Delaware Individual Notice of Preexisting Condition Exclusion

Description

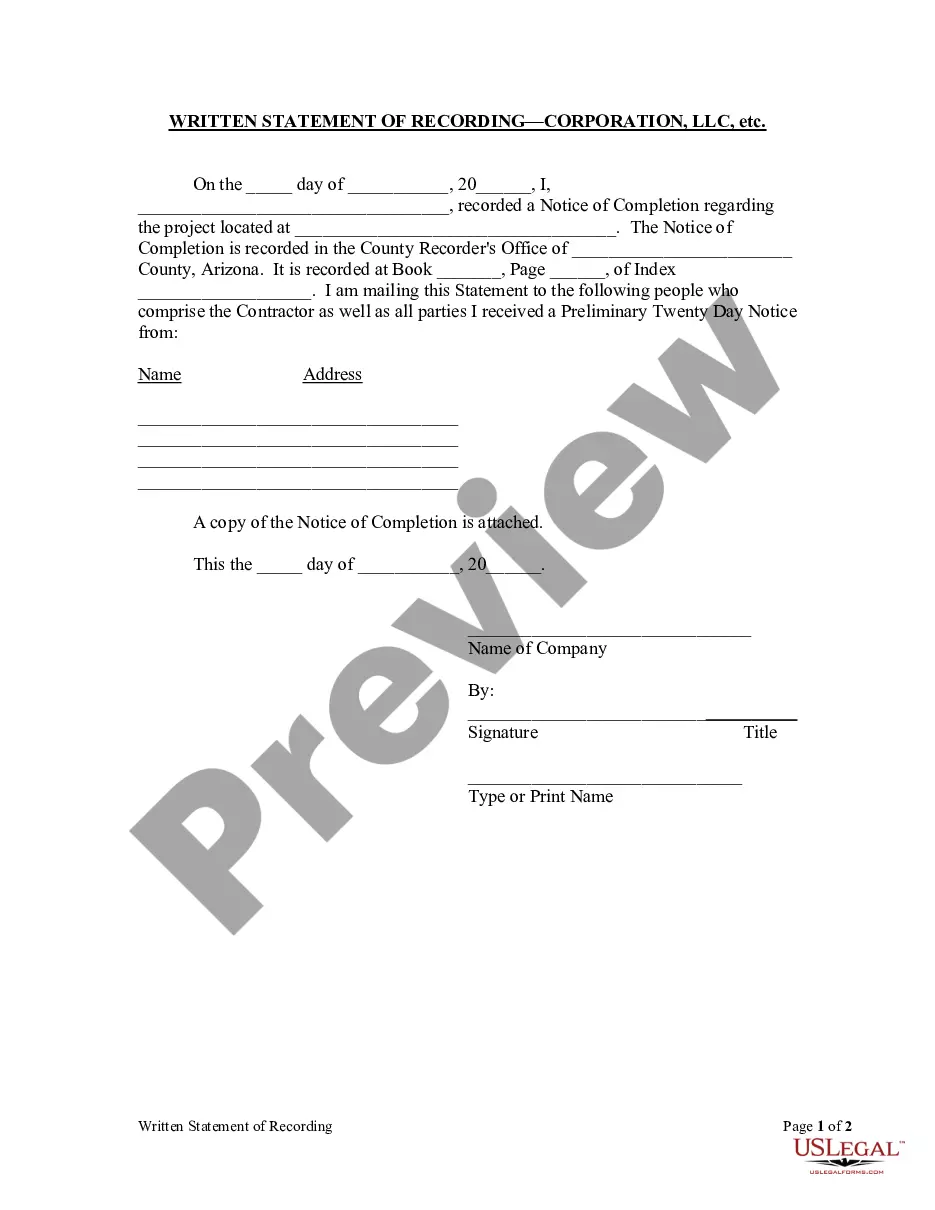

How to fill out Individual Notice Of Preexisting Condition Exclusion?

Locating the appropriate legal document template can be somewhat of a challenge.

Of course, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Delaware Individual Notice of Preexisting Condition Exclusion, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and read the description to confirm it is the right one for you.

- All documents are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Delaware Individual Notice of Preexisting Condition Exclusion.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the appropriate form for your city/state.

Form popularity

FAQ

What Is the Pre-existing Condition Exclusion Period? The pre-existing condition exclusion period is a health insurance provision that limits or excludes benefits for a period of time. The determination is based on the policyholder having a medical condition prior to enrolling in a health plan.

Which of the following is considered a qualifying event under cobra? Divorce. Other qualifying events include the voluntary termination of employment; an employee's change from full time to part time; or the death of the employee.

Premiums for disability income insurance are based on five factors: insured's occupation; insured's earned income; policy's definition of disability; length of the benefit period; and length of the elimination period.

Residents of Delaware are required to have health insurance coverage in accordance with the federal Affordable Care Act (ACA), although there are no individual penalties for failure to do so.

The time period during which an individual policy won't pay for care relating to a pre-existing condition. Under an individual policy, conditions may be excluded permanently (known as an "exclusionary rider").

Pre-existing condition - A pre-existing condition provision in a small employer health benefit plan may exclude coverage for a pregnancy existing on the effective date of the coverage.

3. You won't face a tax penalty for going without health insurance in 2021but there are big downsides to being uninsured. Obamacare's tax penalty went away in 2019. That means that if you don't have health insurance, you won't have to pay a penalty when you file your federal income taxes.

Unlike in past tax years, if you didn't have coverage during 2021, the fee no longer applies. This means you don't need an exemption in order to avoid the penalty.

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

Which of the following factors would be a underwriting consideration for a small employer carrier? Percentage of participation. Coverage under a small employer health benefit plan is generally available only if at least 75% of eligible employees elect to be covered.