Delaware Affidavit of No Coverage by Another Group Health Plan

Description

How to fill out Affidavit Of No Coverage By Another Group Health Plan?

Are you currently in a situation where you require documents for business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Delaware Affidavit of No Coverage by Another Group Health Plan, which can be customized to comply with state and federal regulations.

Choose a preferred document format and download your copy.

Access all the document templates you have purchased in the My documents list. You can obtain another copy of the Delaware Affidavit of No Coverage by Another Group Health Plan whenever necessary. Simply select the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- Then, you will be able to download the Delaware Affidavit of No Coverage by Another Group Health Plan template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/area.

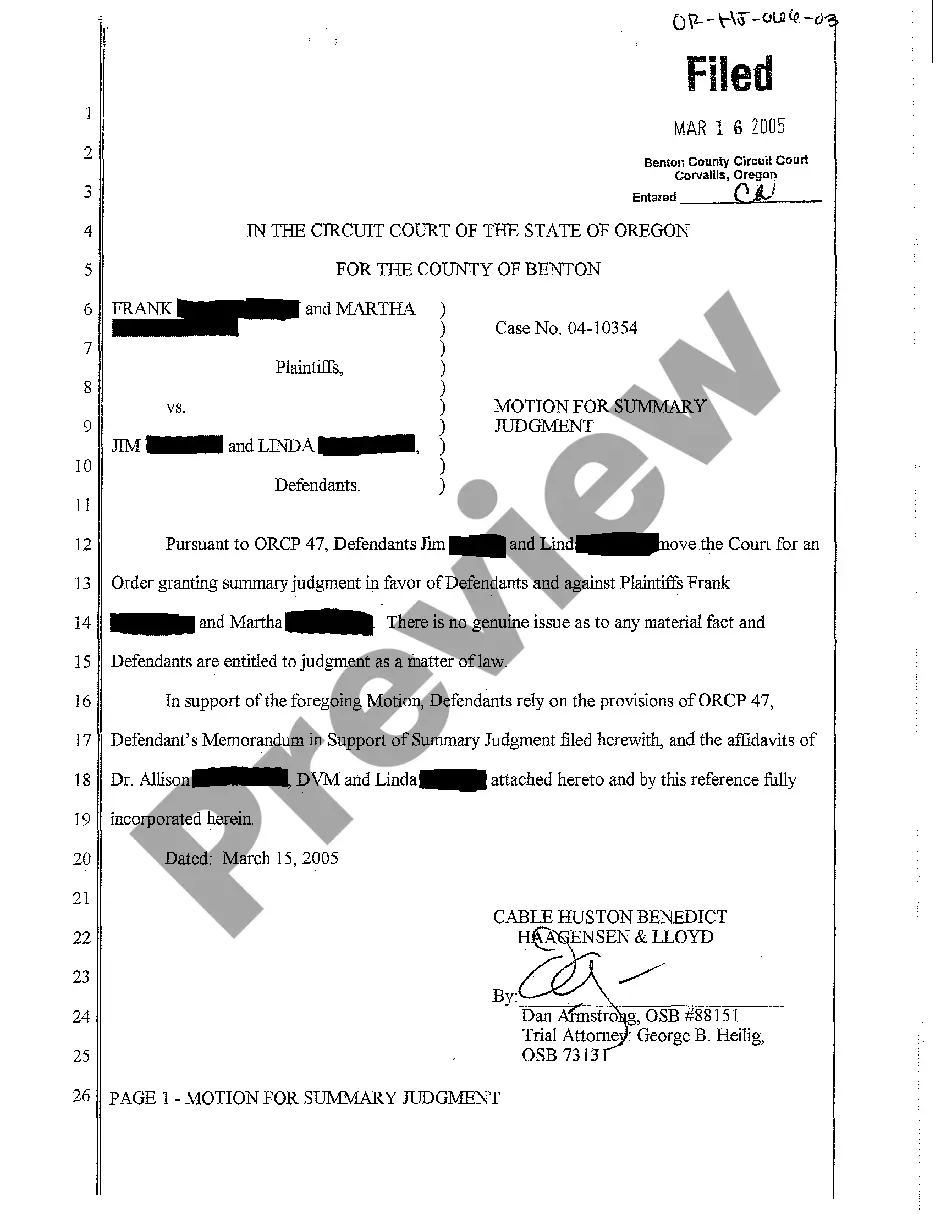

- Utilize the Preview button to examine the form.

- Read the description to ensure you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search section to find the form that suits your needs and requirements.

- When you locate the appropriate form, click Purchase now.

- Select the pricing plan you wish to use, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The primary purpose of the certificate is to show the amount of creditable coverage that you had under a group health plan or other health insurance coverage, because this can reduce or eliminate the length of time that any pre-existing condition clause in a new plan otherwise might apply to you.

Health insurance provided to employees by an employer or by an association to its members is called group coverage. Health insurance you buy on your ownnot through an employer or associationis called individual coverage.

People without health insurance in California must pay a penalty of $750 per adult and $375 per child. However, residents can claim a coverage exemption for the filing situations: Household income below the state threshold. Time without coverage was three consecutive months or less.

Insured coverage. Health insurance issuers and carriers must file Form 1095-B for most health insurance coverage, including individual market coverage and insured coverage sponsored by employers.

There are three basic types of group life insurance: group term life, group universal life and variable group universal life. The most common form of group life insurance is group term life. This is typically provided to the employees by the employer in the form of a 1-year annually renewable term insurance policy.

Group Insurance health plans provide coverage to a group of members, usually comprised of company employees or members of an organization. Group health members usually receive insurance at a reduced cost because the insurer's risk is spread across a group of policyholders.

Residents of Delaware are required to have health insurance coverage in accordance with the federal Affordable Care Act (ACA), although there are no individual penalties for failure to do so.

Obamacare's tax penalty went away in 2019. That means that if you don't have health insurance, you won't have to pay a penalty when you file your federal income taxes.

3. You won't face a tax penalty for going without health insurance in 2021but there are big downsides to being uninsured. Obamacare's tax penalty went away in 2019. That means that if you don't have health insurance, you won't have to pay a penalty when you file your federal income taxes.

Unlike in past tax years, if you didn't have coverage during 2021, the fee no longer applies. This means you don't need an exemption in order to avoid the penalty.