Delaware Affidavit of Heirship for Mineral Rights

Description

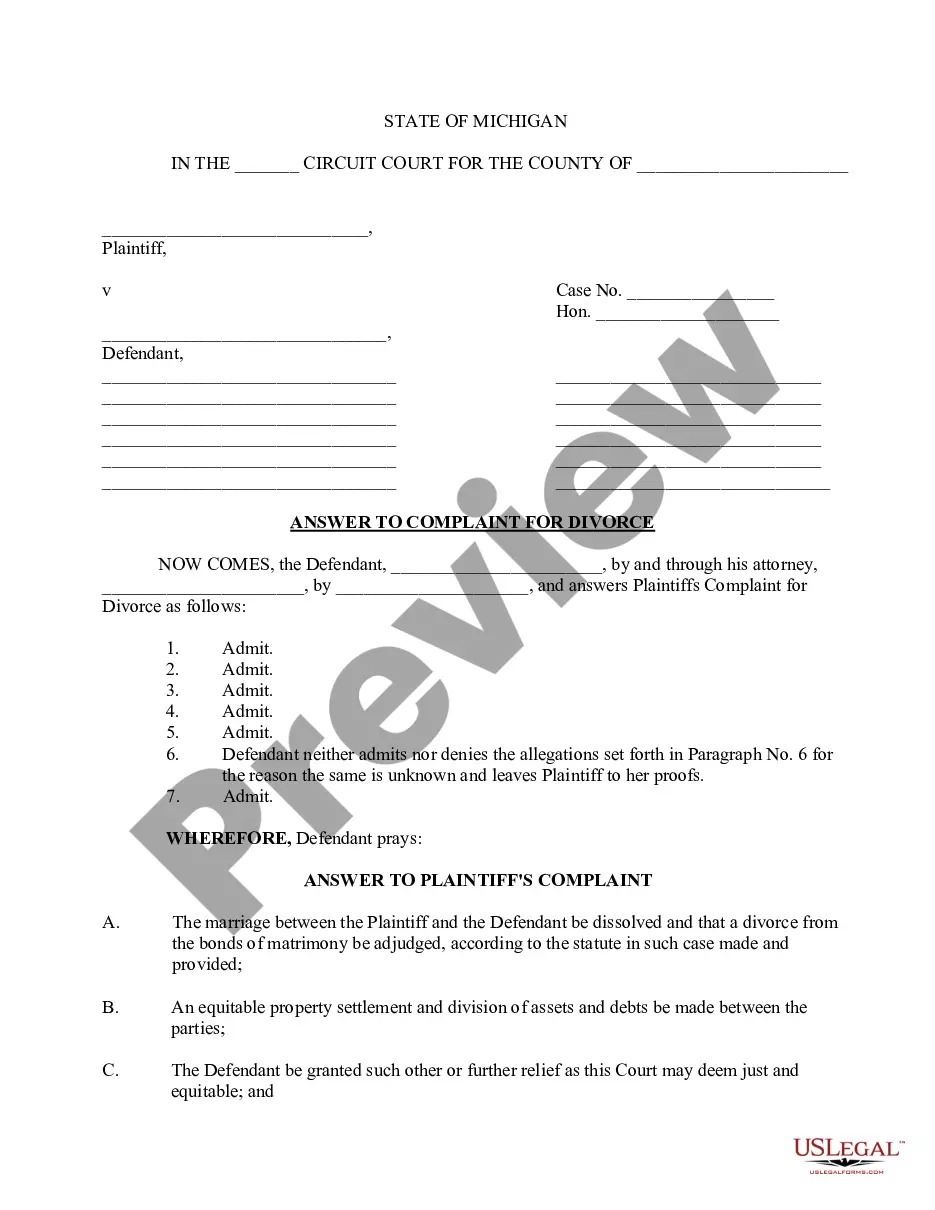

How to fill out Affidavit Of Heirship For Mineral Rights?

US Legal Forms - one of the greatest libraries of legitimate types in America - provides an array of legitimate document themes you are able to down load or print. While using web site, you can find 1000s of types for enterprise and specific uses, categorized by types, suggests, or key phrases.You will discover the newest types of types much like the Delaware Affidavit of Heirship for Mineral Rights within minutes.

If you already possess a membership, log in and down load Delaware Affidavit of Heirship for Mineral Rights through the US Legal Forms library. The Acquire switch will show up on each type you perspective. You gain access to all previously delivered electronically types inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, here are easy directions to obtain started off:

- Be sure you have selected the best type for your city/region. Click on the Review switch to analyze the form`s content material. Look at the type explanation to actually have selected the appropriate type.

- If the type does not suit your specifications, make use of the Look for industry on top of the display to find the one that does.

- In case you are happy with the form, validate your selection by visiting the Purchase now switch. Then, choose the rates program you prefer and offer your qualifications to register to have an accounts.

- Process the purchase. Make use of your credit card or PayPal accounts to perform the purchase.

- Select the structure and down load the form on your product.

- Make alterations. Load, modify and print and indicator the delivered electronically Delaware Affidavit of Heirship for Mineral Rights.

Every single design you included with your account lacks an expiration particular date and is the one you have for a long time. So, in order to down load or print an additional copy, just visit the My Forms segment and then click about the type you will need.

Get access to the Delaware Affidavit of Heirship for Mineral Rights with US Legal Forms, by far the most extensive library of legitimate document themes. Use 1000s of professional and status-specific themes that satisfy your small business or specific demands and specifications.

Form popularity

FAQ

To title and register a vehicle through heirship, you will need: Affidavit(s) of Heirship (Form VTR-262). If there is more than one heir, each of you must sign the form and have the signatures notarized. Heirs may fill out individual Affidavits of Heirship and must have each affidavit notarized.

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

The purpose of an Affidavit of Heirship is to put the county records on notice for mineral owners who are deceased that did not have probate proceedings administered to their estate.