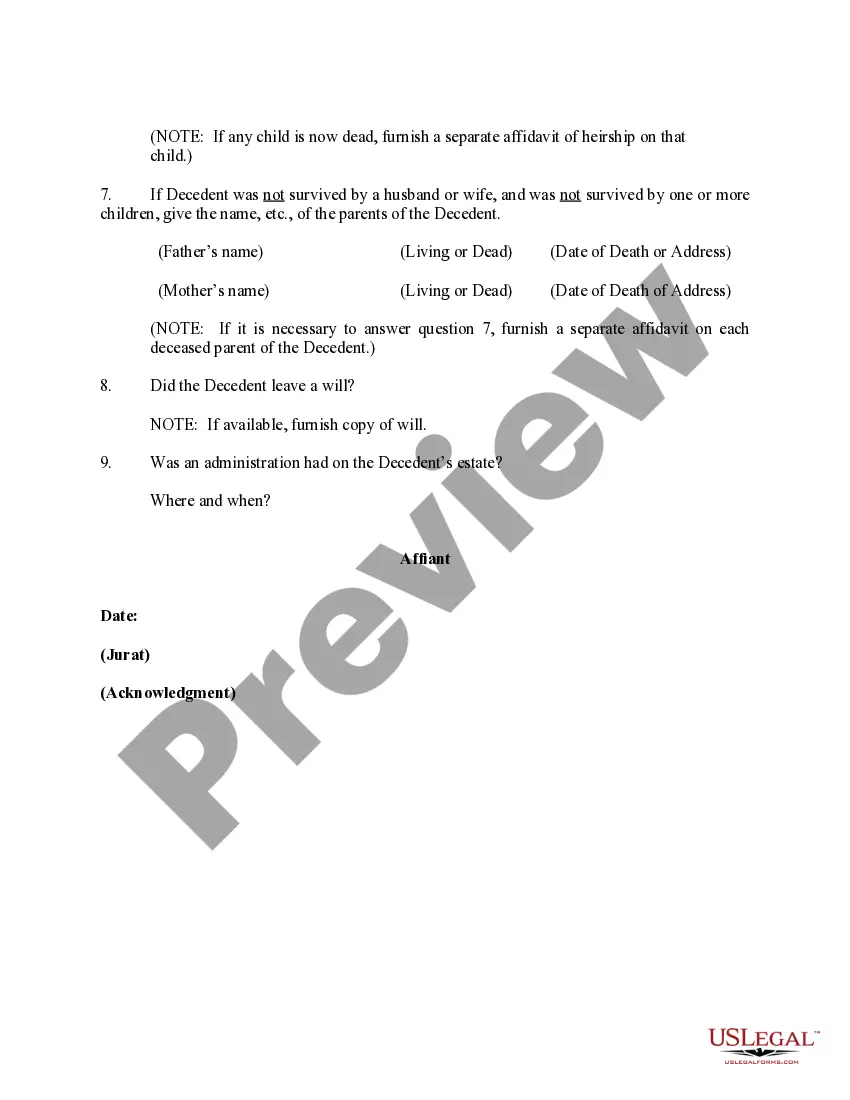

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

When is Probate Required? The decedent had more than $30,000 in personal property in his/her name alone, or. The decedent owned Delaware real estate in his/her name alone, either solely held or as a tenant in common.